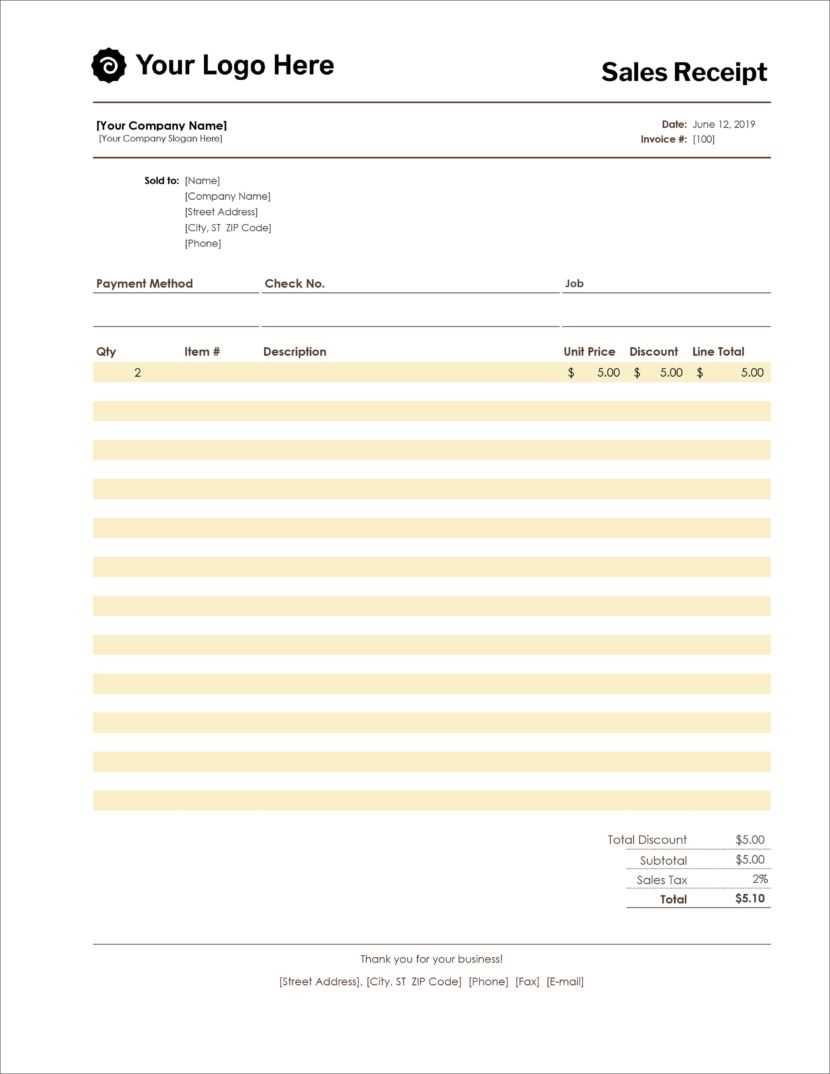

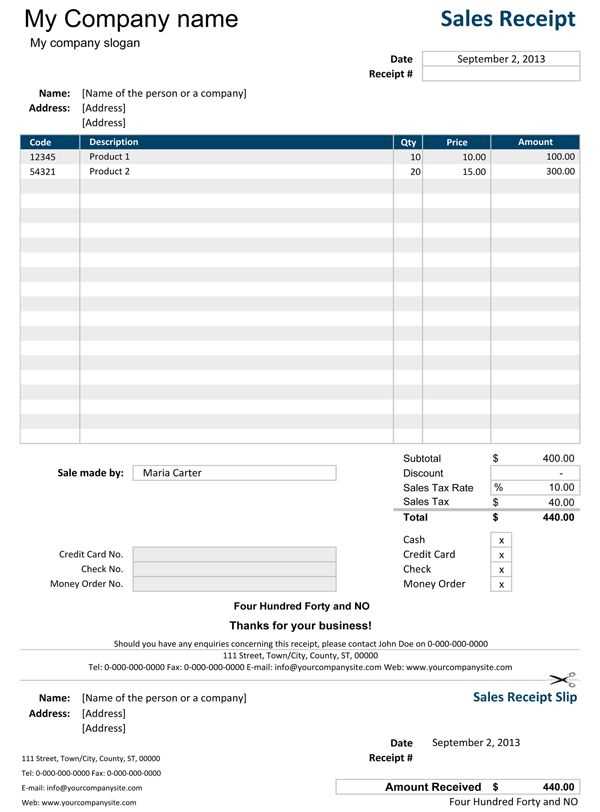

To create a professional and clear sales receipt, focus on structuring the document to cover all necessary details without overwhelming the customer. Make sure each receipt includes key information like the transaction date, itemized list of purchased goods or services, total amount, tax, and payment method.

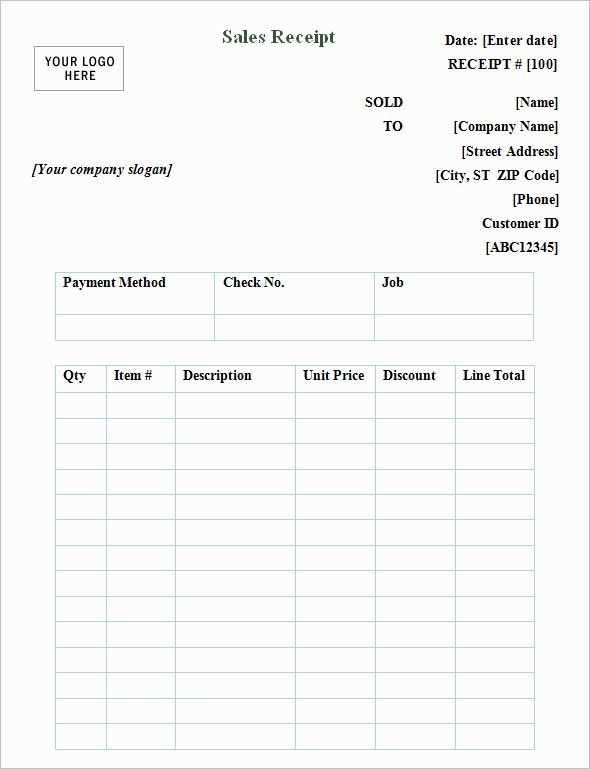

Choose a layout that is easy to read and understand at a glance. Consistency in design is critical–use clear fonts, adequate spacing, and logical placement of the information. Include your business name, address, and contact details prominently, so customers can easily get in touch if needed.

Many businesses opt for customizable templates that allow flexibility in adjusting fields according to specific needs. Ensure your template is adaptable for both physical and digital receipts. Digital versions can be easily emailed to customers, reducing paper waste and providing a quick reference for both parties.

Lastly, keep in mind that a sales receipt is also a legal document. Ensure that the information is accurate and compliant with local regulations, particularly regarding tax rates and transaction records. This way, you’ll build trust with your customers and maintain transparency in your business transactions.

Sales Receipt Templates

Choose a clean, structured layout for your sales receipt to make sure all important details are easy to find. Start by including the seller’s name, business address, and contact information at the top. Right below, add the buyer’s name and contact details, ensuring transparency in the transaction.

Key Elements to Include

Every receipt should have a unique identification number for tracking purposes. Date and time of the transaction are important to document, so always list them clearly. List purchased items with accurate descriptions, quantities, and individual prices. Don’t forget to calculate the subtotal, applicable taxes, and the final total amount to avoid confusion.

Additional Features

Consider incorporating payment methods, such as credit card, cash, or bank transfer, for better tracking. Offering space for discounts, returns, or refund policies can also make your receipt more versatile. Always ensure the template you choose is customizable for different transaction types.

Customizing Receipt Templates for Different Business Needs

Tailoring receipt templates to match your business requirements can streamline your operations and enhance customer experience. Here’s how you can adapt them based on your industry and needs:

- Retail Businesses: Include a clear itemized list with product names, prices, and total amount. Add discounts and taxes to make transactions transparent. You may also want to feature store information and return policies.

- Restaurants and Cafes: Focus on simplicity with sections for food items, drinks, and tips. Consider adding a section for item customizations (e.g., drink size or toppings). Highlight payment methods and transaction time.

- Services and Freelance Work: Include service descriptions, hourly rates, and total charges. If you’re offering subscriptions, make sure the receipt reflects the renewal or payment schedule clearly.

- Online Stores: Emphasize order details, delivery address, and shipping information. Add a tracking number and return policy for convenience. You can also add a promo code or loyalty program reminder.

- Medical or Legal Services: Customize with specific sections for insurance details, patient or client identification, and a breakdown of service fees. Incorporate professional codes or terms as needed.

Consider using dynamic fields in your receipt template for flexibility. These can automatically adjust based on the product, service, or payment type. It allows you to easily update pricing, taxes, and additional fields without manual intervention.

For a more personalized touch, add a “Thank you” message or a special offer for repeat customers. This not only strengthens brand loyalty but also provides a reason for customers to return.

Regularly review and update your receipt templates as your business evolves. Tailor them for special promotions, new services, or any other unique business events that require specific receipt customization.

Integrating Sales Receipts with Accounting Software

Connect sales receipts directly to your accounting software for seamless financial management. This integration ensures accurate and real-time data synchronization, reducing manual entry errors and saving time. You can set up automated transfers of receipt data such as item details, taxes, and payment methods to your accounting platform.

Key Steps for Integration

Most accounting software platforms offer built-in integrations with popular point-of-sale (POS) systems. Begin by choosing the right software that supports your POS system or use an API to link both platforms. Once linked, configure your software to automatically import sales receipts after each transaction. Ensure that your accounting software can handle different types of receipts and formats, including digital and printed versions.

Benefits of Integration

Once connected, sales receipt information flows automatically into your financial reports, making it easier to track revenue, expenses, and taxes. The process streamlines your monthly and yearly reporting, ensuring you meet tax compliance deadlines without hassle. Moreover, it enables more accurate profit and loss statements, helping you make informed decisions.

By integrating receipts with accounting software, you reduce manual data entry errors, improve cash flow tracking, and gain better visibility into your business’s financial health. The integration also supports automatic reconciliation of sales data, eliminating discrepancies between what was sold and what was recorded.

Legal Requirements for Sales Receipts in Different Regions

Sales receipts must include specific details depending on the region in which the transaction occurs. The requirements can vary based on local tax regulations, consumer protection laws, and business practices.

United States

In the U.S., sales receipts must clearly state the transaction date, itemized list of purchased goods, the total amount, and any applicable taxes. Some states require businesses to include a refund policy. Retailers in states with sales tax mandates must ensure that the receipt displays the correct sales tax percentage and the total amount of tax paid. For businesses registered with the IRS, the receipt must also reflect the business’s tax identification number (TIN).

European Union

In the EU, receipts must include the seller’s details, such as their name, address, and VAT registration number. Businesses must list all products and services along with their VAT rates. Countries like Spain or Italy may have additional requirements such as the inclusion of a QR code for digital verification. Receipts should also comply with local language regulations, ensuring they are written in the official language of the country where the transaction takes place.

United Kingdom

In the UK, receipts must include the seller’s name, address, and VAT number for VAT-registered businesses. They should clearly show the items or services sold, their price, and the applicable VAT rate. The receipt must also list the total price and the VAT amount separately. For digital receipts, the format must ensure that these details are easily accessible to the customer.

Australia

Australian sales receipts must comply with the Australian Consumer Law (ACL), which requires sellers to include details like the name of the business, the items or services purchased, and the total price, including GST (Goods and Services Tax). Receipts issued for GST-inclusive businesses must show the GST amount separately. For returns or exchanges, the business may need to provide additional information about their return policy.

Canada

In Canada, receipts should show the business name, address, and contact details. For businesses that collect GST or HST, the receipt must list the tax rate and the amount of tax charged. The total amount of the transaction should be clearly separated from the taxes. Provinces like Quebec may have additional requirements for including the customer’s language preferences on receipts.

Asia-Pacific Regions

In regions like Japan or South Korea, sales receipts generally follow the basic format of listing the seller’s details, transaction date, and tax amount. However, Japan requires a “fiscal receipt” for tax reporting purposes, and it must include a tax registration number. In Hong Kong, businesses are required to provide an itemized breakdown of costs for tax purposes.

Understanding the local legal requirements ensures compliance and provides customers with clear, transparent transaction records.