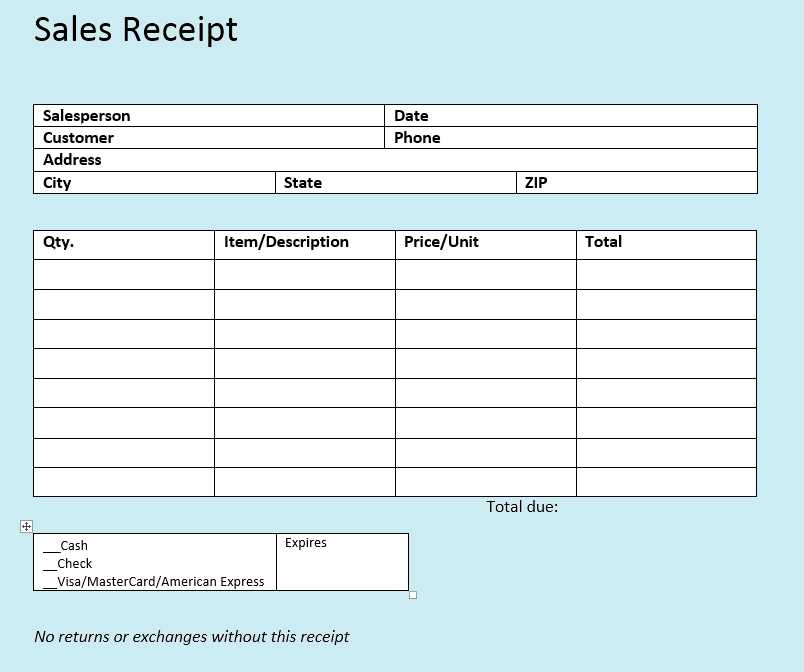

Create a simple and organized sales receipt list to track your transactions. Use a clean and structured format that includes key details such as the date, item description, quantity, price, and total amount for each sale.

Set up columns for each important data point: the customer name, item name, unit price, and total cost. Include a column for discounts or taxes, if necessary, to ensure accurate records. This layout keeps all critical information easily accessible.

Consider using a consistent format for your receipts. This helps avoid confusion and ensures that you can quickly find any necessary information. A template that you can reuse will save you time and improve accuracy, especially for frequent transactions.

For best results, print or save your list regularly to keep your records up to date and avoid losing track of your sales data. Organizing this information promptly will keep your financial management smooth and straightforward.

Sure, here is the improved version:

To create a practical sales receipt list, start with a clear table format. Organize the columns with labels like “Item Name”, “Quantity”, “Unit Price”, and “Total”. This allows for quick referencing and smooth data entry. Be sure to add a “Date” column to track each transaction effectively.

Structuring the List

Use consistent formatting for all numerical values. Align the prices and totals to the right, ensuring readability. Include a “Grand Total” row at the bottom for easy summation of all items purchased. This helps to summarize the sale at a glance.

Customizing for Specific Needs

Consider adding columns for discounts or taxes, if applicable. This customization will allow for flexibility depending on your sales model. Remember to leave room for customer details like “Name” and “Contact Info” if you plan to include them in the receipt.

- Sales Receipt List Template

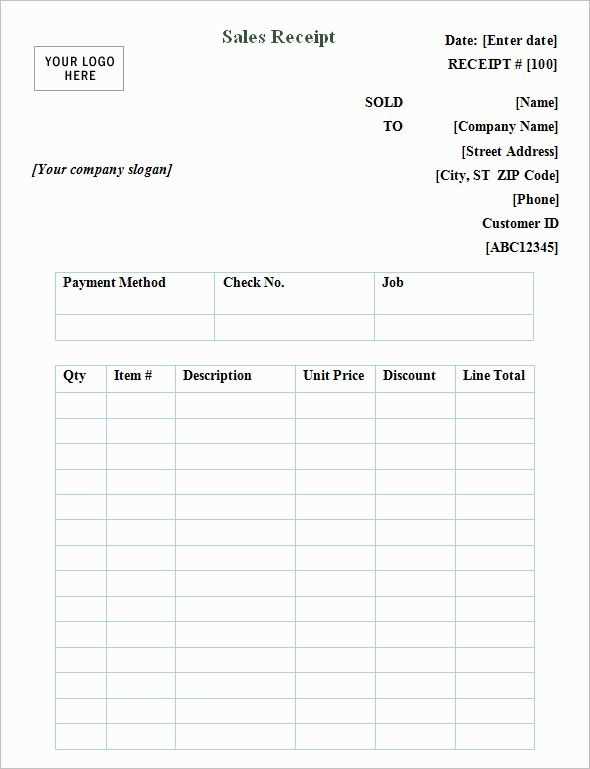

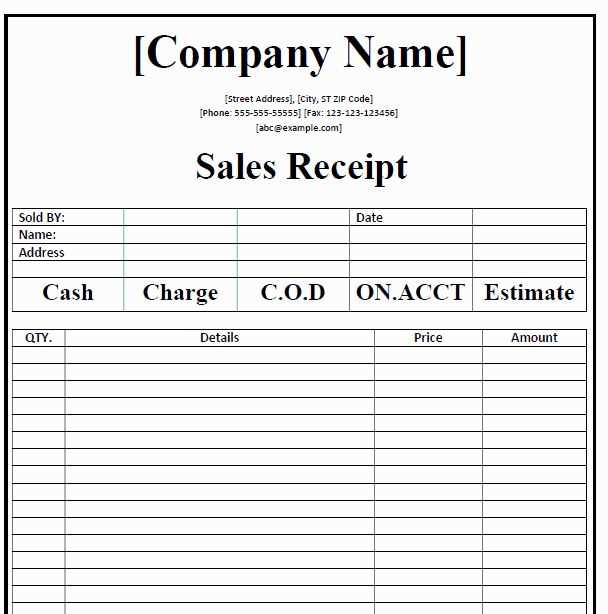

A Sales Receipt List Template is a practical tool to track and organize transactions for businesses. This template includes all the essential details of a sale, such as the date, item description, quantity, price per unit, and total amount. A well-structured list helps streamline financial reporting and makes it easier to review or audit sales records at any time.

To create an efficient template, start by setting up columns for each key component of a sale. Ensure there is a column for the receipt number, so each transaction can be identified easily. This helps with future reference and improves organization. Include a space for customer details such as name and contact information if necessary. Add sections to calculate totals automatically, making it simple to tally up the final sales amount.

Keep your template clean and easy to read. Avoid unnecessary data that may complicate the format. For consistency, use clear headings and ensure the columns are well-aligned. Providing a simple, functional layout ensures quick data entry, minimizing the chances of errors during processing. Finally, include a signature field or space for verification if required, adding an extra layer of formality to the transaction.

Begin by organizing the sales data into a clear structure. Create columns for important details like the date, customer name, items sold, total amount, and payment method. This will help you quickly reference any specific sales receipt when needed.

Use a spreadsheet application or a database to maintain this list. A table format works best for ease of tracking and sorting data. Each entry should correspond to a unique sales receipt, with all relevant details filled in.

| Date | Customer Name | Items Sold | Total Amount | Payment Method |

|---|---|---|---|---|

| 01/01/2025 | John Doe | Product A, Product B | $100 | Credit Card |

| 02/01/2025 | Jane Smith | Product C | $45 | Cash |

Ensure that each entry is accurate and includes all necessary details. Regularly update the list to reflect new transactions and remove any duplicates. This method will allow you to track sales easily and access important information quickly.

A sales receipt should provide clear details for both the buyer and seller. Here’s what to include:

- Receipt Number: Assign a unique number to each receipt for tracking and reference purposes.

- Seller’s Information: Include the business name, address, and contact details to identify the seller.

- Buyer’s Information: If applicable, list the buyer’s name and contact information, especially for larger transactions.

- Transaction Date: Clearly state the date the sale occurred.

- Item Description: List each item purchased, including quantity, unit price, and total price.

- Total Amount: Indicate the final price after taxes, discounts, and additional fees, ensuring transparency.

- Payment Method: Specify how the payment was made, such as cash, credit card, or online payment system.

- Tax Information: Include details on applicable taxes, such as sales tax rate and amount.

- Return and Exchange Policy: Briefly mention the terms for returns or exchanges if relevant.

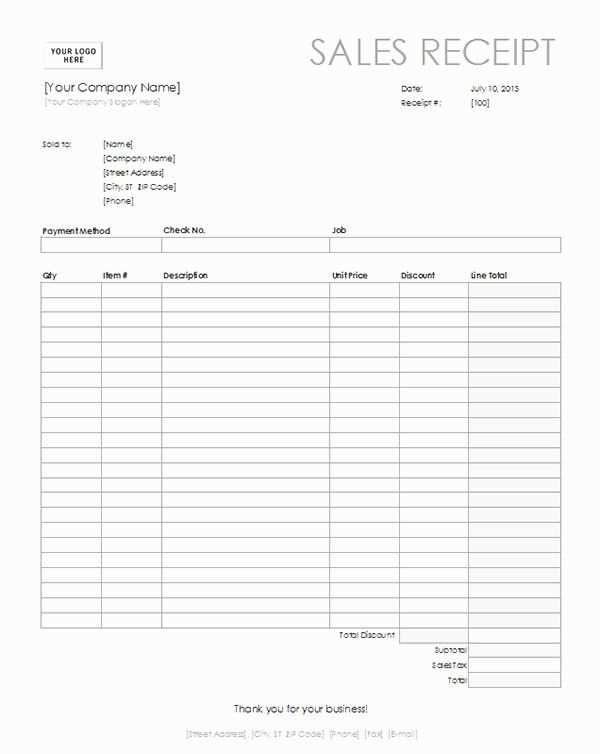

Choose a clear font style, like Arial or Helvetica, for readability. Make sure the text size is large enough to be legible on both print and digital formats. Organize information logically, grouping items like product names, quantities, and prices in separate columns. This helps reduce confusion and makes the list easier to follow.

Consider adding bold or italics for emphasis, such as highlighting important totals or discounts. Use consistent spacing between items and sections, ensuring that each line has enough room to breathe. This prevents the receipt from feeling cramped and improves overall aesthetics.

Opt for alternating row colors or a subtle grid pattern to distinguish between different items on the list. This can make scanning the list quicker and more intuitive for the reader. Avoid excessive use of colors that could distract from the important details.

Always ensure alignment is clean. Left-align text for item descriptions and right-align prices, totals, and taxes to enhance clarity. Keep the list simple; focus on what’s necessary to avoid overwhelming the viewer with unnecessary details.

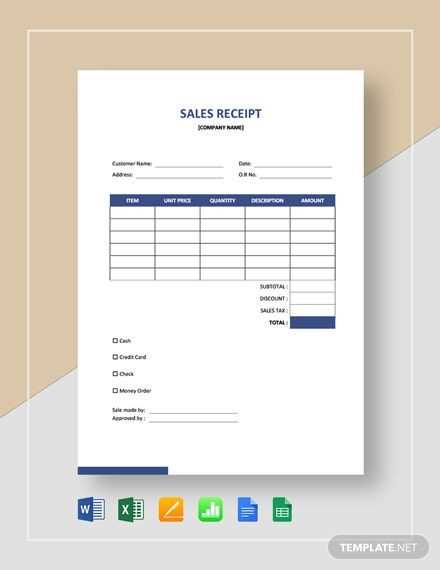

Adjust your receipt template to meet the unique needs of each industry by incorporating specific fields and details relevant to the transactions. For example, in retail, include product names, quantities, prices, and discounts. In restaurants, focus on menu items, meal options, and service charges.

Retail Industry

For retail, set up fields for item descriptions, SKU numbers, taxes, and subtotal amounts. Customize the layout to clearly display this data in a way that customers can easily check the accuracy of their purchases. A simple, straightforward format enhances the user experience and builds trust.

Service Industry

For service-based businesses, include a section for services rendered, hours worked, and any additional fees. Adjust your template to accommodate variables like hourly rates or project-specific details. This makes the receipt a useful tool for both the customer and your accounting team.

Excel and Google Sheets offer flexible and easy-to-use tools for creating sales receipt templates. They allow you to organize transaction details and automatically calculate totals. Here’s how you can set up a basic template:

Creating a Template in Excel

- Start by setting up columns for key receipt details: date, item description, quantity, unit price, total price, and payment method.

- Use simple formulas like SUM to calculate totals for multiple items and auto-calculate tax if needed.

- Apply borders and shading for readability, making sure important fields like total amounts and taxes are highlighted.

- Save the file as a template for quick reuse. You can also create a drop-down list for payment methods using Excel’s Data Validation feature.

Setting Up a Template in Google Sheets

- Google Sheets functions similarly to Excel, allowing you to create and save templates for reuse. The advantage of Google Sheets is its cloud-based access, making it easy to share receipts with clients or coworkers.

- Set up a similar table with columns for transaction data. Use built-in functions like SUM to calculate totals.

- Google Sheets also allows you to add checkboxes or dropdowns for categories, which can help streamline the process for repetitive entries.

- To enhance the design, you can customize fonts, add logos, and use conditional formatting to highlight specific values like discounts or taxes.

Both platforms let you easily modify and print receipts. By customizing templates to match your business needs, you can improve the efficiency of your sales process.

Ensure accurate data entry by double-checking product details, including names, quantities, and prices. A small mistake in item information can create confusion for both your records and customers. Always cross-reference quantities and amounts to prevent errors in totals.

1. Skipping Important Tax Information

Don’t overlook including taxes or discounts on your receipts. Always calculate the applicable tax rate and ensure it is listed separately on the receipt. Customers need transparency on how much they are paying beyond the base price.

2. Incorrect Date Entries

Input the correct transaction date without fail. An inaccurate date can make tracking and auditing sales difficult. Always verify the day and time of each transaction, especially when handling returns or exchanges.

Tip: Check if the receipt automatically generates the correct date or if it needs manual entry to avoid mistakes.

Start by organizing the receipt list logically. Group items in a way that reflects the transaction flow, such as by date, transaction type, or customer. This helps in reviewing or auditing receipts later. Ensure that each entry has a clear label for the product or service, the amount, and the total cost.

Always include the store’s details, like name, address, and contact information, at the top of the list. This makes the receipts easily identifiable and provides the necessary information for follow-up. Keep the format consistent throughout the list to avoid confusion.

It’s a good practice to set up a numbering system for receipts, even if it’s just for internal tracking. This ensures that no receipt is left unaccounted for. Be sure to double-check the total amounts listed at the bottom of each entry for accuracy.