Creating a clear and professional sales receipt template can streamline your transaction process and improve customer experience. A well-structured receipt serves as a record of the purchase, providing transparency and building trust. Focus on including key details, such as the business name, contact information, a description of the products or services sold, and the total amount paid. These elements ensure that both you and your customer have a reliable document for reference.

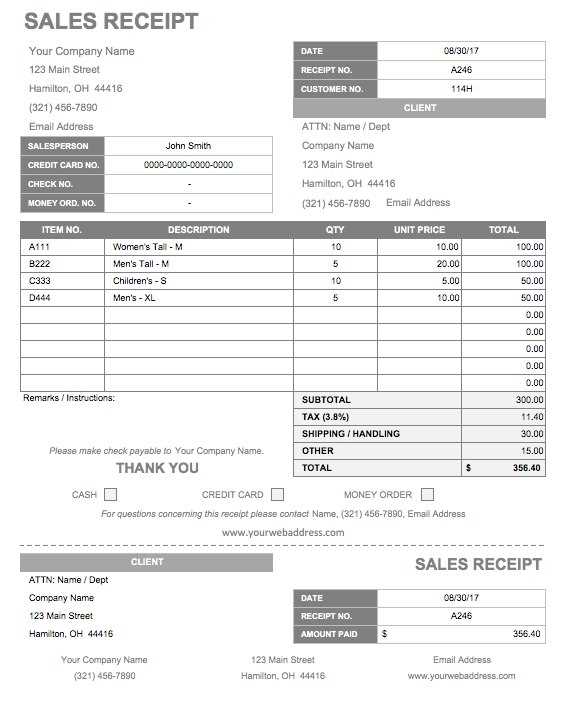

Consider structuring your sales receipt template to include specific fields like item description, quantity, price per unit, and total cost for each item. Additionally, don’t forget to include the date of the transaction and the payment method. Including a unique receipt number can help in tracking purchases and managing returns or exchanges. A clean, organized layout will help your customers easily understand the breakdown of the sale.

If you’re looking to automate the process, digital templates can save you time and prevent errors. Many software tools allow you to create and customize sales receipts, ensuring you can tailor them to your business needs. Just ensure that the template remains simple and avoids clutter–clarity is key. A polished and accurate sales receipt reflects positively on your brand and enhances your professionalism.

Here’s the revised text with reduced word repetition:

To create a clear and concise sales receipt template, focus on structuring the details logically. Avoid redundant phrases and streamline content for quick readability. Each section should contain only the necessary information. For example, when listing items, group them by categories, eliminating repetitive descriptions. Use short, clear phrases for payment and total sections to ensure the key information stands out.

How to Improve Clarity

Rather than repeating similar phrases, replace them with more specific terms. Instead of stating “The total cost comes to…” and “The total amount is…”, simply use “Total: [Amount]”. This reduces the number of words while maintaining clarity. Similarly, avoid over-explaining terms that are already understood by your audience, such as item names or standard payment methods.

Ensure Consistency and Precision

Check that formatting is consistent throughout the receipt. For example, always list tax and discounts in the same order, and use consistent punctuation. Clear and well-organized text makes the document easier to understand and less prone to errors. Adjust any phrases that repeat unnecessarily, keeping each sentence as direct and informative as possible.

Template for Sales Receipt

How to Create a Basic Sales Receipt in Word

Key Elements to Include in a Sales Receipt

Customizing a Sales Receipt for Different Business Types

How to Add Tax and Discounts to a Sales Receipt

Best Practices for Formatting Your Sales Receipt

How to Automate the Sales Receipt for Online Sales

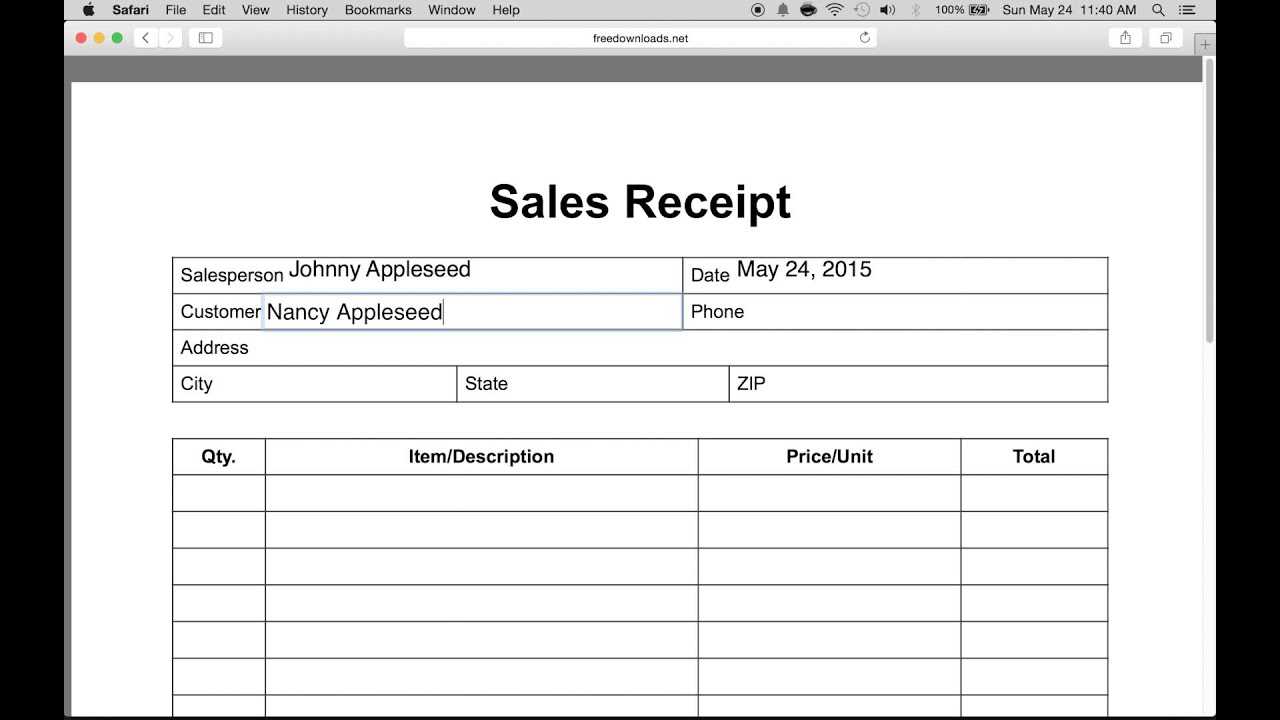

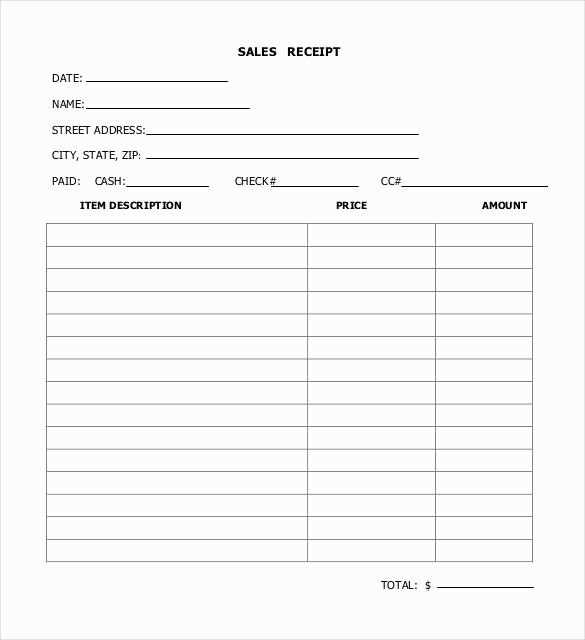

To create a simple sales receipt in Word, start with a blank document. At the top, add your business name, address, and contact details. Below that, include the receipt title, such as “Sales Receipt” or “Invoice.” Add the date of the transaction and a unique receipt number to keep track of records. For each item sold, list the description, quantity, price per unit, and total cost. Conclude with the total amount, including taxes and any discounts.

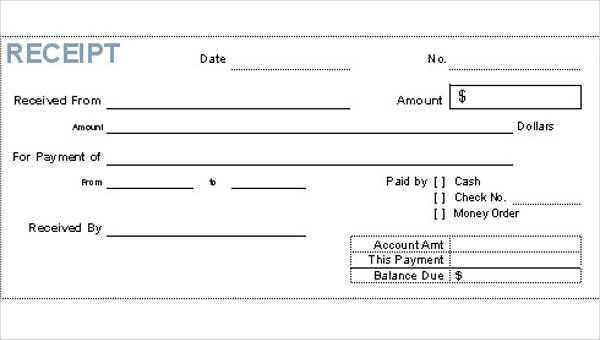

Key elements to include in a sales receipt are the business and customer details, itemized list of products or services, payment method, and total amount due. It’s also beneficial to include the applicable tax rate and any discounts or promotions applied. Don’t forget the transaction date and a clear, sequential receipt number for easy reference.

Customize the receipt based on your business type. Retail businesses should focus on clear product descriptions and pricing, while service-based businesses may need to include hours worked or service type. For freelancers or consultants, adding a brief summary of the service provided and the agreed-upon rates is helpful.

For taxes, ensure you include the applicable tax rate for your region. If your business offers discounts, calculate the discount percentage and subtract it from the total amount before tax. Display both the discount and tax clearly on the receipt, so customers can easily see how the final price was determined.

Best practices for formatting a sales receipt include using a clean and simple layout. Align text properly, ensuring it’s legible. Break the receipt into sections (business info, items, taxes, totals) for easy reading. Choose a professional font and size that’s easy to read on both screen and paper.

For online sales, automate the creation of sales receipts by integrating them with your e-commerce platform. Many platforms allow you to generate and send receipts automatically upon purchase. This reduces manual effort and ensures that customers receive their receipts immediately, improving customer satisfaction.