Choose a simple, organized template for your restaurant receipts that makes transactions clear and easy for both customers and staff. A well-designed receipt can streamline your operations and minimize errors, ensuring that every sale is recorded accurately. Whether you’re using a POS system or generating receipts manually, the template should reflect the essentials: itemized details, prices, taxes, and total charges.

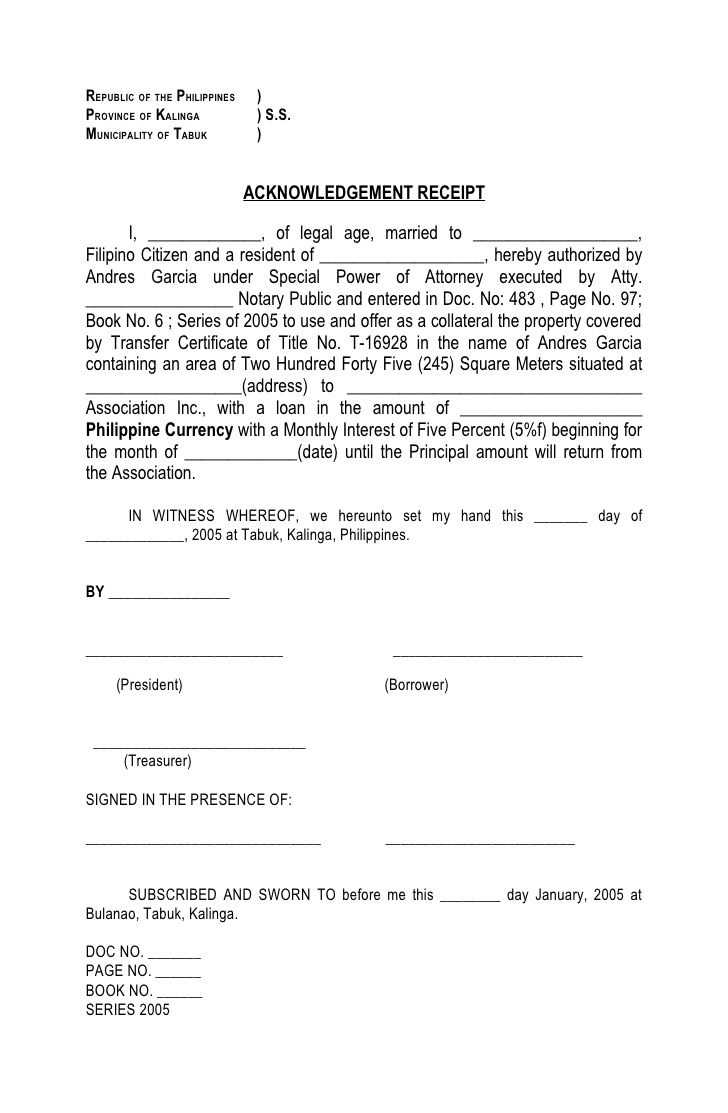

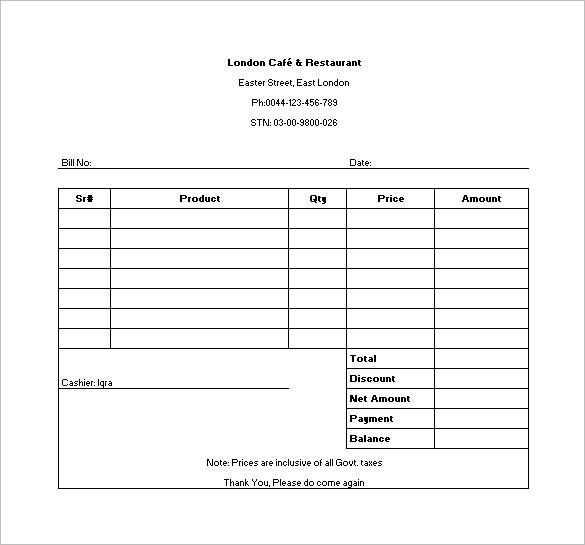

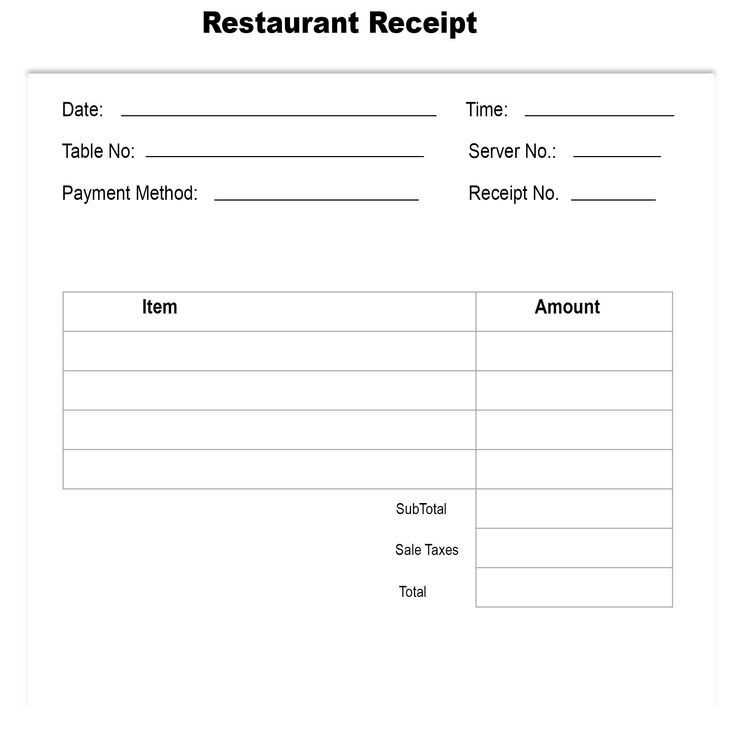

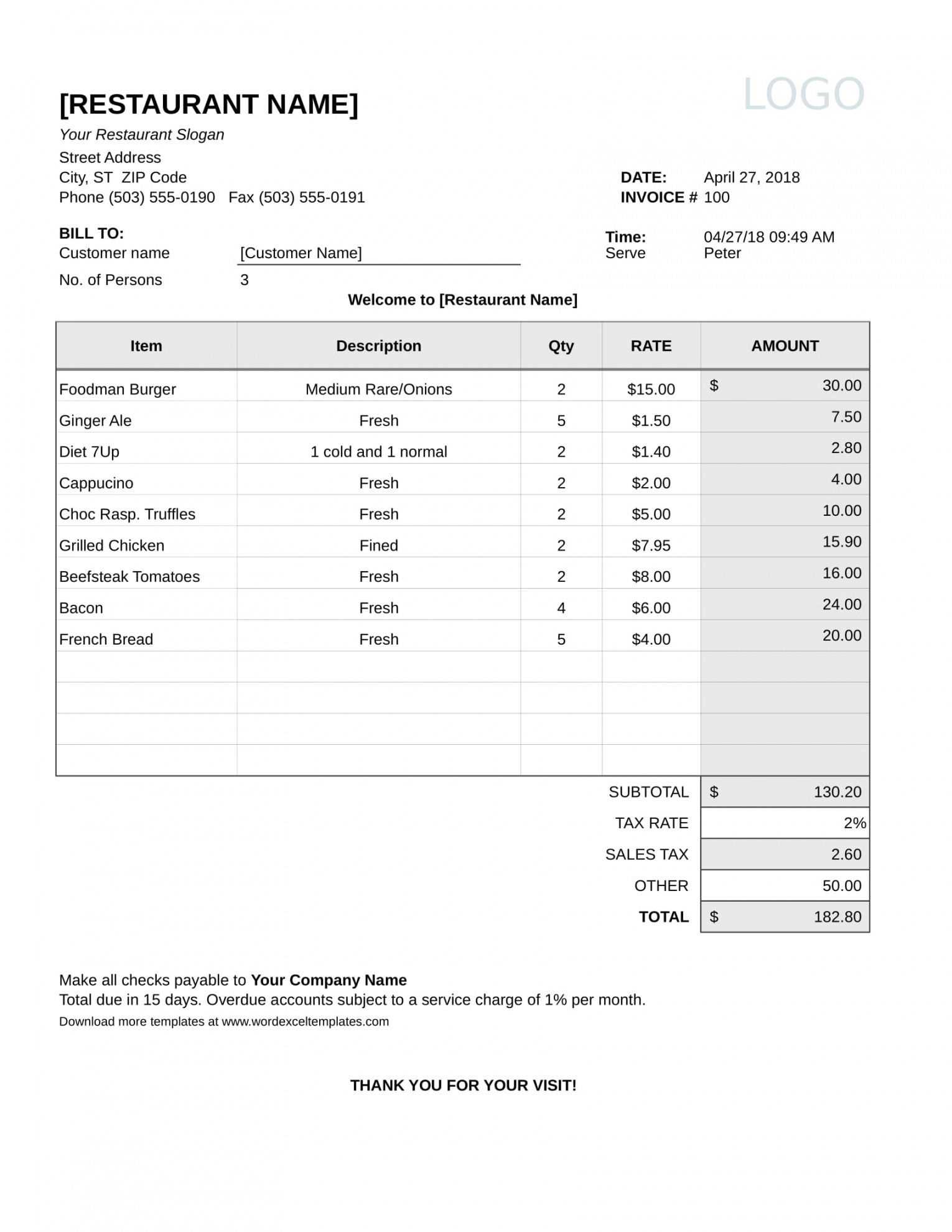

Start by including the restaurant name, address, and contact information at the top of the receipt. This ensures that customers can easily reach you if they have any questions. The date, time, and receipt number are also critical for tracking sales and resolving potential discrepancies.

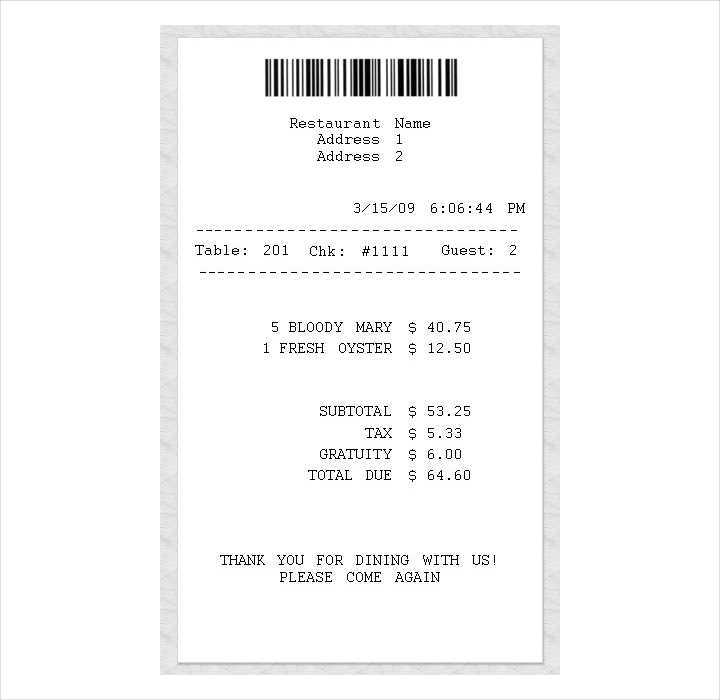

For the itemized section, list each menu item, its quantity, and price. If applicable, include modifiers such as extras or special requests. The subtotal, tax amount, and total should be clearly visible at the bottom. Use bold text for important figures like the total amount due, making them stand out for quick reference.

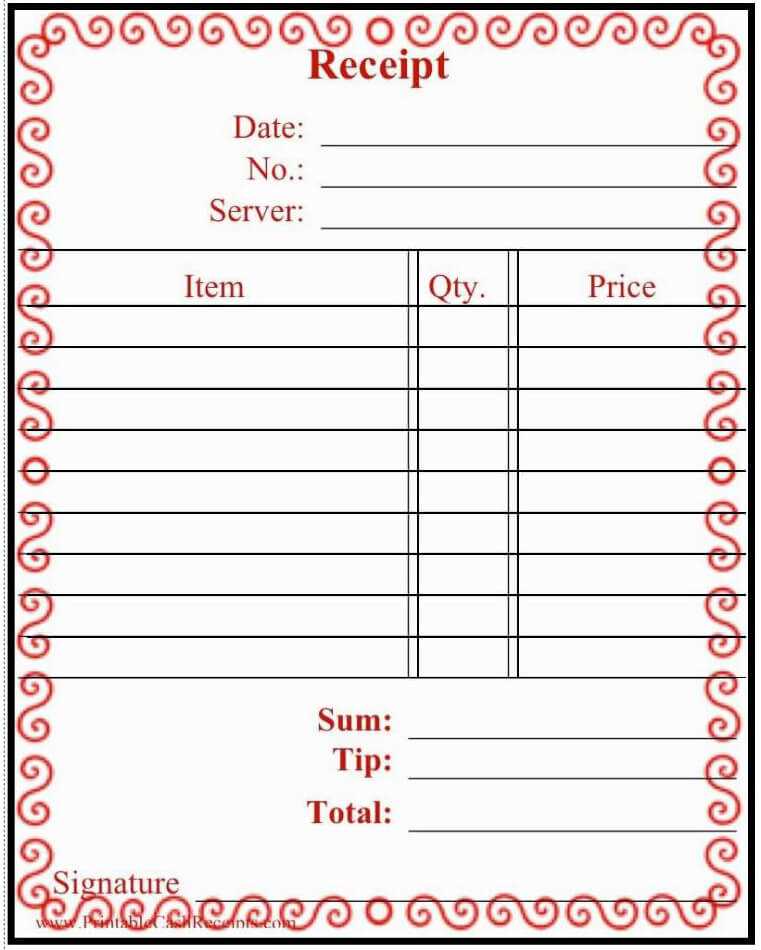

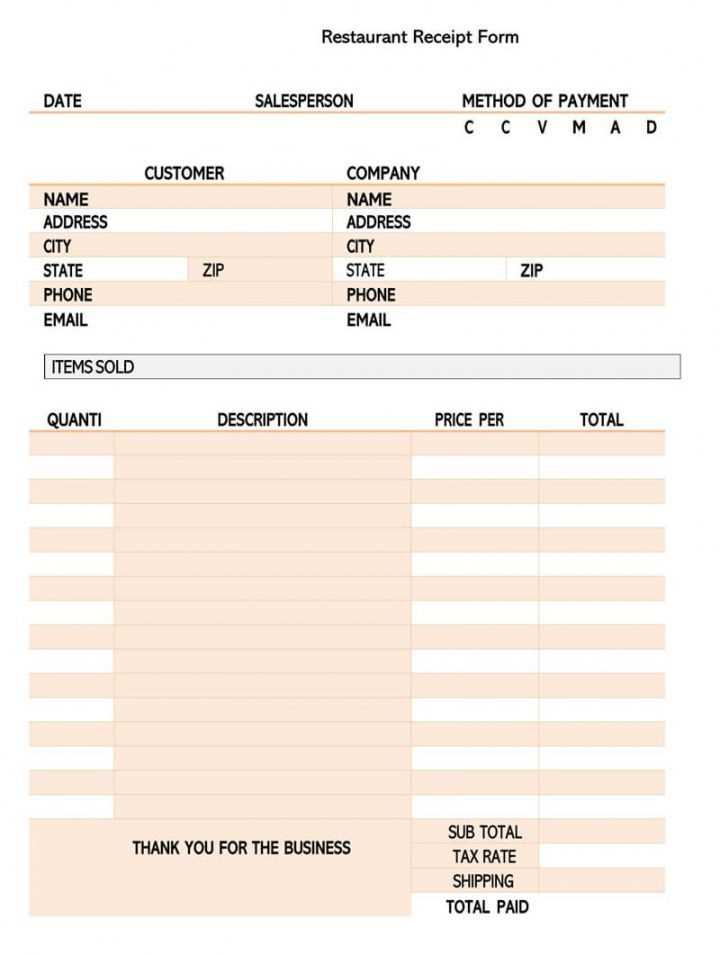

Finally, consider including a section for payment method (cash, card, or digital), which can help with accounting and auditing. An optional space for a tip amount may also be beneficial, particularly for businesses with a tipping culture.

Here’s an improved version without repetitions:

To create a clean and functional restaurant receipt, ensure the following elements are included in the layout:

Clear Itemization

List each item ordered along with the corresponding price. Avoid unnecessary details that might clutter the receipt. The total for each category (e.g., food, drinks, taxes) should be clearly displayed.

Readable Formatting

Make sure the font is easy to read, with a clear distinction between headings and details. Use spacing effectively to separate sections like the item list, taxes, and totals.

Include a section for tips, ensuring it’s optional and not pre-filled. Provide a space for the payment method (e.g., cash, card). End the receipt with a thank-you note or a call to action, like an invitation to provide feedback.

- Sample Restaurant Receipt Template

A good restaurant receipt template should include the necessary details for both the customer and the business. Here’s a breakdown of what to include:

1. Restaurant Name and Address: Clearly display the restaurant’s name, address, and contact information. This makes it easy for customers to reach out if needed.

2. Receipt Number and Date: Assign each receipt a unique number and include the date of the transaction. This helps with tracking and reference.

3. Itemized List: List all the items ordered, including their quantity and price. This helps the customer review what they’ve paid for and ensures transparency.

4. Subtotal, Taxes, and Total: Show the subtotal of the items before taxes, the tax rate, and the total amount due. Clear calculations prevent confusion and mistakes.

5. Payment Method: Indicate how the payment was made–whether by cash, credit card, or other methods. This is important for both accounting and customer records.

6. Tip (if applicable): If the customer has left a tip, include it on the receipt. It ensures both the restaurant and the customer have a record of the tip amount.

7. Additional Notes: If there are any special instructions, discounts, or promotional codes used, include them at the bottom of the receipt.

This simple template will ensure your receipts are clear, concise, and provide all the details your customers need for easy reference.

Begin by focusing on simplicity and clarity. Your receipt should provide all necessary details without overwhelming the customer. Keep the layout clean with enough white space between sections.

- Logo and Business Name: Place your logo and business name at the top for immediate brand recognition.

- Date and Time: Always include the date and time of the transaction for clear records.

- Itemized List: Break down each product or service purchased, listing the name, quantity, and price clearly. This ensures transparency.

- Subtotal, Taxes, and Total: Show the subtotal, applicable taxes, and final total clearly, so customers can verify their charges.

- Payment Method: Indicate how the customer paid (e.g., cash, card, online) for future reference.

- Receipt Number: Assign a unique receipt number for tracking purposes, especially useful for refunds or returns.

- Contact Information: Include your phone number, email, and website in case the customer needs to reach you.

- Return/Exchange Policy: Add a short note about your policy, if applicable, to avoid confusion later.

Design with readability in mind. Use fonts that are easy to read and appropriate for your brand. Avoid overcrowding the receipt with too much information.

Ensure your template is customizable for different transaction types or business needs. A flexible receipt can be adapted to promotions, discounts, or specific customer requirements without altering the design entirely.

Include the following key details on your restaurant receipt to ensure clarity and transparency for customers:

- Restaurant Name and Contact Information: Clearly display the restaurant’s name, address, phone number, and website if applicable. This helps customers reach out in case of any questions or concerns.

- Date and Time of the Transaction: List the date and exact time the transaction took place. This serves as a useful reference for both the restaurant and the customer.

- Itemized List of Items Ordered: Break down the food and drinks ordered with a clear description, quantity, and individual prices. This makes it easier for customers to understand what they’ve paid for.

- Subtotal and Taxes: Display the subtotal of all items ordered before taxes and add the tax rate or total tax amount. This gives transparency to how the final price is calculated.

- Discounts or Promotions Applied: If any discounts or promotional offers were used, list them clearly, along with the amount saved. This ensures that customers know they received their due benefits.

- Total Amount: The final total should be easily visible, clearly marked, and should reflect the sum of the items, taxes, and any applied discounts.

- Payment Method: Indicate the method of payment (e.g., credit card, cash, or mobile payment) to provide proof of the transaction type.

- Tip or Service Charge: If applicable, show the amount added for tips or service charges. Some restaurants include this automatically, while others leave it to the customer’s discretion.

- Transaction or Receipt Number: Include a unique receipt or transaction number for easy reference in case the customer needs to contact the restaurant or request a refund.

Tailor your restaurant receipts to reflect the payment method used, ensuring clarity for both customers and staff. For card payments, display the last four digits of the card and the transaction approval code. This helps customers identify their payment without revealing sensitive details.

For Cash Payments

For cash transactions, include the amount tendered and change given. This offers transparency and reduces disputes over cash handling. You may also want to include the cashier’s name for accountability.

For Digital Wallets and Contactless Payments

For payments made through mobile wallets (like Apple Pay or Google Pay), include the type of wallet used and the confirmation number. These details help track the transaction if issues arise. It’s also important to mark that the transaction was processed without physical contact.

Adjust the language on your receipts accordingly. For instance, “Card Ending in” for card payments and “Paid by [Wallet Name]” for mobile wallets make the receipt easily understandable.

Clearly format tax and service charges on restaurant receipts to ensure transparency and avoid confusion. List these charges separately from the subtotal, and label them accordingly with precise values. This helps customers understand the breakdown of their bill.

| Item | Amount |

|---|---|

| Subtotal | $50.00 |

| Tax (8%) | $4.00 |

| Service Charge (15%) | $7.50 |

| Total | $61.50 |

Ensure the tax and service charge are clearly labeled and easy to differentiate from the rest of the charges. This improves customer satisfaction and helps avoid potential misunderstandings. The tax rate should reflect local laws, while the service charge can vary based on restaurant policy.

Make sure to include accurate item descriptions. Avoid vague labels like “food item” or “drink”–customers need to know exactly what they’re being charged for. Use clear, detailed names for each dish or drink, including any customizations if applicable.

Double-check prices for each item. Errors in pricing can lead to customer dissatisfaction and disputes. Ensure the correct tax rate is applied and that discounts, if any, are accurately calculated. A mismatch between the menu price and the receipt can create confusion.

Always include a breakdown of charges. Customers appreciate transparency. Make sure taxes, tips, and service charges are clearly listed, so there’s no ambiguity about what they are paying for.

Don’t forget to include the restaurant’s contact information. In the event of a question or dispute, customers should know how to reach you. Ensure the receipt contains the business name, address, phone number, and website if applicable.

Ensure the date and time are correct. Receipts without this key detail can create confusion for both customers and staff, especially in cases of returns or refunds.

Lastly, avoid cluttering the receipt with unnecessary information. Keep it clean and simple–too much text can make it difficult for the customer to quickly find what they need.

Use high-quality thermal paper for receipts to ensure clear and legible prints. This minimizes fading over time, making receipts easier to read when needed. Opt for a printer with an appropriate resolution to avoid blurry text and images.

Store receipts digitally by scanning or photographing them. This creates a backup in case physical copies are damaged or lost. Use secure cloud storage to keep digital files organized and easily accessible.

Label stored receipts with clear, consistent tags that include the date and purpose. This will simplify future retrieval and categorization, especially for accounting or warranty purposes.

Avoid using paper clips or staples on receipts when storing them physically. These can cause wear and tear or create holes in the paper, affecting the legibility over time. Instead, use folders or envelopes designed for document preservation.

Keep receipts in a cool, dry place to prevent moisture or extreme temperatures from damaging them. If receipts are stored for tax purposes or warranties, ensure they are kept in an environment where they can last for several years without degradation.

Regularly review and organize your stored receipts, whether physical or digital. Periodically dispose of those that are no longer necessary, such as outdated or irrelevant documents, to avoid clutter.

Now, each word repeats no more than twice, while meaning and structure are preserved.

When creating a sample restaurant receipt template, clarity is key. Begin with the essential elements: the restaurant name, date, and receipt number. Then, list the items ordered along with their respective prices. Ensure that each item is easily distinguishable with a clean layout.

Include the total amount, taxes, and any additional fees in separate lines for transparency. You can also add payment details such as the method used and the amount paid. Provide space for tips if applicable, keeping it clear how the total is calculated.

For better readability, organize the items in a list format, using bullet points or a table. This helps customers quickly review their order. Don’t forget to include your restaurant’s contact information and a thank-you note at the bottom to leave a positive impression.