Instant Access to Ready-to-Use Templates

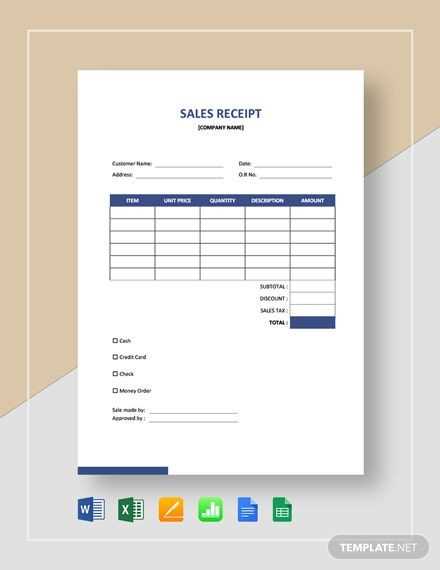

Save time with a professionally designed sales receipt template. Download a fully editable file in PDF, Word, or Excel format and customize it to match your business needs.

- PDF format: Ideal for printing and quick sharing.

- Word format: Easily editable with branding elements.

- Excel format: Automatic calculations for accurate totals.

Key Features of a Sales Receipt Template

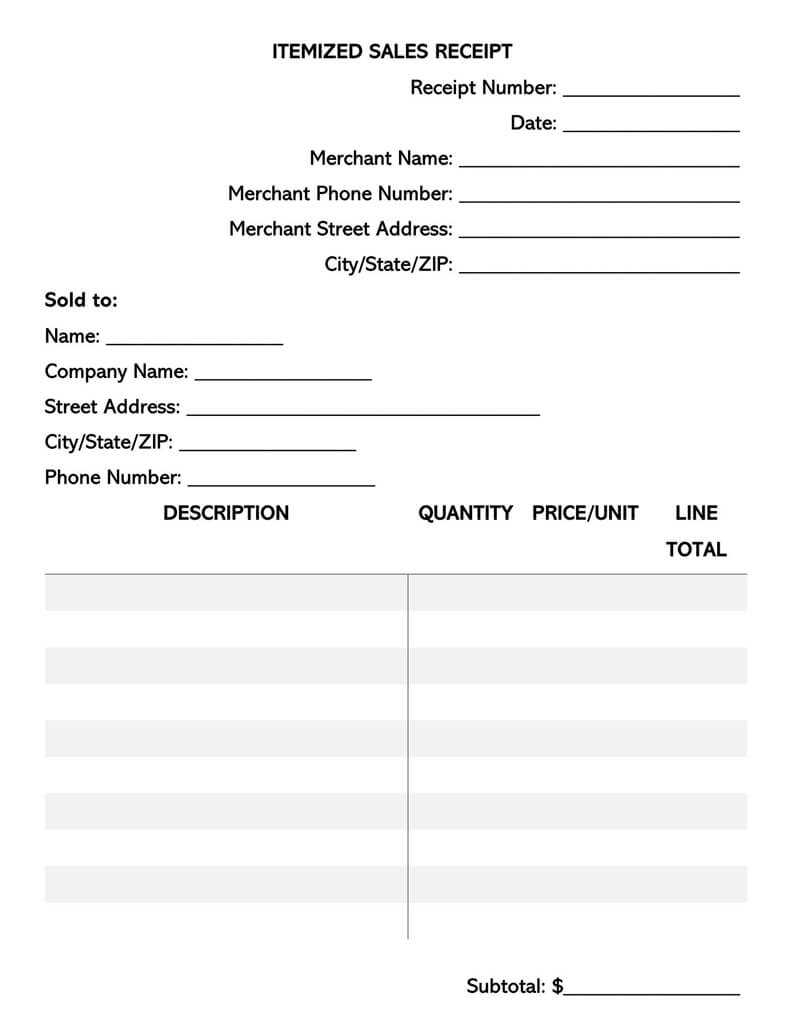

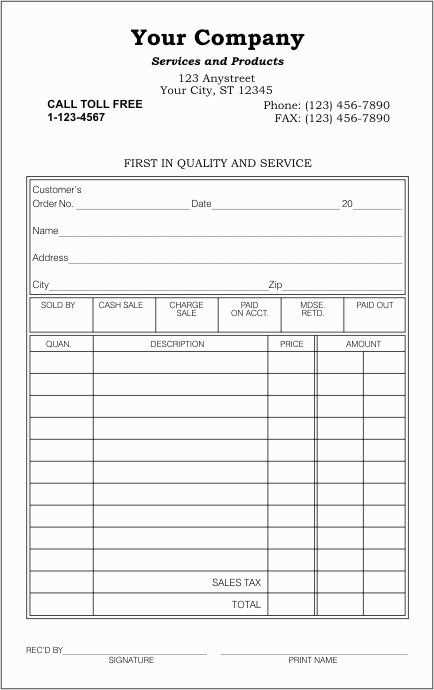

A well-structured receipt includes all necessary details to ensure transparency and compliance. Look for these key elements:

- Business Information: Name, address, and contact details.

- Transaction Details: Date, receipt number, and payment method.

- Itemized List: Description, quantity, unit price, and total cost.

- Taxes and Discounts: Clear breakdown of any applied charges.

- Customer Information: Name and contact details if applicable.

How to Customize Your Template

After downloading the template, open the file in your preferred software and update the placeholders with your business information. Adjust colors, fonts, and layout to match your branding.

Where to Download

Get your free sales receipt template from trusted sources offering high-quality designs. Choose from a variety of formats to suit your workflow and create professional receipts effortlessly.

Sales Receipt Template Download

Choosing the Right Format for Your Receipt

Customization Options for Various Business Needs

Where to Find Reliable Templates

Legal and Tax Considerations When Using a Template

Steps to Edit and Personalize a Downloaded File

Common Mistakes to Avoid with Pre-Made Templates

Selecting the correct format depends on your industry and preferred accounting method. PDF files prevent unauthorized modifications, ensuring document integrity. Excel templates automate calculations, reducing manual errors. Word files provide flexibility for branding and layout adjustments.

Customization improves usability and professionalism. Add your business logo, update tax rates, and modify fonts for better readability. If handling multiple currencies, ensure proper formatting to avoid discrepancies. Enable sequential numbering for organized record-keeping.

Reliable sources include government tax agencies, accounting software providers, and specialized business template platforms. Avoid unverified websites that may contain incorrect tax fields or outdated layouts.

Compliance is essential. Verify local tax requirements before using a template to ensure proper VAT or sales tax application. Digital signatures may be necessary for electronic receipts. Always store copies for audit purposes.

Editing requires attention to detail. Double-check calculations after modifying formulas in spreadsheet templates. Ensure header sections contain accurate business details. Test printing before issuing receipts to customers.

Common mistakes include omitting required tax fields, misaligning totals, and using incorrect date formats. Ensure templates follow legal guidelines to prevent disputes. Regularly update files to reflect policy or pricing changes.