To streamline your sales process, use customizable sales receipts templates. These templates provide a clear structure for recording transactions, ensuring accuracy in your business operations. Tailor the templates to include all relevant details such as the transaction date, item description, price, taxes, and total amount paid.

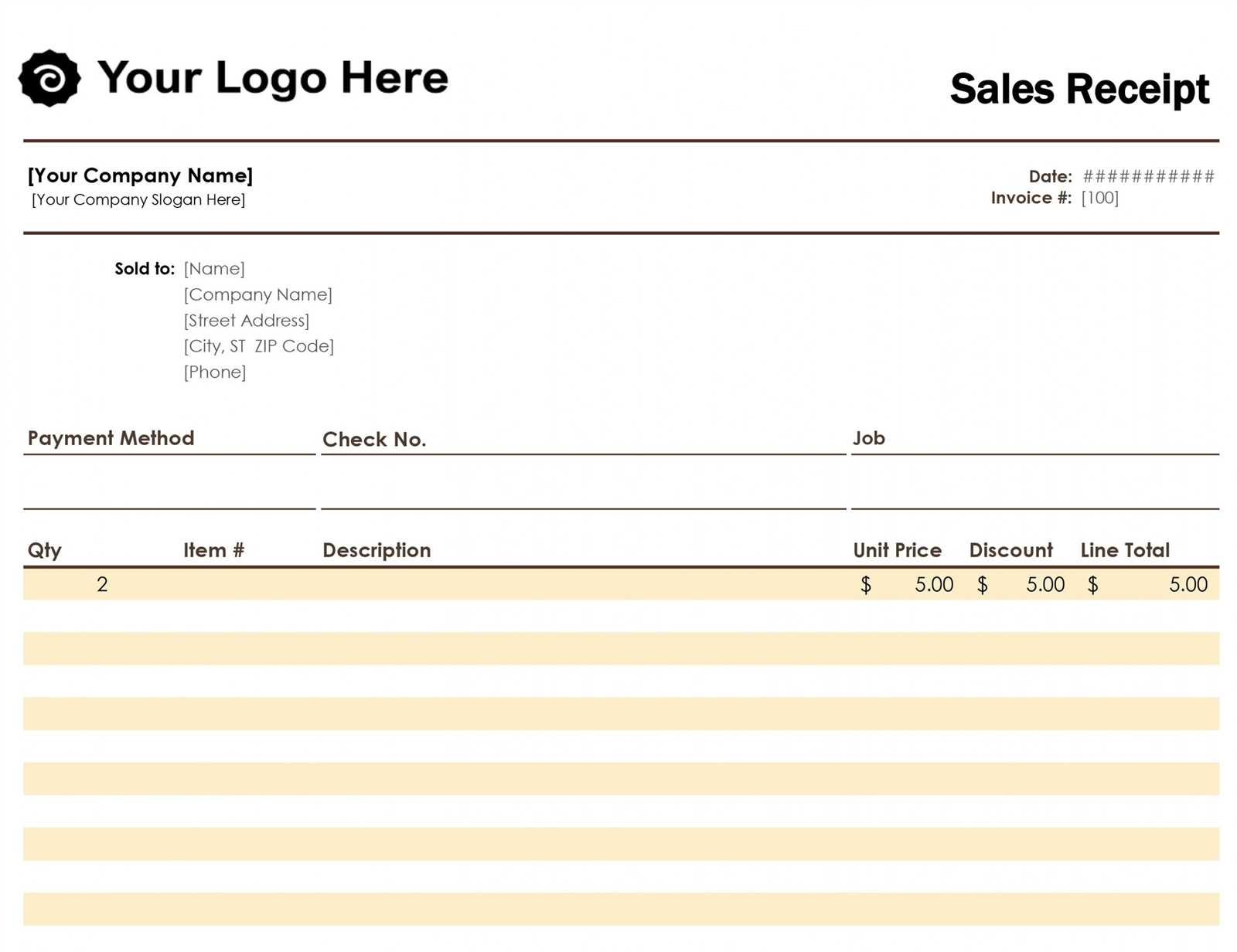

Customize templates according to your branding needs by incorporating your logo, business name, and contact information. This adds a professional touch to your receipts and helps in maintaining consistency across all sales documents.

Ensure that your sales receipts contain all the necessary legal information, including any required disclaimers or return policies. This will protect both your business and customers, creating a transparent transaction process. Regularly update your templates to comply with local regulations and tax laws.

Sales Receipts Templates: Practical Guide

Choose templates that are straightforward and customizable for your sales receipts. Ensure the layout includes essential details such as the company name, transaction date, itemized list of products or services, pricing, and total amount paid. Select a clean design with adequate space between sections for clarity. Include your contact information and a professional footer for brand consistency.

Pick templates that automatically calculate totals, taxes, and discounts to save time and reduce errors. For a more personal touch, include a thank you note or a message of appreciation for repeat customers. Prioritize templates that allow easy exporting to formats like PDF for seamless record-keeping and sharing.

Consider the needs of your business–if you’re in retail, focus on templates that highlight product names, quantities, and prices. For service-based businesses, templates that emphasize hours worked and hourly rates work best. Tailor your receipt templates for the specific industry to provide a smooth experience for your clients.

Stay consistent with branding by using your company’s colors and logo in the receipt template. This not only reinforces your brand identity but also adds a professional touch to every transaction. Regularly update your templates to comply with any legal changes or evolving business requirements.

How to Create Custom Sales Receipt Templates

Create a custom sales receipt template by first selecting the right software. Use tools like Microsoft Word, Google Docs, or specialized programs like Canva or Invoice Generator. These platforms provide flexibility for designing and customizing receipt layouts.

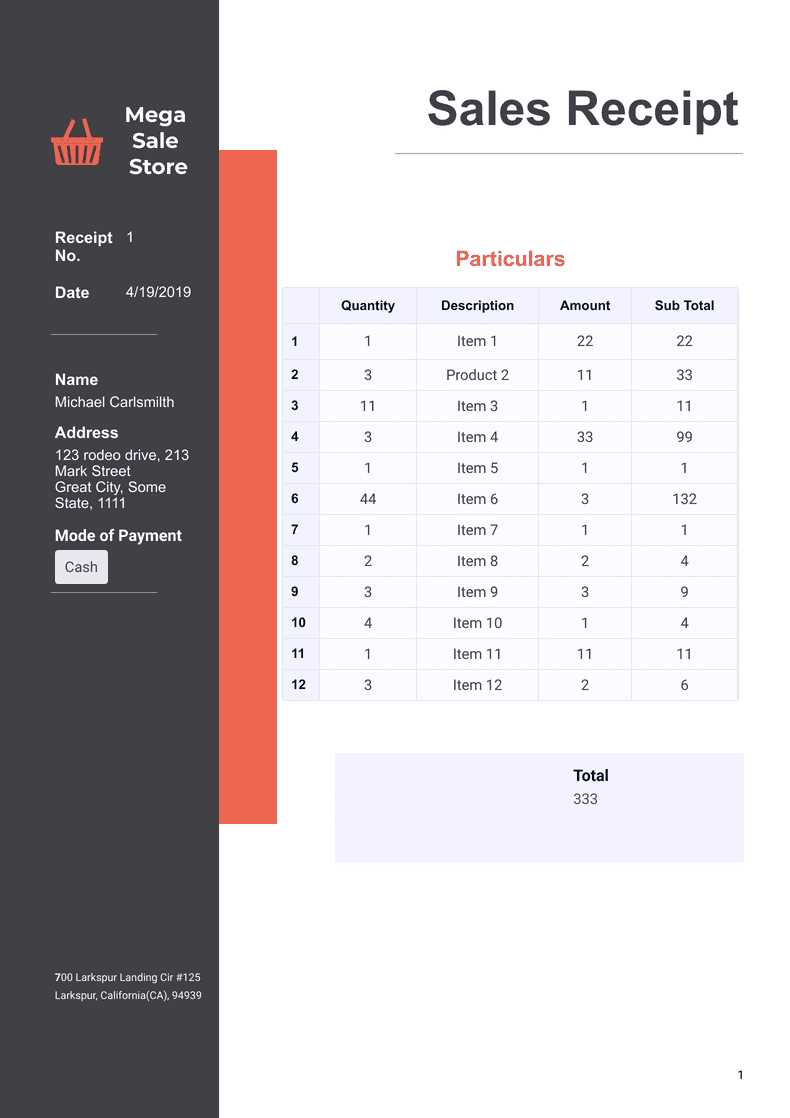

Start with a clear header section. Include your business name, logo, and contact information. This establishes your brand identity and ensures the receipt looks professional.

Next, add details about the transaction. Include fields for the customer’s name, address, phone number, and email. These fields are necessary for record-keeping and future communication.

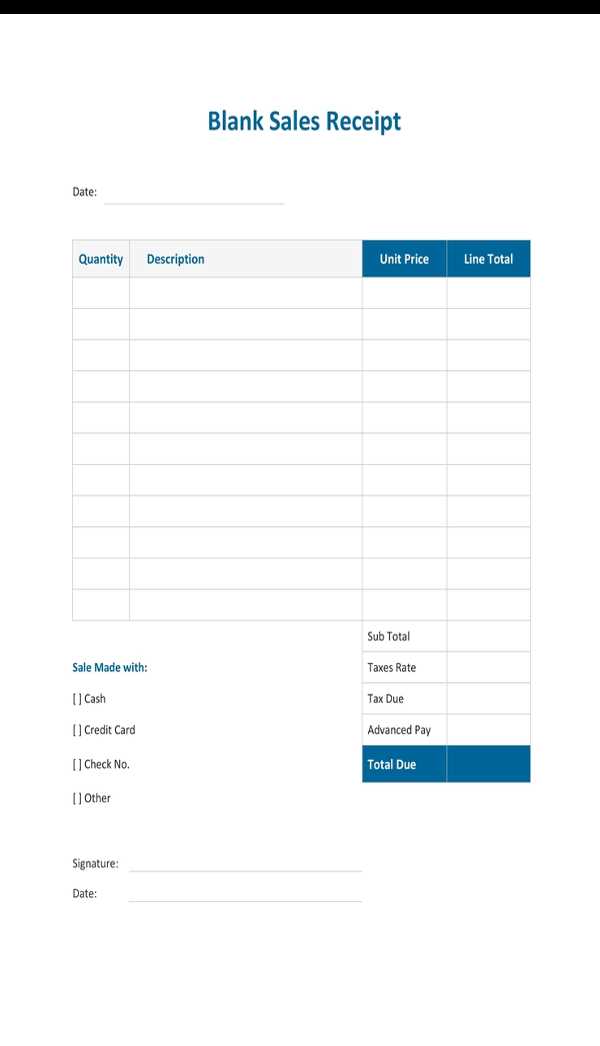

Provide a table or list to show the items or services sold. For each product, include a description, quantity, unit price, and total cost. This keeps the receipt organized and easy to understand.

Don’t forget the payment details. Include the method of payment, the total amount paid, any taxes, discounts, and the final amount due or received. This section ensures clarity about the financial transaction.

Leave space for additional notes. If there are warranties, return policies, or other relevant information, this area will keep it visible and accessible for the customer.

Finally, ensure the design is clean and easy to read. Use simple fonts and adequate spacing. Avoid clutter, so all information is legible at a glance. Consistency in formatting is key to creating a polished and functional sales receipt template.

Choosing the Right Format for Your Business Needs

Select the format that best fits how your business interacts with customers and records transactions. Consider factors such as ease of use, compatibility with your accounting system, and your team’s workflow.

- Standard Templates – These are simple, easy-to-fill formats, ideal for small businesses or when you need quick receipts without too much customization.

- Customizable Templates – If you want more control over what appears on the receipt, choose templates that allow you to add your logo, adjust font sizes, or include extra fields like sales tax breakdown.

- Integrated Solutions – For businesses using a POS system, opt for formats that integrate with your software, ensuring seamless data flow without the need for manual entry.

Choose a format that aligns with the scale of your business and its needs. If you handle a high volume of transactions, an automated format linked to your sales system will save time and reduce errors. If you’re just starting out, a basic template might suffice.

Ensure that the format supports the necessary details: business information, transaction details, payment method, and tax information. This ensures compliance with tax laws and makes audits easier.

Tips for Including Key Information in Sales Receipts

Clearly display the business name, address, and contact details at the top of the receipt. This ensures customers can easily reach you if they have questions or need follow-up service.

Include a unique receipt number for easy tracking. This helps organize records and provides a reference in case of returns or disputes.

Specify the date and time of the transaction. This is crucial for both you and the customer, particularly for warranty purposes or future reference.

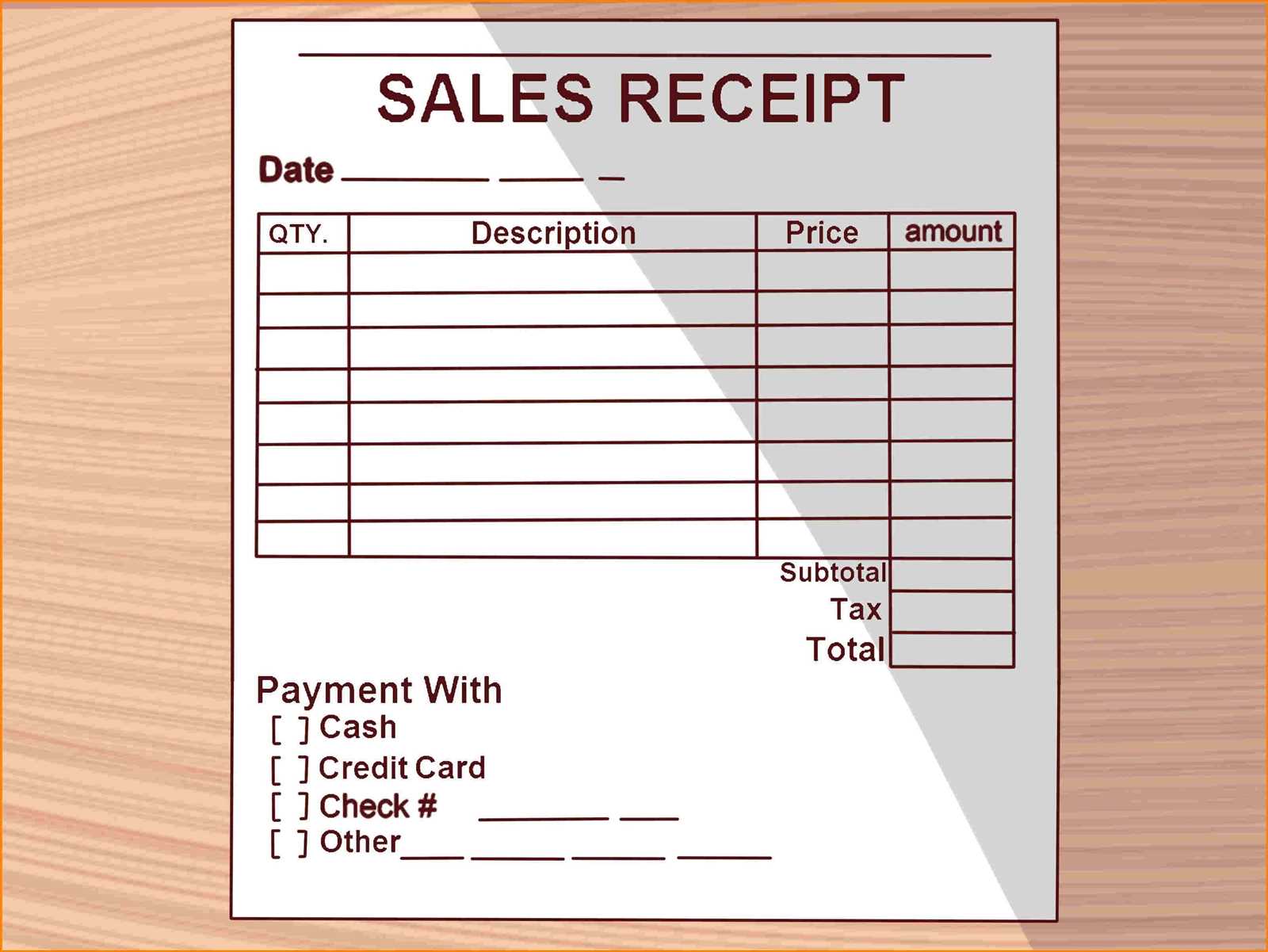

List each item purchased along with the quantity and price. Break down taxes or discounts separately for full transparency.

Provide the payment method used. Whether it’s cash, credit, or digital payment, this gives a clear record of the transaction.

Include return or exchange policies if applicable. Customers appreciate knowing the terms for returns directly on the receipt.

Ensure the total amount due is prominently displayed. This helps avoid confusion and confirms the exact amount paid.