Key Elements of a Legally Valid Receipt

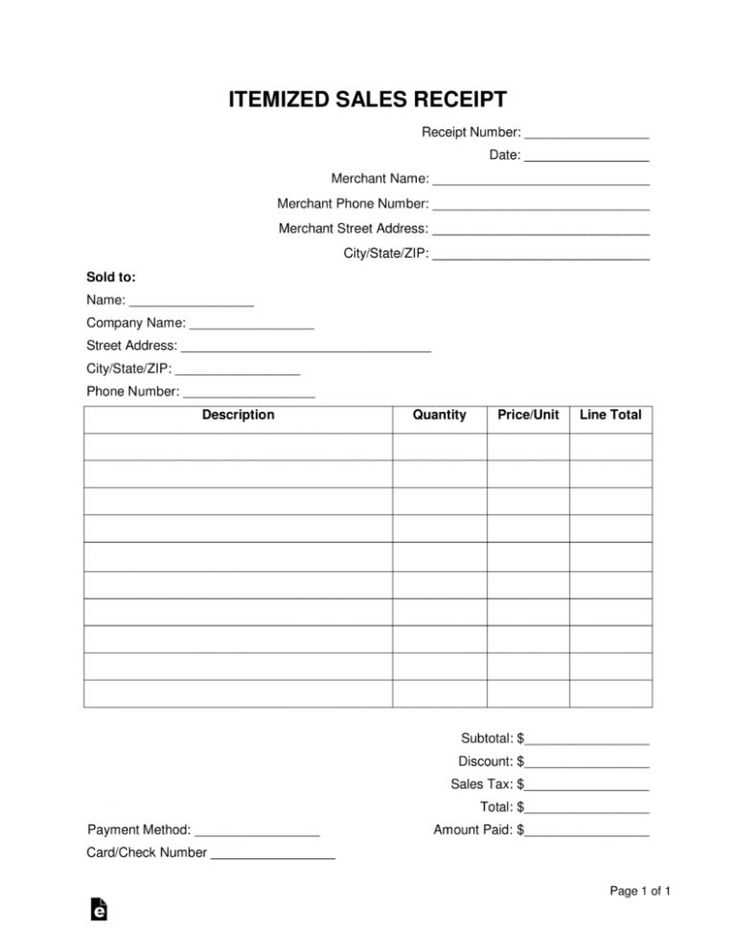

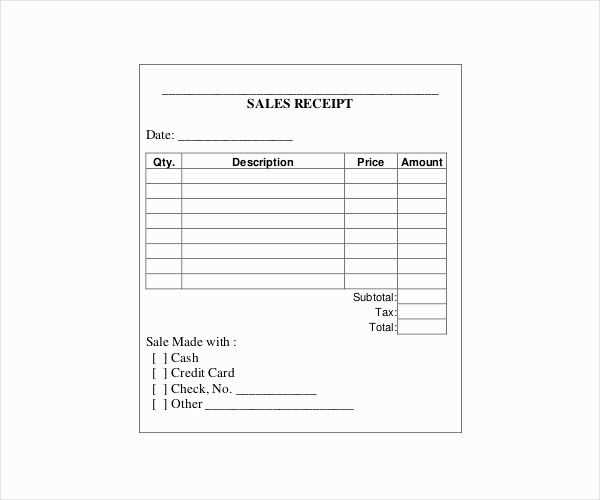

A proper receipt of sale serves as proof of a transaction and must include essential details. Without these, disputes may arise. Ensure that your document contains:

- Buyer and seller details – Full names and contact information

- Transaction date – The exact day of the sale

- Item description – Clear details about the goods or services

- Payment information – Amount, currency, and method

- Unique reference number – Helps with tracking and record-keeping

- Signatures – Both parties should sign for added security

Customisable Receipt Template

Use the following structure for a simple and effective receipt:

Receipt of Sale Date: [DD/MM/YYYY] Receipt Number: [Unique ID] Seller: Name: [Full Name] Address: [Street, City, Postcode] Contact: [Phone/Email] Buyer: Name: [Full Name] Address: [Street, City, Postcode] Contact: [Phone/Email] Item(s) Sold: - Description: [Item Details] - Quantity: [Number] - Price: £[Amount] Total Amount Paid: £[Total Price] Payment Method: [Cash/Bank Transfer/Card] I confirm that I have received the payment in full and the item(s) have been handed over. Seller Signature: _______________ Buyer Signature: _______________

Additional Considerations

For high-value items, include a warranty statement or refund policy. If selling a used vehicle, add the mileage and vehicle identification number. Keep a copy of the receipt for tax and legal purposes.

Receipt of Sale Template UK

Key Elements to Feature in a Sales Receipt

Legal Standards for a Valid Receipt in the UK

Digital vs. Paper Templates: Advantages and Drawbacks

Adapting a Receipt for Various Transactions

How to Organize and Keep Sales Records for Tax Needs

Frequent Errors to Avoid When Drafting a Receipt

Key Elements to Feature in a Sales Receipt

Include the full business name, address, and contact details at the top. State the transaction date, item description, quantity, price, VAT (if applicable), and total amount. Specify the payment method and provide a unique receipt number for tracking.

Legal Standards for a Valid Receipt in the UK

A valid receipt must show accurate financial details, the seller’s information, and VAT registration (if relevant). If the sale includes warranties, mention the terms clearly. For digital transactions, ensure electronic receipts comply with HMRC record-keeping rules.

When choosing between paper and digital formats, digital receipts reduce storage needs and simplify record-keeping, while paper copies may be preferred for in-person transactions. Ensure the format aligns with customer preferences and regulatory requirements.