If you’re looking to create a clear and professional sales invoice receipt, using a template can save time and ensure accuracy. A well-structured template helps maintain consistency in your transactions and provides your clients with a transparent record of their purchases. With the right elements, you can quickly generate invoices that meet both legal and business standards.

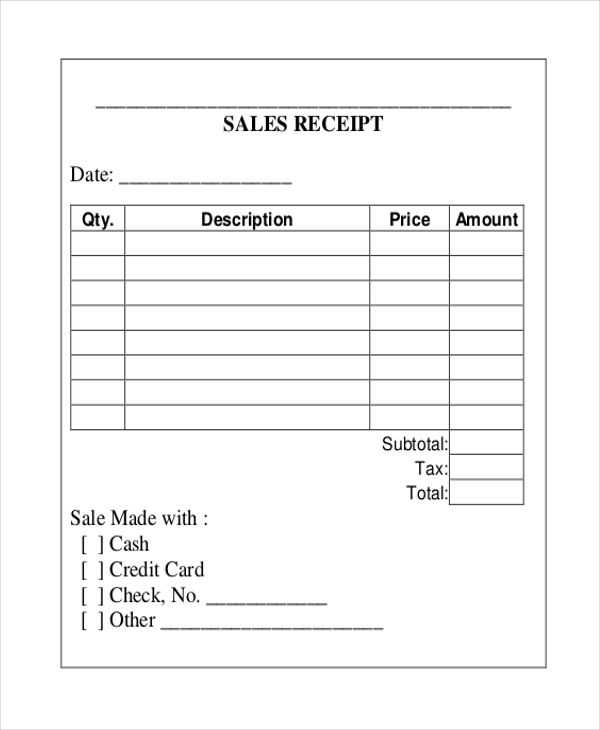

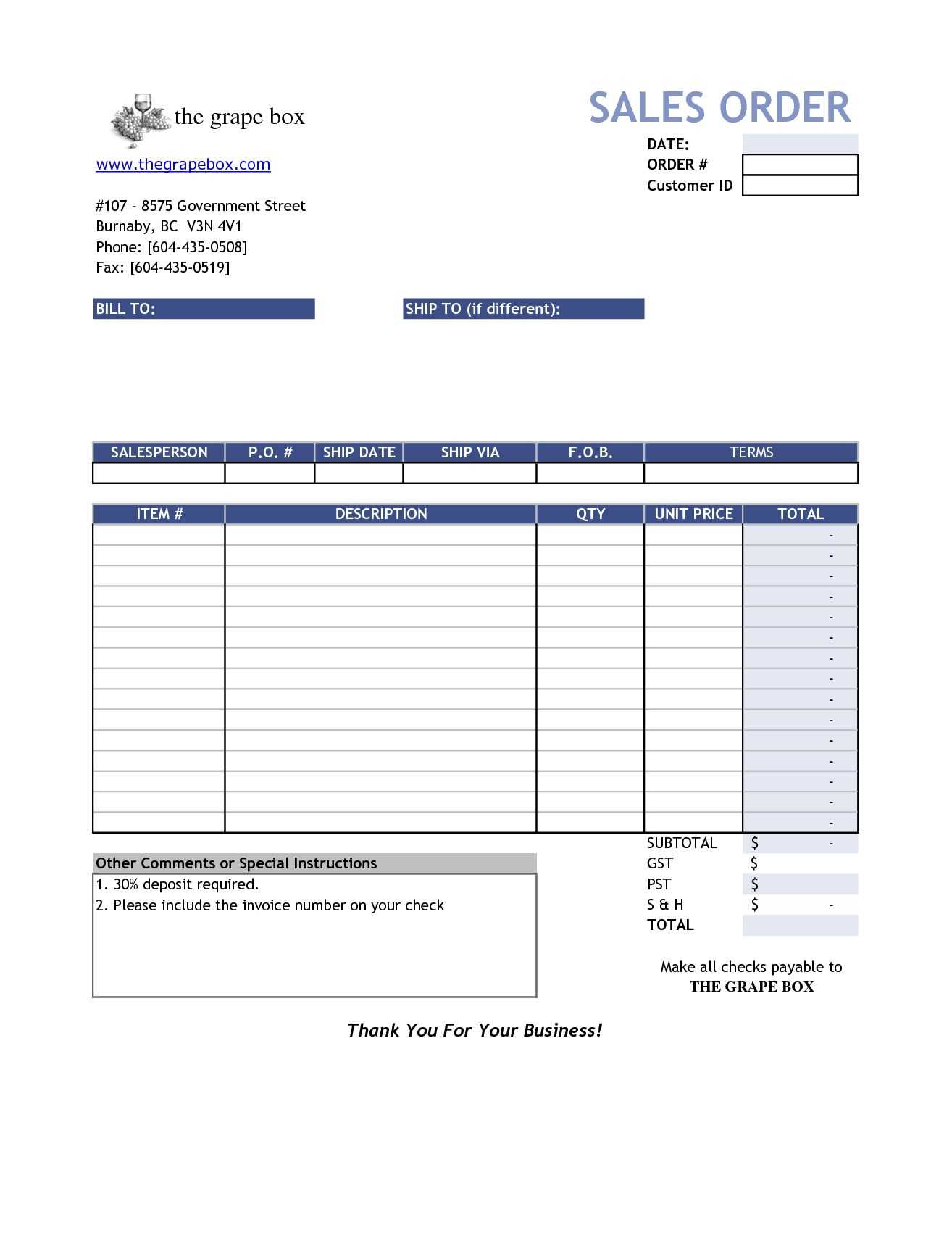

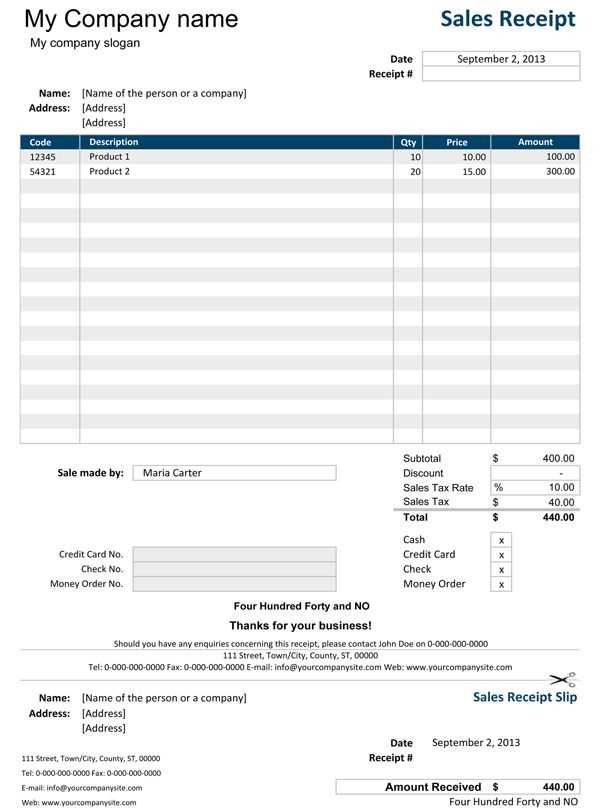

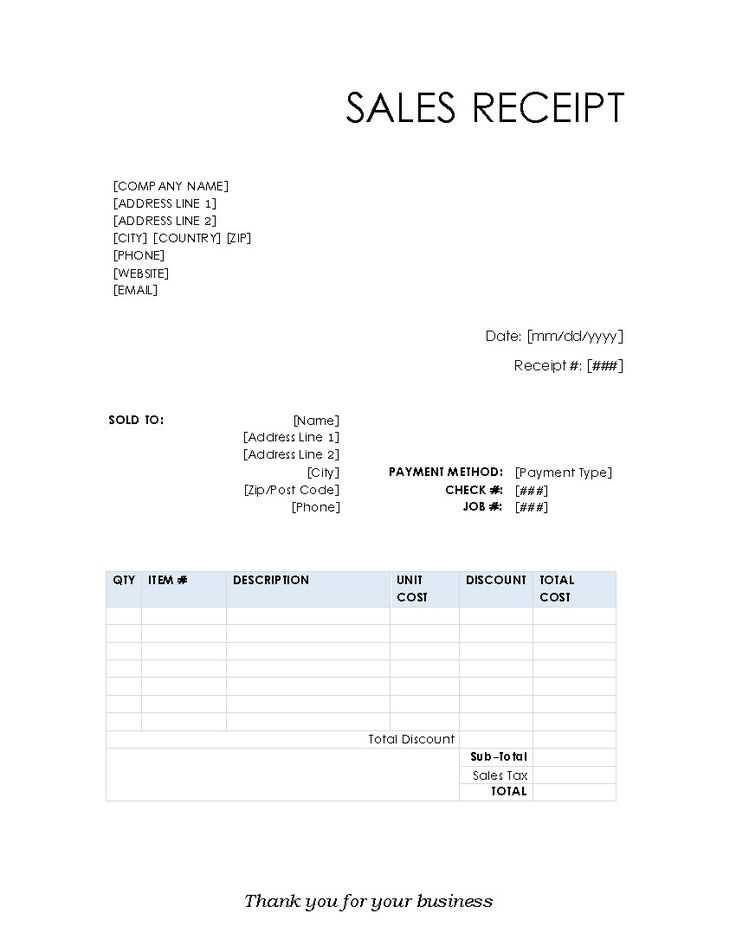

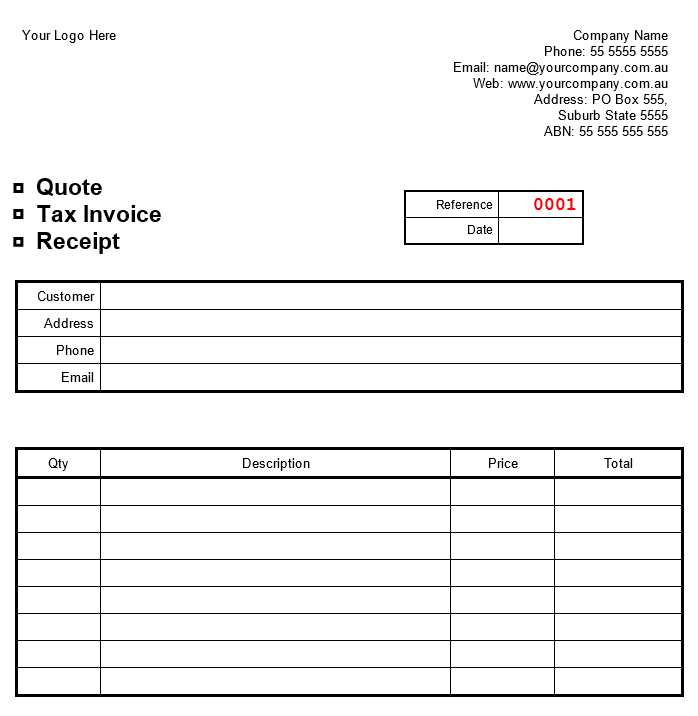

A good template should include basic details such as invoice number, date of issue, and payment terms. These elements help avoid confusion and streamline payment processing. Including seller’s information like the name, address, and contact details will also ensure the recipient can reach you easily for any inquiries.

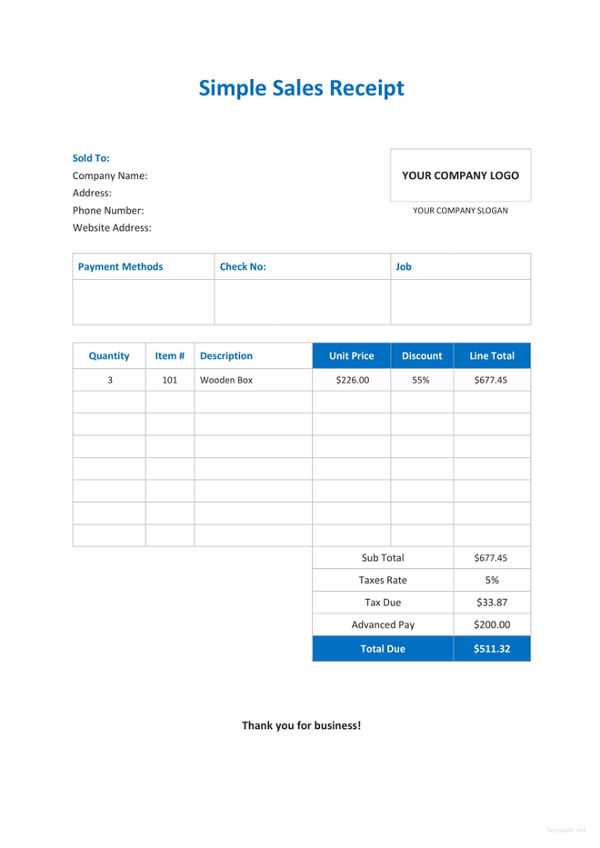

It’s also important to list the products or services sold along with their descriptions, quantities, and prices. This transparency provides a clear breakdown of the transaction and ensures there are no misunderstandings. Don’t forget to include a total amount due and any taxes or discounts applied to give a complete picture of the sale.

By using a sales invoice receipt template, you streamline the invoicing process, avoid errors, and leave a professional impression with your clients. Tailor the template to match your business’s needs, whether it’s a simple or more detailed document, and ensure that it fits the nature of your transactions.

Here is the revised version with minimal repetitions:

Use clear and concise headings to structure your invoice receipt. Organize details logically to make it easy to read and understand.

- Company Name: Add the name of your business at the top for immediate identification.

- Invoice Number: Ensure the invoice number is unique and sequential for record-keeping.

- Date: Include the date the invoice is issued to avoid confusion.

- Payment Due Date: Clearly specify when the payment is expected.

- Customer Details: Provide full customer information, including name, address, and contact information.

Make sure to list each item or service provided with the corresponding cost, quantity, and total price. This breakdown helps avoid any misunderstandings.

- Item Description: Provide a brief but precise description of each item or service.

- Unit Price: Clearly state the price per unit to make calculations transparent.

- Total Amount: Sum up the prices for the total amount due, including taxes if applicable.

Don’t forget to add any applicable payment instructions or methods (e.g., bank transfer, PayPal). A thank you message or a note of appreciation enhances the customer experience.

Finally, ensure the document is easy to print or download, and use a professional format that matches your company’s branding for consistency.

- Sales Invoice Receipt Template Guide

Use a sales invoice receipt template to streamline the invoicing process and ensure clarity in your transactions. A template helps you maintain consistency and prevents errors in the documentation of sales transactions. Here are key aspects to consider when creating or choosing a sales invoice receipt template.

1. Include Basic Information

- Invoice Number: Ensure each invoice has a unique number for easy tracking.

- Seller and Buyer Details: Clearly list both parties’ names, addresses, and contact information.

- Date of Issue: Add the date the transaction was completed to avoid confusion.

- Payment Terms: Specify whether the payment is due immediately or within a certain period.

2. Break Down the Sale Details

- Itemized List: Include a detailed list of products or services provided, with individual prices.

- Quantity and Unit Price: Ensure the number of items sold and their respective prices are clearly stated.

- Total Amount: Clearly show the total due, including taxes, discounts, or shipping fees if applicable.

3. Specify Payment Information

- Payment Method: Note whether payment was made via cash, credit, or bank transfer.

- Transaction Reference: If applicable, include a transaction ID or reference number for easier tracking.

- Amount Paid: Clearly show the amount that has been paid and any outstanding balance.

4. Ensure Legibility and Simplicity

Design the template to be simple and easy to read. Use clear fonts, appropriate spacing, and organize the information logically. This ensures both you and your client can quickly understand the details of the sale without confusion.

Adjust your invoice layout to match your brand identity by adding your logo, business name, and contact details at the top. Make sure the design is clean and professional to give your clients a clear view of the services or products they purchased.

Change the color scheme to align with your company’s branding. Many invoice templates offer customization options, allowing you to select specific colors for text, headings, and borders. Pick colors that are easy on the eyes while remaining consistent with your overall visual identity.

Include fields that are relevant to your transactions. Customize sections for itemized descriptions, quantities, prices, taxes, and total amounts to ensure they match your business needs. Ensure you have a clear breakdown of charges to help customers easily understand the costs.

Incorporate payment terms and due dates to avoid confusion. It’s essential to add clear payment instructions and policies, such as accepted payment methods, late fees, or early payment discounts. This helps set expectations for your clients from the start.

Choose the right font for your invoice. Avoid overly decorative fonts and opt for simple, readable ones like Arial or Helvetica. This will ensure the document is professional and easy to read on any device.

Don’t forget to add a unique invoice number and date. These are important for tracking purposes and help with future reference. Ensure that the invoice numbering system is sequential to avoid any confusion.

Lastly, include a thank-you note or a personalized message. Adding a brief, friendly message can leave a positive impression, reinforcing your commitment to customer satisfaction.

A sales invoice needs to clearly display all relevant details to ensure smooth transactions and record-keeping. Begin with the invoice number, which helps both parties track and reference the document easily. It should be unique for each invoice issued.

Seller’s information must be included, such as the company name, address, phone number, and email. This establishes clear communication channels if any issues arise.

Buyer’s details are just as important. Include the buyer’s name, address, and contact information to ensure accurate delivery and payment correspondence.

The invoice date marks when the sale took place. Pair it with the due date to indicate when payment is expected. This helps both parties manage their financial expectations.

Clearly list itemized products or services. For each item, include the description, quantity, price per unit, and total cost. This gives transparency into the sale and simplifies any future disputes.

The total amount due should be displayed prominently. Include any applicable taxes, discounts, or additional fees, making sure that everything adds up correctly. Double-check this calculation to avoid errors.

If applicable, include payment instructions, such as bank details or links to online payment platforms. Make the process straightforward for the buyer.

Terms and conditions related to payment should also be outlined. This includes policies on late payments, returns, or warranties. Being clear about these terms helps prevent misunderstandings.

Select a format that suits your business style and customer needs. If you’re looking for simplicity and clarity, a plain text receipt might be ideal. It’s straightforward, easy to read, and can be generated quickly using basic tools. However, if you require more detailed documentation, a PDF format works well. It allows for customization with your logo, company details, and a clean layout, making it more professional and reliable for official purposes.

PDF vs. Plain Text: Which One to Choose?

PDF receipts are the preferred choice for many businesses due to their professional appearance and versatility. They ensure consistent formatting, which looks the same on any device or printer. On the other hand, plain text receipts are more practical for informal transactions and can be easily printed without the need for additional software. Consider your audience’s expectations when deciding between the two formats. If you’re handling high-value transactions or dealing with taxes, a PDF is often the better option.

Customizing Your Receipt for Clarity

The format of your receipt should prioritize clarity. Whether you choose a simple text format or a PDF, make sure all essential details–such as the item description, price, payment method, and date–are clearly presented. Using a consistent layout across all receipts helps customers quickly locate necessary information. Additionally, ensure that your contact details are easily visible in case of follow-up questions or returns.

To add payment methods and terms to your sales invoice receipt, begin by clearly listing the accepted payment methods. This should be displayed in a prominent section of the invoice, ensuring that your clients know exactly how they can pay. Include options like bank transfer, credit card, PayPal, or checks, and provide necessary details (such as account numbers or payment links) to guide the customer.

Payment Terms should be outlined to avoid confusion. Clearly specify the due date for payment, such as “Due within 30 days from the invoice date,” and any late payment penalties, like a fixed percentage for overdue balances. If discounts are offered for early payments, make sure to detail the terms, such as “5% discount for payments made within 10 days.”

For recurring payments, mention the frequency of billing (e.g., monthly, quarterly) and the automatic payment process, if applicable. It’s also helpful to state the currency used for payments and any additional charges, such as taxes or handling fees, to keep everything transparent and avoid misunderstandings later on.

Once these terms and methods are clearly laid out, both you and the customer will have a better understanding of the expectations, ensuring a smoother transaction process.

Include the correct legal information in your invoice receipt. For most businesses, this means incorporating the company’s registered name, legal address, and tax identification number (TIN or VAT number) on the document. This ensures that your receipt meets the regulatory requirements for tax reporting in your country or jurisdiction.

Double-check your invoice’s compliance with tax laws, especially regarding VAT or sales tax. Be sure to display tax rates clearly and ensure the total amounts are calculated correctly. In many regions, businesses must also include separate lines for taxable and non-taxable items.

Don’t forget to maintain transparency with the customer about payment terms. Include due dates, payment methods, and any penalties for late payments if applicable. Clear communication of these terms can prevent potential disputes.

If you’re dealing with international clients, research cross-border tax rules. Depending on the situation, you may need to adjust how VAT or sales tax is calculated based on the customer’s location.

Staying compliant also involves regularly reviewing and updating your invoices as laws change. Keeping records up to date is a key part of ensuring long-term compliance and minimizing the risk of legal issues or fines.

Missing or Incorrect Contact Information – Always double-check the accuracy of both the buyer’s and seller’s contact details. Mistakes in email addresses, phone numbers, or company names can cause delays and confusion. Make sure all information is up-to-date and clearly visible on the receipt.

Failure to Include a Unique Invoice Number – Every invoice receipt should have a distinct number. This helps in tracking payments, maintaining records, and avoiding any disputes. A sequential numbering system is an easy solution for this.

Not Specifying the Payment Terms – Be clear about the payment due date, discounts, and late fees. Ambiguous terms may lead to misunderstandings with your clients. Always indicate whether the payment is due immediately, within a set period, or if there are any penalties for late payments.

Omitting Tax Details – If your service or product is taxable, always list the applicable tax rate and amount. Failing to provide tax information can create legal and financial problems later on. Clearly show the tax amount on the receipt to ensure transparency.

Incorrect Pricing or Quantity Information – Verify that all quantities, unit prices, and totals are correct. Simple math mistakes can harm your credibility and lead to conflicts with clients. Always double-check every figure before finalizing the receipt.

Not Including a Payment Method – Specify how the payment was made, whether it was through credit card, bank transfer, or cash. This helps in tracking the transaction and clarifies the payment method for both parties.

Unclear Description of Goods or Services – Make sure your item descriptions are clear and detailed enough for the buyer to understand. Vague descriptions can create confusion about what was purchased. Include enough information to avoid any potential disputes over what was delivered.

Not Providing a Clear Breakdown of Charges – Always list the individual charges, including shipping, taxes, and any additional fees. This allows the buyer to understand exactly what they are paying for and prevents unexpected charges.

A well-structured sales invoice receipt template is key to simplifying transactions. For clarity, ensure that your template includes these essential components:

Invoice Details

The invoice should include a clear title with the words “Sales Invoice Receipt,” the date of issue, and a unique invoice number. This helps both the business and customer track the transaction easily.

Customer and Seller Information

Both the buyer and seller details should be listed, including the full name, address, and contact information. This helps ensure that any issues or questions about the transaction can be resolved quickly.

Transaction Breakdown

Provide a detailed list of all products or services purchased. Include descriptions, quantities, individual prices, and the total price for each item. This ensures the customer knows exactly what they’re paying for and prevents future disputes.

Payment Information

Be sure to specify the payment method (credit card, cash, bank transfer, etc.) and the payment status (paid or unpaid). If applicable, note any discounts applied, taxes, or additional fees.

Tax Information

Ensure that the tax rate is clearly stated, as well as the total tax amount. This is important for both business record-keeping and customer transparency.

Table Example

| Description | Quantity | Price | Total |

|---|---|---|---|

| Item A | 2 | $50 | $100 |

| Item B | 1 | $75 | $75 |

| Subtotal | $175 | ||

| Tax (10%) | $17.50 | ||

| Total | $192.50 | ||

Providing a structured layout like this ensures that both parties have a complete record of the transaction and avoids confusion down the line.