Use a receipt template to streamline your transactions and maintain clear financial records. A well-structured receipt provides both you and your clients with proof of purchase and ensures accurate tracking of sales or services provided. Organize the template to include all the relevant fields, such as date, item or service description, quantity, unit price, and total cost.

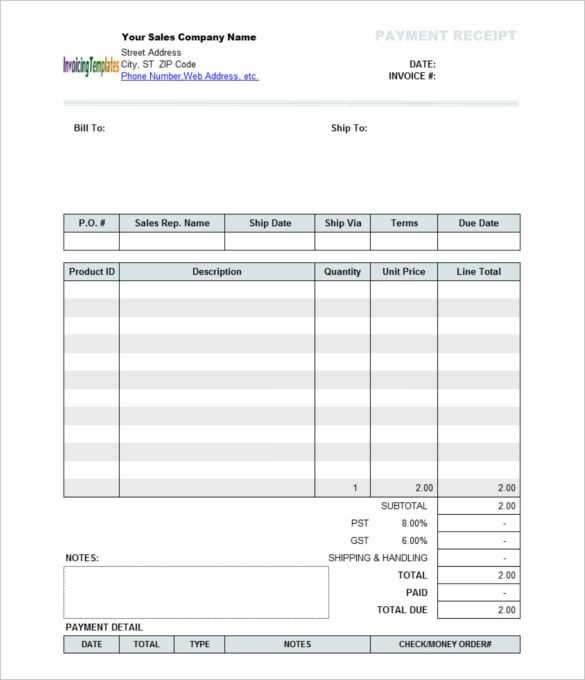

Ensure that your template reflects your business’s branding by incorporating your logo, contact information, and company details. This reinforces professionalism and enhances customer trust. Avoid cluttering the receipt with unnecessary information; focus on the key elements that confirm the transaction. If applicable, include payment methods, tax rates, and discounts.

Update your receipt template regularly to accommodate any changes in pricing or services. This helps maintain consistency in your records and ensures the document is always accurate. Whether you use it for sales, services, or other business transactions, a tailored receipt template saves time and ensures smooth interactions with customers.

Here’s the revised version:

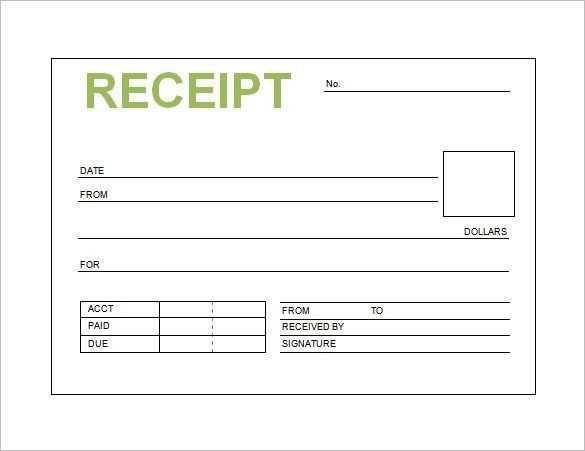

Ensure all key details are included when setting up a receipt service template. Begin by listing the transaction number, date, and total amount. This ensures clarity and prevents confusion later. Use a clear and readable font, ensuring all elements are easy to identify.

For added accuracy, incorporate a table to display itemized charges. This allows users to review each charge individually. It is also helpful to include tax details and any discounts applied. Here’s an example of how to structure it:

| Item | Price | Quantity | Total |

|---|---|---|---|

| Product 1 | $10.00 | 2 | $20.00 |

| Product 2 | $15.00 | 1 | $15.00 |

| Tax | $3.50 | ||

| Total | $38.50 | ||

Ensure that any payment methods used are clearly stated, whether credit card, PayPal, or others. Lastly, offer a space for customer feedback or additional notes at the bottom of the receipt. This improves transparency and provides helpful insights for both the service provider and the customer.

- Receipt Services Template

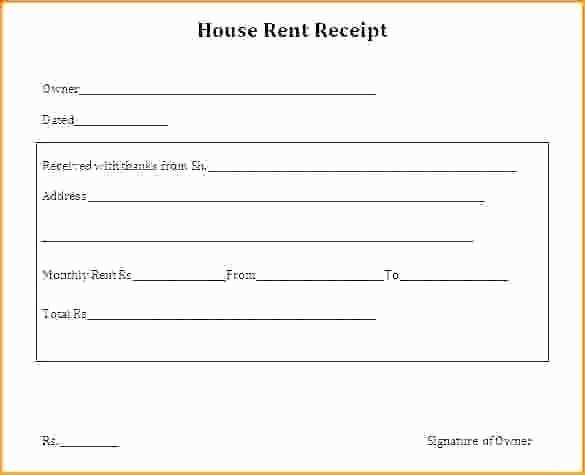

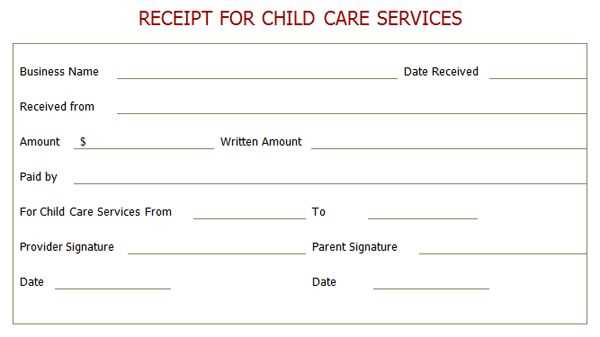

The receipt services template should include all necessary information for both the customer and the service provider. Start with a clear heading that indicates it’s a receipt. Include fields like the service provider’s name, address, and contact details. For easy reference, provide a unique receipt number and date of service.

Next, list the specific services provided, including a description and price for each. Break down any additional fees or taxes to avoid confusion. Make sure to include the total amount paid and the payment method used (credit card, cash, etc.). If applicable, add terms for refunds or cancellations to clarify your policies.

Finally, include space for both the customer’s signature and the provider’s signature. This adds a layer of confirmation for both parties and ensures accountability. Keep the design clean and easy to follow, with bold headings for each section to enhance readability.

Designing a custom receipt begins with identifying key details that reflect your business. Include your company name, logo, address, and contact information at the top. This gives your customers a clear point of contact and reinforces your brand.

Choose a Simple Layout

A cluttered receipt can confuse customers. Stick to a clean, organized format with clear headings for the items or services purchased, quantities, prices, and totals. Use simple fonts and proper spacing to ensure everything is legible.

Include Legal or Tax Information

Depending on your location, you may need to display tax details such as the tax rate applied, any exemptions, or your business’s tax ID. Make sure you comply with local regulations to avoid legal issues.

Offer customers a summary of the transaction, including any discounts, promotions, or loyalty points used. This not only clarifies the purchase but also enhances the customer experience.

Finally, create a digital version of the receipt. This can be emailed or stored electronically, which is both environmentally friendly and convenient for customers who prefer paperless transactions.

Integrate receipt services with your payment systems by ensuring seamless data transfer between the two. Use API endpoints that allow automatic generation of receipts once payments are processed. This minimizes manual data entry errors and enhances the user experience.

Ensure your payment gateway supports receipt generation, either as a built-in feature or via third-party integration. For example, payment processors like Stripe or PayPal provide APIs to create detailed receipts after every transaction. By linking the payment API with your receipt service, you can automatically trigger customized receipt templates based on transaction data.

Set up an automated workflow that generates, stores, and sends receipts immediately after a payment is successful. This helps maintain consistency and ensures customers receive accurate documentation promptly. Include relevant details like transaction ID, itemized list of purchases, and taxes for transparency.

Secure data transfer is key to integrating these systems. Use encryption protocols like SSL/TLS to protect customer information and ensure receipts are securely transmitted. Avoid storing sensitive data directly in your system to comply with privacy regulations such as GDPR or PCI DSS.

Test the integration thoroughly before going live. Conduct simulations to check the accuracy of receipt data and ensure the payment system updates in real-time. Customer satisfaction depends on the reliability and speed of this process, so optimization is important.

Consider scalability as well. As your business grows, you may need to handle a higher volume of transactions. Make sure the integration can scale without performance degradation or delays in receipt generation.

Ensure your online receipt templates comply with local and international regulations. Many jurisdictions require businesses to maintain records of transactions for tax, legal, and financial purposes. These receipts must include accurate, complete, and specific information to be legally binding.

- Include Necessary Details: Make sure each receipt includes essential details such as the business name, contact information, transaction date, items purchased, prices, and payment method. This transparency ensures compliance with tax laws and customer protection regulations.

- Data Protection Laws: Respect data privacy regulations, such as GDPR in the EU. Online receipt templates should avoid storing or transmitting personal data unless necessary and should ensure secure handling of sensitive information.

- Electronic Signature Considerations: If your receipt template uses digital signatures, check that they are legally recognized in your jurisdiction. Some regions require specific encryption methods to validate electronic signatures.

- Tax Compliance: Tax laws often dictate the information required on receipts. For example, some countries mandate including tax identification numbers or VAT details. Double-check that your templates align with local tax regulations to avoid fines.

- Retention of Records: Maintain receipts for the legally required period. In many places, businesses must store transaction records for a certain number of years for auditing and tax purposes.

Stay up-to-date with the specific regulations of the regions you operate in, and regularly audit your receipt templates to ensure full compliance. This will protect your business from potential legal risks while enhancing customer trust.

To create an organized and user-friendly receipt service template, structure the data clearly. Start by listing key elements such as the service name, date, and amount. Include a unique receipt number for easy reference.

Service Details

List the service type, a brief description, and any relevant details. This makes the receipt more informative and allows the customer to understand what the charge is for at a glance.

Payment Information

Clearly outline the payment method used, whether it’s credit card, cash, or another form. This helps both parties keep track of transactions with accuracy.

Tip: Ensure to include tax information separately if applicable. This keeps things transparent and avoids confusion later.

To finish, include contact information for customer support, should they have any questions or need clarification regarding their receipt.