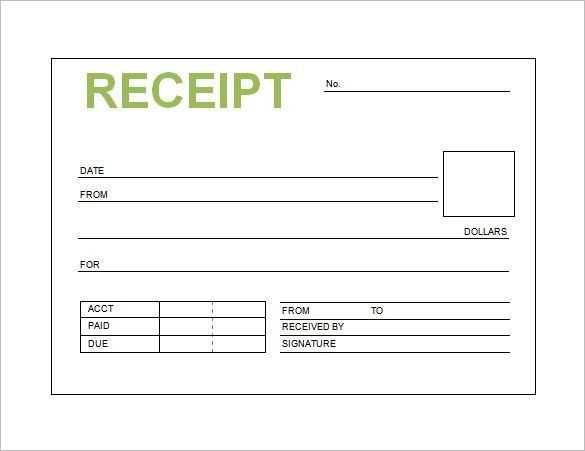

To create a professional sales receipt, you need a well-structured template. A simple PDF version provides a clean, readable format that can be easily customized to fit your business needs. Use clear sections to list the items purchased, quantities, prices, and total amounts, ensuring all essential details are captured.

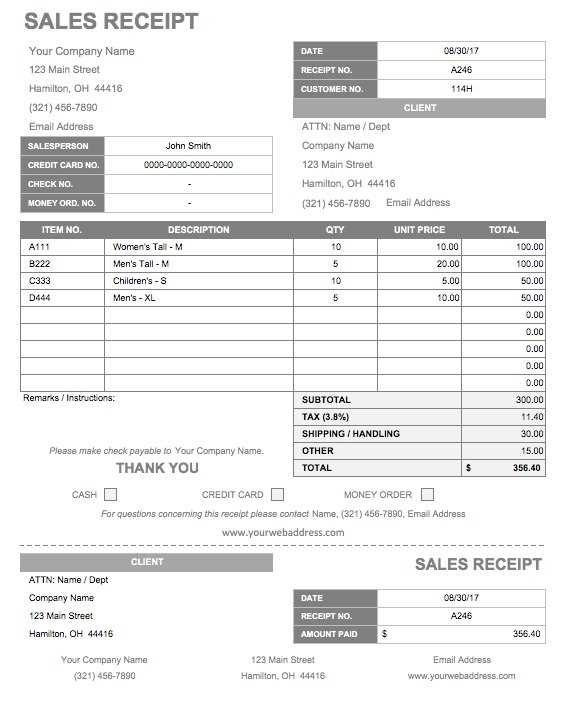

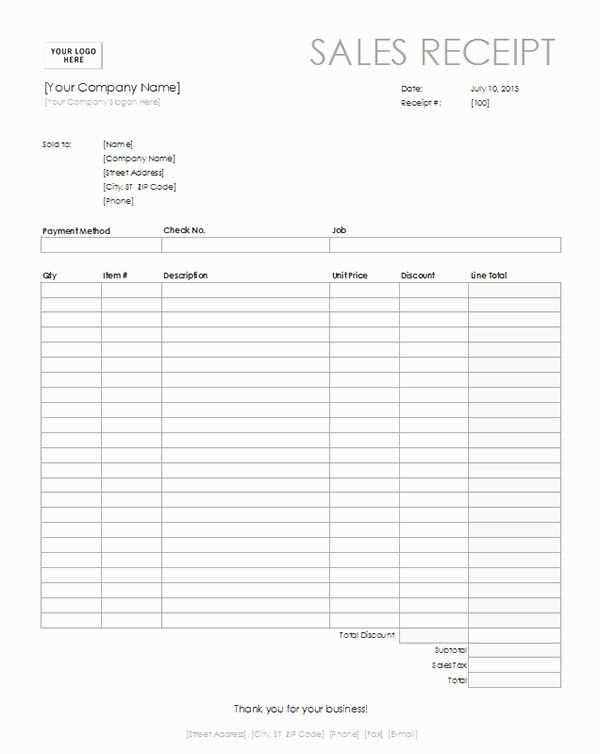

Start with your business logo at the top of the document. This adds a personal touch and helps customers easily identify your brand. Below that, include the transaction date, receipt number, and your business contact details. This information establishes a reference for both you and your customers.

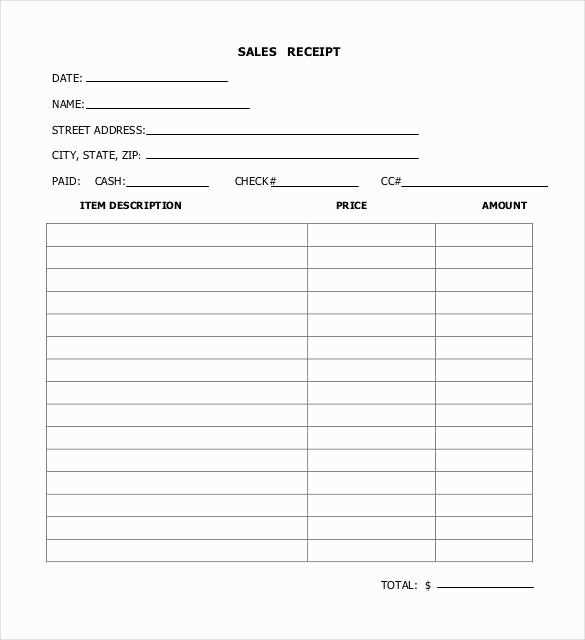

Next, break down the purchased items with a column for each item’s description, quantity, and price. This transparency not only prevents confusion but also provides a clear record of the transaction. Conclude the template with a total section, outlining taxes and discounts applied if applicable. Save this as a PDF to ensure it maintains formatting across devices and is easy to print or share electronically.

Here’s a revised version with reduced repetition while keeping the meaning intact:

For creating a clean and efficient sales receipt template in PDF format, focus on including the key details in a concise layout. Ensure the following elements are present:

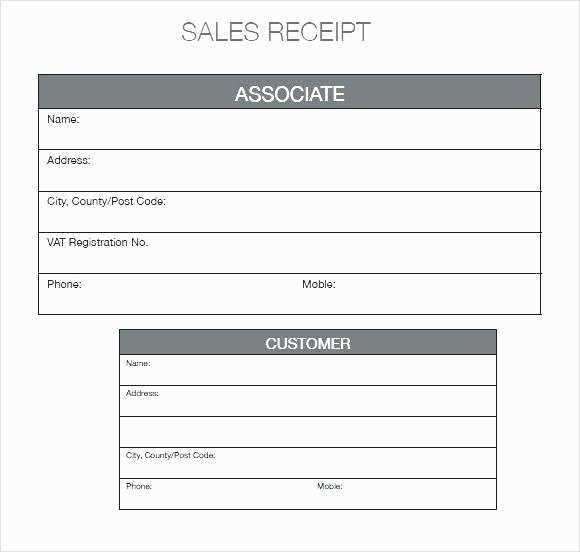

- Seller’s Information: Include the business name, address, contact number, and email. This makes the receipt look professional and provides clear contact details.

- Buyer’s Information: Add the customer’s name and contact info to personalize the receipt. This is especially useful for records and customer service.

- Transaction Details: List the items sold, including a description, quantity, and price for each. Group similar items together for better clarity.

- Total Amount: Clearly display the subtotal, any taxes, and the final amount due, making it easy to read at a glance.

- Payment Method: Indicate whether the payment was made via cash, card, or another method. This adds clarity to the transaction history.

Formatting Tips:

- Use a simple font: Keep the font legible and clean, such as Arial or Times New Roman.

- Utilize bold for headers: Bold section titles for quick identification and better visual organization.

- Consistent spacing: Ensure there is enough space between sections to avoid a cluttered look.

- Include a footer: Adding a footer with your business’s website or customer service number enhances professionalism.

Finally, always check the template on various devices before finalizing to ensure it’s accessible and readable across platforms.

Here’s a detailed HTML structure for an informational article titled “Sales Receipt Template PDF” with six specific and practical headings:

1. Key Elements of a Sales Receipt

A well-structured sales receipt should include the business name, date, itemized list of purchased products or services, total amount, and payment method. Adding tax information and a unique receipt number helps with tracking and bookkeeping. Including a clear breakdown ensures transparency for both the buyer and seller.

2. How to Format the Sales Receipt for PDF

When creating a PDF version of a sales receipt, ensure that the layout is clean and easy to read. Use tables for itemization, and consider adding borders or lines to separate sections. A good balance between text and white space improves readability and user experience. You can use a tool like Adobe Acrobat or online PDF editors to create professional receipts quickly.

3. Customizing the Sales Receipt Template

Personalize your template by including your business logo, address, and contact details. Custom fields like loyalty points or promotional discounts can also be added if applicable. Modify the font size and style for key details such as the total amount, making it stand out to the customer.

4. Creating a Sales Receipt in Google Docs

Google Docs offers an easy way to design a simple sales receipt. Start with a blank document and insert a table to organize the receipt items. After designing the template, you can export it directly as a PDF for professional presentation and printing.

5. Benefits of Providing PDF Receipts to Customers

PDF receipts are easy to store, search, and access electronically. Customers appreciate the convenience of having a digital copy for their records. PDFs also eliminate the need for paper receipts, contributing to environmentally friendly practices and reducing physical clutter.

6. Printing or Sharing Your Sales Receipt

Once your sales receipt is ready in PDF format, you can either email it to the customer or print it for physical delivery. Ensure the file is correctly formatted and properly aligned for printing. Many businesses offer email receipts to streamline the transaction process, providing a quicker and more efficient option for both parties.

- Choosing the Right Format for Your Receipt

Pick the format that suits your business needs while ensuring compatibility with your existing systems. A PDF format provides a clean and universally accepted way to present receipts, but other formats like Excel or plain text can also be effective depending on your workflow.

Consider File Size and Accessibility

PDF files are compact and can easily be emailed or stored on devices. They are easy to access across various platforms, from smartphones to computers. However, if file size is a concern, you might opt for simpler formats like plain text or Excel that offer easy editing and smaller file sizes.

Check for Compatibility

Ensure that the format you choose integrates seamlessly with your point-of-sale system and accounting software. Some systems may only support specific formats like PDF or Excel for automatic uploads, so double-check compatibility before committing.

- PDF: Ideal for final, printable receipts.

- Excel: Useful for tracking and analyzing sales data.

- Plain Text: Good for quick, low-data transactions where minimal detail is needed.

Choosing the right format depends on balancing ease of use with functionality. Select the one that ensures smooth operations and customer satisfaction.

Include a clear header displaying the business name and logo for immediate identification. Make sure the contact details, including phone number and email, are visible for customer follow-up.

Transaction Details

Clearly present the date and time of the transaction. Include an invoice or receipt number for reference. The payment method (credit card, cash, etc.) should be specified to avoid confusion.

Itemized List of Purchases

Provide a detailed list of all items or services purchased, along with their prices. Indicate the quantity and unit price for transparency. Display applicable taxes separately, and show the total amount paid.

| Description | Unit Price | Quantity | Total |

|---|---|---|---|

| Item 1 | $10.00 | 2 | $20.00 |

| Item 2 | $5.00 | 1 | $5.00 |

| Subtotal | $25.00 | ||

| Sales Tax (8%) | $2.00 | ||

| Total | $27.00 | ||

Include a footer with return and refund policies. Lastly, ensure that the document is formatted to fit both printed and digital formats for ease of access.

Adjust your PDF template to meet the unique requirements of different business functions. By incorporating specific elements, you can streamline your processes, reduce errors, and improve customer satisfaction. Here are practical ways to tailor your template:

- Branding: Ensure the template reflects your business identity. Add your logo, choose fonts that match your brand’s style, and select colors that align with your company’s palette. This creates consistency across all your documents.

- Itemized Details: Include space for detailed descriptions of products or services. Use clear, concise language to avoid confusion. Depending on your industry, you may want to add product codes, serial numbers, or detailed pricing structures.

- Customer Information: Customize fields for customer data. You can include sections for contact information, billing addresses, or account numbers. This makes it easier for customers to review their purchases and helps your business maintain accurate records.

- Payment Terms: Clearly outline payment methods, due dates, and any applicable discounts or fees. You can modify sections to include installment plans or specific payment instructions based on your business model.

- Tax Calculations: For businesses dealing with varying tax rates, configure the template to automatically calculate taxes based on the customer’s location. This eliminates manual errors and ensures accuracy.

- Additional Notes: Create a dedicated section for special instructions, return policies, or custom messages. This can help you communicate essential information effectively while maintaining professionalism.

By personalizing these elements, your PDF templates will become more aligned with your business operations, enhancing both the customer experience and your workflow efficiency.

To simplify calculations on your sales receipt, incorporate formulas directly into the template. This method ensures real-time updates for totals, taxes, and discounts without manual input.

Start by setting up fields for unit price, quantity, and subtotal. Then, use a formula for the total price, such as multiplying the unit price by quantity. Most PDF tools allow you to define these formulas within text fields.

To calculate taxes automatically, create a tax rate field and multiply the subtotal by the tax rate. You can also apply conditional logic to adjust tax calculations based on the region or type of product being sold.

For discounts, integrate percentage-based fields. If a discount applies, the template can subtract the appropriate amount from the subtotal before calculating the final total.

Below is an example of how you can structure your template with automatic calculations:

| Item | Unit Price | Quantity | Subtotal |

|---|---|---|---|

| Product A | $10.00 | 2 | $20.00 |

| Product B | $5.00 | 3 | $15.00 |

| Total | $35.00 | ||

| Tax (5%) | $1.75 | ||

| Final Total | $36.75 | ||

By integrating these automatic calculations into your template, you reduce errors and speed up the invoicing process for both you and your customers.

Choose a clean layout with enough white space around text and sections. This makes the receipt easy to scan and reduces visual clutter. Align elements like dates, item names, and prices in a straight line to improve readability.

Use a legible font, preferably sans-serif, with a minimum size of 10pt. Avoid using multiple fonts; stick to one for headers and another for body text to maintain consistency.

Ensure text contrasts well with the background. Dark text on a light background is easiest to read. If you’re using color, make sure it doesn’t overpower the text or make it harder to read.

Group related information together. Place the payment method and totals at the bottom or in a separate section to make them stand out. Organize items by categories or product types, keeping the layout intuitive.

Check alignment and spacing before finalizing. Misaligned text can make the receipt look unprofessional. Adjust margins and padding where necessary for balanced spacing between sections.

To save your receipt as a PDF, open the document or receipt template you wish to convert. Use the “Save As” or “Export” function in your software, and choose the PDF format. This will create a copy of your receipt that’s easy to store and access. If you’re using an online tool, look for a “Download” or “Export to PDF” option, typically found in the top menu or as a button within the tool.

For sharing the receipt, attach the saved PDF to an email. Most email services support PDF attachments, and they can be sent securely and quickly. If you prefer, use cloud services like Google Drive or Dropbox to upload the receipt and share the link. This is particularly helpful when sharing with multiple recipients or keeping a backup accessible from any device.

This version reduces redundancy by using synonyms and slightly modifying the structure while keeping the meaning clear.

To create a clear and concise sales receipt template, it’s important to structure the document logically and ensure all necessary information is included. The template should start with a header that outlines the business name, address, and contact details. Below this, list the items purchased, along with their quantities, prices, and total cost. Each item should be clearly separated to avoid confusion.

For the pricing section, include a subtotal, applicable taxes, and the final total in an easy-to-read format. Ensure the breakdown is transparent, showing customers exactly how the total was calculated. To avoid redundancy, use concise descriptions for the items and services. Instead of repeating the same phrase, swap words like “total” and “final amount” as needed to keep the text varied.

The payment method section should be simple, specifying whether the payment was made by cash, card, or other means. This helps clarify the transaction without unnecessary repetition. For additional clarity, include a unique receipt number, date, and time of purchase at the bottom. This ensures easy referencing for both the business and customer.