Creating a year-end statement for daycare services is an excellent way to provide parents with a detailed breakdown of the costs for the services rendered throughout the year. A well-organized receipt can help parents with tax filing and budgeting, making it a practical tool for both parties. Start by listing all payments made, including dates, amounts, and any special circumstances like discounts or extra charges. Ensure clarity in the breakdown to prevent any confusion.

Accurate Record Keeping is key. Keep a detailed record of all services, including any special programs or extended hours offered. Each service should be listed with the corresponding cost, making it easier for parents to review and file their claims. Grouping charges by category–such as regular care, meals, or extracurricular activities–adds to the statement’s clarity.

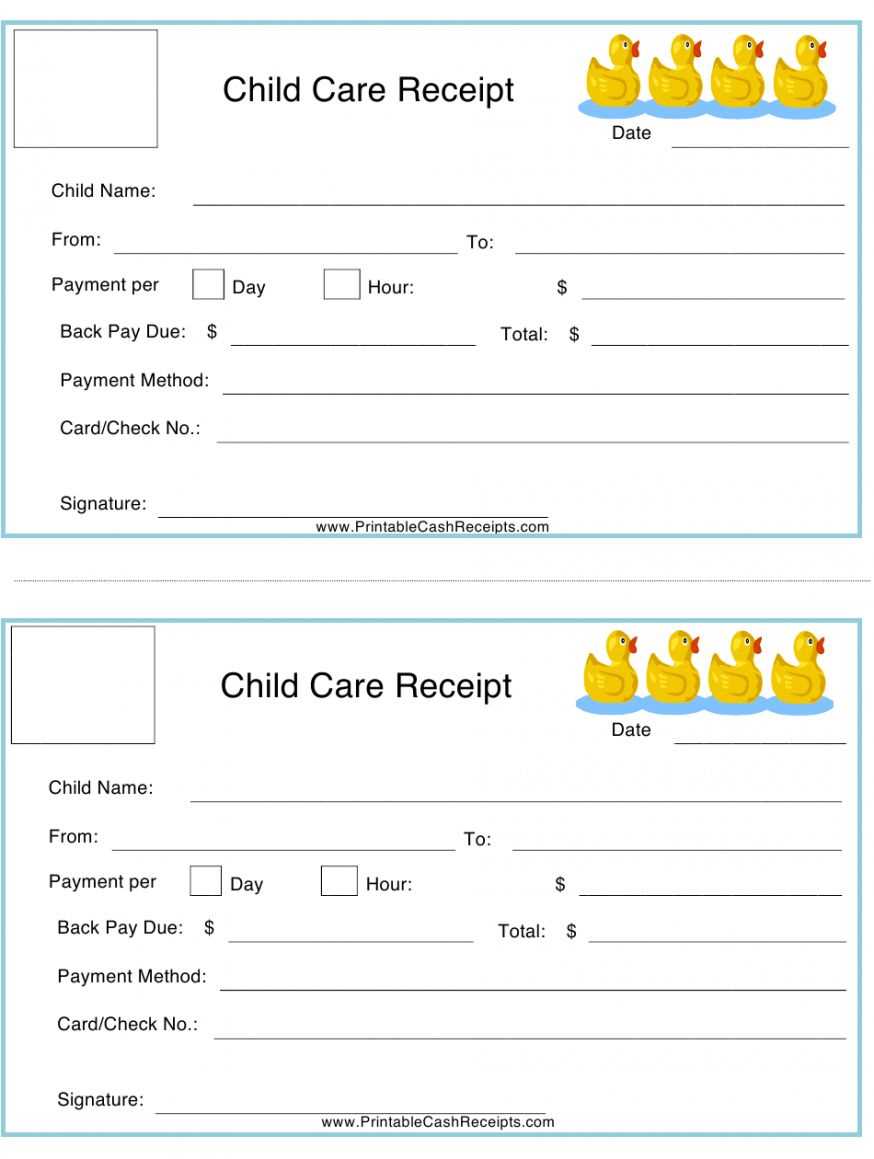

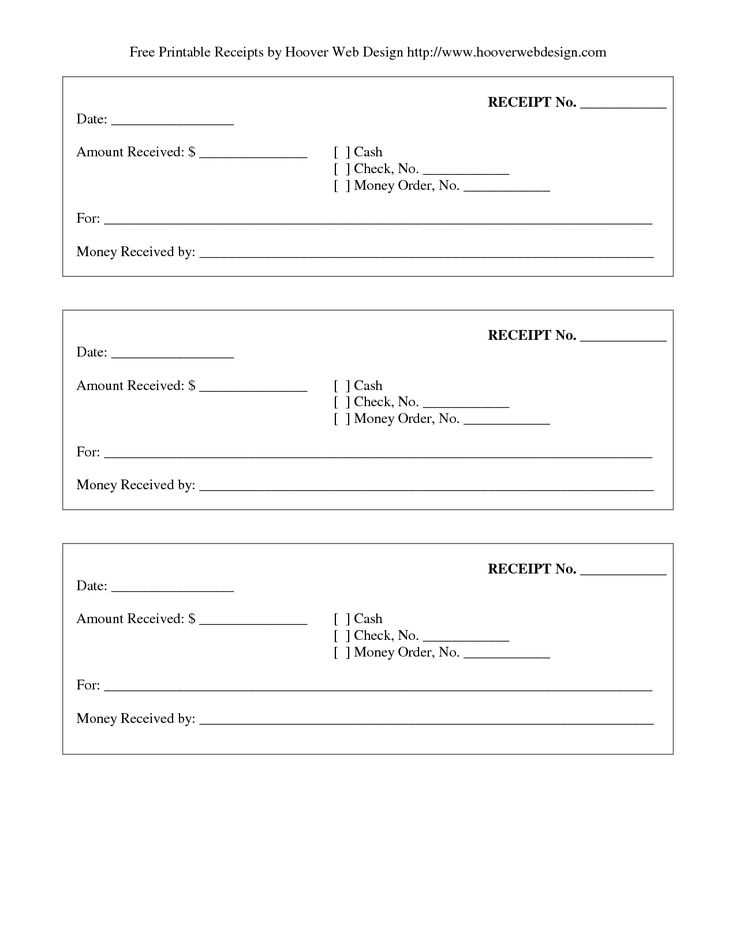

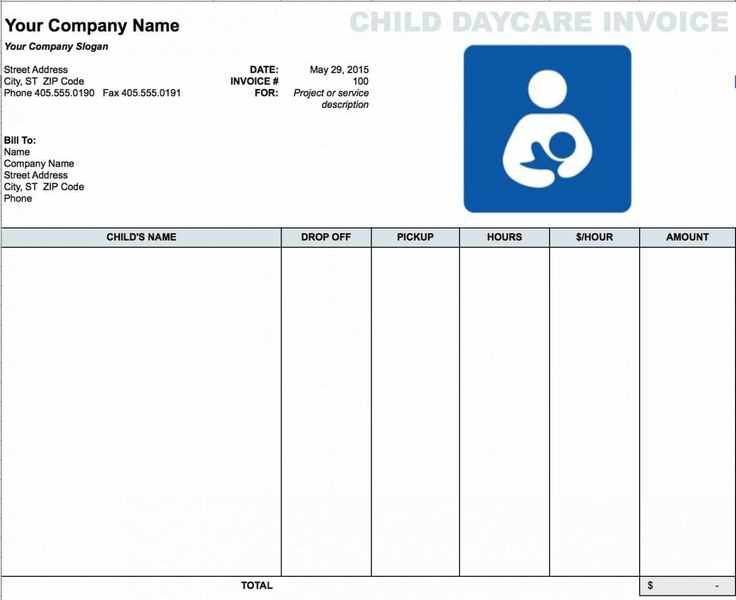

Format and Layout should be user-friendly. Organize the receipt with clear headings and dates. Use bullet points or a table format to separate different types of charges. A total section at the bottom will help parents quickly see the total amount paid during the year. Including payment methods and confirmation numbers can add a level of detail that supports both record-keeping and transparency.

By keeping the statement straightforward and accessible, you provide a valuable document that serves both functional and legal purposes, making it a helpful resource for parents throughout the year.

Receipt for Daycare Services Year-End Statement Template

Creating a year-end statement for daycare services is a helpful way to provide clients with an organized summary of their payments and services throughout the year. This statement should clearly outline the services provided, the payment details, and any outstanding balances. Here’s a simple template you can use to generate a comprehensive receipt for your clients.

Template Breakdown

- Header: Include the daycare facility’s name, address, and contact information.

- Client Information: Name of the client, child’s name, and contact details.

- Service Period: Specify the date range (e.g., January 1, 2023, to December 31, 2023).

- Summary of Services: List the types of services provided (e.g., full-time care, part-time care, after-school care) and any special services (e.g., meals, transportation).

- Payment Details: Include the total amount paid, payments made throughout the year, and any remaining balance (if applicable).

- Signature Section: Provide space for the daycare administrator’s signature and the date the statement was issued.

How to Use the Template

To customize this template for each client:

- Fill in all the details for the specific client and service period.

- Update payment records based on your transaction history.

- Ensure accuracy in the service types listed to reflect what was provided during the year.

- Use this template to issue the year-end receipt as an official document for tax or reimbursement purposes.

This template ensures your clients receive a clear and detailed summary of the daycare services provided, helping both parties maintain transparent financial records.

Creating a Clear Summary of Yearly Payments

Begin by organizing all transactions related to daycare services for the year. List each payment with the date, amount, and method of payment. For better clarity, break down payments by month or quarter, depending on the frequency of billing.

Use a consistent format for recording the payments. Include any applicable discounts, late fees, or adjustments to ensure the final total reflects the actual amount paid. A clear summary should leave no room for ambiguity, so make sure all data is accurate and easy to interpret.

Include a section for total payments. After listing the individual transactions, add a summary at the bottom that tallies the total amount paid for the year. This gives a quick snapshot of the overall expenditure without having to review each entry individually.

For transparency, consider providing an itemized breakdown, highlighting any special services or additional charges. This can be especially helpful for clients who may need to submit the summary for tax or reimbursement purposes.

Review the summary for accuracy before sharing. Verify all amounts and check that each payment has been properly accounted for, ensuring there are no discrepancies.

Incorporating Tax-Eligible Expenses into the Statement

Include all daycare-related expenses that qualify for tax deductions. Clearly itemize charges for childcare services, tuition, and any additional fees that meet eligibility criteria. Be specific about dates and service descriptions to avoid confusion.

Ensure that you provide receipts for each expense listed. This documentation is crucial for verifying the amounts you claim. It also helps support your claim during tax filing or in the event of an audit.

Adjust for any payments made on your behalf, such as subsidies or government programs, and subtract these from the total amount to reflect the actual expense. This step ensures that your statement only includes what is eligible for tax purposes.

Ensuring Proper Documentation for Filing Purposes

Keep all receipts and statements from daycare services organized and easily accessible. These documents must clearly show the dates and amounts paid throughout the year. When preparing your filing, gather invoices or payment records that are legible and complete, ensuring they contain the provider’s full name, contact details, and any necessary tax information.

Double-check that each payment record corresponds with your bank or credit card statements. This reduces the risk of errors or discrepancies. For added clarity, consider creating a spreadsheet to track payments, noting any changes in the service charges or frequency. Ensure that all necessary details are captured for accurate reporting come tax time.

For tax purposes, make sure your daycare provider issues a year-end summary or statement. This should include a breakdown of total payments made during the year. Keep a copy of this statement, along with supporting documents like checks or receipts, in a secure file. Having these records ready will streamline the filing process and help avoid any issues with deductions or claims.