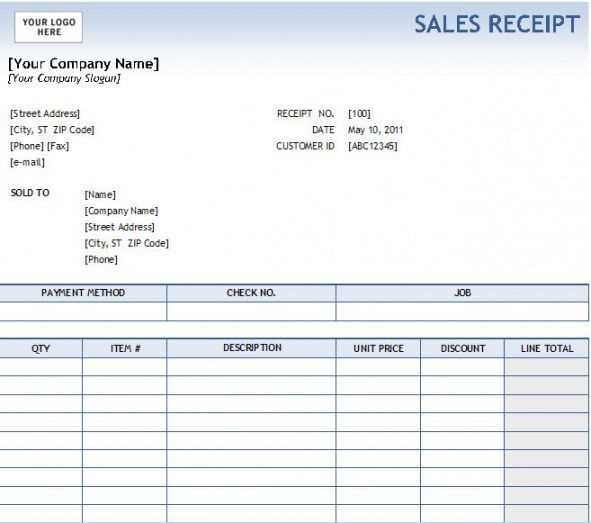

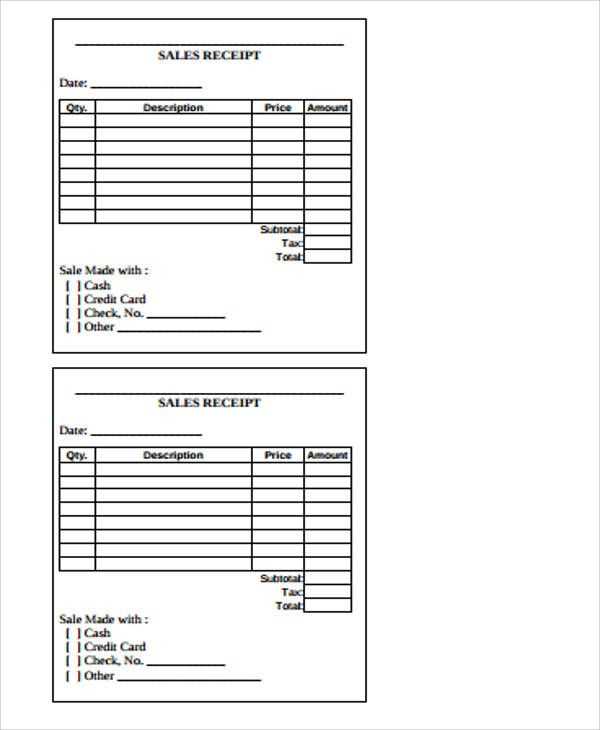

Creating a clean, professional sales receipt is key for any business, ensuring both the seller and buyer have clear records of the transaction. A well-designed template should be simple but include all necessary details: business name, contact information, itemized list of purchased goods, total price, taxes, and payment method.

Use a clear font and a logical layout. A typical sales receipt includes the transaction date and time, the items or services purchased, unit prices, quantity, and the subtotal before tax. Be sure to display the tax amount and total price, including any discounts applied. Including a section for payment method–whether credit card, cash, or other forms–adds clarity and helps with record keeping.

For businesses, it’s important to personalize the template with your logo and brand colors, reinforcing your company’s identity. Make sure your template is easy to adapt for different products or services, and consider using software tools that automatically populate customer and sales data for faster processing.

Here is the corrected version:

For a clear and professional retail sales receipt, focus on the following key elements:

1. Accurate Transaction Details

Include the date, time, and transaction number. These are crucial for tracking and referencing purchases. Make sure each item is clearly listed, along with its price, quantity, and any applicable discounts. Always round up totals and taxes to avoid confusion.

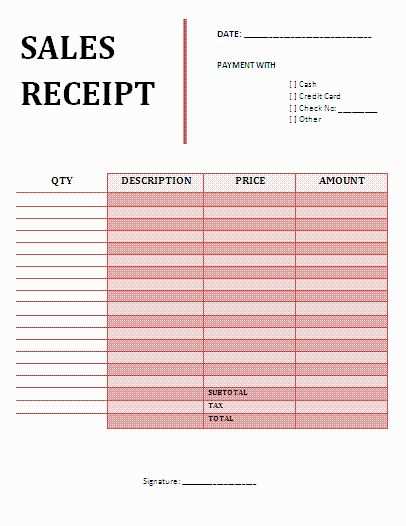

2. Simple Layout for Readability

The layout should be straightforward and easy to read. Use bold or larger font for the most important details, like the total amount and store name. Ensure that there is enough spacing between sections to make the information accessible at a glance.

| Item | Price | Quantity | Total |

|---|---|---|---|

| Product A | $10.00 | 2 | $20.00 |

| Product B | $5.00 | 1 | $5.00 |

| Subtotal | $25.00 | ||

| Tax (5%) | $1.25 | ||

| Total | $26.25 | ||

Ensure that contact information for customer support is easily accessible. Include return or exchange policies, if applicable. Double-check for any spelling errors or incorrect prices before printing.

- Retail Sales Receipt Template

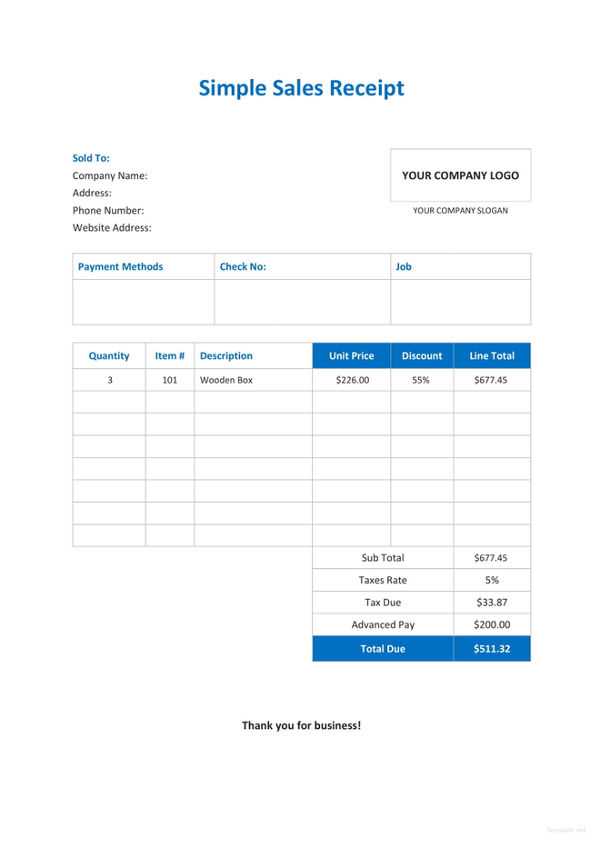

To create a functional retail sales receipt template, include the following key elements:

- Store Information: Clearly display the store’s name, address, phone number, and email at the top. This ensures customers can easily contact the store if needed.

- Receipt Number: Assign a unique identifier to each receipt for tracking and organizational purposes.

- Date and Time: Include the transaction date and time, making it easier for both customers and store owners to reference later.

- Itemized List of Purchases: List each item purchased, along with its quantity, unit price, and total price. This breakdown helps customers verify their purchases.

- Taxes: Display the applicable sales tax clearly, ensuring transparency in pricing.

- Total Amount: Show the total cost of the purchase, including taxes, to avoid confusion.

- Payment Method: Indicate how the transaction was paid, whether by cash, credit card, or other methods.

- Return Policy: Briefly include the store’s return policy or link to it for customer reference.

By organizing the receipt with these components, you’ll provide a clear and professional document that enhances the customer experience and ensures proper record-keeping for both parties.

Focus on readability and space. Place key information, like store name, date, and total amount, in clear, distinct sections. Use larger font sizes for important details, such as the total cost, to make them stand out. Organize the content logically, with an obvious flow from one section to the next, and avoid cluttering the receipt with unnecessary elements.

Choose a clean, easy-to-read font. Sans-serif fonts work well, as they offer clarity and legibility, especially on small formats. Ensure there’s enough contrast between text and background, so everything is readable even in low-light environments.

Maintain balance by leaving enough space between different sections. This creates a clean and breathable layout, making the information easier to digest. Prioritize grouping related items together, such as product names and their corresponding prices, for quick reference.

Limit the use of colors. A monochrome design or a minimal accent color will help maintain focus on the essential details. Avoid overly bright colors, which can create confusion or distract from important information.

Finally, ensure that all text is aligned properly–left or center-aligned–and maintain consistency across the receipt. This promotes a professional and organized appearance, making the receipt both functional and user-friendly.

A sales receipt should clearly display all relevant details. Begin with the store’s name, address, and contact information. This helps the customer quickly identify where the transaction took place. Ensure the date and time of purchase are visible, as this serves as a reference for both the customer and the business.

Next, include a unique transaction or receipt number. This will make tracking and managing purchases easier for both parties. Clearly list the items purchased, including a brief description and the quantity, along with the individual prices for each item.

Don’t forget to highlight the total amount paid. Break down the pricing structure if applicable, showing any discounts, taxes, or additional fees. Transparency here builds trust and ensures clarity for the customer.

For refunds or returns, include a clear statement of your return policy or the conditions under which a refund is possible. Lastly, add any payment methods used, whether it’s credit card, cash, or digital payment systems, and provide any necessary details, like the last four digits of a card number for verification.

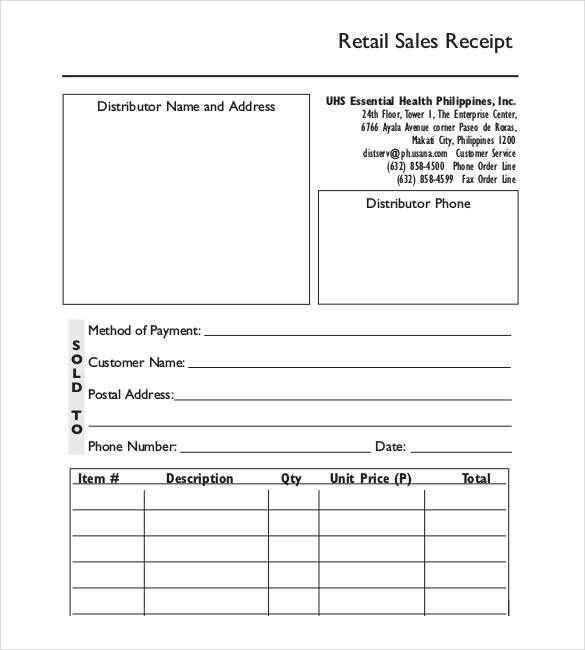

Customize the retail receipt template to meet the specific needs of your business. The design and content of the receipt should reflect the type of products or services sold, the transaction process, and the expectations of your customers.

- For retail stores: Include detailed product descriptions, pricing, and tax breakdowns. Add return policies and loyalty program information to enhance customer experience.

- For service-based businesses: List the service provided, along with time spent and hourly rates if applicable. Also, incorporate payment methods and details about any follow-up services offered.

- For e-commerce: Ensure the receipt includes shipment tracking details, delivery information, and a clear return/exchange policy. Include customer service contact information to address any potential concerns.

- For food and beverage establishments: Focus on clear itemization of food/drinks ordered, including applicable taxes and tips. Highlight any special promotions or discounts that were applied to the bill.

By tailoring the receipt template to your specific business type, you enhance transparency and improve customer satisfaction. Make sure to regularly review the layout to ensure all key information is easily accessible and clearly presented.

Sales receipts must comply with local laws to ensure their validity. Different jurisdictions have specific rules for what information must appear on a receipt. Businesses should understand these requirements to avoid legal issues.

Required Information on Sales Receipts

In most regions, sales receipts must include the following elements:

| Required Element | Description |

|---|---|

| Business Name and Address | The receipt should clearly state the seller’s business name and physical location. |

| Transaction Date | The date of the transaction is necessary for record-keeping and tax purposes. |

| Item Description | Each item purchased must be listed with a description and price. |

| Total Amount | The final price of the transaction, including applicable taxes, must be shown clearly. |

| Tax Information | Many regions require a breakdown of sales tax or VAT on the receipt. |

Retention Period and Dispute Handling

Receipts should be kept for a certain period as specified by local regulations. In case of a dispute or return, having proper records is necessary to resolve the issue efficiently. Ensure the retention period is in line with local requirements to stay compliant.

Choose legible fonts such as Arial, Helvetica, or Verdana for clear, crisp text. Avoid overly decorative fonts that may impair readability. Stick to a font size of at least 10pt for easy reading, especially on smaller screens.

Contrast and Colors

Ensure sufficient contrast between text and background colors. Use dark text on light backgrounds for better visibility, particularly for older customers. Tools like the WebAIM Contrast Checker can help test contrast ratios.

Line Spacing and Paragraph Structure

Maintain adequate line spacing–at least 1.5x the font size–to make content easier to follow. Break information into short paragraphs or bullet points to improve clarity and reduce visual clutter.

- Provide alternative text for images, enabling screen readers to describe visual elements to users with visual impairments.

- Ensure your template is responsive and functions across all devices, making it accessible on phones, tablets, and desktops.

- Use simple language and avoid jargon to make the receipt clear to all users, regardless of their background.

Ensure accurate dates and timestamps on your receipts. Mistakes with the date can lead to confusion and disputes, especially for returns or warranty claims. Always include the correct date and time of the transaction to avoid issues later on.

Double-check for missing item descriptions or pricing. It’s easy to overlook details, but not listing products clearly can cause confusion for customers. Ensure each item is described properly, and confirm the pricing matches what was agreed upon at checkout.

Watch for incorrect tax calculations. A common error is adding taxes incorrectly or leaving them out entirely. Always verify that the tax percentage is applied properly according to the local regulations.

Clear payment information is a must. Avoid vague payment terms. Specify the exact method of payment (e.g., cash, card, digital payment), and include transaction or authorization numbers for card payments. This ensures clarity for both the seller and the buyer.

Avoid cluttering the receipt with unnecessary information. A clean, simple layout is key. Only include the necessary details–too much information can make the receipt harder to read and lead to confusion.

To create a retail sales receipt template, focus on clear itemization. Ensure the receipt includes a header with your business name, address, and contact details. Directly after, list the purchased items, their quantities, and prices. Include applicable taxes and a subtotal, followed by the total amount due. Add a payment method section and a thank you message at the bottom. Consider integrating an area for discounts or promotions if applicable.

Example layout:

- Business Name

- Address

- Phone Number

- Date and Time of Purchase

- Item List: Quantity, Description, Price

- Subtotal

- Taxes

- Total Amount Due

- Payment Method

- Thank You Note

With this format, customers can easily understand their purchase details and your business can maintain organized records.