Using a clear and organized receipt template ensures accuracy and professionalism in any transaction. A rabbit sales receipt should contain specific details about the transaction, such as the buyer’s and seller’s information, the date of sale, and a description of the animal sold. This helps both parties keep a reliable record of the exchange.

Include essential data like the rabbit’s breed, age, and any health-related information. A section for additional notes, such as vaccinations or special instructions, adds clarity. Remember, the receipt should list the total price and any applicable taxes to avoid confusion later.

By using a structured template, sellers can maintain consistency in their records, making it easier to track past sales and provide transparent information to customers. Customizing the template to match your business needs will further streamline your sales process.

Here’s a detailed plan for an informational article on the topic “Rabbit Sales Receipt Template” in HTML format, with six specific and practical subheadings:htmlEditRabbit Sales Receipt Template

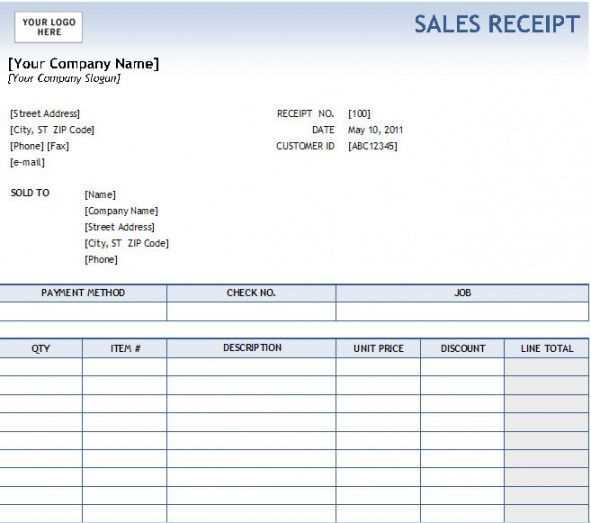

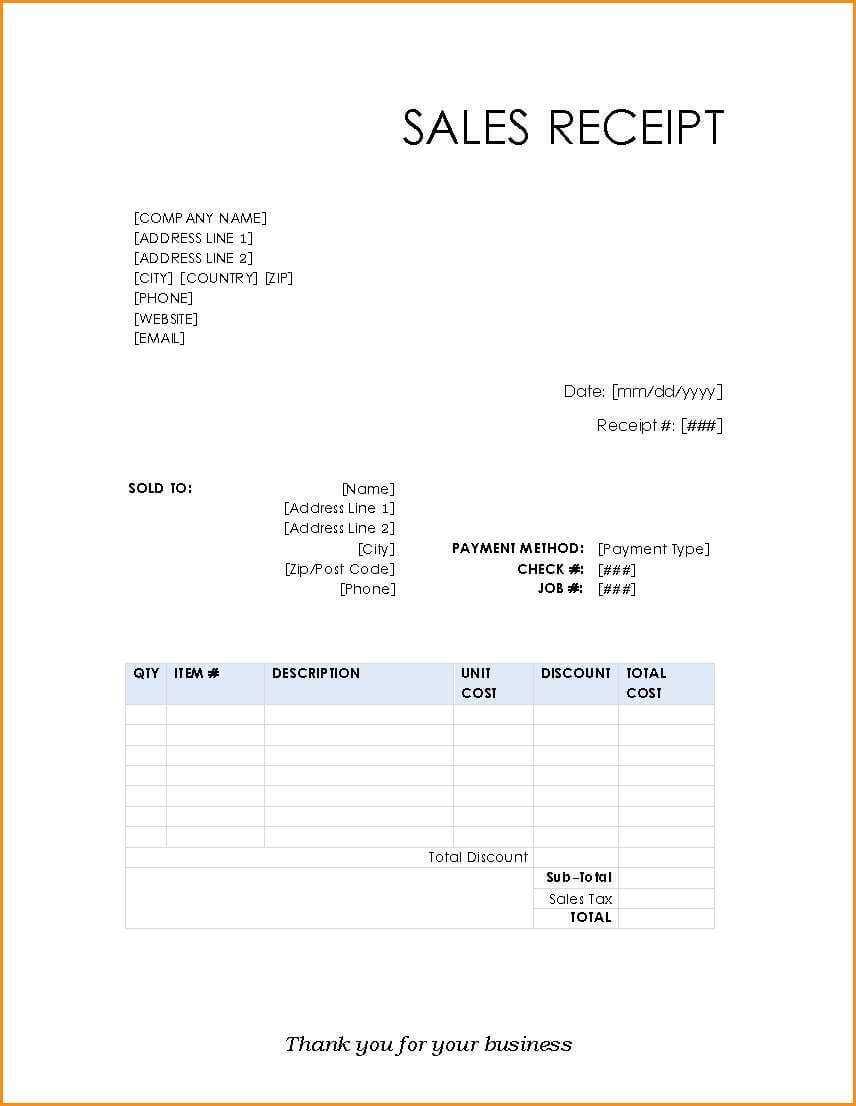

Begin by outlining the key components that must be included in any rabbit sales receipt template. Clearly specify the essential fields such as buyer’s name, seller’s name, date of sale, rabbit breed, quantity, price per unit, and the total amount. Ensure there is a space for additional comments or special instructions that may be necessary for each transaction.

Key Information to Include

Focus on capturing accurate buyer and seller details, transaction specifics, and any applicable taxes or discounts. Design a section for payment method (e.g., cash, card, check) and any deposits received prior to the sale. This helps maintain clarity and completeness for both parties involved.

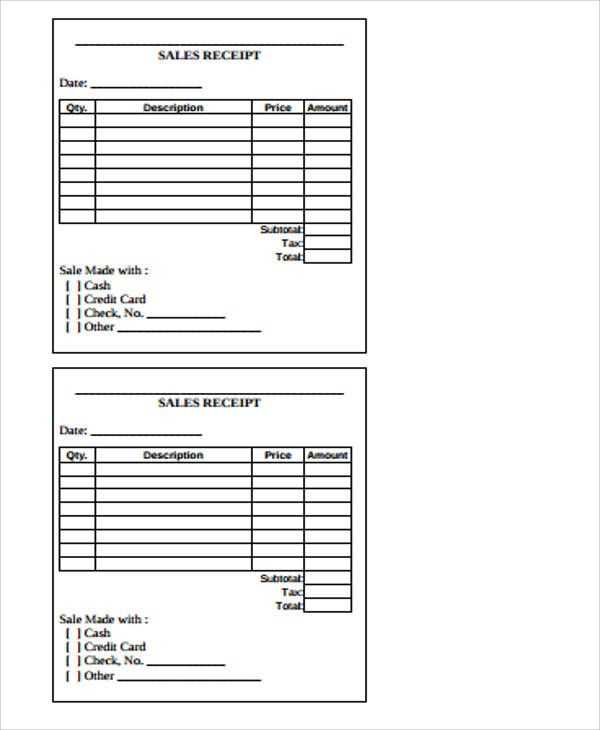

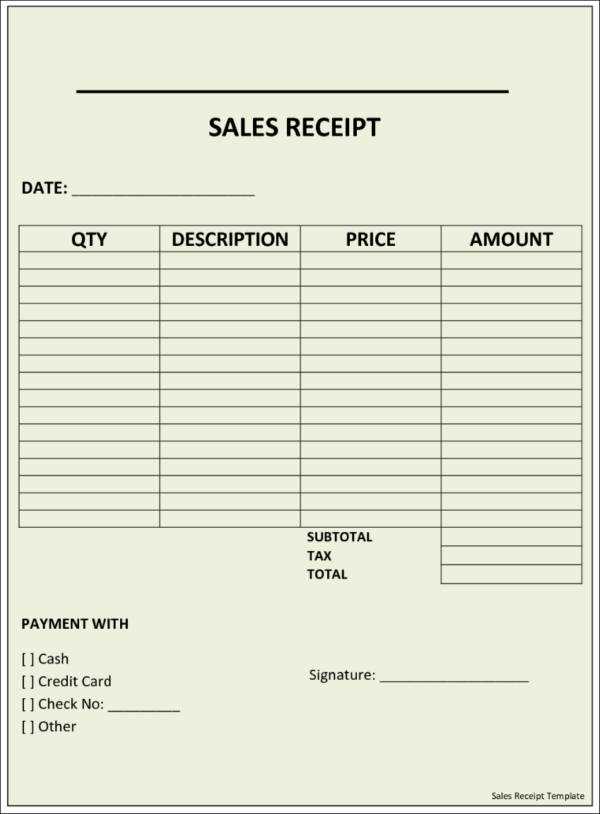

Designing the Template Layout

Choose a layout that is simple, professional, and easy to read. Ensure that important information such as the total price is prominently displayed, but without cluttering the template with unnecessary graphics or information. A clean, structured approach will make the document more user-friendly.

Incorporate space for signatures. Having both buyer and seller sign the receipt can help validate the transaction and offer legal protection if needed. This can be done with a digital signature field if the template is used in electronic formats.

Consider including a footer with the seller’s contact details, including phone number and address. This ensures that the buyer can reach out if they need further information or have any questions after the transaction.

Finally, ensure the template is customizable. It should be easy to adapt for different types of rabbit sales (e.g., purebred, mixed breed) and for transactions involving additional services, such as transportation or veterinary care. Offering flexibility will help make the template suitable for a range of sales scenarios.

Designing a Clear Sales Receipt Layout

Focus on simplicity and clarity. Use a clean, organized layout with distinct sections to separate key information. Place the business name and contact details at the top for easy reference. Follow with a clear date and receipt number for quick identification.

Structure Your Information

Group items logically. Start with the item name, followed by quantity, unit price, and total cost. Use clear labels for taxes, discounts, and shipping fees. This helps customers quickly verify what they are paying for. Consider using bold text or different font sizes to highlight important figures like the total amount due.

Visual Appeal and Readability

Ensure the text is easy to read by using standard fonts and sizes. White space is key–avoid overcrowding the receipt with too much information. Use lines or boxes to separate sections for better organization. Keep the design consistent and professional, with no unnecessary graphics or distractions.

Incorporating Rabbit Specific Information

Include key rabbit details in the sales receipt to enhance clarity and provide transparency for the buyer. Always mention the breed, age, and any relevant health status to give a complete picture of the animal’s condition.

Record the following information:

| Field | Details |

|---|---|

| Breed | Specify the rabbit’s breed, for example, Netherland Dwarf, Lionhead, or Flemish Giant. |

| Age | Note the rabbit’s age in months or years. This can be helpful for understanding care needs. |

| Health Status | List any health-related information, such as vaccinations, spaying/neutering, or other veterinary care received. |

| Purchase Date | Indicate the date the rabbit was sold to ensure accurate tracking of ownership. |

Providing these details not only builds trust but also ensures the buyer understands the animal’s background and care history. Avoid generalizing; instead, tailor the receipt to reflect each rabbit’s unique characteristics.

Adding Customizable Fields for Discounts and Taxes

To integrate discounts and taxes into your sales receipt template, begin by creating customizable fields that can adjust based on transaction details. This allows for flexibility in both applying discounts and calculating tax amounts accurately.

Custom Fields for Discounts

Include a field where a percentage or fixed amount discount can be applied. For percentage-based discounts, use a formula that calculates the discount based on the subtotal. Ensure this field can accept manual input or be automatically calculated based on predefined rules. For fixed amount discounts, include a simple numeric input field that can subtract a specific amount from the total.

Custom Fields for Taxes

Add a separate field for tax calculations that can either display a fixed tax rate or allow for percentage-based entries. Ensure the tax field adjusts according to the region or the product category, as tax rates often vary. You can also implement multiple fields if different tax types apply (e.g., sales tax, service tax). Allow these fields to be easily modified, ensuring compliance with local tax laws.

Including Payment Method Details

List the payment method clearly to avoid confusion. Indicate whether the payment was made via credit card, PayPal, cash, or another method. This helps ensure both the buyer and seller have a record of the transaction’s completion.

Include the following details for transparency:

- Payment Method: Specify the type (e.g., Credit Card, PayPal, Bank Transfer, Cash).

- Transaction ID or Reference Number: Provide any unique identifiers related to the payment, such as a transaction code or invoice number.

- Amount Paid: Clearly state the exact amount paid by the customer.

- Date of Payment: Mention the exact date the payment was processed.

For credit card transactions, it can be useful to add the last four digits of the card number to help with tracking payments, without compromising privacy.

Ensure that these details are placed near the bottom of the receipt to allow easy verification when reviewing the document.

Ensuring Legal Compliance in the Template

Include all required tax information, such as applicable VAT or sales tax rates, and ensure the correct tax identification numbers are displayed. Failure to do so may result in penalties. Check the jurisdiction’s regulations for proper tax handling on transactions.

Incorporate a clear and concise statement about the refund or return policy. This avoids misunderstandings and aligns with consumer protection laws. Display this policy prominently on the receipt template.

Ensure that the receipt includes full business details, including the name, address, and registration number, if applicable. This aligns with business transparency and helps in case of any disputes.

Review the template for accessibility. Make sure it can be easily understood by individuals with different needs. This includes using legible fonts and providing clear itemized lists for all products or services.

Update the template regularly to reflect changes in laws or business practices. Compliance with evolving local regulations prevents legal complications.

Printing and Digital Format Considerations

Ensure receipts are legible in both printed and digital forms. For printed versions, use high-quality paper and clear fonts to avoid text fading over time. A standard font size of 10 to 12 points works well for readability. For digital formats, ensure compatibility across various devices. PDFs are ideal for maintaining formatting consistency, while images of receipts should be high resolution to prevent blurriness when zoomed in.

For printed receipts, consider margins and layout carefully. Keep key information, such as date, item details, and total, well spaced and easy to read. A cluttered design can make the receipt harder to understand at a glance. Digital receipts should prioritize accessibility, offering text-based formats for screen readers while also supporting standard image formats for users who prefer visual receipts.

Ensure file sizes are optimized for digital versions. Large file sizes can be slow to download and may take up too much storage space on mobile devices. Use file compression tools to balance quality and size, especially when distributing receipts through email or apps.