Creating a reliable and clear receipt for the sale of goods is a key step in any transaction. This document serves as proof of the exchange and ensures both parties are on the same page regarding the details of the sale. It’s crucial that all relevant information is included in the receipt to avoid confusion or disputes later on.

Start with the date of the transaction. It’s important to specify when the sale occurred, as this marks the official record of the exchange. Include the buyer’s and seller’s contact details, such as names and addresses, to provide clarity on both sides of the agreement. Add a unique receipt number for easy tracking and reference.

Clearly list the items sold, including quantities, descriptions, and prices. This level of detail makes it easy to identify the transaction later if necessary. Also, ensure the total amount is calculated correctly, including any taxes or additional fees, to avoid misunderstandings.

Lastly, don’t forget to include payment details. Specify whether the transaction was made via cash, credit, or another method. If applicable, note any deposits or remaining balances to clarify the financial side of the agreement. A well-structured receipt will help maintain transparency and avoid any potential issues down the road.

Here are the corrected lines with minimized repetitions:

To create a clear and professional receipt template, it’s important to ensure that all required details are accurately and concisely included. This reduces redundancy and improves the clarity of the document.

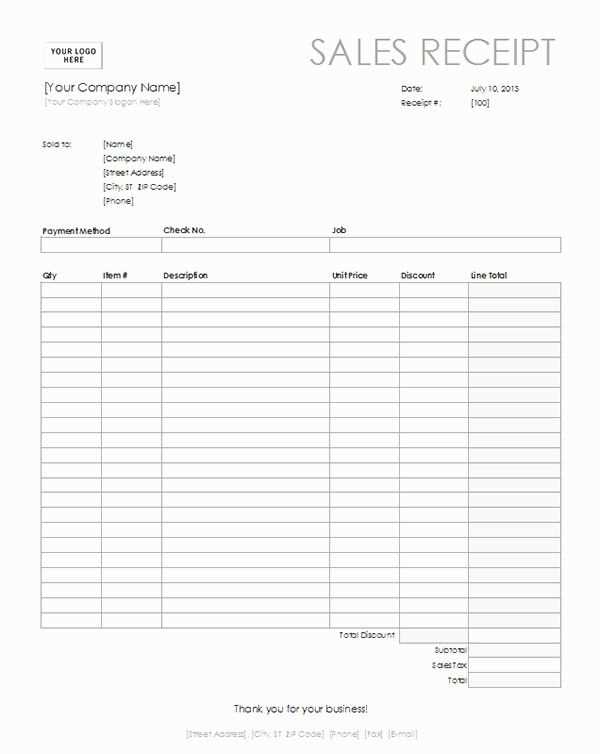

Header Information

Include the seller’s name, business name, address, and contact details at the top of the receipt. This information should appear only once, ensuring that the header is concise and free from unnecessary repetition.

Item Details

List each item sold with a brief description, quantity, and price. Avoid repeating item details or descriptions. If the same item appears multiple times, consider consolidating the entries to reduce repetition.

By limiting unnecessary details and structuring the information effectively, you create a receipt that is both easy to understand and professional.

Review the template for redundant wording. If the same information is mentioned more than once, eliminate or combine those lines to streamline the text.

- Receipt for Sale of Goods Template

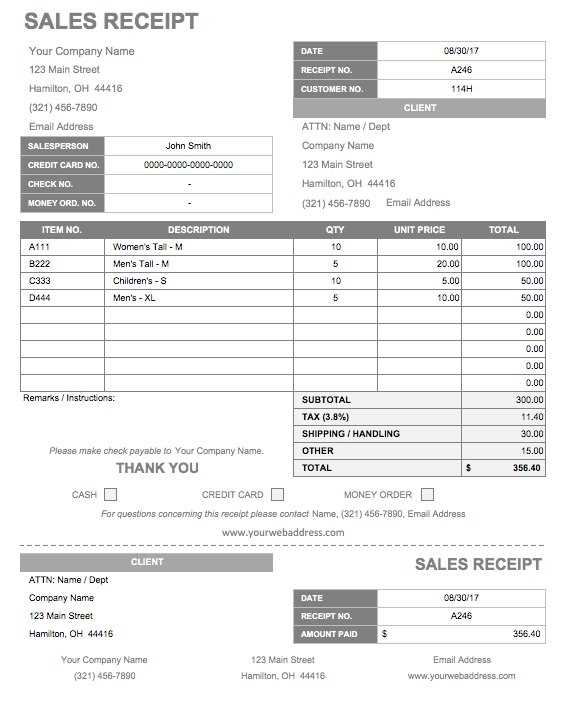

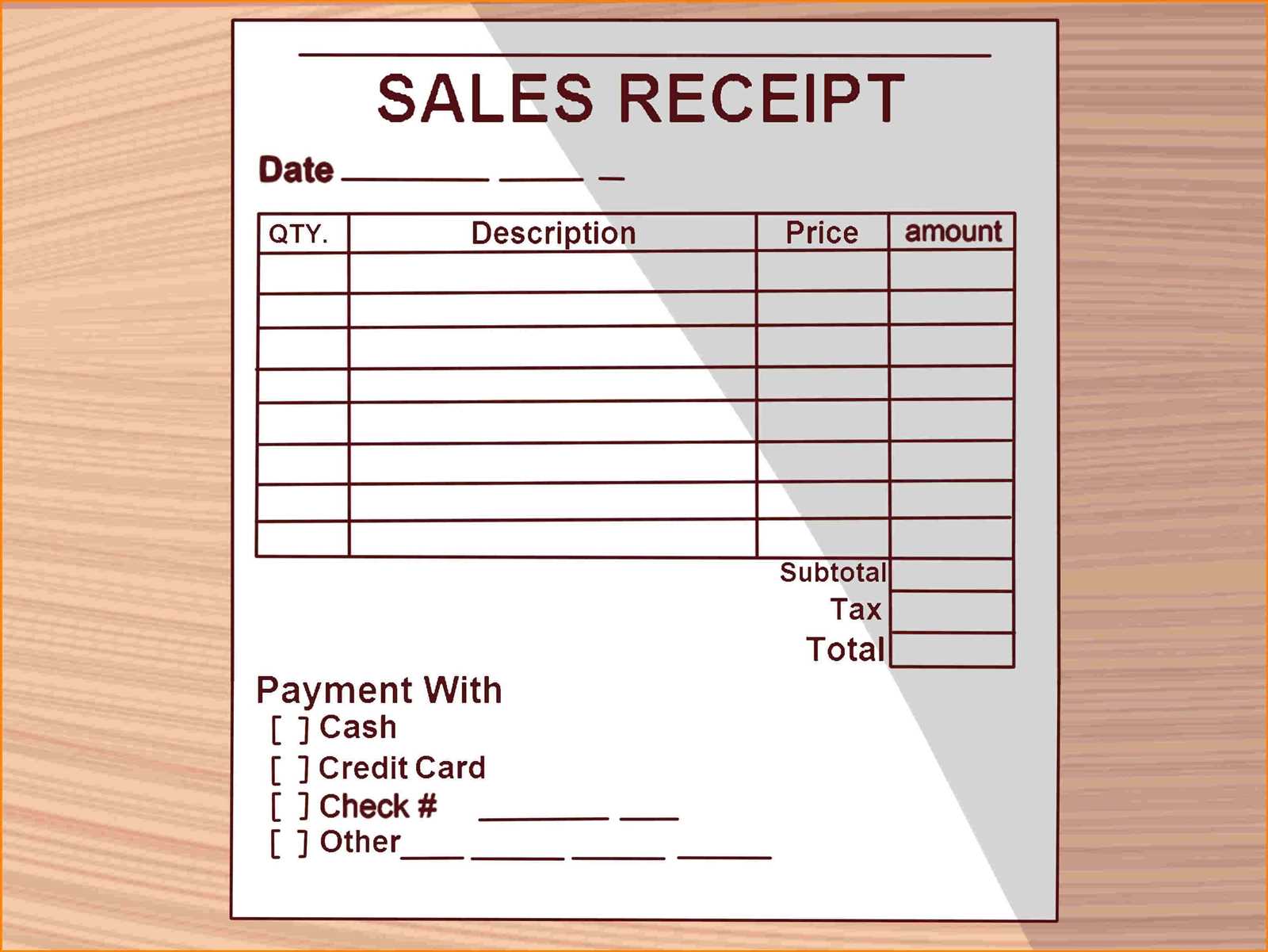

A receipt for the sale of goods should include the following key details to ensure clear documentation of the transaction:

Key Components

Start by including the date of the transaction at the top of the receipt. Specify the seller’s full name and contact details, such as an address or phone number. The buyer’s details should also be included, especially if required for tax or legal purposes.

Clearly list the goods sold with descriptions, quantities, and individual prices. Include the total price of the transaction, including any taxes, discounts, or additional charges that apply. It’s important to break down these figures to avoid confusion.

Payment Method

Specify the method of payment used (cash, credit card, bank transfer, etc.) and any relevant transaction or authorization numbers. If the payment was made partially or on credit, note the balance remaining or the agreed payment terms.

End the receipt with a confirmation of the sale, such as a simple statement like, “Paid in full” or “Balance due.” Finally, provide a space for the seller’s signature to validate the receipt and a unique receipt number for record-keeping.

Begin by clearly stating the seller’s and buyer’s information. Include full names, addresses, and contact details for both parties. This ensures clear identification in case of any issues or questions about the sale.

Next, specify the date of the transaction. The date should reflect when the goods were sold and payment was made. This will be useful for both record-keeping and potential tax purposes.

List the sold goods with detailed descriptions. For each item, include the quantity, unit price, and a brief description. This helps to avoid confusion and provides a clear breakdown of what was purchased.

Indicate the total price for each item and include the subtotal. If applicable, include any taxes or additional fees. Clearly show the final amount the buyer has to pay, separating each cost for transparency.

Specify the payment method used in the transaction. Whether it was through cash, bank transfer, or card payment, the payment method should be clearly documented. If the payment was partial, indicate the amount paid and the balance due, if any.

Conclude with a statement confirming the sale and thanking the buyer. A simple “Thank you for your purchase” or “We appreciate your business” is sufficient.

Lastly, provide a receipt number or reference code for easy tracking. This is particularly useful for record-keeping and any future correspondence between the buyer and seller.

Adjusting a receipt to fit different types of transactions requires flexibility in layout and detail. Whether it’s a standard sale, a return, or a discounted item, tailoring the receipt can provide clarity for both the seller and the buyer.

Sale with Multiple Items

For transactions involving multiple products, include a detailed list of each item, including its name, quantity, and price. Add a section for any applicable taxes and the total price after taxes. Ensure that the subtotal is clearly visible, followed by the final total.

Discounts and Promotions

When applying a discount, clearly show the percentage or amount discounted next to each item or at the bottom of the receipt. The total should reflect the discount, and it should be evident how much the customer saved. Including the promotion code or reference number can also be helpful for tracking purposes.

For returns, adjust the receipt to reflect the refunded amount, including the original price and the refund applied. A clear note should state the reason for the return and any restocking fees, if applicable.

Every modification should maintain clarity and provide a transparent record of the transaction, ensuring all parties understand the details involved.

Sales receipts carry significant legal weight as they act as proof of transaction between buyer and seller. These documents establish the terms of the sale and can be used in case of disputes or audits. To ensure that receipts are legally compliant, they should contain specific information that is required by law in various jurisdictions.

Key Legal Requirements

Most jurisdictions mandate that sales receipts include certain details for them to be legally binding. These include:

| Information | Legal Requirement |

|---|---|

| Seller’s Name and Contact Information | Required in most regions to identify the seller in case of disputes. |

| Buyer’s Information (if applicable) | May be necessary in business transactions, especially for high-value items. |

| Item Description | Details about the goods sold, including quantity and model, must be specified. |

| Price and Taxes | The total price, along with applicable taxes, should be clearly outlined. |

| Date of Sale | Important for tracking purposes and determining warranty periods. |

| Payment Method | Indicating the payment method, such as cash or credit card, is crucial for record-keeping. |

Consumer Protection and Refund Policies

Sales receipts often serve as a point of reference for consumer protection. They outline the terms of warranties, refunds, and returns. Without a receipt, it becomes difficult for buyers to claim warranty or return rights. It’s essential for businesses to ensure that their receipts comply with consumer protection laws to avoid legal complications.

Receipt for Sale of Goods Template

Ensure clarity and accuracy in every section of the receipt. Organize each element systematically to avoid confusion. Include key details such as:

- Seller’s information: Name, address, and contact details.

- Buyer’s information: Name, address, and contact details.

- Description of goods: Clearly list the items sold, including quantity, specifications, and price.

- Total amount: State the total cost, including taxes or additional charges.

- Date of transaction: Specify the exact date.

- Signature: A section for both parties’ signatures to validate the agreement.

Formatting Tips

Structure the receipt to enhance readability. Use bullet points for listing items, prices, and additional charges. Make sure each section is concise yet informative, providing just enough detail to verify the transaction.

Final Checklist

- Confirm that all personal and transaction details are accurate.

- Ensure that tax information is included where applicable.

- Review the layout for clarity and ease of understanding.