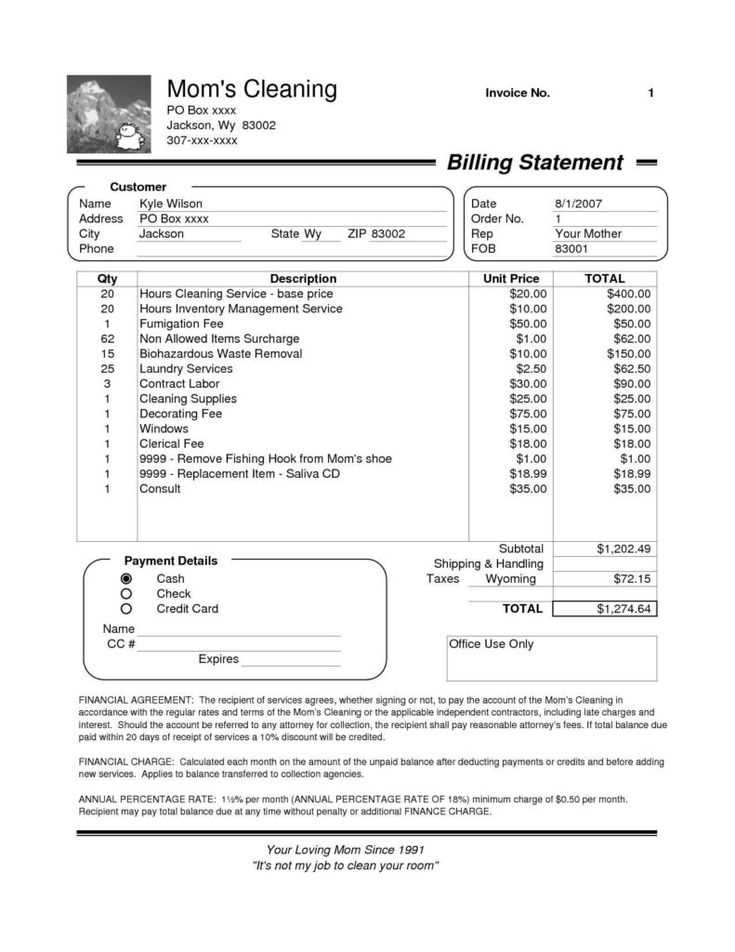

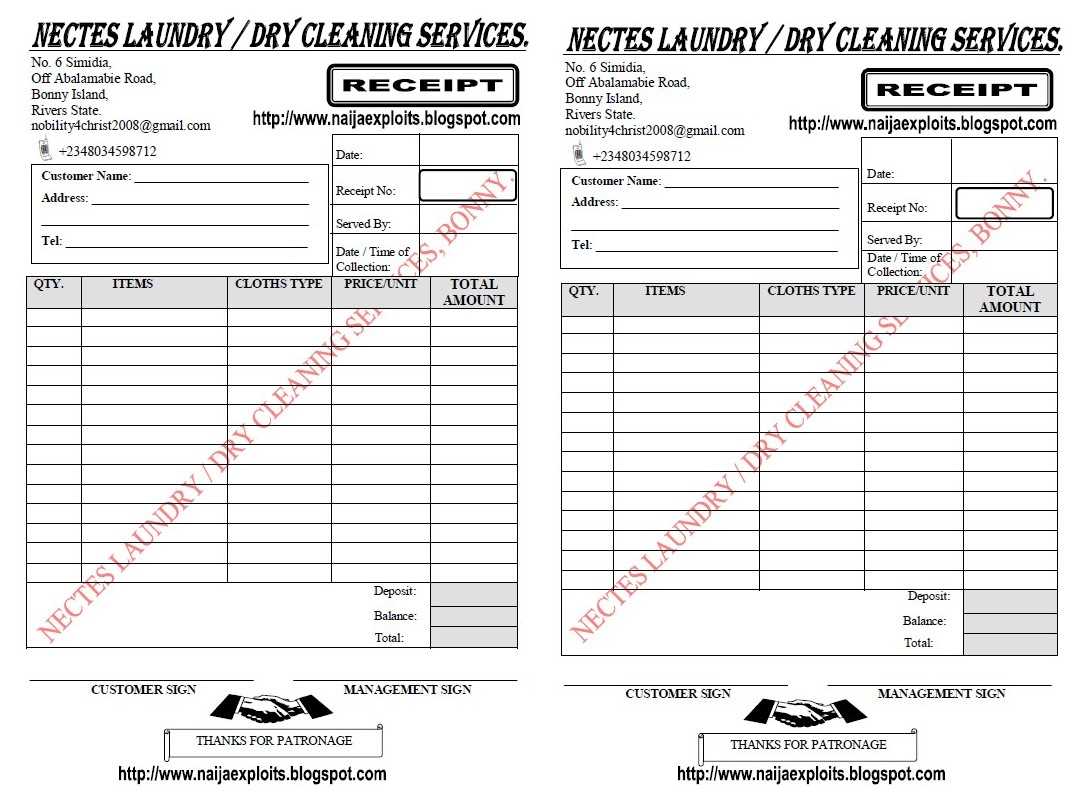

A well-structured receipt helps both service providers and clients keep track of payments and services rendered. Below is a ready-to-use template with essential details.

Key Components of a Cleaning Service Receipt

- Business Information: Name, address, contact details.

- Client Details: Name, address, and contact information.

- Receipt Number: Unique identifier for tracking.

- Date of Service: When the cleaning was performed.

- Service Description: Detailed list of tasks completed.

- Total Amount: Cost breakdown and final amount paid.

- Payment Method: Cash, card, bank transfer, or other.

- Signature (if required): Confirmation from both parties.

Sample Template

Copy and customize the template below to fit your needs:

Business Name: ______________________ Business Address: ___________________ Phone/Email: ________________________ Client Name: ________________________ Client Address: _____________________ Date of Service: ______________ Receipt No.: __________ Services Provided: - _________________________________ - _________________________________ - _________________________________ Total Amount: $_________ Payment Method: _______________ Authorized Signature: _____________

Why Use a Standardized Receipt?

Clear documentation minimizes disputes, ensures accurate bookkeeping, and builds trust with clients. Using a structured format streamlines operations and keeps records organized.

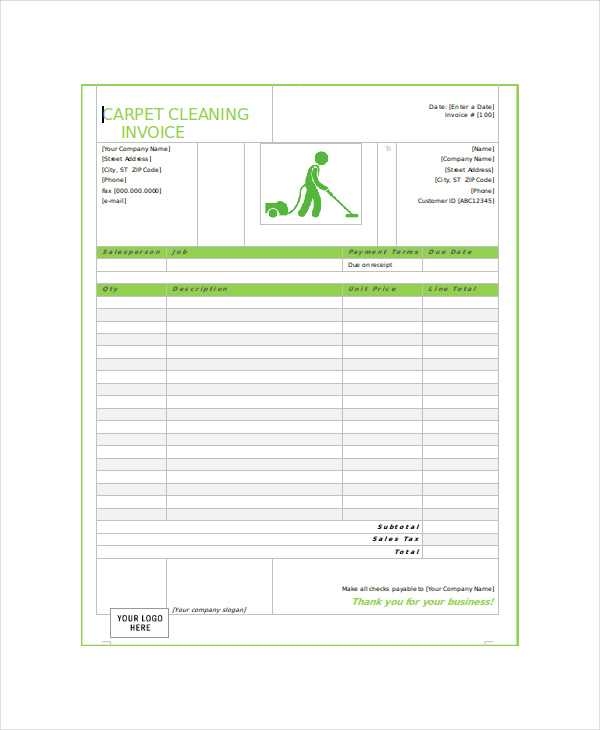

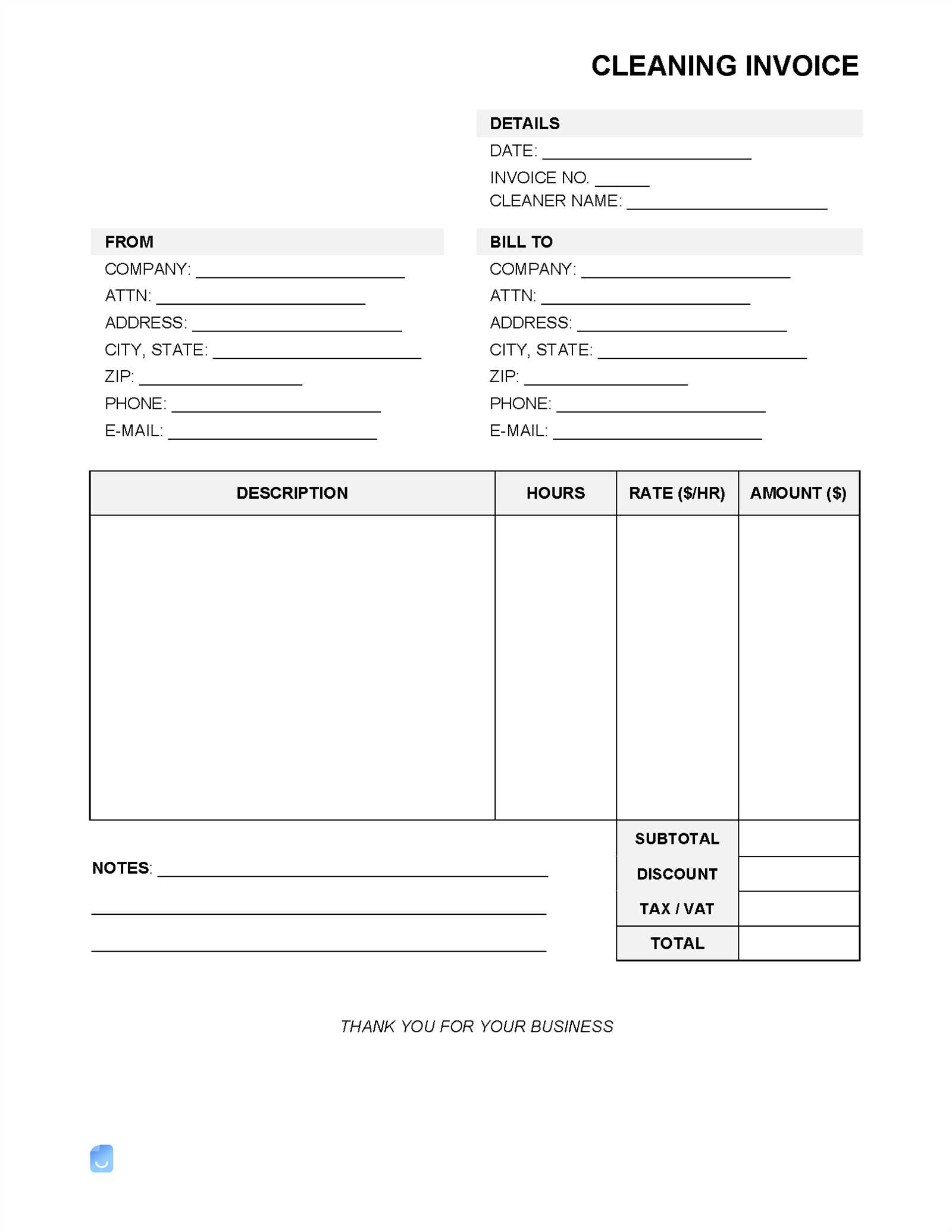

Cleaning Service Receipt Template

Key Elements to Include in a Service Receipt

Include the business name, address, and contact details at the top. List the customer’s name and service location. Specify the cleaning services provided, including descriptions, hours worked, and pricing. Clearly display the total amount due, tax breakdown (if applicable), and payment method. Add a unique receipt number and issue date for tracking.

How to Format a Professional Invoice

Use a structured layout with aligned sections. Keep font sizes readable and ensure key details like total cost and due date are prominent. Separate service descriptions and costs into columns for clarity. If sending digitally, provide a PDF format to maintain consistency across devices.

Legal and Tax Considerations for Receipts

Ensure receipts include legally required details such as tax identification numbers and proper sales tax calculations. Maintain copies for record-keeping, as tax authorities may require them for audits. If applicable, include refund policies and liability disclaimers to protect both the service provider and the client.