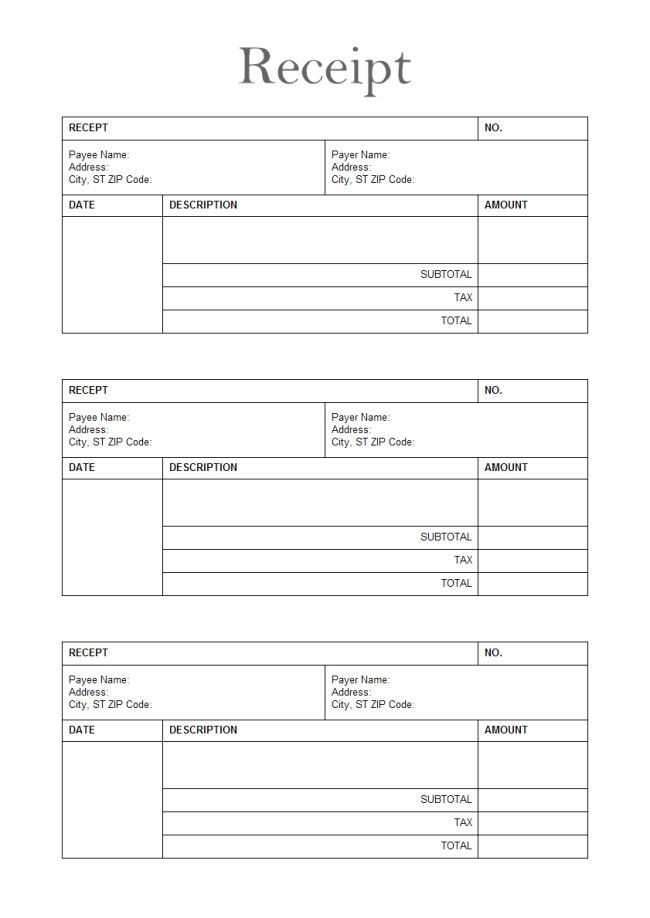

Use a clear and concise receipt for services template to document transactions and avoid confusion between you and your clients. A detailed receipt helps ensure that both parties understand the terms of the service and payment. Make sure to include the service description, date, cost, and any additional details relevant to the transaction.

The template should feature a header with your business name and contact information. Below, list the service provided with an accurate breakdown of the charges. Include a section for the payment method used and the total amount received. Having this template ready ensures smooth transactions, minimizes misunderstandings, and helps you stay organized.

To keep records accurate, always use the same format for each receipt. This makes it easier for clients to track their payments and for you to manage finances. A professional-looking receipt reinforces trust and shows that you value transparency in your business dealings.

Here’s the revised version:

Start by including clear information about the service provided, the amount charged, and the date of the transaction. Make sure the service description is concise yet thorough enough to avoid confusion.

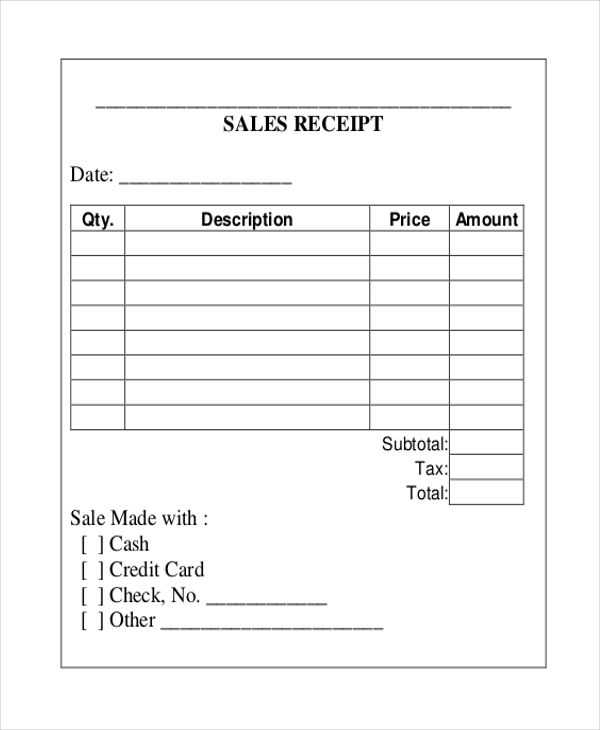

Ensure the format is simple and easy to follow. Below is an example layout for a service receipt:

| Service Description | Amount Charged | Service Date |

|---|---|---|

| Consulting Service | $100.00 | February 4, 2025 |

| Web Development | $500.00 | February 4, 2025 |

Be sure to include your business details at the top of the receipt: company name, address, and contact information. This way, the recipient can easily reach out in case of any questions or discrepancies.

Lastly, provide a unique reference number for each transaction to keep records organized.

- Receipt for Services Template

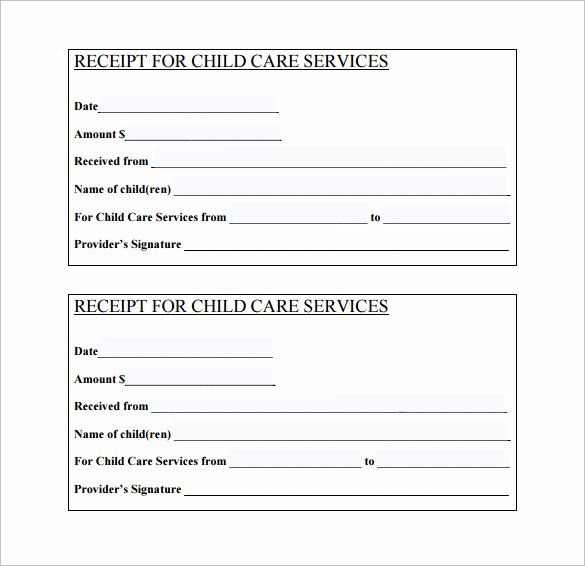

A receipt for services should include key details for clarity and record-keeping. Include the service provider’s name, business address, and contact information at the top of the receipt. Clearly state the client’s name and contact details as well.

Important Elements

List the services provided with a brief description, along with the date they were completed. Include the amount charged for each service, along with any applicable taxes or additional fees. Total the amount at the bottom of the receipt, ensuring all calculations are correct.

Payment Details

Specify the payment method (cash, credit card, etc.), including the transaction or reference number. Add any relevant payment terms or instructions for the client.

To create a service receipt in Word, follow these steps:

- Open Microsoft Word and select a blank document.

- Insert the title at the top, such as “Service Receipt”. Use a large font size to make it stand out.

- Start with the client’s details. Include their full name, address, and contact information. Add a line break between the client’s information and the service details.

- List the service provided. Specify the type of service, date of completion, and quantity if applicable. You can create a simple table with columns for each of these details.

- Next, add the price for each service item. Include any taxes, discounts, or additional fees. Provide the total amount at the bottom.

- Include a payment method section, where you can note how the payment was made (e.g., credit card, cash, or check).

- Finally, add a thank you note or a reminder for further services, if necessary.

Save the document and print or send it electronically to your client. For recurring receipts, you can save a template for future use.

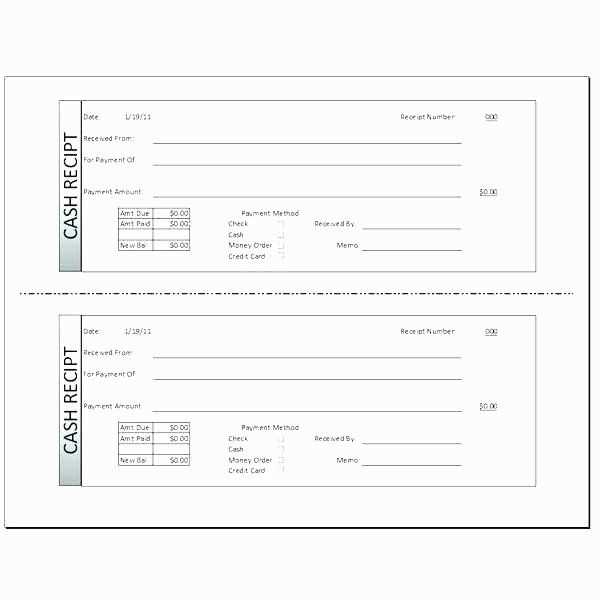

Date of Transaction: Always include the date of the service. This helps both parties reference the transaction in the future.

Service Description: Clearly specify the service rendered. Be precise about what was provided, including the type, duration, and scope of the service if applicable.

Amount Charged: List the amount due for the service, including any applicable taxes or additional fees. Make sure this total matches what the customer agreed to pay.

Payment Method: Indicate how the payment was made, whether by cash, credit card, bank transfer, or any other method. This adds clarity for both parties.

Service Provider Information: Include the name, address, and contact details of the service provider. This ensures that the receipt is traceable to the business or individual offering the service.

Client Information: Provide the name and contact details of the client receiving the service. This is important for record-keeping and future communication.

Receipt Number: Use a unique identifier or receipt number for easy reference. This helps organize and track receipts for both the provider and the client.

Signature: A space for either the service provider or client’s signature adds a level of confirmation that the transaction has occurred and is agreed upon by both parties.

Choose a clean, organized layout that highlights key details. Use clear fonts and enough spacing to avoid clutter, making the receipt easy to read. Stick to a simple color palette that aligns with your brand identity to create a polished look.

Highlight Important Information

Ensure the client’s name, service description, and total amount stand out. Use bold text or larger font sizes to differentiate these from other details like date or payment method.

Incorporate Your Logo and Contact Info

Include your business logo at the top along with your contact details for easy reference. This personalizes the receipt and reinforces your branding.

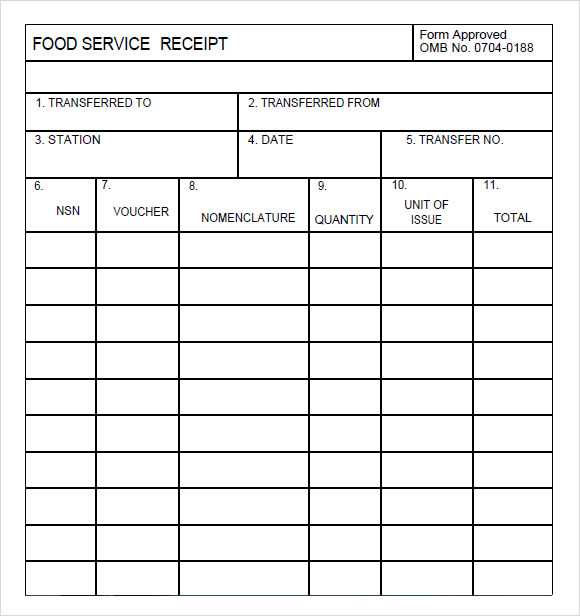

Adjust the layout and details of your receipt to match the specific needs of each industry. Start by including relevant service categories, payment terms, and specific information that reflects the nature of the transaction. For example, a healthcare receipt should include the patient’s name, the type of service provided, and insurance details if applicable. A construction receipt might list materials used alongside labor costs, while a retail receipt should focus on product details, quantities, and taxes.

Tailoring to Specific Industries

For restaurants, receipts often include an itemized list of food and drinks, along with tips and taxes. Adding a table for service charges or delivery costs can be useful for industries such as hospitality or delivery services. When customizing receipts for service industries like salons or spas, include staff names and the duration of the service rendered. This not only helps in record-keeping but also offers clients a clear breakdown of the service they received.

Incorporating Tax and Legal Requirements

Different industries may require specific tax or legal information. Ensure your receipt format includes space for applicable taxes, such as VAT for retail, or specialized service taxes for professional industries. It’s also important to comply with local legal requirements, including adding your business license number or tax ID where necessary. Customizing receipts with this information helps you stay compliant while providing clients with clear, detailed documentation of their purchases.

To maximize tax benefits, always keep a service receipt that clearly outlines the services rendered, the amount paid, and the date of transaction. This document helps verify your expenses when filing taxes.

First, ensure the receipt contains all necessary details such as the business name, description of services, and payment information. You can claim the cost of services as deductions, provided they are related to your business or professional activities. Without a clear receipt, the IRS may reject these deductions.

In case of an audit, service receipts act as proof that the expense occurred. They provide credibility to your tax filings, demonstrating transparency in your financial activities.

| Required Information on Service Receipts | Why It Matters |

|---|---|

| Business Name and Contact Information | Confirms the source of the service for tax verification. |

| Detailed Description of Services | Clarifies the nature of the expense for proper categorization. |

| Date of Service | Establishes the tax year the expense occurred. |

| Amount Paid | Helps calculate potential deductions based on the payment made. |

Make sure to store your service receipts in an organized manner. Whether digitally or in physical form, easy access to these receipts can save you time during tax season and reduce the risk of missing potential deductions.

Double-check the service details. Always verify that the service description is clear and accurate. Mistakes in wording can cause confusion and potential disputes.

Missing Contact Information

Ensure that both your contact details and the client’s information are included. Missing phone numbers or email addresses can delay communication in case of follow-up questions or issues.

Incorrect Payment Details

- Verify that the payment method and amount are correctly stated. Mistakes in amounts or transaction numbers can lead to misunderstandings.

- Include any applicable taxes or additional charges clearly to avoid future disputes.

Failing to Include a Unique Receipt Number

Each receipt should have a unique identification number. This helps track transactions and is important for both record-keeping and potential auditing.

Omitting the Service Date

Without a clear service date, it can be difficult to verify when the service was provided. Always include the exact date the service was completed.

Unclear Terms and Conditions

If there are specific terms tied to the service, make sure they are easy to understand and are clearly outlined. This avoids confusion or misunderstandings later on.

Receipt for Services Template

When preparing a receipt for services, include the service provider’s name, contact details, and business information at the top. Clearly list the services rendered with specific descriptions, dates, and the total amount due.

Key Sections to Include:

- Provider Information: Name, address, phone number, and email.

- Customer Information: Name, address, phone number, and email.

- Description of Services: Include clear and concise descriptions of each service provided.

- Date of Service: The specific dates when the service was rendered.

- Total Amount: The total amount charged for the services, including any applicable taxes.

- Payment Method: Indicate how the payment was made (e.g., credit card, cash, bank transfer).

- Additional Notes: Any additional terms or details relevant to the transaction.

Always ensure the receipt is easy to read, with all amounts clearly presented and any discounts or special offers clearly stated. Include a unique receipt number for tracking purposes, and consider adding a thank-you note to enhance customer relations.