To create a clear and professional cheque receipt, it’s crucial to include key details like the cheque number, date of receipt, payer’s information, and the purpose of the payment. These elements help ensure transparency and facilitate future reference.

Start with a receipt number for easy tracking and record-keeping. This number will be unique for each transaction. Include the date when the cheque is received, as well as the payer’s name and their contact details, if applicable.

The amount should be clearly stated in both numerical and written form, ensuring there is no ambiguity. Additionally, briefly describe the purpose of the payment to provide context. Finally, always include the signature of the receiver as a form of acknowledgment.

By using this simple format, you can maintain accurate records and prevent any misunderstandings related to payments made via cheque.

Here is the revised version:

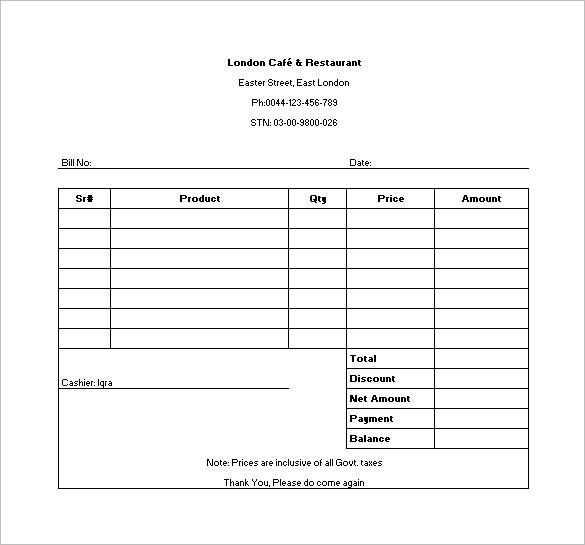

To create a sample cheque receipt template, focus on clarity and accuracy. Ensure all essential information is included, such as the payer’s name, amount, date, cheque number, and recipient details. The layout should be straightforward, making it easy for both parties to verify details quickly.

Key Elements to Include

| Element | Description |

|---|---|

| Payer’s Name | Ensure the name of the person or company issuing the cheque is clearly stated. |

| Cheque Number | Include the cheque number for reference in case of discrepancies or follow-up. |

| Amount | List the amount both in words and numerically to avoid confusion. |

| Date | Specify the date when the cheque was issued. |

| Recipient Name | Clearly indicate the name of the person or company receiving the payment. |

Template Example

Below is an example of how to structure the cheque receipt:

| Cheque Receipt |

|---|

| Cheque Number: 123456 |

| Payer: John Doe |

| Amount: One thousand dollars ($1000) |

| Date: February 12, 2025 |

| Recipient: XYZ Services |

This simple structure ensures all necessary details are captured, preventing any misunderstandings between the payer and the recipient.

- Sample Cheque Receipt Template

Here is a practical cheque receipt template that you can use for your business or personal record keeping:

Cheque Receipt Template

- Date: Enter the date when the cheque was received.

- Receipt Number: Assign a unique number for easy tracking.

- Payer’s Name: Write the full name of the person or company who issued the cheque.

- Cheque Number: Include the unique cheque number for reference.

- Amount: State the amount written on the cheque (in words and numbers).

- Bank Name: Mention the bank on which the cheque is drawn.

- Payment Purpose: Specify the reason for the cheque payment (e.g., goods, services, rent).

- Received By: Indicate who received the cheque and provide their signature.

Example

- Date: 12th February 2025

- Receipt Number: 0054

- Payer’s Name: John Doe

- Cheque Number: 12345678

- Amount: One Thousand Five Hundred Dollars ($1,500.00)

- Bank Name: Bank of America

- Payment Purpose: Payment for consulting services

- Received By: Jane Smith (Signature)

This template allows for proper documentation of cheque payments, ensuring accuracy and clear records. Keep a copy of the receipt for both parties’ reference.

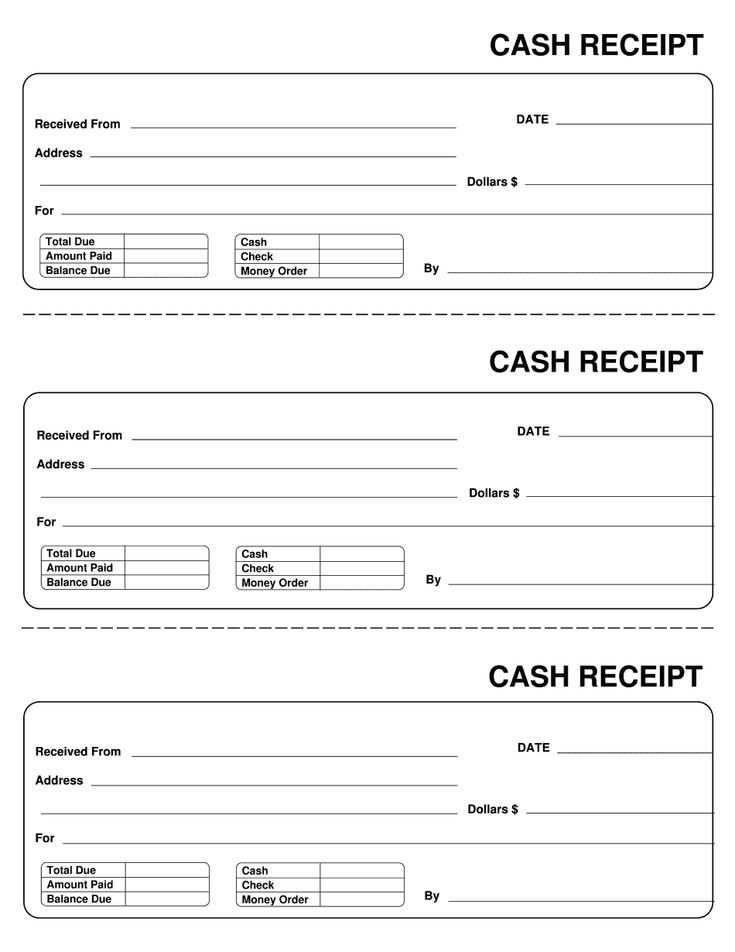

Design a cheque receipt template by including the following key details:

Basic Structure

- Title: Clearly label the document as “Cheque Receipt.”

- Receipt Number: Assign a unique identifier for tracking purposes.

- Date: Include the date the cheque was received.

- Payee Information: List the name of the person or company receiving the cheque.

- Cheque Number: Record the unique cheque number.

- Amount: Specify the amount received, both in numeric and word form.

- Drawer Information: Include the name of the person or company who issued the cheque.

- Bank Name: Indicate the name of the bank that issued the cheque.

- Signature: Provide space for the payee’s signature.

Design Tips

- Organized Layout: Keep sections clear and easy to distinguish for quick reference.

- Legible Font: Use simple, easy-to-read fonts with a proper size for all text.

- Minimalist Approach: Keep the template clean by avoiding unnecessary elements that distract from the key details.

This approach ensures clarity and organization, making it easier for both parties to reference the cheque receipt when needed.

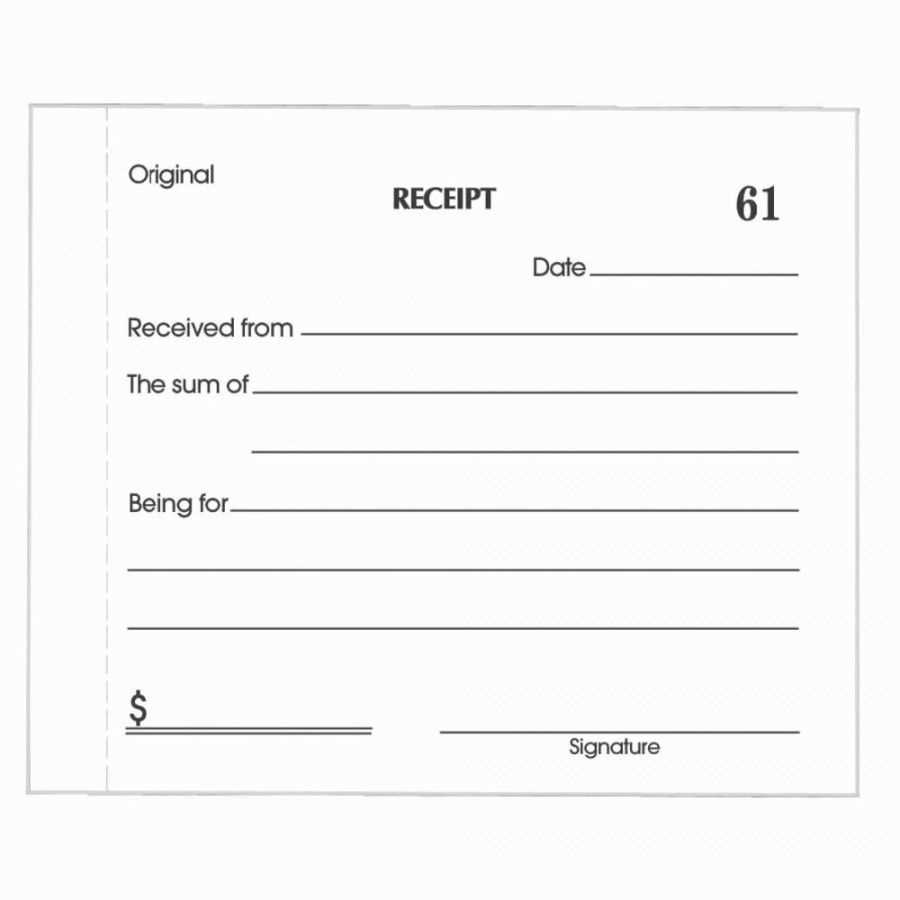

A cheque receipt should clearly list the details that confirm the transaction. Key fields to include are:

1. Receipt Number

Assign a unique number to each receipt for easy tracking and reference. This helps maintain an organized record of transactions.

2. Date of Receipt

Record the exact date the cheque was received. This provides clarity on the timing of the transaction and serves as proof of receipt.

3. Payee Information

Include the name of the individual or business receiving the payment. This ensures the cheque is tied to the correct recipient.

4. Amount in Words and Figures

State the cheque amount both numerically and in words. This minimizes the risk of errors and discrepancies during processing.

5. Bank Details

List the name of the bank on which the cheque is drawn, along with its branch if applicable. This adds transparency and helps with verification if needed.

6. Cheque Number

Include the cheque number for reference. This helps track the cheque and identify it in case of any issues.

7. Purpose of Payment

Briefly describe the reason for the payment to provide context. This is useful for accounting purposes and for both parties to confirm the transaction details.

8. Authorized Signature

Have the payee or an authorized person sign the receipt to validate the transaction. This adds a layer of authenticity and confirms acceptance.

One key mistake is not including all required cheque details. Ensure the template captures the cheque number, the payer’s name, the date of issue, and the amount in both numeric and written formats. Missing any of these can cause confusion later.

Avoid vague descriptions in the “payment for” section. Be specific about the purpose of the payment to prevent misunderstandings. Clearly state what the cheque is being paid for, whether it’s for goods, services, or a specific agreement.

Never leave room for ambiguity when documenting the payment method. Always specify that the payment was made via cheque, and include the cheque number. This helps prevent mix-ups with other forms of payment.

Don’t forget to include a clear and concise receipt number. This is vital for record-keeping and tracking transactions. Without it, it becomes difficult to reference past payments.

Ensure the recipient’s details are correct and complete. Mistakes in spelling or address information can lead to confusion, and in some cases, legal issues if the cheque needs to be traced or verified later.

Refrain from using unclear fonts or small text sizes. Make sure the text is legible, even in printed form. It’s crucial that all information is easily readable for both the payer and the recipient.

Lastly, double-check for any typographical errors before finalizing the receipt. A small mistake in any section, especially in numerical figures, could create complications when reconciling the payment later on.

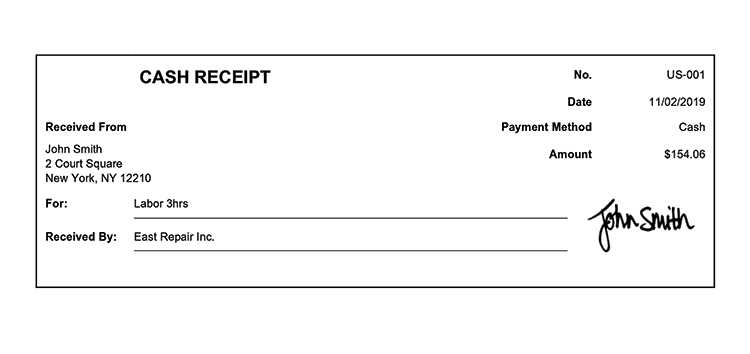

Cheque Receipt Template

Design your cheque receipt template to be clear and functional. Focus on the essential details to ensure smooth record-keeping and tracking of payments. A standard template should include the payer’s information, amount received, date of payment, and the cheque number.

Key Fields to Include

- Payer’s Name: Clearly state the name of the individual or business making the payment.

- Amount Received: Include the exact amount in both numbers and words to avoid confusion.

- Cheque Number: Write the cheque number for future reference or verification.

- Date: Mention the date the cheque was received to track payment timelines.

- Receipt Number: If applicable, assign a unique receipt number for organizational purposes.

Additional Considerations

Consider adding a section for signatures, both from the payer and the receiver, to confirm the transaction. This ensures accountability and avoids potential disputes.

Customize the template to fit your specific needs, but always prioritize clarity and accuracy. A well-designed receipt not only helps with accounting but also fosters trust with your clients or business partners.