Ready-to-Use Templates

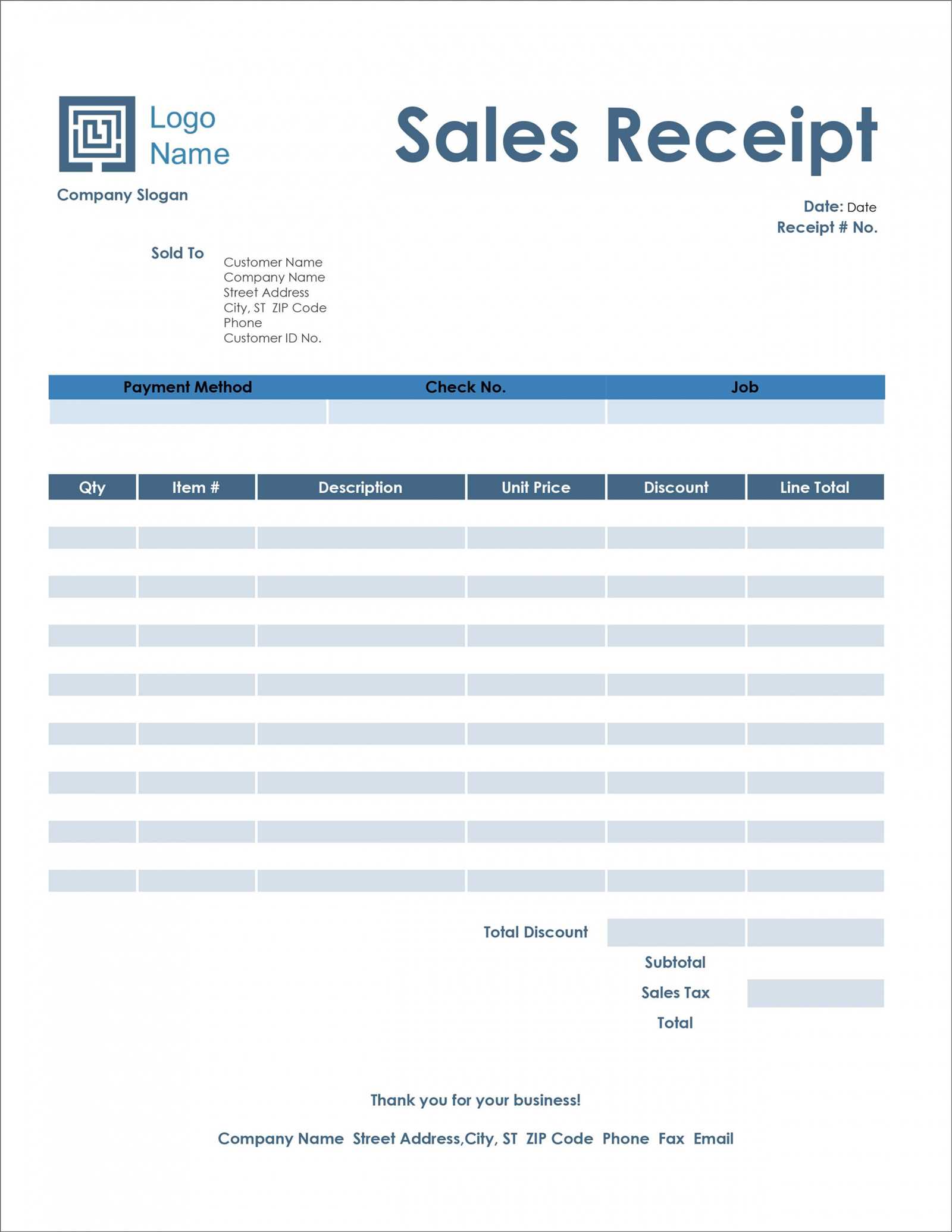

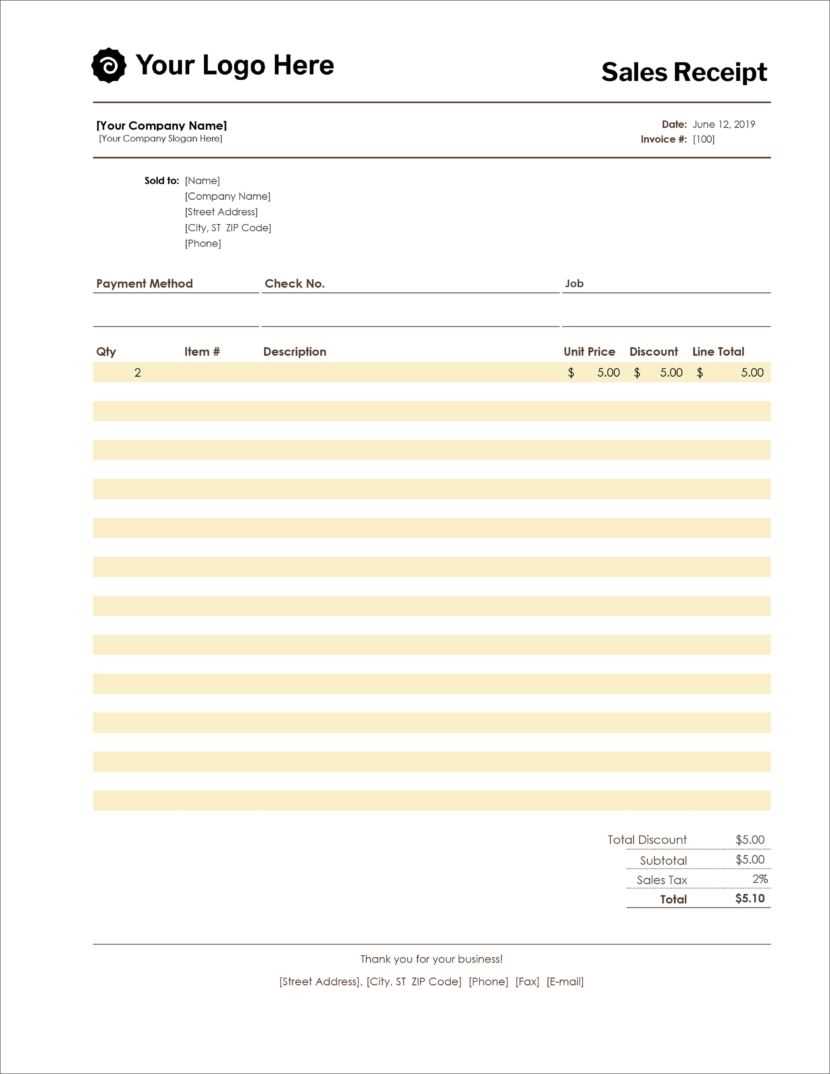

Download a structured sales receipt template in DOC format to streamline transactions. Pre-formatted fields ensure clarity for both sellers and buyers. Customize company details, payment methods, and item descriptions.

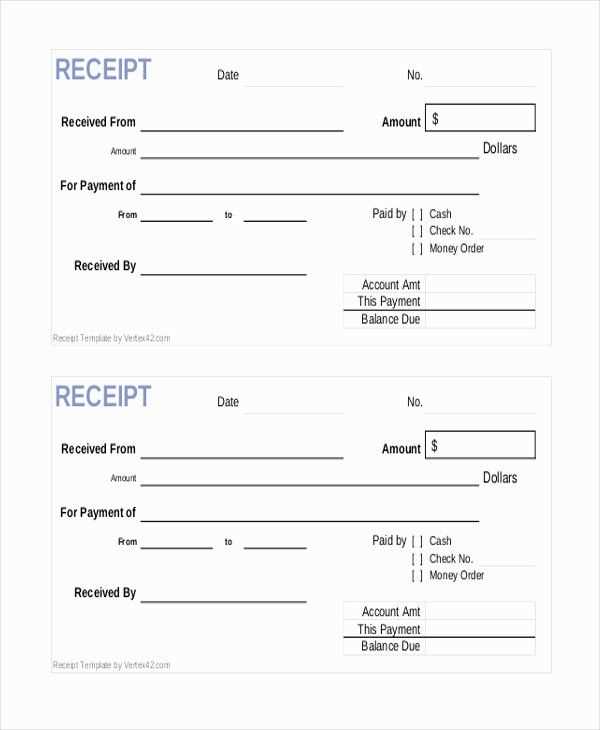

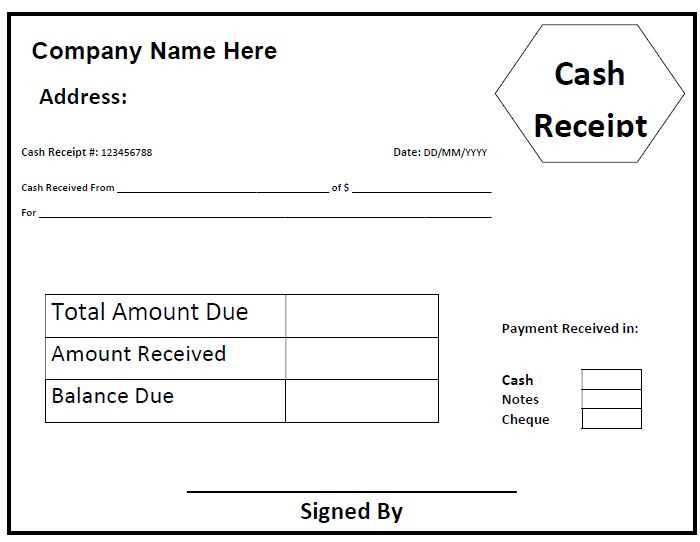

- Header: Business name, address, and contact details.

- Date & Receipt Number: Unique identifiers for tracking.

- Buyer Details: Name and contact information.

- Itemized List: Products, quantities, and prices.

- Total Amount: Subtotal, tax, and final cost.

- Payment Method: Cash, card, or bank transfer.

- Signature Line: For confirmation if required.

Customization Tips

Modify the template for specific needs. Add a company logo for branding, adjust tax calculations based on location, and include return policies to set clear expectations. Ensure fonts and formatting enhance readability.

Automated Calculations

Use Microsoft Word’s table functions for automatic subtotal and tax calculations. Insert formulas in table cells to avoid manual errors.

Legal Compliance

Check local regulations for required information. Some regions mandate tax registration numbers or disclaimers on receipts.

Storage & Sharing

Save receipts as PDFs for secure record-keeping. Email copies to customers for convenience and maintain a digital archive for future reference.

Sales Receipt Template DOC

Key Elements of a Purchase Receipt Form

How to Customize a Payment Slip in DOC Format

Common Mistakes to Avoid When Designing a Sales Slip

Include All Required Transaction Details

Ensure the receipt contains the date of purchase, buyer and seller details, item descriptions, quantities, and total amount. Missing any of these may lead to disputes or accounting issues.

Customize for Readability and Branding

Use a clear font, structured layout, and company logo for a professional look. Adjust the margins and spacing in the DOC format to maintain clarity, avoiding overly condensed text.

Common design mistakes include cluttered layouts, inconsistent fonts, and lack of tax or discount breakdowns. Keep the format clean, align figures properly, and ensure all amounts are easy to read.

Double-check calculations before finalizing the receipt to prevent errors. A mistake in the total amount can cause confusion and complicate bookkeeping.