A simple sales receipt template can save time and help you keep your records organized. With just a few essential fields, you can quickly document a transaction while ensuring both the buyer and seller have the necessary details for future reference. Using a straightforward layout ensures clarity, avoids confusion, and simplifies your workflow.

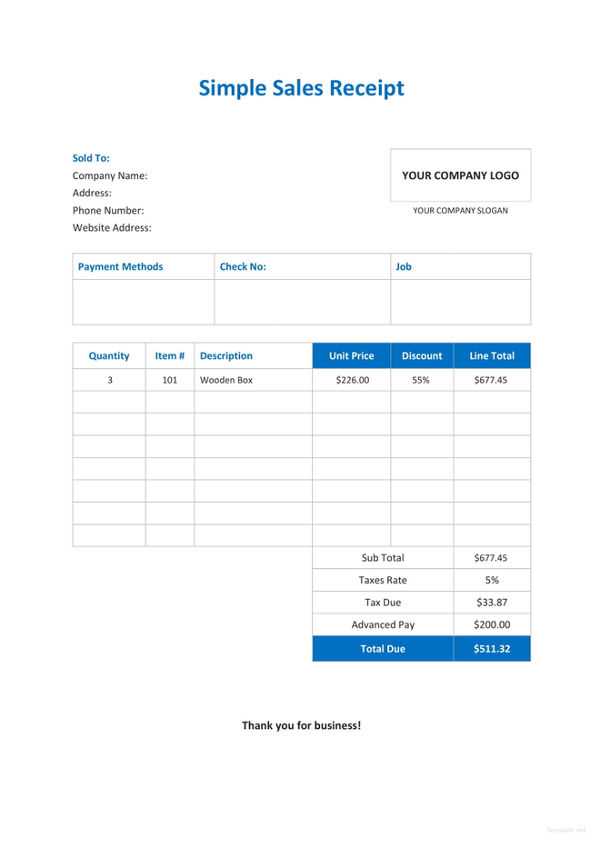

The basic components of a sales receipt include the transaction date, seller and buyer contact information, a detailed list of items or services sold, along with their corresponding prices. Don’t forget to add any applicable taxes and the total amount paid. Including a unique receipt number or transaction ID adds an extra layer of accountability, helping you track sales efficiently.

For businesses, having a standardized sales receipt template ready to use can reduce errors and streamline the invoicing process. Whether you’re managing a small shop or handling occasional sales, creating and customizing your own template is simple. You can adjust the layout, fonts, and structure to best fit your needs, making the receipt as clear and professional as possible.

Here are the corrected lines with minimized word repetition:

To improve clarity, replace redundancies in the sales receipt template. Begin by removing unnecessary words. For example, instead of saying “total amount total,” use “total amount” only. This reduces repetition while keeping the message clear.

1. Correct Redundancies in Product Descriptions

For product names, avoid repeating the term “product.” Instead of “Product name product,” just write “Product name.” This streamlines the text and makes it more readable.

2. Avoid Overusing Common Phrases

Cut down on using phrases like “customer’s name” or “customer’s contact details” multiple times. Instead, group related details in a single sentence to save space and avoid repetition.

These small adjustments will make the receipt template more efficient and user-friendly.

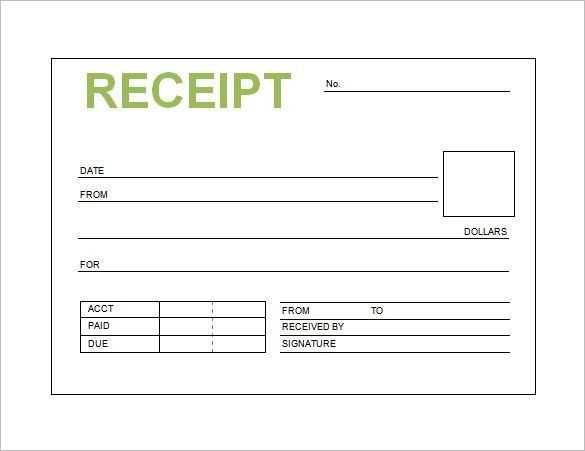

- Simple Sales Receipt Template

A simple sales receipt template should include key information that reflects the transaction accurately. It doesn’t need to be overly complex, but it must be clear and easy to understand for both parties involved.

- Seller Information: Include the business name, address, contact number, and email. Make sure this is easy to find, typically at the top.

- Buyer Information: Include the buyer’s name or company name, and optionally their contact details, especially for larger transactions.

- Receipt Number: This provides a unique identifier for every transaction. A numbering system helps keep everything organized and traceable.

- Date of Purchase: Ensure the date is prominently listed so both parties can easily reference the sale.

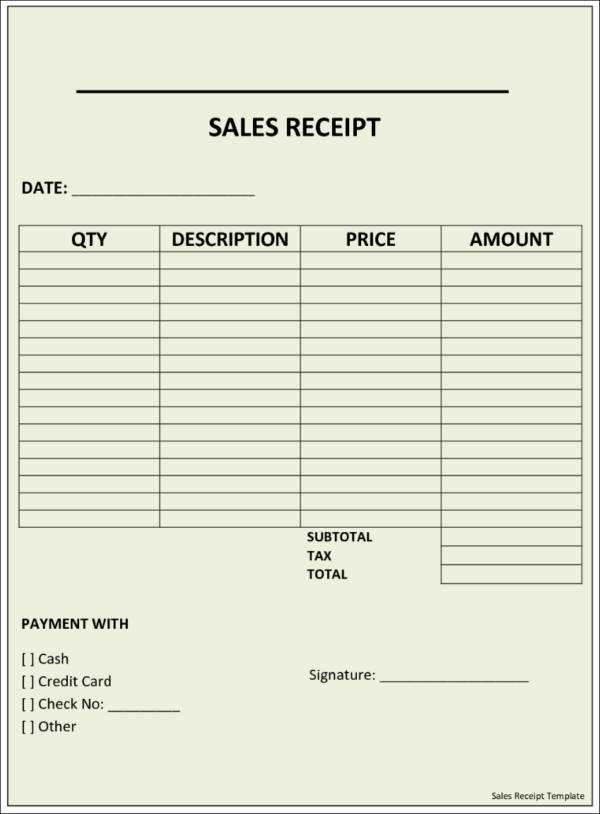

- Description of Goods or Services: List each item sold, including quantities, unit price, and total price for each line item. It makes tracking sales and inventory easier.

- Subtotal: Add up the total cost before taxes or discounts. This section should be clearly separated to highlight the pre-tax amount.

- Taxes: Include any applicable sales tax, clearly separated from the subtotal. Specify the tax rate for transparency.

- Total Amount: This is the final amount due after tax or discounts. Make it easy to spot, ideally in a larger or bold font.

- Payment Method: Specify how the payment was made (e.g., credit card, cash, bank transfer). This can help with future reference or disputes.

- Terms and Conditions: If there are any return policies or other important notes, include them here to avoid confusion later.

Designing the receipt with clear sections and consistent formatting helps maintain professionalism and avoids any potential confusion. Keep the information concise, but make sure it’s thorough enough to serve as a reference for both the buyer and the seller.

Design your sales receipt template with clarity. Make sure it includes these key sections:

- Receipt Title: Clearly label the document as a “Sales Receipt” at the top.

- Seller Information: Include the name, address, and contact details of your business. This helps customers easily reach out if necessary.

- Buyer Information: Add the customer’s name and contact information to personalize the receipt.

- Receipt Number: Use a unique identifier for each receipt. This makes tracking transactions easier.

- Date of Sale: Record the exact date when the transaction took place.

- Product or Service Description: List the items or services purchased with brief details. Include quantities and individual prices.

- Total Amount: Clearly show the total cost, including any taxes or discounts applied.

- Payment Method: Specify how the customer paid (e.g., cash, credit card, check).

- Transaction Notes: If applicable, add any special instructions or conditions related to the sale.

Keep the layout clean and organized to ensure readability. You can also add your company logo and a thank-you note to enhance the customer experience. Lastly, save the template for future use to streamline your sales process.

Key Elements to Include in Your Receipt

Each sales receipt should be clear and provide key details that ensure both parties are on the same page. Here’s what you need to include:

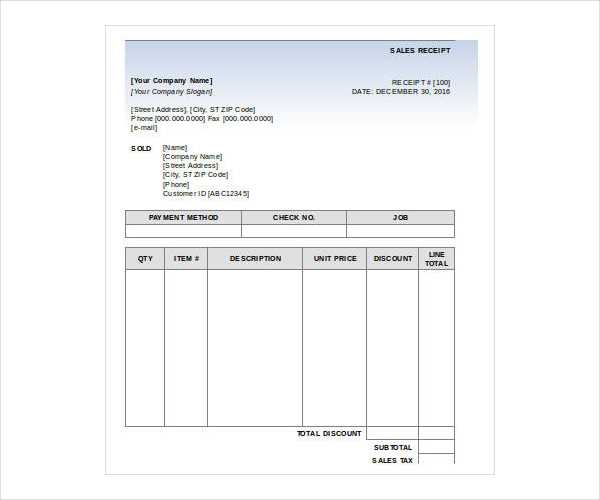

1. Business Information

Start with your business name, address, and contact details. This helps your customer identify where the transaction took place. It’s also useful for future reference or in case any issues arise with the purchase.

2. Receipt Number and Date

Assign a unique receipt number for tracking purposes. Always include the date of the transaction to help with record-keeping and returns.

3. List of Products or Services

Detail the items or services purchased, including quantity, unit price, and a brief description. This ensures clarity on what the customer is paying for and helps resolve any discrepancies later.

4. Total Amount

Clearly state the total amount due, including any taxes or discounts applied. This transparency builds trust and confirms the final price for the customer.

5. Payment Method

Indicate how the payment was made, whether by cash, card, or another method. This adds another layer of transparency and verifies the payment method used for the transaction.

6. Return and Exchange Policy

Including a brief return and exchange policy on the receipt helps manage customer expectations. It’s helpful in case of future returns or issues related to the product or service.

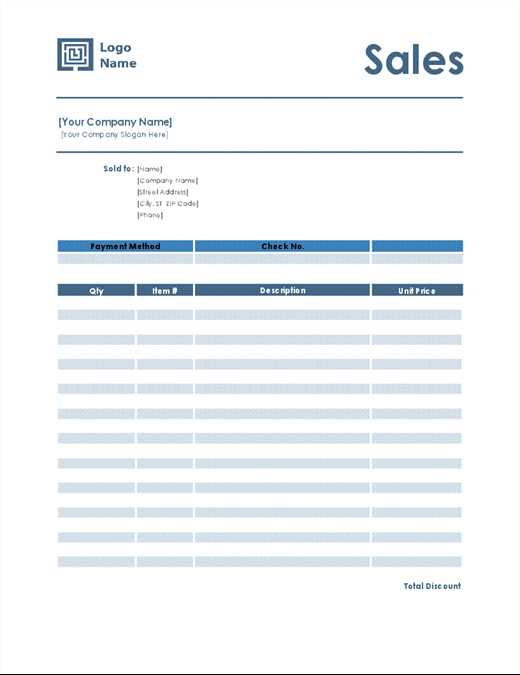

Adjust your receipt template to reflect your brand and meet your business needs. Begin by adding your business logo at the top of the template. This instantly builds brand recognition and ensures that customers associate the receipt with your company.

1. Add Business Details

Include your business name, address, phone number, and website. This will help customers reach out if they have any questions. If applicable, include tax identification numbers for official purposes.

2. Tailor the Item List

Customize the item section with clear descriptions of what’s being sold, including quantity and price. If you offer discounts or promotions, add a space to highlight them. Adjust the columns for better visibility of taxes, shipping costs, or any other added fees.

3. Payment Methods and Terms

Make sure the receipt clearly lists the payment method, whether it’s credit card, cash, or another option. You may also want to include payment terms such as due dates for invoices or refund policies.

4. Design and Format

Choose a clean, simple design that makes important information easy to read. Avoid clutter. Keep text legible by selecting a professional font and organizing the layout with enough spacing between sections.

5. Add a Thank-You Message

Include a brief note thanking your customer for their purchase. This simple gesture builds rapport and can help create loyalty.

Selecting the right format for your sales receipt is key to providing clarity and convenience for both your business and customers. A simple and clear layout ensures that all necessary details are presented in an understandable way, preventing confusion or disputes later. Your receipt format should include essential elements like the transaction date, itemized list of products or services, prices, and any taxes or discounts applied. These details should be easy to spot, ensuring a smooth and professional transaction process.

Consider Your Business Needs

Your business type plays a major role in determining the right format. Retail businesses often opt for compact, easy-to-read receipts, while service-based businesses may require a format that explains the services in more detail. Think about what information your customers need most. If your business deals with multiple products or services, include a clear breakdown. If you offer warranties or returns, feature this info prominently to avoid misunderstandings.

Print vs. Digital Receipts

Deciding between printed or digital receipts depends on your operational setup and customer preferences. Printed receipts work best for in-person transactions where you want to provide something physical to the customer. Digital receipts, on the other hand, are more eco-friendly and convenient for both parties, especially for online transactions or repeat customers who prefer to manage records electronically. Make sure your digital receipts are formatted clearly for email or SMS viewing, without overwhelming the customer with excessive details.

To automate receipt generation, integrate a sales system with a receipt generation tool. Use software that can automatically populate fields like transaction details, customer information, and payment method. Many systems allow users to create custom templates for receipts, making automation straightforward.

Use cloud-based platforms like Google Sheets or Airtable, which offer built-in scripting capabilities. These platforms can generate a new receipt every time a sale is recorded. Alternatively, explore specialized POS (Point of Sale) software that automates the entire process and integrates with accounting systems to create accurate, compliant receipts instantly.

| Platform | Features | Automation Type |

|---|---|---|

| Google Sheets | Custom templates, Google Apps Script | Manual trigger via script |

| Airtable | Database, Zapier integrations | Automated triggers for new entries |

| POS Software (e.g., Square) | Instant receipt generation, Integration with CRM | Fully automated with no manual input |

Additionally, consider using APIs to automatically send receipts via email or SMS. This can streamline your workflow, reducing human error and improving customer satisfaction. Always test the system to ensure that the correct data is being populated and formatted as expected.

Ensure all details are correct before sending the receipt. Double-check the date, item descriptions, prices, and any applicable taxes. Missing or incorrect information can lead to confusion or disputes.

1. Leaving Out Contact Information

Always include your business contact details, including phone number, email, and physical address. This helps customers reach out if they have any questions or issues with the transaction.

2. Failing to Specify Payment Method

Clearly state the payment method used (cash, credit card, etc.). This prevents misunderstandings regarding how the transaction was completed.

3. Using Unclear Descriptions

Avoid vague or unclear item descriptions. Provide specific details so the customer knows exactly what they are being charged for. This ensures transparency and trust.

4. Ignoring the Receipt Layout

Make sure the layout is simple and easy to read. Too much information crammed into a small space can make it hard for customers to understand key details. Prioritize readability.

5. Forgetting to Include a Total

Don’t skip the total amount due. A receipt without a total can cause confusion and leave your customer unsure of what they paid for.

6. Overlooking Tax Information

If taxes apply, clearly display them on the receipt. This ensures both you and your customer are on the same page regarding the tax calculation and any potential refunds or claims.

7. Using Incorrect Formatting

Check your receipt template for proper alignment. Misaligned text or overlapping details can make the document look unprofessional and difficult to read.

Use a clean layout to ensure all necessary information is easily visible. Focus on the buyer’s name, the product or service purchased, and the total amount paid. This ensures your sales receipt serves its purpose as both a record and a confirmation of the transaction.

Details to Include

Make sure to include the transaction date, the quantity of items, unit price, and total. If applicable, list any discounts or taxes applied, showing a clear breakdown of the final amount. This transparency builds trust with customers.

Design Tips

Keep the design simple with a clear structure. Avoid cluttered fonts and excess information. Prioritize readability by using appropriate font sizes and spacing. This makes it easy for the recipient to review their purchase details quickly.