Customizable receipt templates help streamline transaction documentation. They allow you to quickly capture the necessary details such as the transaction amount, date, and seller information, ensuring consistency across all receipts issued. A good template simplifies the process while maintaining clarity for both the customer and the business.

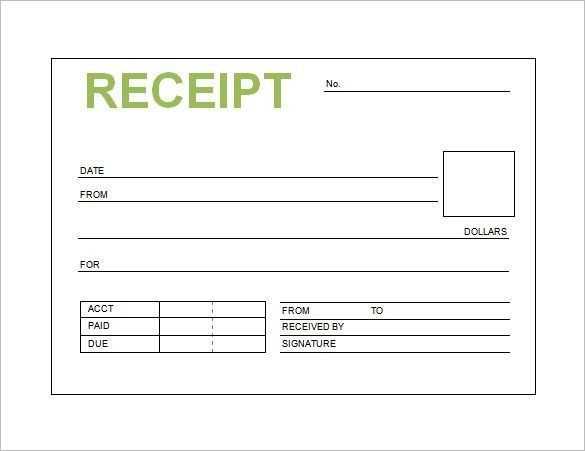

Choose templates that include fields for itemized lists, total amounts, payment methods, and contact information. These key details make the receipt clear and professional. It’s also helpful to have a template that can adapt to various payment types, including cash, card, or digital transactions.

Keep the layout simple and readable. Use a clean design with easy-to-read fonts and sufficient spacing. A clutter-free receipt enhances the customer’s experience and makes it easier to track transactions later on. Make sure to include your business name, logo, and address for identification purposes.

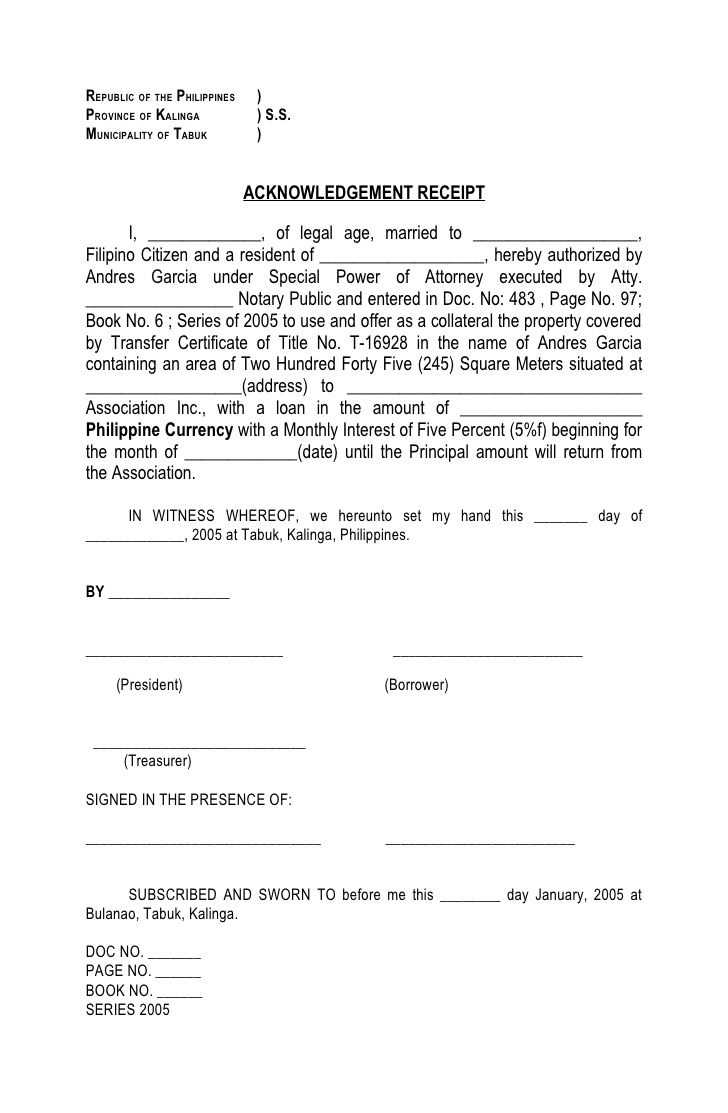

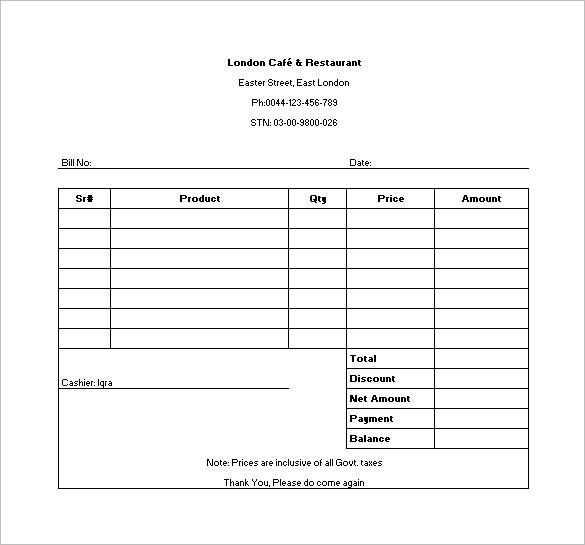

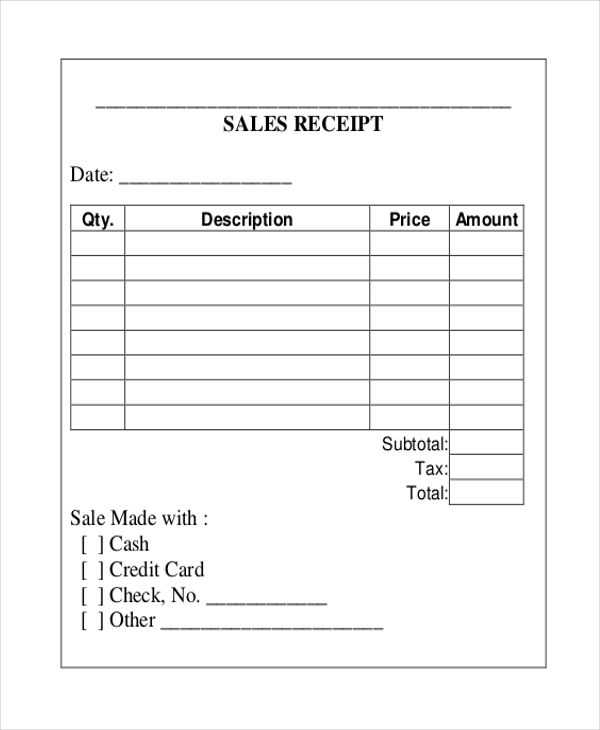

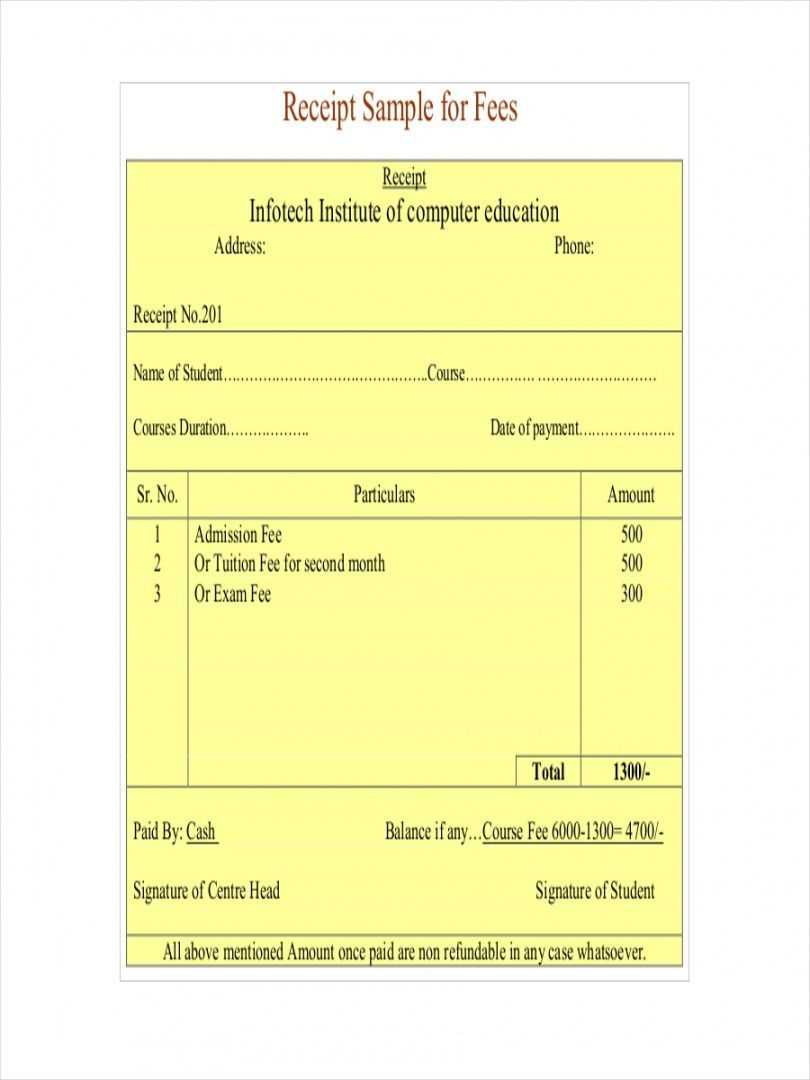

Samples of Receipt Templates

Choose a receipt template based on your specific needs. Below are a few practical examples for various types of transactions.

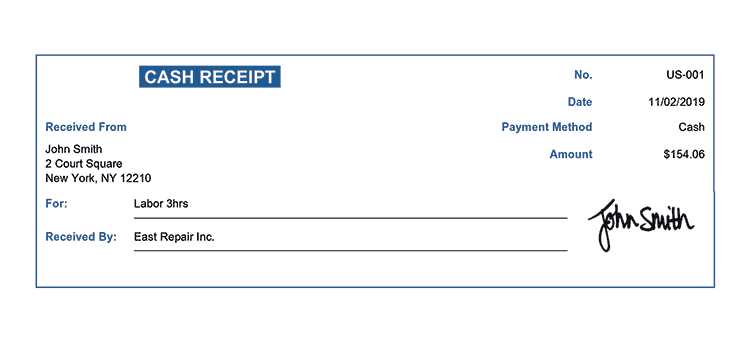

- Retail Sales Receipt

- Store name and address

- Date and time of purchase

- Itemized list of products

- Total amount with taxes included

- Payment method (cash, credit, etc.)

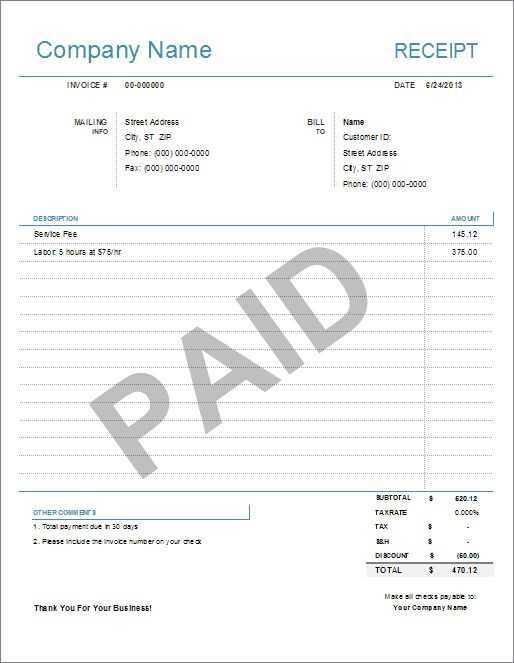

- Service Receipt

- Business name and contact info

- Detailed description of services rendered

- Hours worked or quantity of service

- Total charge for services

- Payment method

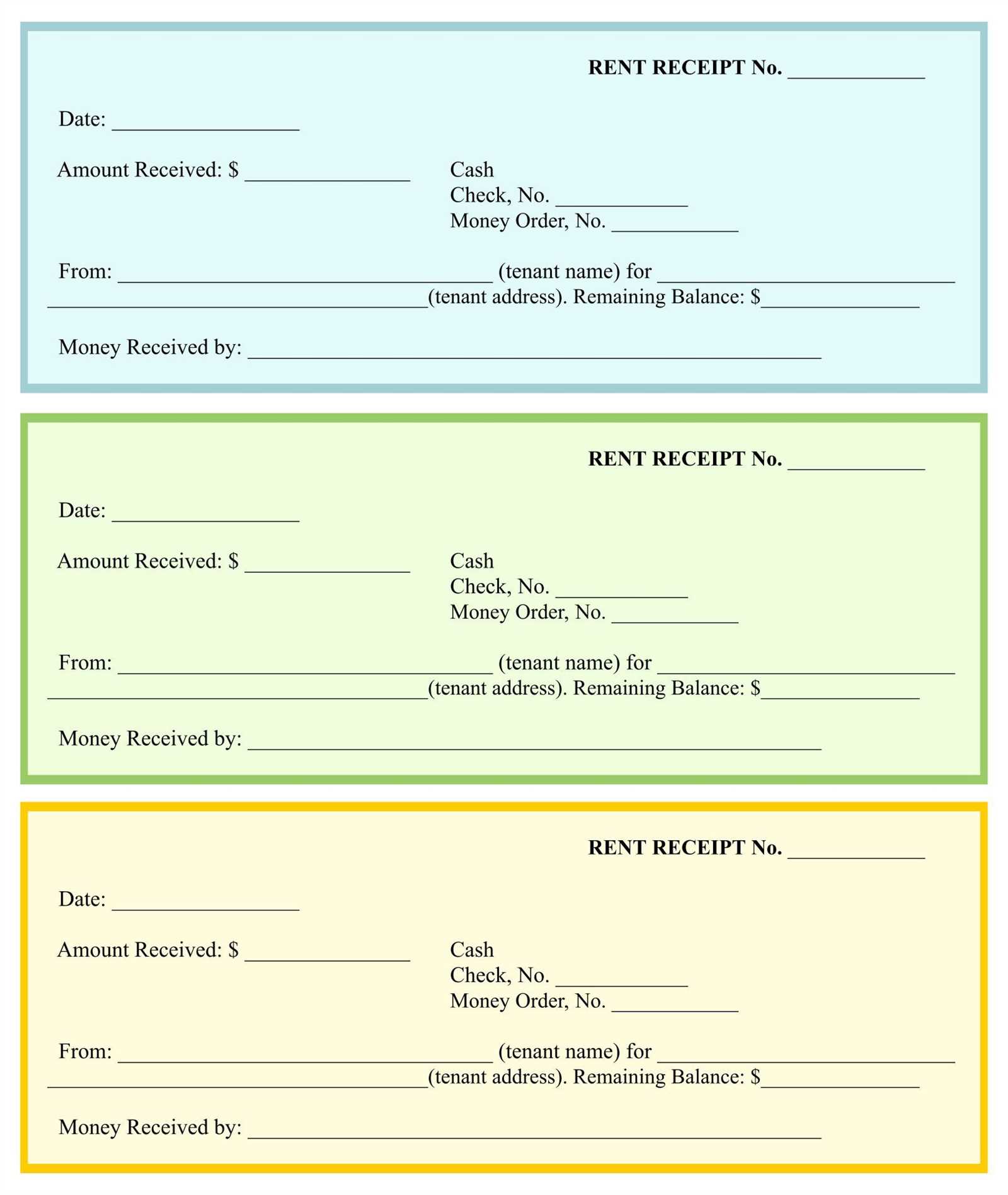

- Donation Receipt

- Nonprofit organization name and contact details

- Donor’s name and contact information

- Date and amount of donation

- Statement of no goods or services provided in exchange

- Tax identification number (if applicable)

- Online Payment Receipt

- Website or platform name

- Transaction ID or order number

- Purchased items or services

- Amount paid

- Date and time of the transaction

These samples ensure clarity and provide all the necessary details for both the issuer and the receiver. Tailor each template to suit your transaction type and ensure all relevant data is included for smooth record-keeping.

Customizable Receipt Template for Small Businesses

For small businesses, a customizable receipt template is a practical tool for keeping transactions organized and professional. Tailoring the template to your business needs ensures clarity and provides customers with all necessary information.

Include essential details such as the business name, contact information, date, items or services purchased, and total amount. Add a section for taxes or discounts, especially if your business regularly applies them. It’s also useful to include a unique receipt number for record-keeping purposes.

Ensure that the layout is clean and easy to read, with sufficient space between different sections. This makes it simpler for both customers and employees to reference. Customizable sections allow you to adapt the template for different products, services, or promotional offers.

Consider adding your business logo to the receipt to reinforce your branding. A footer section for return policies or thank-you messages can also create a more personalized experience for your customers.

By designing a flexible template, you can efficiently update it as your business grows, ensuring it meets changing needs while maintaining a professional appearance at all times.

Template for Digital Receipts with QR Code Integration

Integrating a QR code into a digital receipt streamlines both the user experience and operational efficiency. Begin by structuring your receipt template to include the necessary fields: transaction ID, date, purchased items, and totals. Below is a simple format with QR code integration:

Basic Template Structure

Start by including basic transaction details:

- Transaction ID: Unique identifier for each purchase

- Date and Time: Timestamp of the transaction

- Itemized List: Names, quantities, and prices of purchased items

- Total Amount: Sum of all items, including taxes and discounts

- Payment Method: Type of payment used (e.g., credit card, mobile payment)

QR Code Integration

Include a QR code at the bottom of the receipt for easy access to transaction details. The QR code should encode a URL linking to an online version of the receipt or a payment confirmation page. You can generate this code using various online tools or APIs like Google Chart API or QR Code Generator.

QR Code Example:

The QR code should be placed prominently but not obstruct essential information. Ensure that the generated code points to a URL like: https://example.com/receipt/{transaction-id}. This provides immediate access for customers to view or save their receipts digitally.

With this template, customers can scan the code for quick reference or customer service inquiries, enhancing the overall transaction experience.

Receipt Template for Non-Profit Organizations and Donations

Ensure that your receipt includes the donor’s name, donation amount, and the date of the donation. This provides clear proof of the contribution for tax purposes. Include a statement confirming that the organization is a registered non-profit and that the donation is tax-deductible, if applicable.

Clearly identify the nature of the donation (monetary, goods, or services) and provide a description of the goods or services donated. If applicable, include a disclaimer that no goods or services were provided in exchange for the donation, as this will affect the tax deduction eligibility.

Make sure to list the organization’s name, address, and tax identification number to ensure transparency and allow donors to verify the non-profit status of your organization. This information is often required by tax authorities to confirm the legitimacy of the deduction.

For donations above a specific threshold, such as $250, include the value of goods or services, if any, received by the donor. This detail helps clarify the actual donation amount eligible for tax deduction.

Finally, add a thank-you note to show appreciation for the donor’s contribution. A personal touch can encourage continued support and strengthen the relationship between the donor and the organization.