When you need to confirm a transaction, providing a receipt is one of the best ways to ensure clarity and trust between buyer and seller. A proof of sale receipt is a straightforward document that outlines key details of the transaction. This includes the items purchased, their prices, the total amount, and payment method.

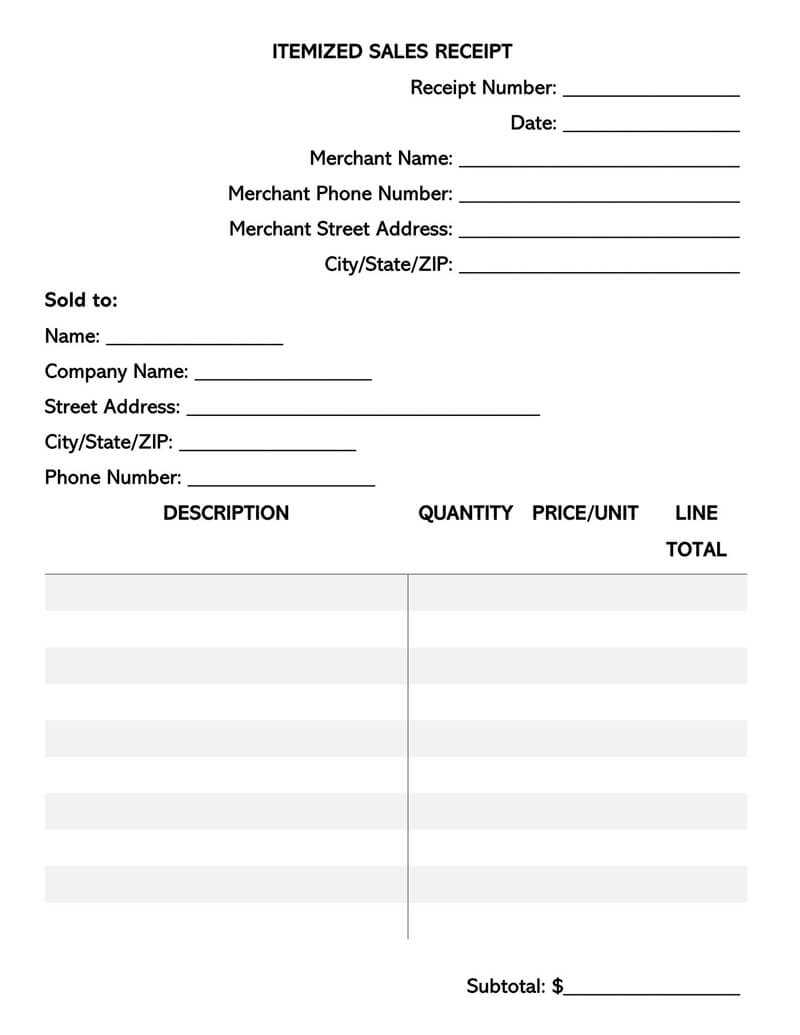

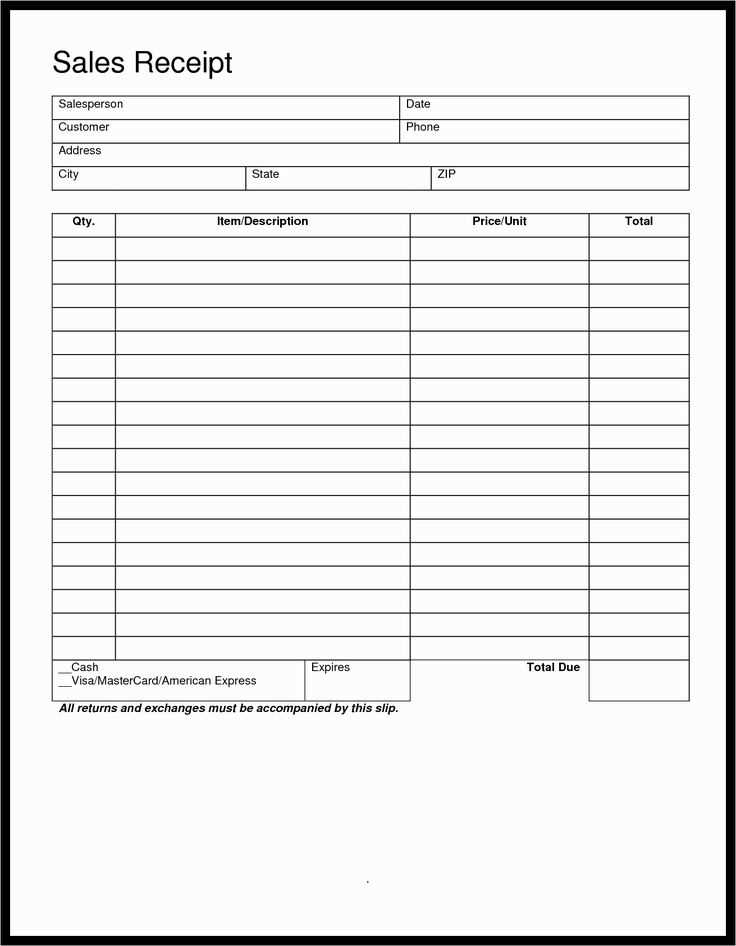

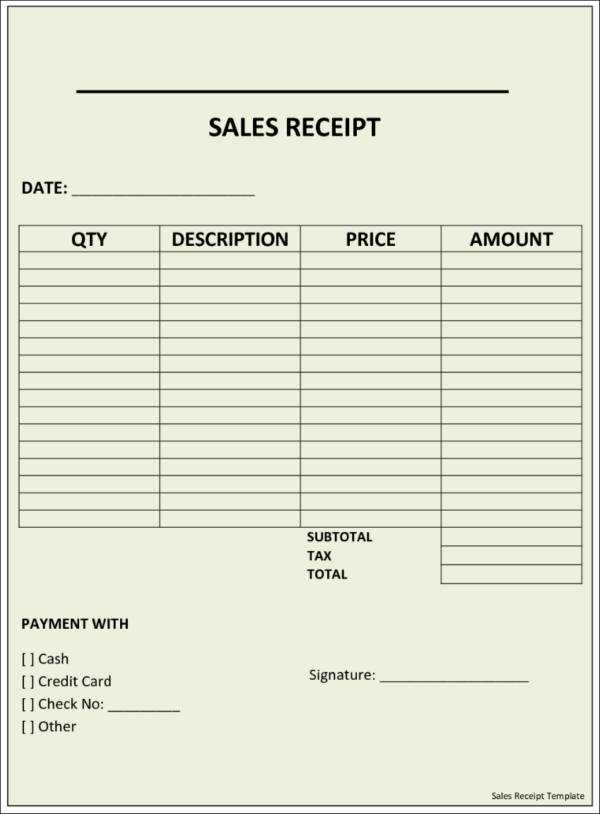

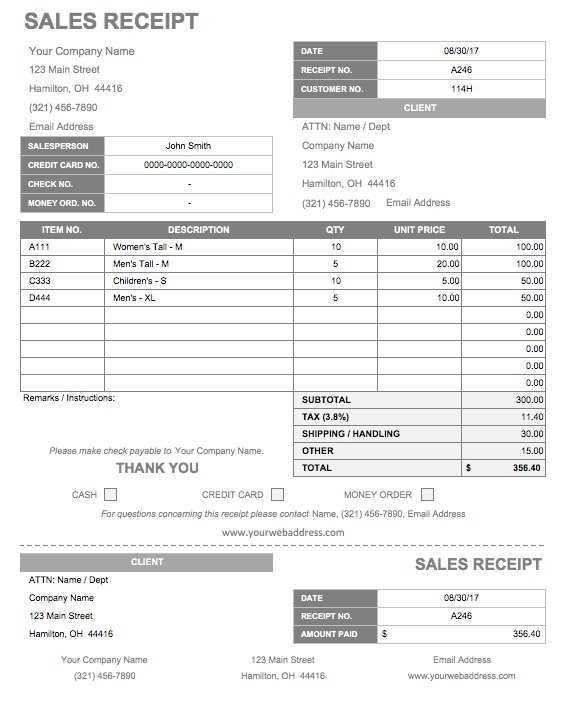

To create a useful receipt, start by including the seller’s information such as name, address, and contact details. Then, list the items sold with a brief description, quantity, and price. Ensure the total amount due is clearly stated and include the date of the transaction. A payment section will highlight whether the transaction was completed through cash, credit, or another method. Lastly, don’t forget to add a unique receipt number for tracking purposes.

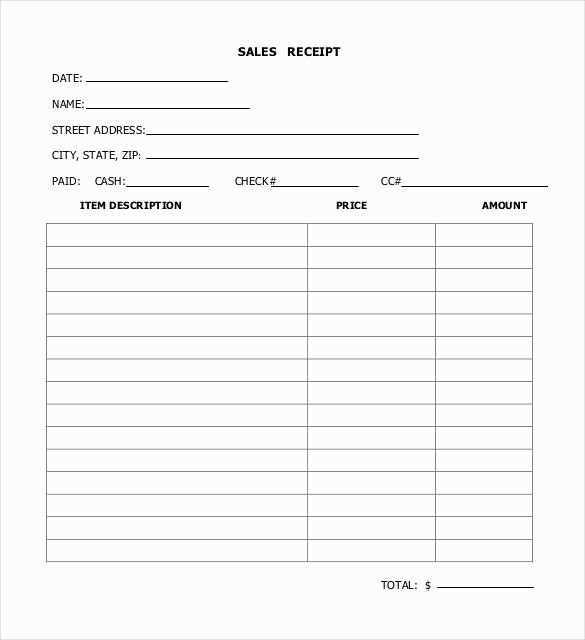

Using a template can save you time while ensuring you don’t miss any important details. Look for a simple layout that keeps everything clear and easy to read. Once you’ve set up your template, all you need to do is fill in the transaction-specific details and print it out for your records.

Here’s the revised version with reduced word repetition, while keeping the meaning intact:

For a concise and functional proof of sale receipt template, focus on the key details. Include the transaction date, item or service description, price, and payment method. Organize the layout in a clear manner, with space for buyer and seller information. Avoid cluttering the document with unnecessary elements. A well-structured template can increase professionalism while maintaining clarity.

Essential Details for the Template

Ensure the template captures the transaction specifics without overloading the recipient with too much text. Include the following sections: buyer and seller names, item description, total cost, and method of payment. Keep each section short, direct, and easy to read. Consider offering an additional section for terms or return policies if applicable.

Layout Tips

Arrange the information logically to make it easy to follow. Use bold for headings to distinguish each section, and keep font sizes consistent for readability. If applicable, provide a section for the signature of both parties to confirm the transaction. Lastly, ensure the template is printable or adaptable to digital formats for convenience.

Detailed Guide on “Proof of Sale Receipt Template”

How to Create a Customizable Proof of Transaction Receipt

Key Information to Include in a Sale Document

Common Formats for Proof of Sale Documents

How to Integrate Transaction Receipts with Your Business Software

Legal Considerations When Issuing a Transaction Record

Best Practices for Storing and Organizing Sale Documents

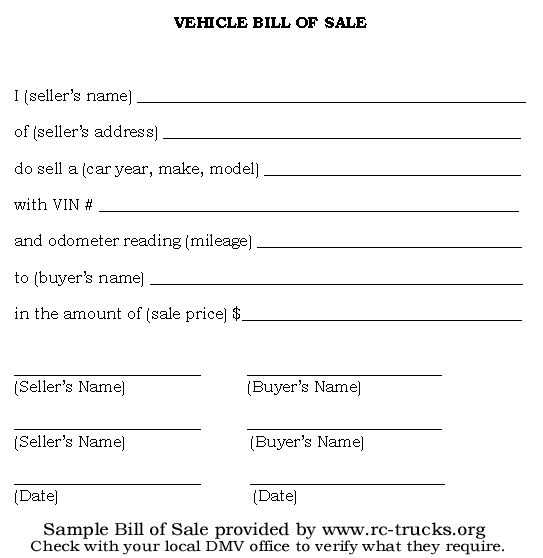

Start by identifying the key components required in a customizable proof of transaction receipt. A template should include sections for the seller’s and buyer’s details, transaction date, item or service description, amount, and payment method. You can easily create a customizable template using word processing software or specialized receipt generators. Adjust the template according to the specifics of your business needs, ensuring it’s user-friendly and easy to modify for each sale.

Key Information to Include:

Make sure to include the full name and contact details of both parties involved. Clearly mention the transaction date and unique receipt number for tracking purposes. Provide a detailed description of the item or service purchased, including quantity and unit price. Summarize the total amount paid and specify the payment method (e.g., credit card, cash, bank transfer). If applicable, include tax rates or discounts.

Common Formats for Proof of Sale Documents:

Proof of sale receipts come in various formats, including printed paper copies, PDFs, and digital receipts. Each format serves different purposes; for example, digital receipts are more convenient for email or online transactions. Choose the format based on how the document will be shared or stored. Make sure that digital receipts are formatted clearly, with readable text and the same key information as physical receipts.

Integrating Transaction Receipts with Business Software:

Linking transaction receipts to business software, such as accounting or inventory management systems, enhances efficiency. By automating the process, you ensure data consistency and minimize human errors. Many modern point-of-sale (POS) systems automatically generate transaction receipts and sync them with your software, making record-keeping seamless and accurate.

Legal Considerations:

Issuing a transaction record must adhere to local tax and business regulations. Ensure that the receipt includes all legally required information, such as tax identification numbers, applicable taxes, and compliance with consumer protection laws. For international sales, adjust the template to meet the legal requirements in different jurisdictions. Always check with a legal professional to confirm that your receipt template aligns with relevant laws.

Best Practices for Storing and Organizing Sale Documents:

Organize your receipts by date or transaction type. Whether physical or digital, keeping receipts accessible and well-organized is key for tax filings, warranty claims, or customer service inquiries. Digital receipts should be backed up regularly, either locally or on a cloud storage system. Implement a consistent naming convention for digital files to make retrieval easier. For physical receipts, consider filing them in labeled folders or filing cabinets for easy access.