To create a vehicle sales receipt in Ontario, it’s important to include specific information that meets legal requirements. This ensures that both the buyer and seller are protected in case of disputes or future transactions. A well-structured receipt helps clarify the details of the sale, including the price, condition of the vehicle, and both parties’ contact information.

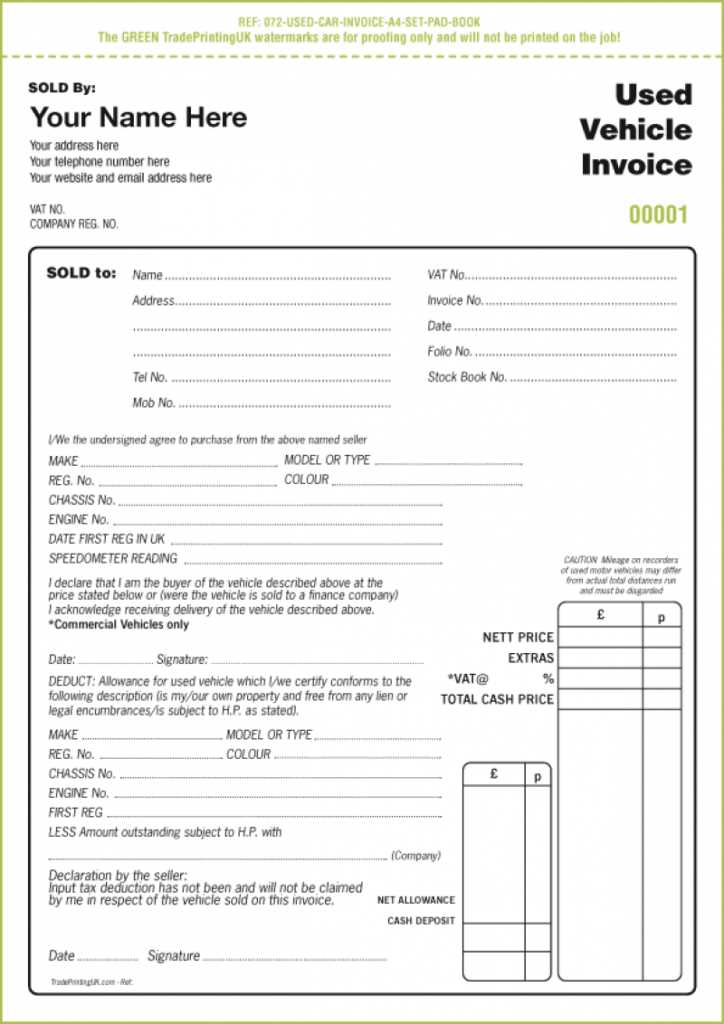

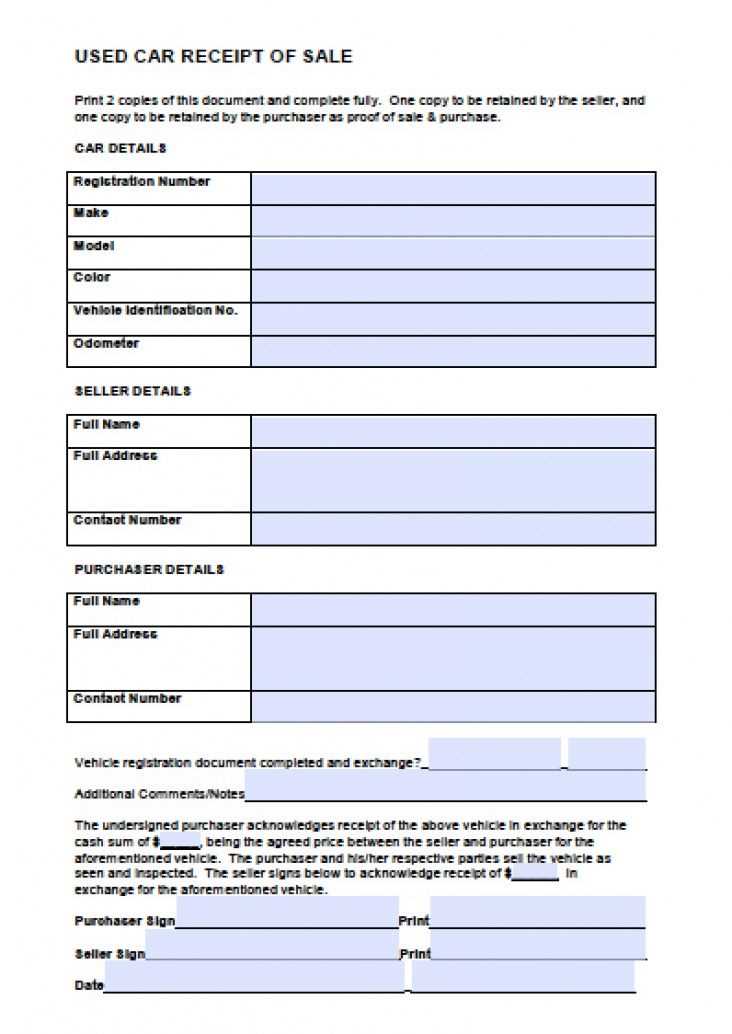

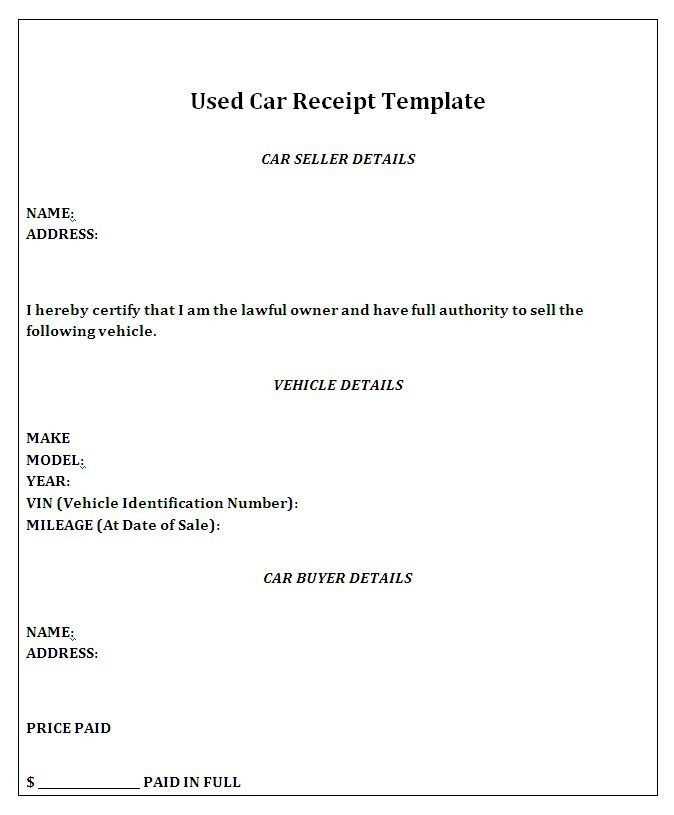

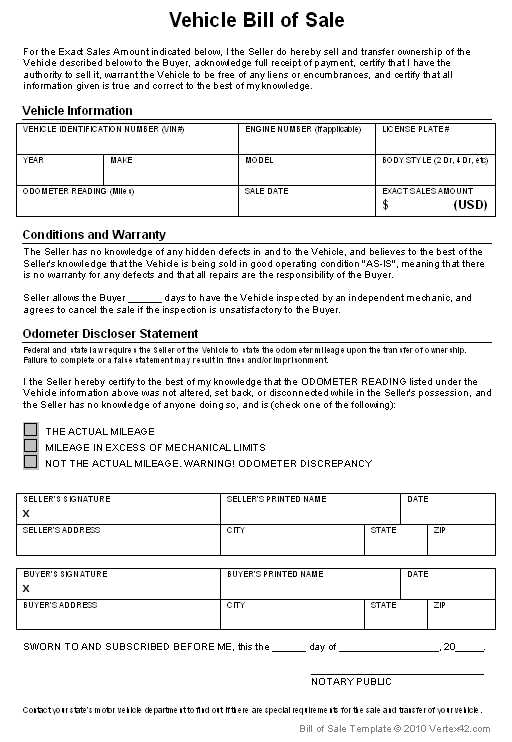

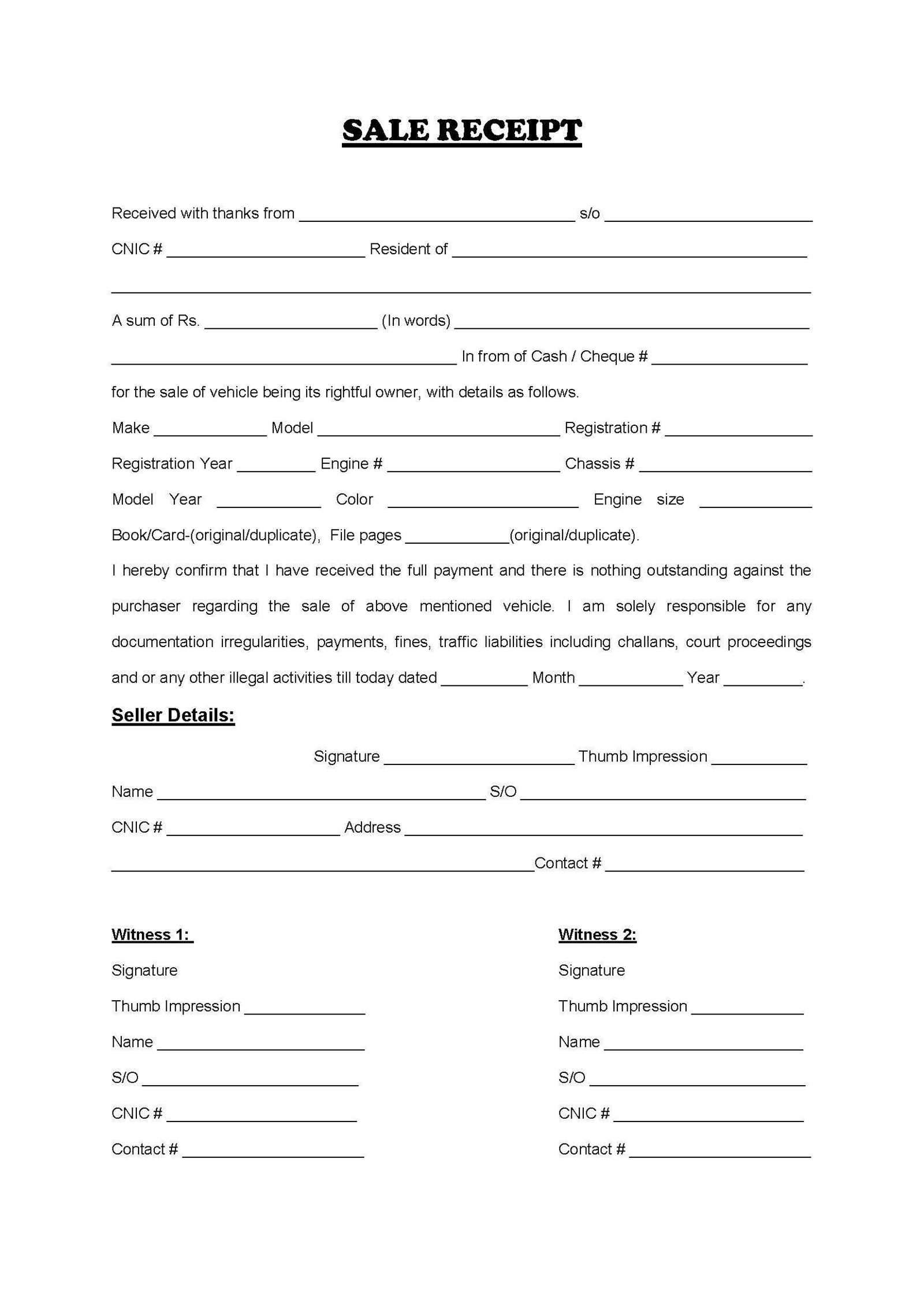

The template should list the vehicle’s make, model, year, VIN, and the odometer reading at the time of sale. Include the sale price and specify whether any taxes were collected. Make sure both the buyer and seller sign the document, and provide a section for their addresses and phone numbers for identification purposes.

It’s also a good idea to note any warranties or conditions attached to the sale. This can help avoid future disagreements if the vehicle experiences issues shortly after the purchase. Ensure that the date and location of the sale are clearly marked to confirm the transaction details.

Here’s the corrected text, where repetitions of words are reduced:

When creating a vehicle sales receipt in Ontario, focus on clarity and conciseness. The document should include the buyer’s and seller’s full names, addresses, and contact information. Specify the vehicle’s details, including make, model, year, VIN, and odometer reading. Clearly state the purchase price, any taxes, and the payment method. It’s also necessary to indicate the date of the transaction and any warranties or “as-is” clauses.

Key Elements to Include

| Field | Details |

|---|---|

| Buyer’s Information | Full name, address, and contact information. |

| Seller’s Information | Full name, address, and contact details. |

| Vehicle Details | Make, model, year, VIN, odometer reading. |

| Price | State the total cost and any applicable taxes. |

| Payment Method | Cash, check, or financing details. |

| Transaction Date | Date of sale. |

| Warranties | Specify any warranty or “as-is” condition. |

Be sure to include a clear statement about the terms of the sale, whether the car is sold “as-is” or with a limited warranty. Also, both parties must sign and date the receipt to make it legally binding. If the transaction involves any trade-in, it should be separately listed with its value. Keep a copy of the receipt for record-keeping purposes.

- Vehicle Sales Receipt Template for Ontario

Creating a vehicle sales receipt in Ontario requires including specific information for both parties involved, ensuring compliance with local regulations. The receipt serves as proof of the transaction and should clearly outline the vehicle’s details, transaction terms, and buyer/seller information.

Key Components to Include

Start by listing the full legal names and addresses of both the buyer and seller. This is crucial for verifying identities and resolving any future disputes. Add the vehicle’s make, model, year, VIN (Vehicle Identification Number), and current odometer reading to ensure clear identification of the vehicle being sold.

Detail the transaction amount, including the sale price, and mention if any taxes, fees, or additional charges apply. For Ontario, the Harmonized Sales Tax (HST) should be clearly specified. Include a statement indicating whether the vehicle is sold “as is” or with any warranties, as this can impact the buyer’s rights post-purchase.

Final Considerations

Both the buyer and the seller should sign the receipt to confirm their agreement to the terms. It’s advisable to include a section where the buyer acknowledges receipt of the vehicle and the transaction amount. Lastly, make sure the receipt is dated to mark the official transfer of ownership.

1. Gather Buyer and Seller Information: The receipt must clearly list the full names, addresses, and contact information for both the buyer and the seller. This helps identify the parties involved in the transaction.

2. Include Vehicle Details: Write the make, model, year, Vehicle Identification Number (VIN), and current odometer reading of the vehicle. These details ensure that the vehicle is properly identified.

3. State the Sale Price: Specify the agreed-upon sale price of the vehicle. If payments are to be made in installments, provide those details, including the amount of each payment and due dates.

4. Include Date of Sale: The date of the transaction must be clearly stated on the receipt. This establishes the official date of transfer of ownership.

5. Signatures: Both the buyer and the seller must sign the receipt. These signatures confirm that both parties agree to the sale terms and acknowledge the transfer of ownership.

6. Vehicle Condition: If the vehicle is sold “as-is,” make sure to note this on the receipt. This protects the seller from liability regarding the vehicle’s condition after the sale.

7. Additional Details: If there are any special terms or conditions, such as warranties or repairs, include them in the receipt. Any details that may affect the sale should be clearly noted.

8. Keep Copies: Both parties should retain a copy of the signed receipt for their records. This serves as legal proof of the sale and can help resolve potential disputes in the future.

Clearly state the full legal names and addresses of both the seller and buyer. This is vital for future reference and any potential disputes.

Include the vehicle’s details: make, model, year, VIN (Vehicle Identification Number), and mileage at the time of sale. These specifics ensure that both parties are clear about the vehicle being exchanged.

Specify the sale price, including taxes and any additional fees, such as for documentation or safety inspections. Both parties should know exactly what’s being paid and what is included in the total amount.

State the payment method(s) used for the transaction, whether it’s cash, cheque, or a bank transfer. If payments are made in installments, indicate the agreed-upon schedule.

Clarify the condition of the vehicle, particularly if it’s being sold “as-is” without warranties or guarantees. If there are any issues, list them to avoid misunderstandings later.

Include the date of sale and signatures of both parties. These validate the transaction and confirm the agreement.

If applicable, note whether the vehicle’s ownership has been transferred. In Ontario, the seller must provide the buyer with a completed Used Vehicle Information Package (UVIP), which is essential for the transfer of ownership.

Ensure that all details on the vehicle sales receipt are accurate, as errors can lead to legal or financial issues. Here are the most common mistakes to watch out for:

- Incorrect Vehicle Information: Double-check the make, model, year, VIN (Vehicle Identification Number), and odometer reading. A simple typo or missing detail can complicate ownership transfer and insurance processes.

- Missing Seller or Buyer Information: Both the seller’s and buyer’s full names, addresses, and contact details must be included. Failing to provide complete information can lead to disputes about ownership or who is liable after the sale.

- Omission of Sales Price: Always include the agreed sales price of the vehicle. Omitting this information or listing an inaccurate amount can result in tax complications or issues with the transfer of ownership.

- Improper Date: Ensure the date of sale is accurate. An incorrect date can create confusion about the timeline of the transaction and affect registration and insurance.

- Not Noting the Condition of the Vehicle: Clearly state whether the vehicle is sold “as-is” or if there are any warranties. If the sale includes any terms or warranties, be sure they are explicitly stated to avoid future misunderstandings.

- Failure to Sign: Both parties must sign the receipt to make the transaction legally binding. An unsigned receipt is not enforceable and can cause issues when trying to register the vehicle or make claims later.

- Ignoring the HST (Harmonized Sales Tax): If applicable, ensure that the receipt reflects the correct HST. Ontario buyers and sellers are required to account for HST in vehicle transactions. If the tax is left off or incorrectly listed, it can lead to penalties from the Canada Revenue Agency (CRA).

- Not Keeping Copies: Always retain a copy of the receipt for your records. Both buyer and seller should have a copy in case of disputes, tax reporting, or registration issues later on.

- Not Completing the Transfer of Ownership: After the sale, the buyer must complete the necessary steps to transfer the title with the Ministry of Transportation (MTO). Leaving this step incomplete can create problems for both parties, especially if the vehicle is involved in an incident after the sale.

Avoiding these common mistakes will help ensure a smooth transaction and prevent potential complications. Keep the information clear, accurate, and complete, and make sure all legal steps are followed to finalize the sale properly.

Ensure your Ontario vehicle sales receipt includes all the required details. A clear and accurate receipt helps both parties and serves as proof of transaction. Below are the key elements to include:

- Seller’s Information – Include the seller’s full name, address, and contact details. This confirms the identity of the person selling the vehicle.

- Buyer’s Information – Similarly, include the buyer’s full name, address, and contact information. This makes the transaction traceable.

- Vehicle Information – Clearly state the vehicle’s make, model, year, VIN (Vehicle Identification Number), and odometer reading. This uniquely identifies the vehicle.

- Transaction Amount – Specify the total amount paid for the vehicle, including any taxes, fees, and other costs.

- Date of Sale – Indicate the exact date of the sale. This helps establish the timeline of ownership transfer.

- Signatures – Both parties should sign the receipt. This confirms that both the seller and the buyer agree to the terms of the transaction.

- Warranty and “As-Is” Statement – If applicable, clarify whether the vehicle is sold with any warranty or “as-is.” This protects both parties in case of future disputes.

Ensure all these details are clearly listed and double-check for accuracy. A properly filled-out sales receipt will prevent future misunderstandings and protect both buyer and seller.