Why Choose Templates for Sales Receipts?

Using templates for sales receipts saves time and ensures consistency. A reliable template can quickly generate a professional receipt with the necessary details, such as transaction amounts, dates, and buyer information. Templates also reduce the chances of missing critical details, offering clarity for both the seller and the buyer.

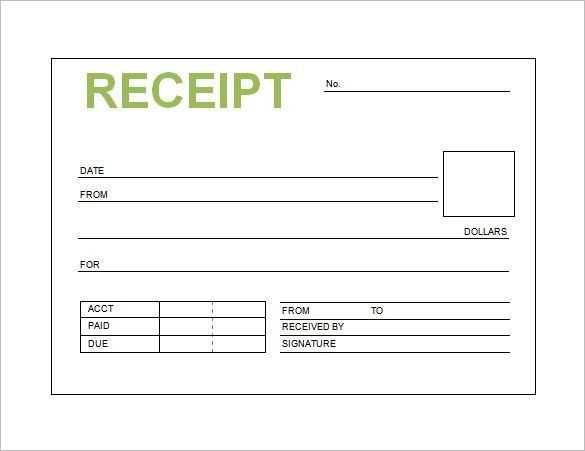

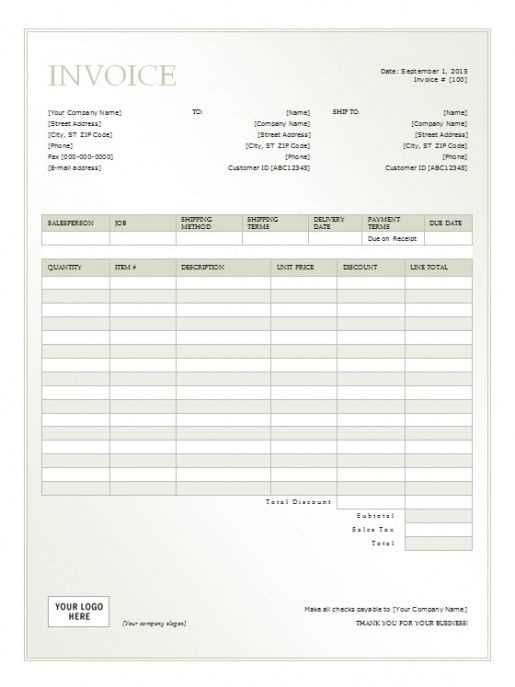

What to Include in a Sales Receipt Template

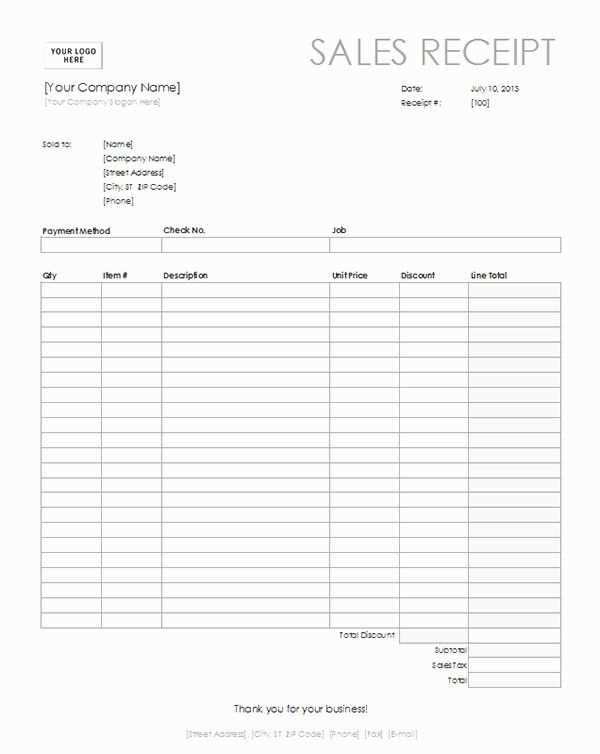

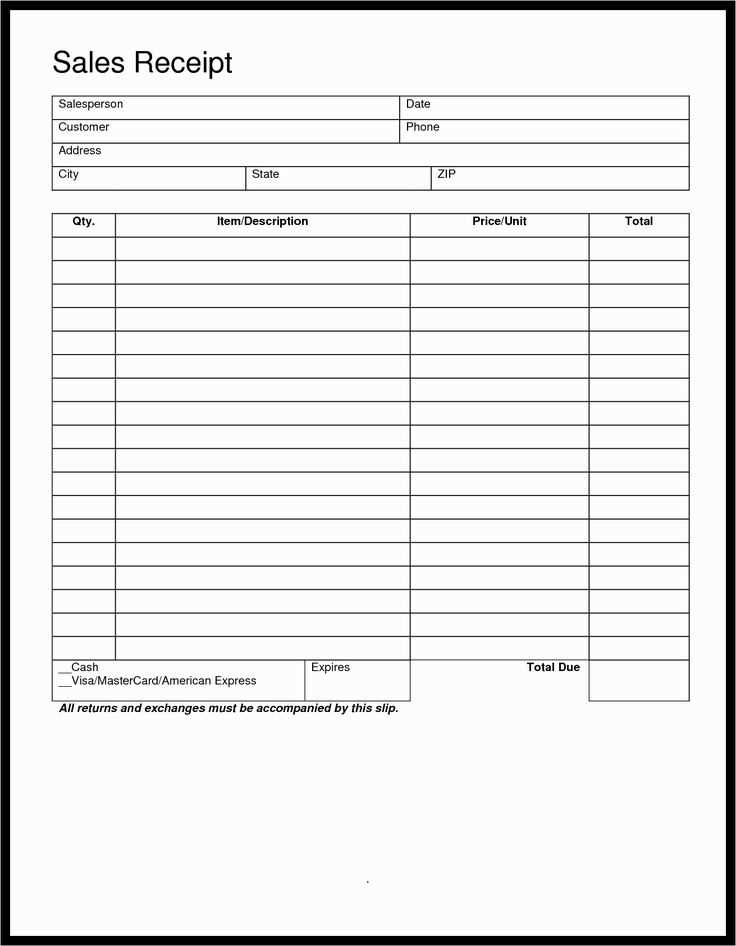

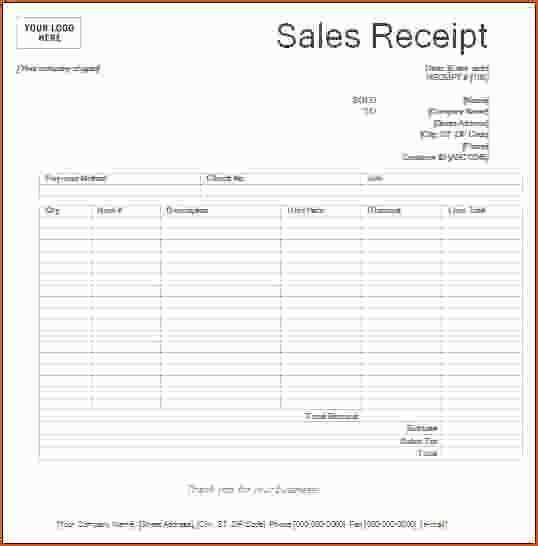

- Business Details: Name, address, contact info, and logo for identification.

- Receipt Number: Unique number for easy tracking and reference.

- Transaction Details: Item descriptions, quantities, individual prices, and total amount.

- Payment Information: Payment method (cash, card, etc.) and transaction date.

- Tax Information: If applicable, include tax rate and total tax amount.

- Return Policy: Brief notes on return or exchange policies if necessary.

Choosing the Right Template

Look for templates that offer customizable fields for all the essential transaction data. Opt for templates that match your business branding, ensuring the design aligns with your professional image. You can find templates in various formats such as PDF, Word, and Excel, each with its own set of advantages depending on your needs.

Benefits of Digital Templates

Digital templates are often more efficient than handwritten receipts. You can easily save them as records, email them to customers, or print them directly when required. Many software programs offer pre-designed receipt templates, enabling quick adjustments and printing when needed.

Where to Find Sales Receipt Templates

Numerous online platforms offer free and paid templates. Websites like Google Docs, Microsoft Office, and template-specific platforms have multiple options designed to cater to various types of businesses. Select a template that is adaptable to your sales process and supports your receipt volume.

Templates for Sales Receipts: Practical Guide

Choose a template based on the nature of your business. For retail stores, use a basic receipt template that includes the transaction date, itemized list of products or services, and total price. Service-based businesses may require more detailed templates with sections for labor charges, materials, and terms of service.

Personalizing templates for specific transactions can improve clarity and professionalism. Add a customer reference number, payment method, and delivery details when necessary. If your business deals with recurring clients, create templates that highlight any discounts, loyalty points, or personalized offers, ensuring a smoother customer experience.

Ensure your templates comply with local tax laws. Incorporate tax calculations and necessary business identification information, like your tax ID number. Some regions may also require specific wording, such as “Tax included” or “VAT exempt,” depending on the transaction type. Customize your templates to reflect these legal requirements.