For anyone managing childcare services, having a clear and structured receipt template is key to maintaining accurate records. This helps both service providers and parents track payments and ensure transparency in financial transactions. A well-crafted receipt not only simplifies bookkeeping but also builds trust with clients.

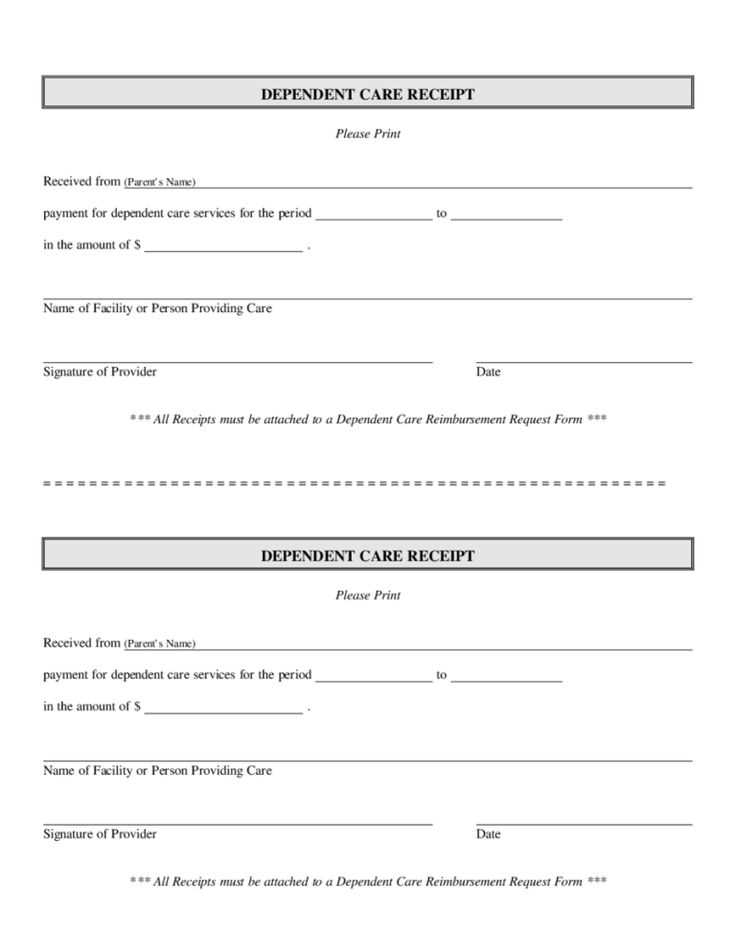

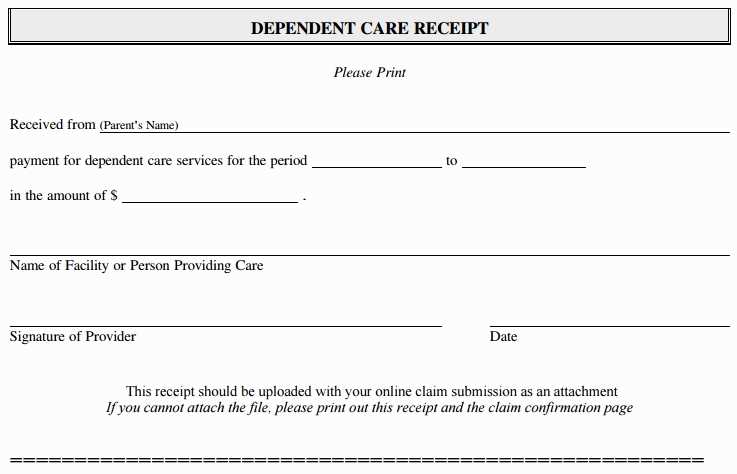

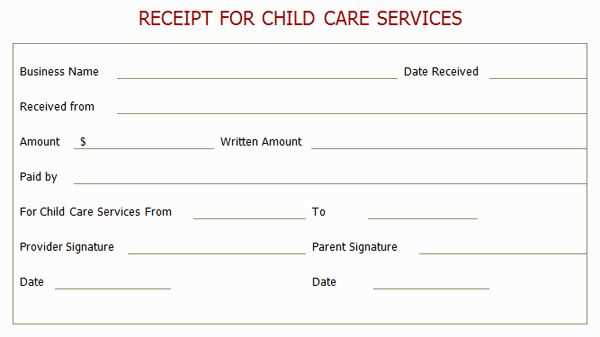

Start by including the basic details: the provider’s name, address, and contact information. Add the date of service and a breakdown of charges, such as hours worked or any additional fees. It’s helpful to include a payment method, whether it’s cash, credit, or electronic transfer, along with the total amount paid. If applicable, list any discounts or tax information that may be relevant to the transaction.

Lastly, make sure the receipt is easy to read and includes a unique receipt number for easy reference in case of future inquiries. Providing a clear and detailed record ensures both parties are aligned and helps avoid potential misunderstandings. Use this template consistently for every transaction to streamline the process and keep everything organized.

Here is the revised version without repetitions:

To create a childcare services receipt, ensure clarity by including the following key details:

1. Child’s Information

- Full name of the child receiving care

- Date of birth

- Address (optional, if needed for identification purposes)

2. Service Details

- Date(s) of the childcare service provided

- Hours of service for each day

- Description of services (e.g., babysitting, educational support, etc.)

3. Payment Information

- Amount charged per hour or session

- Total amount due

- Payment method (cash, check, or electronic transfer)

- Payment date

4. Caregiver’s Information

- Full name of the caregiver or childcare provider

- Business name (if applicable)

- Contact information (phone number, email address)

Having this information in the receipt ensures both the provider and parent have a clear understanding of the transaction. It also makes any future references to the service easier and more transparent.

- Childcare Services Receipts Template

Create a simple and clear childcare receipt by including the following key details:

- Service Provider Information: List the childcare provider’s name, address, phone number, and email at the top.

- Parent or Guardian Information: Include the name of the parent or guardian receiving the services, along with their contact details.

- Date of Service: Record the exact date or dates the childcare services were provided.

- Description of Services: Provide a brief description of the services rendered, such as hours of care, activities, or additional services.

- Amount Charged: State the total amount charged for the services. Break it down if applicable (e.g., hourly rate, flat fee, or additional charges).

- Payment Method: Specify how the payment was made (e.g., cash, credit card, check, or online transfer).

- Receipt Number: Include a unique receipt number for reference purposes and record-keeping.

This template helps maintain a professional and transparent record of transactions, ensuring both parties have clear documentation. Adjust the details as needed for specific circumstances.

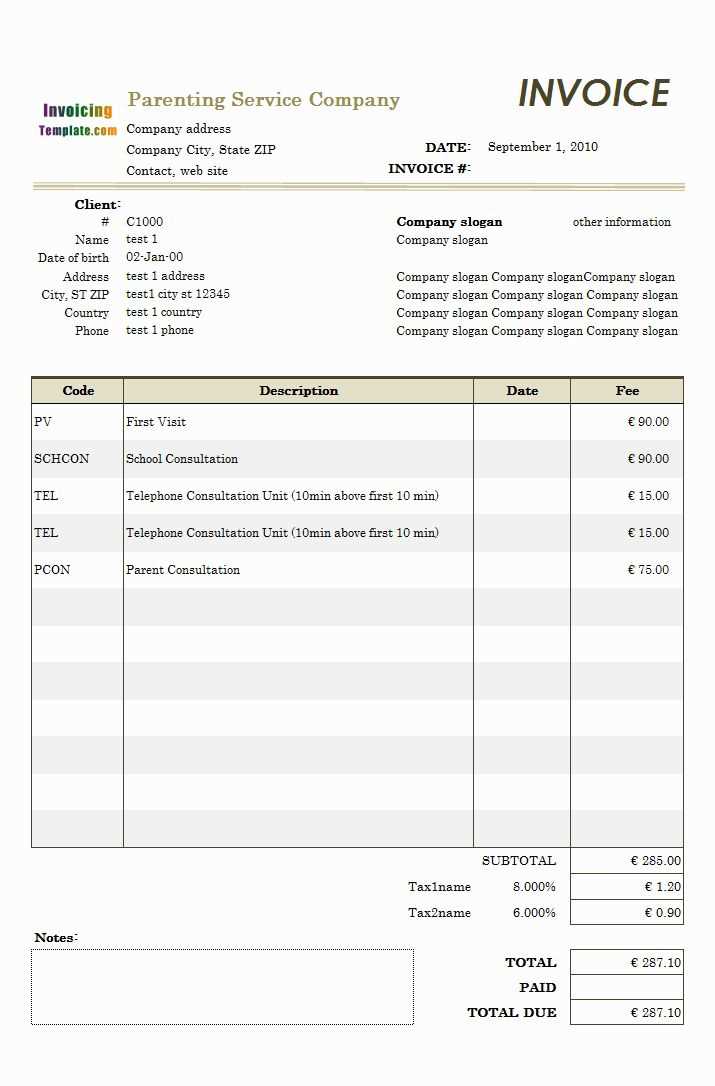

Begin by adding your business logo to the top of the receipt. This makes your receipt look professional and reinforces your brand identity. Keep the logo size proportional to the rest of the content to ensure a clean, balanced appearance.

Include your business name, address, phone number, and email clearly below the logo. Ensure the contact information is easy to locate for customers who may need to reach you later. A simple font and clear spacing are key.

Customize Payment Details

Tailor the receipt template to include specific fields for services or products your business offers. Customize the item list to reflect your services, with clear descriptions, quantities, and individual pricing. This transparency will help avoid confusion for your clients.

Add Terms and Conditions

If applicable, include terms of service or refund policies at the bottom of the receipt. Make these easily readable and concise so customers understand your policies at a glance. Use bullet points or a small paragraph for clarity.

Lastly, ensure your receipt template is compatible with your point-of-sale system or invoicing software for smooth integration. Regularly review and update it as needed to keep the format relevant to your evolving business needs.

A childcare service receipt should include the following details for clarity and proper documentation:

1. Service Provider Details

Ensure that the name, address, and contact information of the childcare provider are clearly stated. This makes it easy for both the provider and the parent to identify the transaction and resolve any potential issues.

2. Parent or Guardian Information

List the name of the parent or guardian receiving the service. This ensures that the receipt accurately reflects the transaction and can be referenced if needed in the future.

3. Dates and Times of Service

Include the exact dates and hours of care provided. This can help clarify any questions about the specific time frame the childcare service covered and avoid confusion over billing periods.

4. Itemized Services

Provide a breakdown of the services rendered, including any additional activities, meals, or special accommodations. This allows for transparent billing and helps prevent any misunderstandings about what was included in the cost.

5. Payment Details

State the total amount paid and the method of payment (cash, card, check, etc.). If applicable, include any discounts, taxes, or additional fees that were applied. This ensures both parties have an accurate record of the financial transaction.

6. Unique Receipt Number

Assign a unique number to each receipt for easy tracking and reference. This number can be used in case of follow-ups or disputes and helps organize records more efficiently.

Pick a receipt format that aligns with both your business needs and customer expectations. Opt for a simple, clean layout that is easy to read and scan. Avoid overcrowding the receipt with excessive details; focus on what is necessary for a transaction record. For example, include the childcare service’s name, date, payment amount, and breakdown of services provided.

Consider using a digital format, such as a PDF or an email receipt. Digital receipts are eco-friendly and easily accessible for your clients. Plus, they can be stored and searched quickly, providing a more organized method of record-keeping. If you’re offering printed receipts, ensure the font size is legible, and the design is neat and professional.

Adapt the format to suit your clientele. If your clients prefer a more visual approach, incorporate relevant icons or logos. For those who value clarity, keep the design minimalistic with clear labels and organized sections. Choose a format that balances professionalism with simplicity to enhance the overall customer experience.

Ensure your receipts meet legal requirements by including all necessary details. A valid receipt should include the name and address of your business, the date of the transaction, and a clear breakdown of the services provided. Make sure the receipt complies with tax regulations by listing the amount paid and any applicable taxes. This is crucial for both your records and your clients’ tax filings.

Details to Include

- Business name and contact information

- Date of the transaction

- Description of services provided

- Total amount paid, including taxes

- Payment method used

Tax and Compliance Rules

Stay informed about local tax laws and include required tax details on the receipt. This may include sales tax or other taxes applicable to the region. If your business operates in multiple areas, ensure you’re issuing receipts that comply with each location’s specific regulations.

Keep copies of receipts for your own records. Many jurisdictions require businesses to retain copies of receipts for a certain number of years. Failure to do so could result in fines or issues during audits.

Keep a separate system for tracking payments related to childcare services. Use software or spreadsheets to record each payment, including date, amount, payer’s name, and services provided. This method will simplify year-end tax filing.

To avoid missing anything, request and store receipts from clients. Include payment method (cash, check, or card) and any additional details, such as discounts or late fees, that could affect the total. Keep a digital or paper copy of each transaction for reference.

Track any expenses related to your childcare services, such as supplies or travel costs. Organize these receipts in categories for easy access. Having everything in order ensures you can claim the correct deductions at tax time.

If you’re working with multiple clients, create a client-specific folder or record. This helps to keep payments and transactions organized for each individual client. Use unique reference numbers to match each receipt to its respective client for added clarity.

Consider using accounting software or a dedicated tool designed for childcare providers. These tools often include built-in reports that organize and summarize payments, making tax filing less time-consuming.

At the end of the year, generate a report that includes all receipts, payment history, and expenses. This consolidated record will streamline the tax preparation process and reduce any potential mistakes when submitting your tax forms.

Tips for Providing Clear and Professional Receipts to Parents

Include key information in a well-organized format. Clearly state the child’s name, the provider’s name, and the dates of service. Also, break down the services provided and the corresponding costs.

1. Be Transparent with Payment Details

Specify the amount charged for each service, including any discounts or additional fees. Show taxes separately if applicable. A detailed breakdown helps parents understand the cost structure and prevents confusion.

2. Provide Contact Information

Include your business address, phone number, and email. This makes it easier for parents to reach out if they have any questions or need clarification on the receipt.

| Date | Service Description | Amount |

|---|---|---|

| 01/15/2025 | Full-day care | $50.00 |

| 01/16/2025 | Half-day care | $30.00 |

| 01/16/2025 | Late pick-up fee | $10.00 |

| Total | $90.00 |

By following these steps, you help parents stay organized and make payments hassle-free.

Create a clear and professional childcare services receipt by following a simple structure. Include the full name of your business at the top, followed by the date the service was provided. Make sure to list the parent’s name, child’s name, and contact details clearly. Add a breakdown of services provided, such as hourly rates, total hours, and any additional fees for special services, if applicable.

For tax purposes, include a unique receipt number, which will help track your records. Make sure to specify the total amount due and the payment method (cash, credit card, etc.). It’s also recommended to add a space for any notes, such as discount details or special instructions. This simple format will ensure that both parties have accurate records of the transaction.

Consider providing receipts on high-quality paper for a professional touch, and ensure they are easy to read. Keep a digital copy for your records and provide one to the client promptly after payment is made. This transparent process will strengthen trust and help maintain smooth operations in your childcare service business.