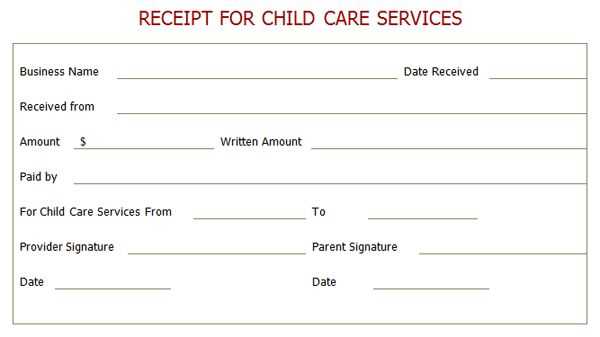

Use this receipt service template to simplify the process of issuing receipts for your transactions. It provides a structured format that ensures all necessary information is included, reducing errors and enhancing clarity.

Start by filling in the date and transaction details, including the items purchased or services rendered. Ensure the total amount is clearly displayed, with a breakdown of taxes or additional fees, if applicable. This helps maintain transparency for both parties.

Include a unique receipt number for easy reference and record-keeping. This is especially helpful for both accounting purposes and customer inquiries. Lastly, don’t forget to add your company name, contact information, and a brief thank you message to leave a positive impression with your customers.

Here’s the revised version:

Begin with defining clear variables for receipt details, such as transaction ID, date, item names, and amount. This structure helps maintain consistency across different receipts. Set up an easy-to-use function to generate unique receipt IDs that reflect both time and transaction type.

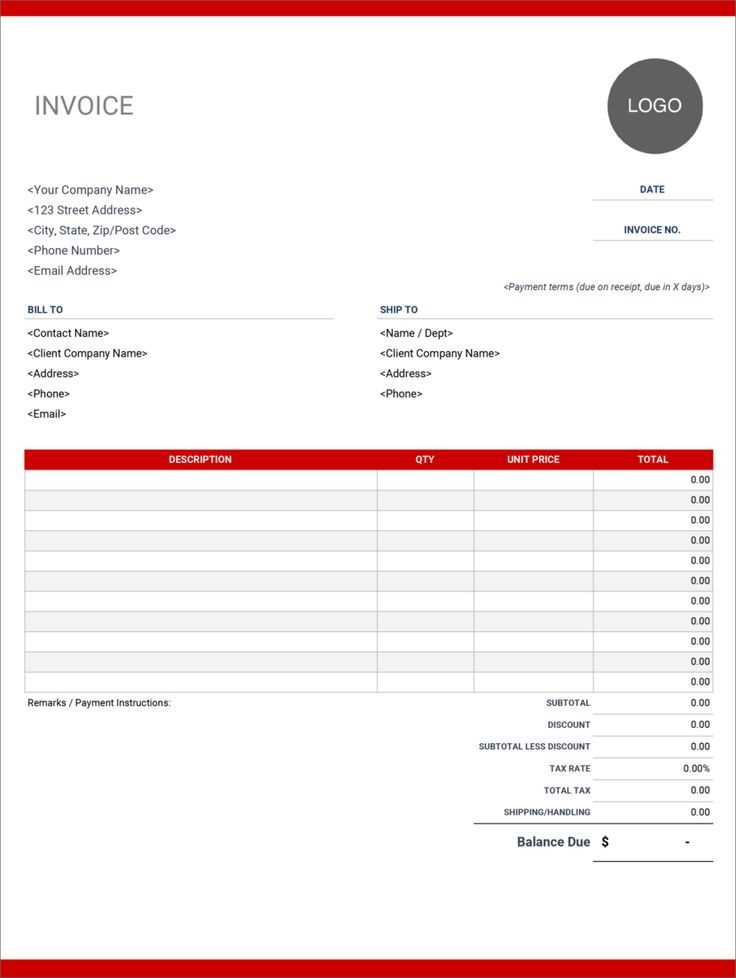

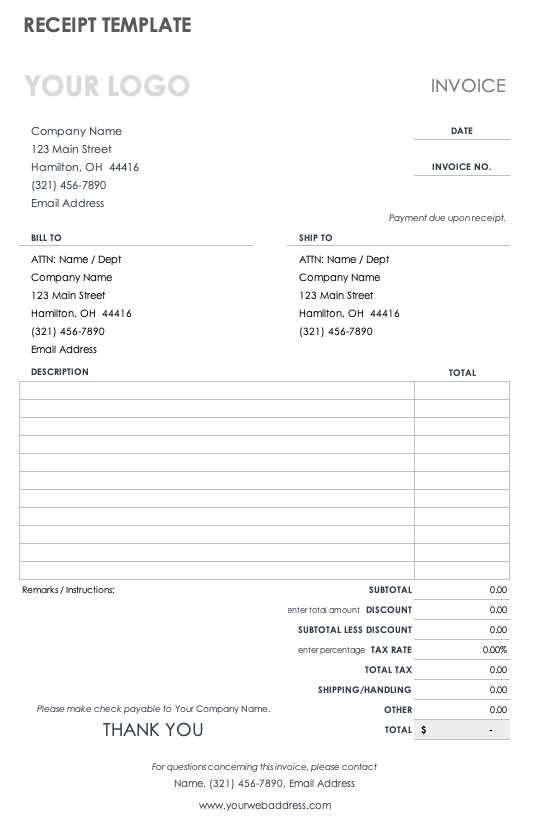

Receipt Layout and Design

The layout should be simple and readable. Arrange key information at the top, such as the business name, followed by transaction details. Keep the font size consistent and easy to read, especially for the total amount and itemized list. Use bold for totals and headings to make them stand out.

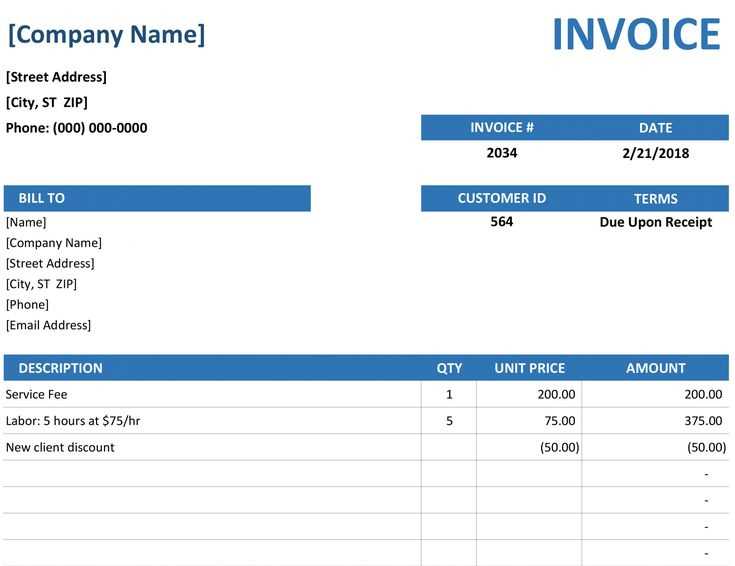

Transaction Details

Ensure the transaction breakdown is clear. Each item should be listed with its name, quantity, and price. Apply proper currency formatting for amounts, and include tax breakdowns where applicable. Make sure the receipt reflects the correct total after discounts or taxes.

Consider adding a short note at the bottom for return policies or support contact details, but avoid overloading the receipt with unnecessary information.

- Receipt Service Template

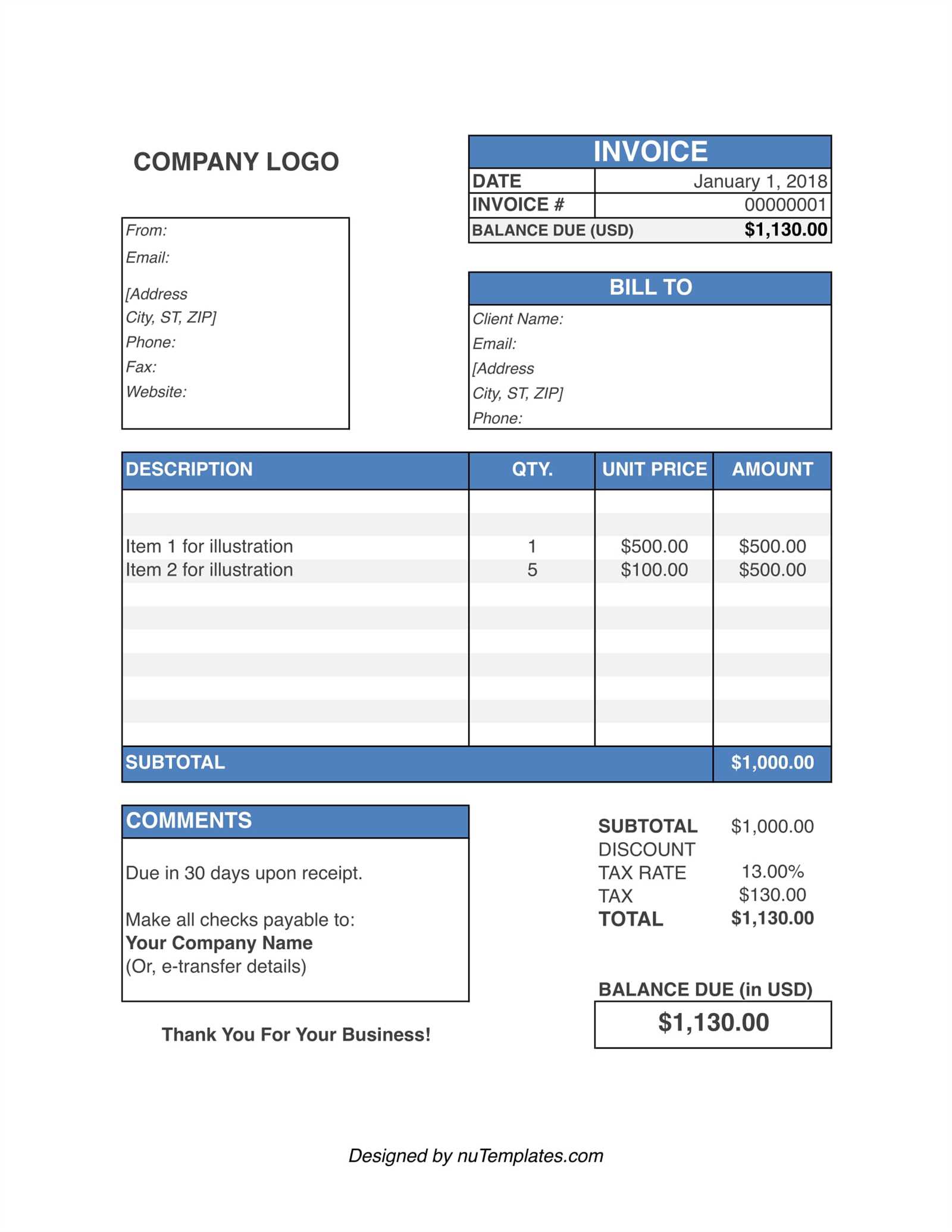

A well-structured receipt service template helps businesses streamline transactions and maintain clear records. To create a functional receipt, make sure to include the following key elements:

1. Basic Information

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Date: Include the transaction date for reference.

- Vendor/Business Name: Clearly display your company name and contact details.

2. Transaction Details

- Purchased Items/Services: List the items or services with their respective prices.

- Quantity: Specify the quantity of each item or service bought.

- Total Amount: Display the total amount due, including taxes or any discounts applied.

3. Payment Information

- Payment Method: Indicate whether the payment was made via cash, card, or online transfer.

- Amount Paid: Record the exact amount paid by the customer.

- Change Due: If applicable, show the amount of change returned to the customer.

By following this template, you ensure clarity and accuracy in your transactions, improving both customer experience and business efficiency.

To create a receipt that reflects your business’s identity, focus on elements like logo placement, font style, and color scheme. Start by adding your company’s logo at the top for immediate recognition. Use a simple, clear font that matches your brand’s tone–whether it’s modern, professional, or casual. Keep the font size legible, especially for key details such as the total amount and transaction date.

Consider your color palette. Choose colors that align with your brand, but ensure they don’t overwhelm the information. A clean contrast between the background and text will make the receipt easy to read. For example, use darker text on a light background or vice versa.

Include all necessary transaction details–date, time, items purchased, prices, and totals–while keeping the layout uncluttered. You can break information into clear sections for better readability. A simple grid format or bold section headers can help differentiate the various types of information.

Integrate contact details like your business address, phone number, or website. This gives customers easy access to further information about your services. You might also want to add a thank you note or any other message to reinforce your brand’s personality.

Consider offering an option for digital receipts. This can be a simple addition with a QR code or a link to a downloadable receipt, especially if you’re operating in an online space.

Test your design on different devices and paper sizes. Ensure that the receipt maintains its clarity and professionalism when printed or viewed digitally. A streamlined, well-organized design will make a positive impression on your customers and enhance their experience with your business.

To create a functional receipt template, it’s crucial to incorporate payment options clearly and precisely. Include a section dedicated to the payment method used, such as credit card, cash, or digital payment platforms. This ensures that the receipt reflects the transaction type accurately, providing transparency to both the customer and your business.

List the Payment Method Clearly

Ensure the payment method is specified in a prominent section of the receipt. Use clear labels such as “Paid by” followed by the exact method–”Credit Card,” “Cash,” or specific names of online payment services like PayPal or Stripe. If applicable, include a transaction ID or reference number for online payments. This makes tracking and verifying payments straightforward.

Include Payment Amount Breakdown

Show a clear breakdown of the total payment, including taxes, discounts, and the final amount paid. If the customer used multiple payment methods (e.g., part credit card, part cash), make sure both amounts are listed separately. This provides a detailed view of how the transaction was processed and ensures both parties are on the same page.

Legal requirements for receipts can vary depending on the country and type of business. However, there are a few standard elements that need to be included to stay compliant. Make sure to display the business’s name, address, and tax identification number (TIN) on every receipt. This ensures transparency and provides necessary information for taxation purposes.

Key Compliance Elements

Receipts must also clearly state the transaction date and a breakdown of the items purchased or services rendered. Including the correct sales tax rate and amount ensures businesses comply with tax laws. Failure to do so can lead to legal challenges, fines, or delays in tax filings.

| Required Information | Description |

|---|---|

| Business Details | Business name, address, and tax identification number. |

| Transaction Date | Date when the transaction took place. |

| Itemized List | Detailed breakdown of items or services purchased. |

| Sales Tax | Accurate tax amount and applicable tax rate. |

Additional Considerations

Consideration should also be given to the format and legibility of the receipt. Depending on jurisdiction, a receipt may need to be issued in a specific language or meet particular size requirements. Always verify local legal standards to ensure full compliance and prevent future issues.

Focus on clear and concise presentation of receipts in your service template. Provide specific details that reflect the transaction clearly.

- Transaction Date and Time: Always include the exact date and time the service was completed or the purchase was made.

- Itemized List: Break down all items or services provided with quantities and unit prices for transparency.

- Total Amount: Display the final amount due, including any taxes or additional charges that apply.

- Payment Method: Indicate whether the payment was made via credit card, cash, or other methods.

- Contact Information: Ensure that customer support details are easily visible for inquiries or disputes.

These elements create a straightforward and professional receipt layout. Keep all sections organized for quick comprehension, ensuring that each part of the transaction is clearly presented to the customer.