Key Elements of a Sale Receipt

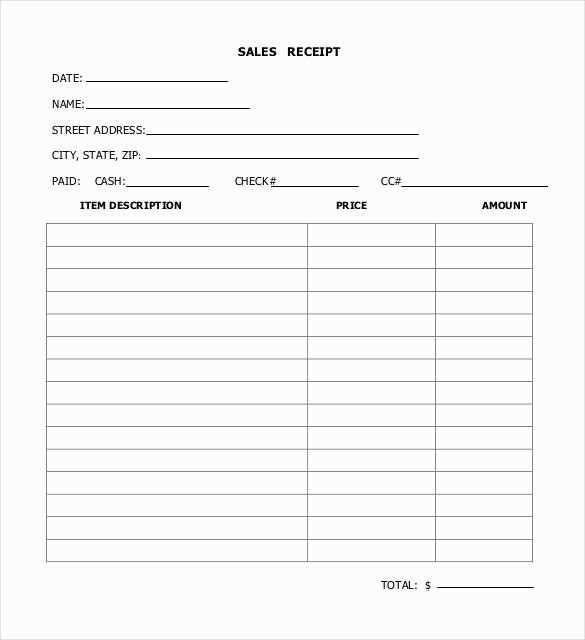

A sale receipt needs to clearly document the transaction details. Make sure to include the following information:

- Date: Record the exact date of the transaction.

- Seller Information: Include the name, address, and contact information of the seller.

- Buyer Information: Provide the buyer’s name and contact details.

- Product/Service Details: List the item(s) purchased, including a brief description, quantity, and price per unit.

- Total Amount: Show the total cost, including any applicable taxes and discounts.

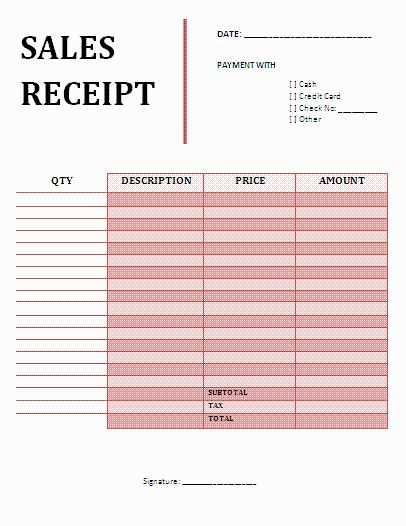

- Payment Method: Indicate how the payment was made (e.g., cash, credit card, etc.).

- Transaction ID: If applicable, include a unique transaction number for reference.

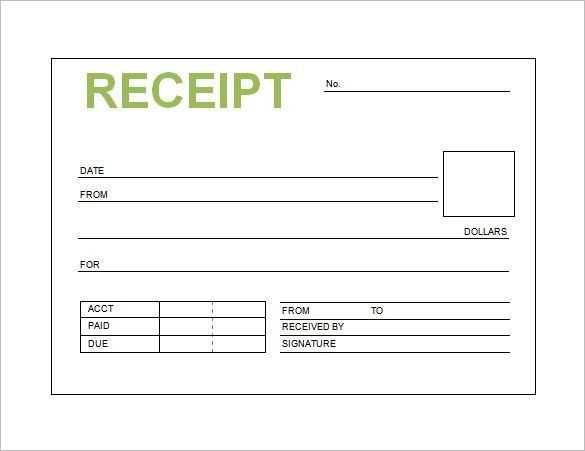

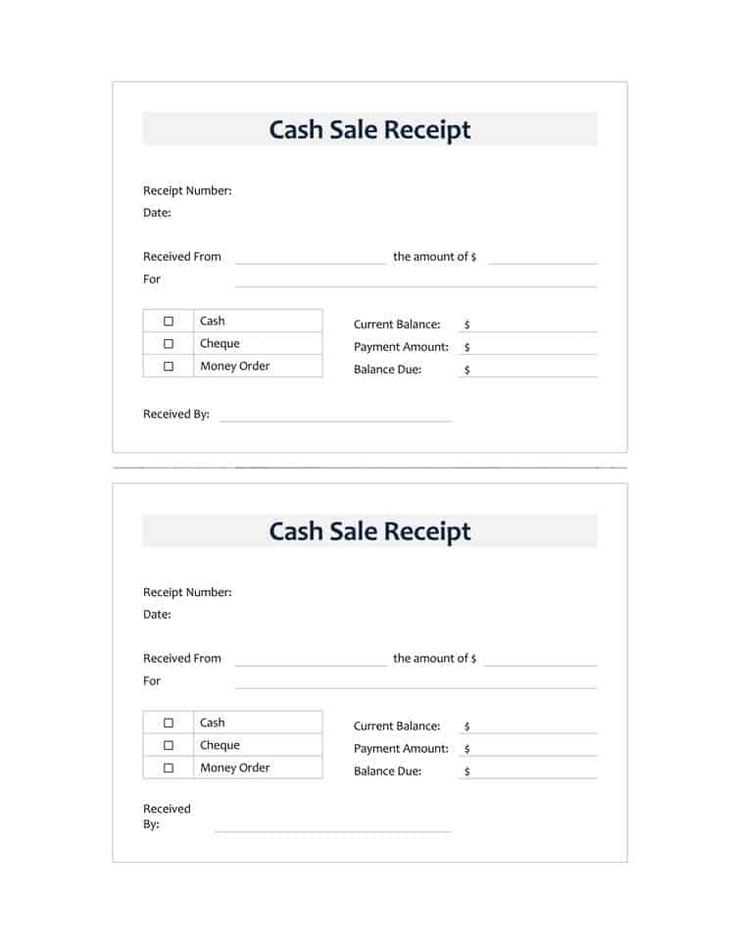

Template Example

Below is a simple receipt template you can use for your sales:

Receipt of Sale

Seller: [Seller Name] Address: [Seller Address] Phone: [Seller Phone] Email: [Seller Email] Buyer: [Buyer Name] Address: [Buyer Address] Phone: [Buyer Phone] Email: [Buyer Email] Date of Sale: [Sale Date] Transaction ID: [Transaction ID] Product Description | Quantity | Unit Price | Total -------------------------------------------------------- [Item 1] | [Qty] | [Price] | [Total] [Item 2] | [Qty] | [Price] | [Total] Subtotal: [Subtotal Amount] Tax (if applicable): [Tax Amount] Discount (if applicable): [Discount Amount] Total Amount: [Total Amount] Payment Method: [Payment Method] Thank you for your purchase!

Formatting and Customizing the Template

Modify the template according to your specific needs. For example, you can add a section for return or warranty policies, or customize it to include your company’s branding and logo. Keep it clear and concise so both the buyer and seller can easily reference the document if needed.

Tips for Creating a Sale Receipt

- Clarity: Use a simple layout to ensure the buyer can easily understand the receipt.

- Accurate Information: Double-check the details, especially the pricing and payment method.

- Professional Tone: Even for personal sales, maintain professionalism in the language and structure of your receipt.

- Backup: Always save a copy of the receipt for record-keeping and future reference.

Receipt of Sale Template

Key Elements to Include in a Sales Receipt

Legal Requirements and Compliance Considerations

Customizing Receipts for Different Transactions

Digital vs. Paper: Pros and Cons of Receipts

How to Store and Organize for Record-Keeping

Common Mistakes to Avoid When Creating a Sales Receipt

Key Elements to Include in a Sales Receipt

A well-designed receipt should include the following core elements: the seller’s name and contact details, the buyer’s information (if applicable), a detailed list of items or services purchased, their prices, the date of the transaction, the total amount paid, and the method of payment. Additionally, any applicable taxes should be clearly indicated, and if relevant, any discounts or promotions should be noted.

Legal Requirements and Compliance Considerations

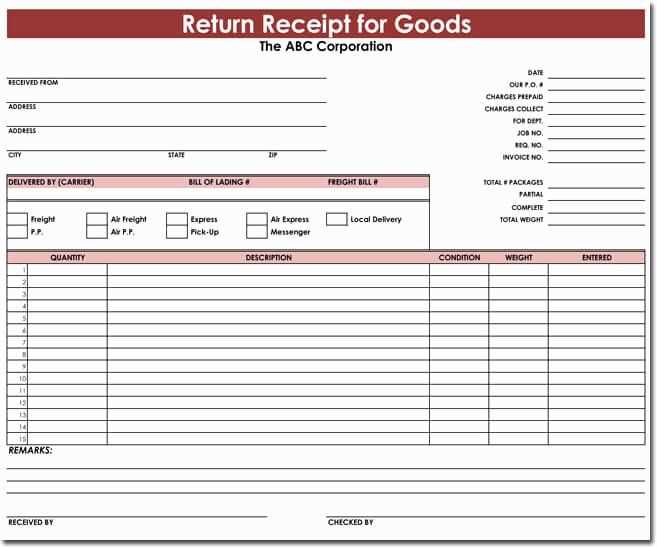

Ensure compliance with local regulations by including mandatory details such as business registration numbers or tax IDs. Depending on the jurisdiction, receipts may need to show VAT numbers or other specific information. Always check the relevant consumer protection laws to avoid fines or penalties. For international sales, include any necessary customs or shipping details.

Customizing Receipts for Different Transactions

Adapt receipts for various transaction types by considering the nature of the sale. For example, a service-oriented transaction may require space for labor charges and materials, while a product sale may need SKU codes or product descriptions. Customizing for recurring transactions can streamline future purchases, while adding warranties or return policies can enhance customer satisfaction.

Digital vs. Paper: Pros and Cons of Receipts

Digital receipts are easier to store and access, reducing paper waste and offering quick retrieval. They can also be integrated into accounting systems, simplifying record-keeping. However, paper receipts provide tangible proof of purchase and may be preferred by some customers. Consider offering both options, allowing customers to choose based on their preferences.

How to Store and Organize for Record-Keeping

Digital receipts should be stored in a secure, organized folder system, with proper naming conventions for easy identification. Use cloud storage solutions for backup. Paper receipts must be categorized by date, type of transaction, and customer for efficient retrieval. Invest in a filing system or an envelope method for long-term physical storage.

Common Mistakes to Avoid When Creating a Sales Receipt

Avoid omitting important details like the item description or correct tax calculations. Ensure that the total is clear and accurate, with no discrepancies between the subtotal and the final amount. Also, always check for typos in customer information or pricing errors. Incomplete or unclear receipts can lead to customer frustration or legal complications.