To streamline payments for contract services, having a reliable pay receipt template is key. This simple tool allows both service providers and clients to track transactions accurately, reducing any potential misunderstandings.

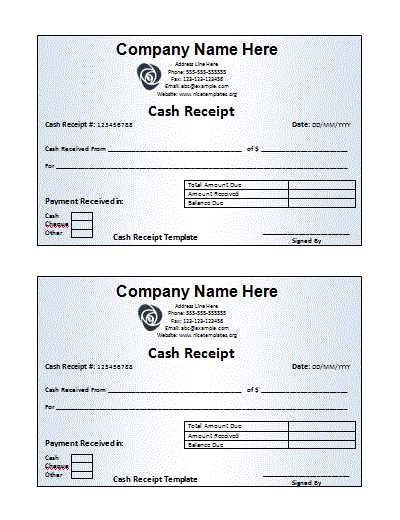

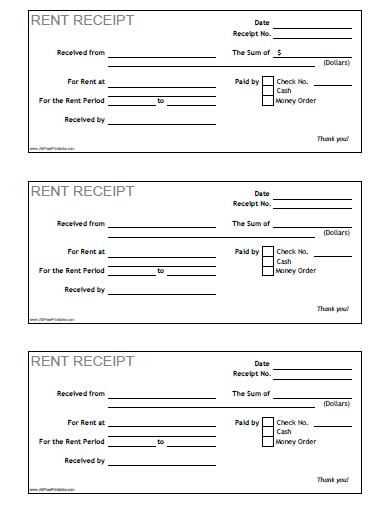

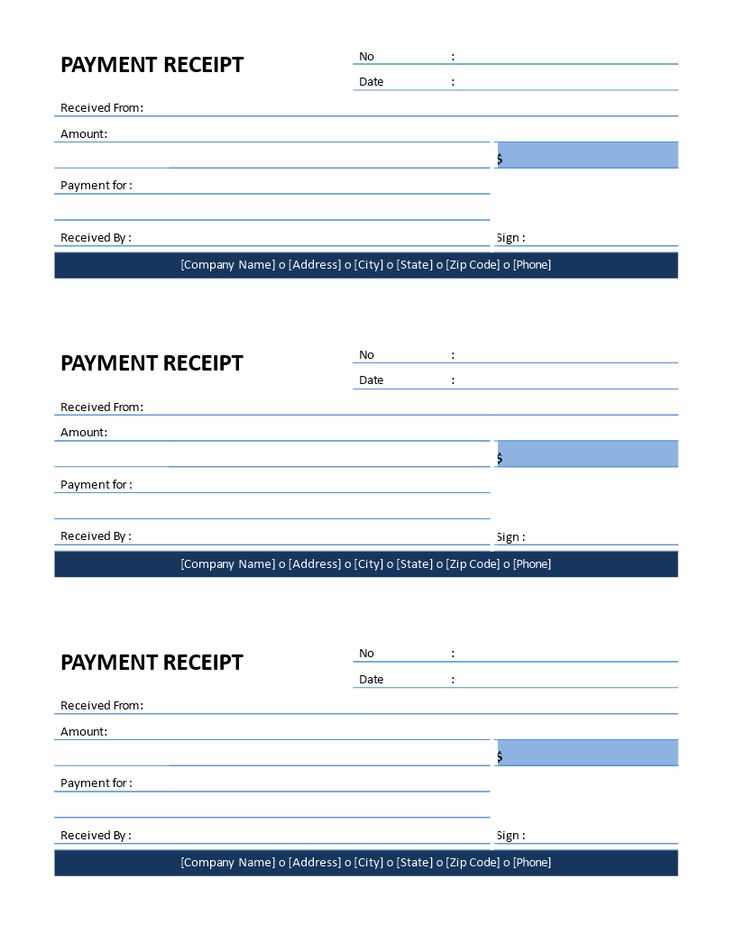

The template should clearly outline the details of the service provided, the payment amount, the date, and any additional notes that might be relevant. Include space for the name and contact information of both parties, the agreed-upon terms, and a unique identifier for each transaction.

By using a pay receipt template, service providers can maintain transparency and keep a clear record of completed work. Clients, in turn, receive confirmation that their payment has been processed, ensuring both sides are on the same page.

Here’s the corrected text:

To create a contract services pay receipt template, begin by including the service provider’s and client’s names, addresses, and contact details. This ensures that both parties are clearly identified and accessible for future reference.

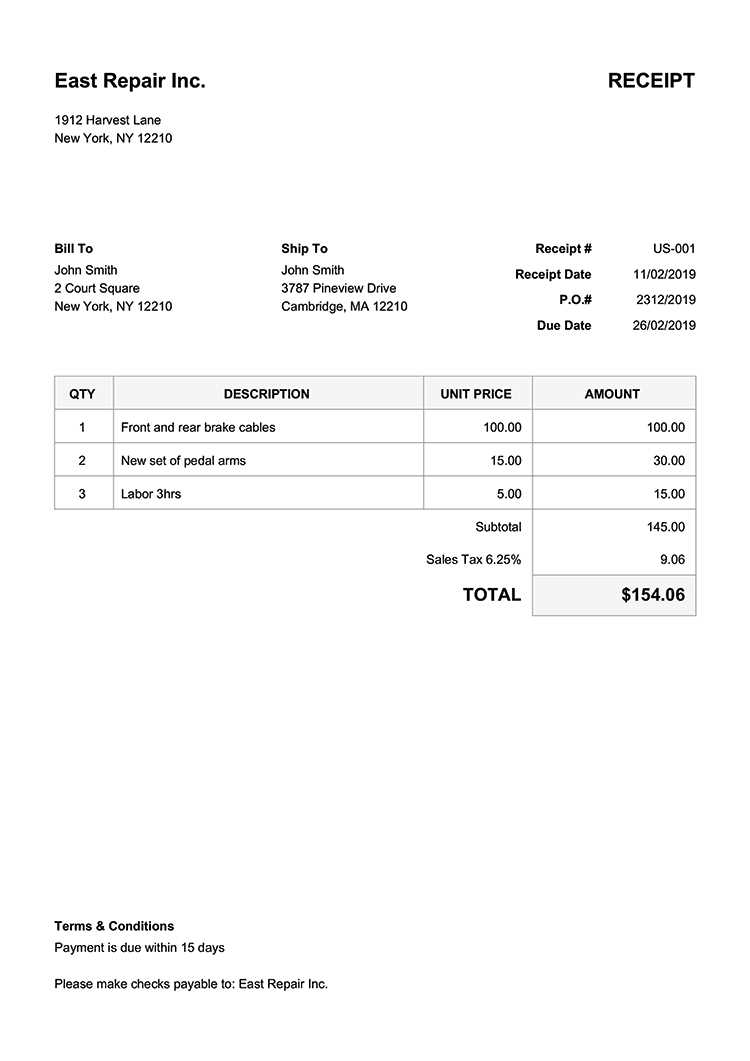

Next, list the specific services provided along with the dates they were rendered. It’s important to break down each service into a clear description and the corresponding charge. This promotes transparency and avoids confusion later.

Incorporate payment terms such as the total amount due, payment method, and due date. Including any additional fees or taxes is crucial, so both parties are fully aware of the final payment amount.

End with a space for both parties to sign, acknowledging that the terms of the receipt have been agreed upon. This makes the document legally binding and confirms that the payment has been processed correctly.

Here’s a simple list of key elements to include:

- Service provider and client details

- Description of services provided

- Payment terms (amount, method, and due date)

- Signatures from both parties

Make sure your template is clear, accurate, and legally sound. Double-check for any missing information before finalizing the receipt to avoid potential issues.

- Contract Services Pay Receipt Template

A well-structured contract services pay receipt template is key to ensuring clear documentation for both the service provider and the client. The template should include specific fields that detail the service, payment amount, and terms of agreement. Below is a recommended breakdown for such a template:

- Service Description: Clearly define the type of service provided, including dates, location, and any special instructions.

- Payment Details: Include the total amount paid, payment method, and any deductions or additional charges.

- Client Information: Provide space for the client’s name, address, and contact details to ensure proper identification.

- Service Provider Information: Include the service provider’s name, business details, and contact information for reference.

- Payment Date: Specify the exact date the payment was made or the date of the transaction.

- Signature Section: Add areas for both parties to sign, confirming that the services were rendered and payment has been received.

Additional Considerations for the Template

- Clear Terms: Be sure to include a section on any payment terms or conditions that both parties have agreed upon.

- Invoice Number: Include a unique invoice number for easy reference and tracking of payments.

- Taxes and Deductions: Specify if any taxes or deductions apply to the payment, such as service fees or tax rates.

Using a clear and detailed contract services pay receipt template helps prevent misunderstandings and ensures both parties are aligned with the terms of the contract.

Design a straightforward pay receipt by including clear sections for essential details. Start by specifying the contract worker’s name, address, and the service period covered by the payment. Then, detail the agreed-upon amount and the payment date, making sure the figures match any contract terms. Ensure the receipt includes a breakdown of the payment, listing hours worked, rate per hour, and any additional fees or deductions. This transparency helps to avoid misunderstandings.

Structuring the Pay Receipt Template

Use a structured format for easy reading. List the contractor’s contact information at the top, followed by the client’s details. Below, indicate the service period and payment terms, which should be aligned with your agreement. A table works well for organizing payment calculations: hours worked, rate per hour, any extra charges, and the total. Finish by adding a unique reference number for the receipt and the method of payment used (e.g., bank transfer, check).

Key Considerations for Clarity

Be precise with numbers and dates to prevent any confusion. Add a section for notes or comments, where either party can address any special conditions or modifications made after the contract was signed. Signatures from both the client and the contractor confirm agreement and close the document.

This simple yet comprehensive format will help contractors and clients alike keep accurate financial records.

A Contract Pay Receipt should clearly outline key details related to the payment made under a contract. These components ensure both parties have a clear understanding of the transaction. Below are the must-have elements for a well-structured receipt:

| Component | Description |

|---|---|

| Receipt Title | State that this is a “Pay Receipt” for clarity. |

| Contractor’s Information | Include the full name, address, and contact details of the contractor. |

| Client’s Information | Provide the client’s name, address, and contact details. |

| Payment Date | State the exact date the payment was received. |

| Payment Amount | Clearly mention the amount received and any currency type involved. |

| Payment Method | Specify whether the payment was made by cash, cheque, wire transfer, etc. |

| Description of Work | Provide a brief description of the services or goods paid for under the contract. |

| Invoice Number | If applicable, reference the invoice number tied to this payment. |

| Signature | Include spaces for both parties to sign as confirmation of receipt and agreement. |

By incorporating these components into a Contract Pay Receipt, both parties can maintain a transparent record of transactions and avoid future misunderstandings.

Tailor your pay receipt to reflect the specifics of each project by including relevant details such as project name, duration, and task descriptions. Customize the payment breakdown to include any project-specific rates, bonuses, or penalties. If applicable, add separate line items for materials or subcontractor fees. This approach helps ensure clarity for both you and your client, as it directly ties compensation to the work completed on the project.

For long-term contracts, incorporate payment schedules or milestones. Each milestone should be clearly identified with a corresponding amount, payment date, and any conditions tied to payment. This ensures transparency and avoids confusion over the terms.

When working with multiple projects for the same client, create individual receipts for each project, even if the client is being billed under one contract. This allows for a clearer record of services rendered and payment history, making it easier to track progress and manage finances effectively.

Double-check the payment amount against the contract terms. Ensure that all figures match, including hourly rates, total hours worked, or lump sum amounts. Any discrepancies can cause confusion or lead to disputes.

Verify the payment date carefully. This ensures that both parties agree on the timing of the transaction and avoids misunderstandings about payment schedules.

Check the payee’s information. Confirm that the name, address, and contact details are accurate and up to date. This reduces the risk of sending payments to the wrong recipient.

Ensure that the payment method is correctly listed. Whether it’s a check, bank transfer, or another method, accurately specifying this prevents delays and keeps records clear.

Always review the contract terms for specific payment instructions. This includes any deductions, bonuses, or special conditions that may apply. Matching these details ensures that the pay receipt aligns with the agreed terms.

Include all relevant reference numbers, such as invoice numbers or project identifiers. This makes it easier to trace payments and verify records, especially for bookkeeping or audits.

Finally, proofread the receipt before submission. Small errors in spelling or figures can lead to confusion or delays, so taking the time to carefully review everything will help maintain accuracy.

Pay receipts must meet specific legal requirements to ensure compliance with labor laws. First, make sure to include key details such as the employee’s full name, the employer’s name, and the period of payment. These elements are often mandated by state or local regulations to ensure clarity in payroll records.

Next, specify the breakdown of wages, including regular hours worked, overtime, and any deductions. Transparency regarding deductions is required by law to avoid misunderstandings or disputes. Common deductions include taxes, retirement contributions, and insurance premiums. Clearly listing these on the pay receipt ensures compliance with tax reporting requirements.

In many jurisdictions, pay receipts should be provided within a certain time frame after payment is made. Employers are obligated to deliver pay slips or receipts either electronically or in print, depending on local laws. Ensure that employees can easily access and review their pay details without unnecessary barriers.

Finally, keep records of pay receipts for a defined period. Many laws require employers to retain payroll records for several years. Failing to do so could result in penalties or issues during audits. It’s best practice to store these records securely and ensure they are accessible for future reference.

Use cloud storage for easy access and backup of your receipts. Platforms like Google Drive or Dropbox offer secure, organized solutions. Create folders based on contract type or date to keep everything sorted.

For physical receipts, invest in a filing system with labeled folders or binders. Categorize by year, contractor, or project to avoid confusion. Ensure receipts are stored in a safe, dry place to prevent damage.

Keep track of your receipts with a simple spreadsheet. Log receipt details such as date, amount, contractor name, and payment method. This helps with quick retrieval and accurate record-keeping when needed.

Consider scanning paper receipts and saving them digitally. This saves physical space and adds a layer of security against loss or damage. Ensure scanned files are clear and legible for easy reference.

Set a reminder to review and organize receipts regularly. This prevents accumulation and ensures receipts are filed in the correct place. Regular checks also help spot discrepancies early, minimizing errors.

To create a clear and organized contract services pay receipt, follow this straightforward format:

- Header: Include the title “Contract Services Pay Receipt” at the top. This helps identify the document’s purpose instantly.

- Contractor Details: List the contractor’s name, address, and contact information. Ensure this information is accurate and up to date.

- Client Information: Similarly, provide the client’s full name, address, and contact details.

- Payment Breakdown: Detail the services provided, the amount paid, and any applicable taxes or deductions. This section should be as clear and detailed as possible to avoid any confusion later.

- Payment Method: Indicate the method of payment, whether it is by check, bank transfer, or another method. This clarifies how the transaction was completed.

- Signature Section: Include a space for both the contractor and the client to sign, confirming the receipt of payment.

- Date of Payment: Clearly state the date when the payment was made. This serves as a reference for both parties.

This format ensures all necessary details are captured and easily accessible, reducing potential disputes in the future. Keep the layout simple and professional to maintain clarity.