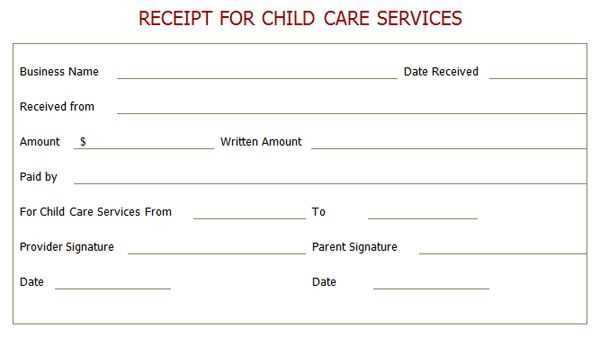

A caregiver receipt should list services rendered with clarity and accuracy. Include the caregiver’s name, the type of service, the number of hours worked, and the date of service. This information ensures both the caregiver and recipient have a mutual understanding of the work completed.

Break down any charges for additional services or materials used. This helps the recipient see how the total amount is calculated. If payment was made, note the method (cash, check, etc.) and the amount received.

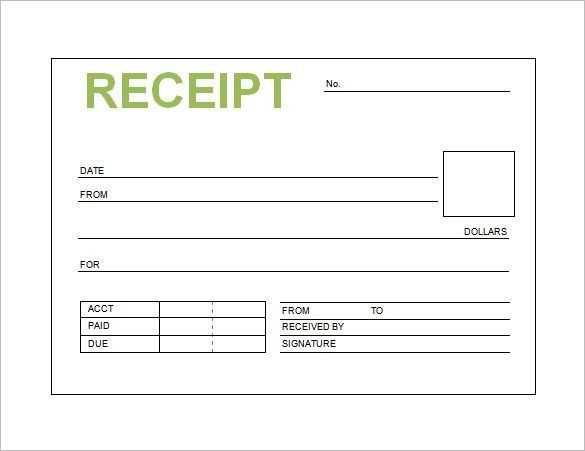

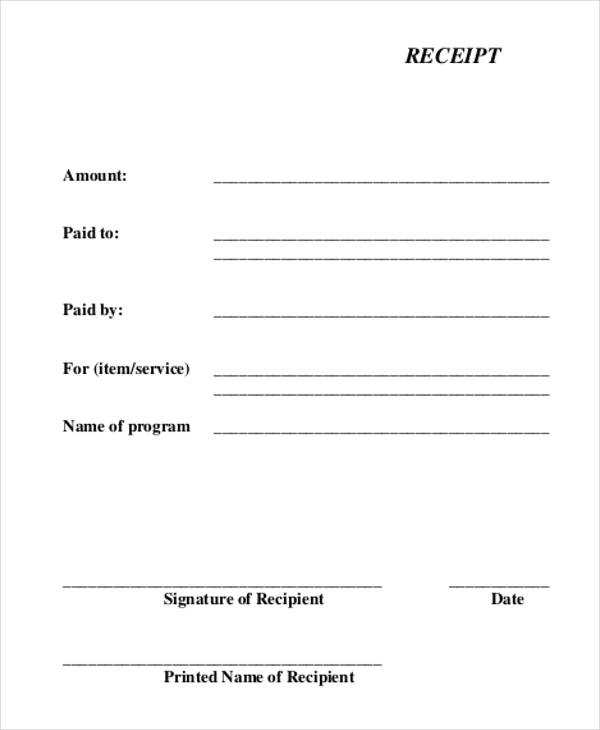

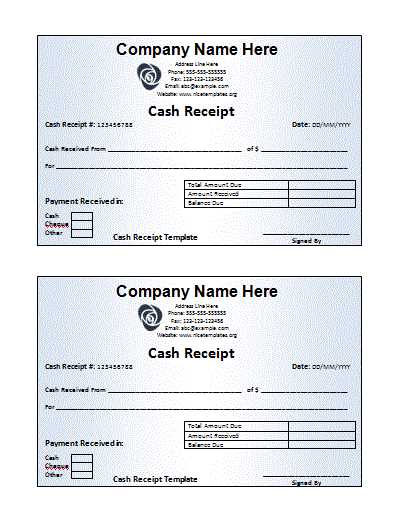

Use a template to streamline the process. Templates save time and help maintain consistency across receipts. A standardized format makes it easier to track payments over time and ensures nothing is overlooked.

How’s the writing going? Anything specific you need help with for your articles today?

HTML Article Plan: “Caregiver Receipt for Services Template”

Step 1: Begin the receipt with a clear title such as “Caregiver Service Receipt” or “Receipt for Caregiving Services Provided.” This ensures both parties immediately understand the document’s purpose.

Step 2: Include the caregiver’s full name, contact information (phone and email), and their professional credentials, if applicable. This section confirms the provider’s identity.

Step 3: List the services provided with details like dates, duration, and any special tasks completed. Use bullet points or a table for clarity and easy reference.

Step 4: Clearly state the payment amount, including hourly rates, total charges, and any agreed-upon fees. If applicable, mention any taxes or discounts. This transparency avoids confusion.

Step 5: Add payment method information, specifying whether the transaction was made by check, cash, or another method. This helps track the payment history.

Step 6: Include a signature line for both the caregiver and the person receiving the services. This confirms that both parties agree on the details of the receipt.

Step 7: Consider adding a brief note about privacy or confidentiality to reassure clients that their personal information will not be shared without consent.

- How to Format a Caregiver Service Receipt

To format a caregiver service receipt, include the following key details:

1. Header Information

Start with your business or personal name, address, and contact information. This ensures the receipt is traceable. Include the caregiver’s name and contact details if applicable.

2. Service Description

Clearly list the services provided, with each service itemized. Specify dates and times of service, along with a brief description of the care given.

3. Payment Details

Include the total amount charged, hourly rate (if applicable), and payment method (e.g., cash, check, credit card). Break down the charges to make it transparent.

4. Signature and Date

Conclude with the caregiver’s signature and the date of service. This adds validity to the receipt and ensures mutual agreement on services rendered.

5. Optional Notes

If there are any special conditions or agreements related to the service, include them in a notes section at the bottom.

Include the caregiver’s name and contact details at the top of the receipt. This ensures clear identification of the service provider. Follow with the client’s name and contact information to link the transaction to the recipient.

Service Details

Describe the services rendered, including dates and specific tasks performed. This will provide transparency and clarity on what was covered by the payment.

Payment Breakdown

List the total amount paid, itemized if applicable. If there were any discounts or additional charges, mention them clearly for a full accounting of the transaction.

| Date | Description of Service | Amount |

|---|---|---|

| 2025-02-06 | Personal Care for 3 hours | $45.00 |

| 2025-02-06 | Transportation Assistance | $20.00 |

Finally, include the date of payment and the payment method used, whether by cash, check, or electronic transfer, to complete the receipt details.

Track your work hours daily to ensure accuracy and avoid missing any entries. Use a consistent method, whether it’s a digital tool or a physical logbook, and avoid skipping days. Record the start and end times precisely, including any breaks taken. This will help to accurately account for every moment worked and avoid discrepancies when calculating pay or benefits.

Use a Clear System

Implement a clear and simple system for tracking hours. Group your work into manageable time blocks, such as hourly or by task, and always note overtime or special shifts. Ensure all entries are legible and easy to understand to prevent confusion later. This makes reviewing hours and preparing reports easier and faster.

Double-Check Your Entries

Before finalizing any hours, double-check the entries for accuracy. Mistakes happen, but identifying them before submission helps maintain transparency and trust. Take a moment to review your records each week to catch any errors or omissions, making corrections as needed.

Caregiver receipts must follow specific legal requirements to ensure they are valid for tax purposes. First, the document should clearly outline the service provided, including the dates and description of the care. Both the caregiver and the recipient should sign the receipt to verify the services rendered.

Tax Implications

Caregivers may be classified as independent contractors, meaning that the services provided are taxable. It’s essential that caregivers include the appropriate tax identification numbers, both for the recipient and the caregiver, on the receipt. This helps prevent potential complications during tax filing, ensuring both parties meet their legal obligations.

State and Local Regulations

Different states or regions may impose additional requirements for caregiver receipts. Some may require specific documentation for state assistance programs, while others may have particular formats for tax deduction purposes. It’s important to familiarize oneself with local laws to ensure full compliance with the legal framework in place.

For seamless billing, create a template that includes the following key elements:

- Client Information: Include the client’s full name, address, and contact details for accurate identification.

- Service Details: List the services provided, including the type, duration, and frequency of care.

- Rate and Payment Terms: Specify the hourly rate or flat fee, along with payment deadlines and methods.

- Billing Period: Clearly state the start and end dates for each billing cycle to avoid confusion.

- Invoice Number: Generate unique invoice numbers to maintain an organized record of payments.

- Due Date: Provide a specific due date for payment to encourage timely settlement.

- Contact Information for Inquiries: Include your contact details for any questions about the bill.

Designing the Layout

Keep the layout simple and clear, making it easy for clients to understand the charges. Use tables to organize the service details and payment terms. Make sure the font is readable, and ensure the document looks professional.

Automation for Efficiency

Consider using a word processor or spreadsheet software to automate parts of the template, like adding invoice numbers or calculating totals. This will save time and reduce errors.

Keep detailed and accurate records of every transaction related to caregiving services. Document the payment date, amount, and method, along with the service provided. Use a spreadsheet or accounting software to track these details easily.

Addressing Payment Discrepancies

If there is a payment dispute, review the records first. Verify the agreed-upon terms in the contract, such as hourly rates or flat fees, and compare them with the payment received. If necessary, contact the payer with clear evidence to clarify any misunderstandings. Remain professional and courteous during communication to resolve the issue smoothly.

Dispute Resolution Steps

If informal communication doesn’t lead to resolution, escalate the issue by documenting your attempts to resolve it. Consider mediation or third-party arbitration if needed. Keep all evidence, including emails or letters, to support your case. Proper documentation will help you navigate the process more effectively.

Got it! If you need help with any specific article structure, writing tips, or anything else related to your work, feel free to ask!