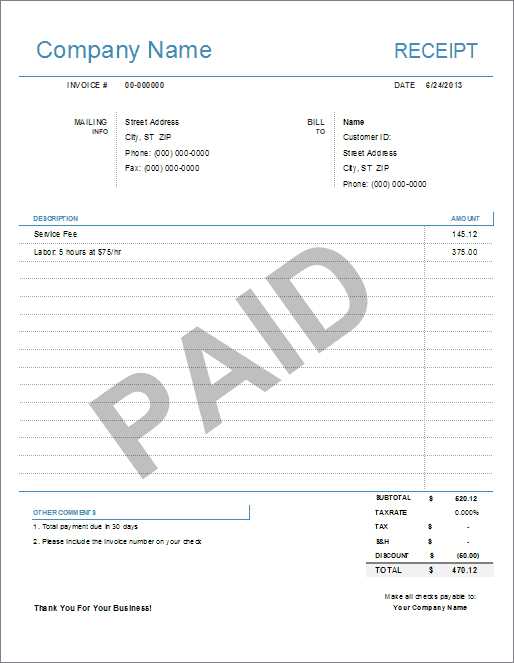

Use a structured template to create clear and professional receipts for services. A well-organized receipt should include the service provider’s details, client information, date, service description, total amount, and payment method. Keep the format simple to ensure readability and accuracy.

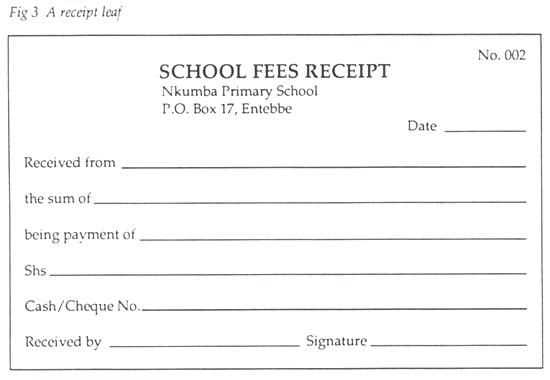

Essential details: Start with your business name, address, and contact information at the top. Follow with the client’s name and details. Include the date of service completion and a unique receipt number for tracking purposes.

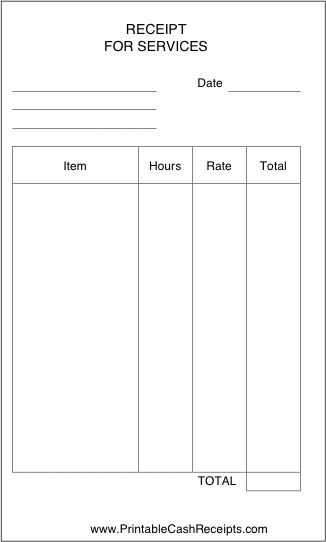

Service breakdown: List each service separately with a brief description and the corresponding cost. If applicable, specify hourly rates, materials used, or additional charges. Clearly state the subtotal, taxes (if required), and the final amount due.

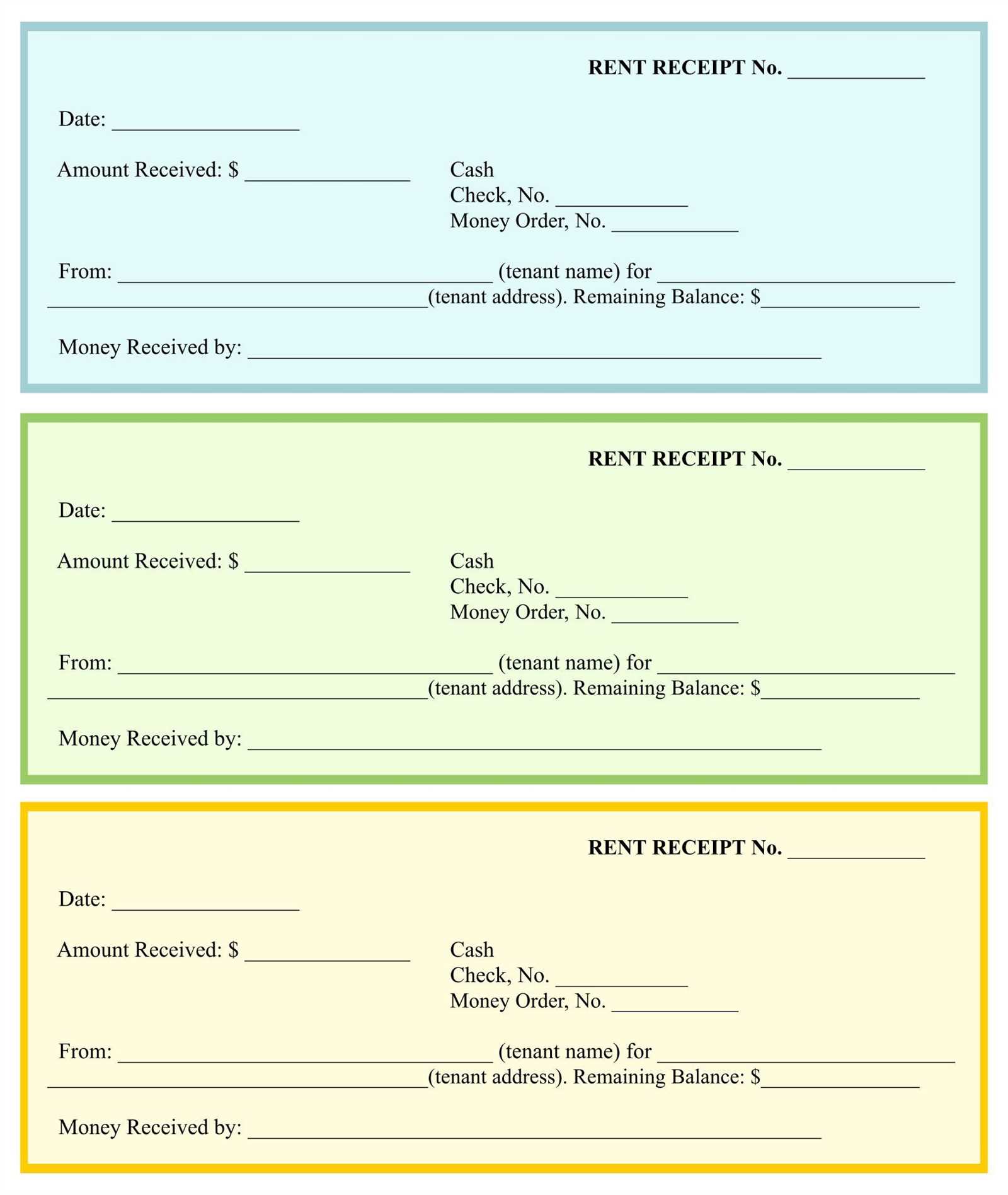

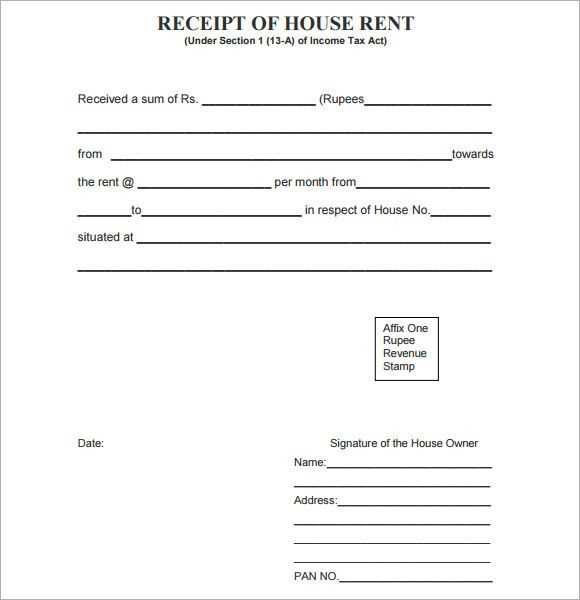

Payment confirmation: Indicate the payment method–cash, credit card, bank transfer, or other options. If paid in full, note the payment date and provide a confirmation signature or stamp. For partial payments, specify the remaining balance and due date.

Save copies of all receipts for your records. Digital and printed formats both work, but ensure backups for future reference. A well-structured receipt protects both the provider and the client while maintaining a professional image.

Homemade General Receipts Template for Services

Use a structured format to ensure clarity and professionalism in your receipts. A simple table or neatly formatted text helps organize details efficiently.

Essential Receipt Components

- Service Provider’s Information: Include your name, business name (if applicable), and contact details.

- Customer’s Information: Name and contact details for proper record-keeping.

- Date of Service: Clearly state when the service was provided.

- Description of Services: Specify the service performed, ensuring transparency.

- Total Amount: List the price, including any applicable taxes.

- Payment Method: Note how the payment was received (cash, check, or digital transfer).

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Signature (Optional): A signature from either party adds authenticity.

Formatting Tips

For a clean look, align details properly and use consistent font sizes. If handwriting the receipt, ensure legibility. Digital templates in word processors or spreadsheet programs simplify customization and reuse.

Save copies of all receipts for tax purposes and future reference. Keeping an organized record helps in case of disputes or audits.

Structuring a Service Receipt: Key Components and Layout

Include a clear header with the business name, logo (if applicable), and contact details. Place this at the top for easy identification.

Use a section for client information, listing their name, address, phone number, and email. This ensures proper documentation and reference.

Specify the receipt number and date. A unique identifier helps with tracking, while the date confirms when the service was provided.

List services provided in a table or bullet format. Include a description, quantity (if applicable), rate, and total cost for each item. This improves transparency.

Summarize the total amount due, taxes (if applicable), and any discounts applied. Clearly separate these figures to avoid confusion.

Indicate the payment method and status. Mark whether it was paid in full, partially, or remains outstanding.

Add a notes section for extra details, such as warranty terms, refund policies, or special agreements.

Finish with a thank-you message and business contact details for further inquiries.

Choosing the Right Wording for Descriptions and Payment Terms

Use clear, precise language when describing the services you offer. Focus on the core elements of the service, detailing what the client can expect. Avoid using vague terms and be specific about the scope of work, such as “repair of water pipes” instead of “plumbing services.” This clarity will help avoid misunderstandings and set expectations properly.

For payment terms, ensure your wording is straightforward and includes necessary details like deadlines, payment methods, and any potential late fees. For example, “Payment due within 15 days of receipt” clearly defines the time frame. If there are installment options, specify the amount and timing of each payment. Keep the tone professional but accessible, avoiding overly formal or complex terms that might confuse clients.

When addressing additional fees, such as for overtime or extra services, be direct. For instance, “An additional charge of $50 per hour will apply for work exceeding the estimated time” leaves no room for confusion. Always keep your payment language aligned with the work and services you provide.

Printing, Digital Formats, and Storage Options for Easy Access

When managing homemade receipts for services, organizing them efficiently is key for easy retrieval and long-term access. Start by deciding how you will handle both physical and digital records.

For printed receipts, use a clear, legible format. Ensure the details are well spaced and include sections for service descriptions, amounts, and dates. Utilize standard printing paper for consistency and durability. Storing printed copies in clearly labeled folders or filing cabinets will prevent disorganization.

For digital formats, PDF is the most reliable choice. It maintains formatting and ensures the document looks the same across devices. Use a naming system for files that includes the service date or type for quick searches. Save files in cloud storage platforms like Google Drive or Dropbox to access receipts from any device, at any time.

- Advantages of Digital Formats: Searchability, no physical storage space needed, easy to share via email or cloud links.

- Recommended Digital Formats: PDFs, JPGs, PNGs for scanned receipts.

For easy access and backup, consider storing receipts both digitally and physically. Digitally store the majority of your receipts while keeping select critical ones in physical form. Use external drives as an additional backup option for further security.

- Storage Tips: Keep scanned copies in organized folders by month or service type. Ensure cloud storage is set up with proper access permissions.

These methods provide an accessible, organized way to manage your homemade receipts and ensure they are readily available when needed for reference, auditing, or tax purposes.