Creating a clear and professional receipt template for services ensures smooth transactions and helps maintain accurate records for both parties. The format should include all necessary details like service descriptions, pricing, and payment information.

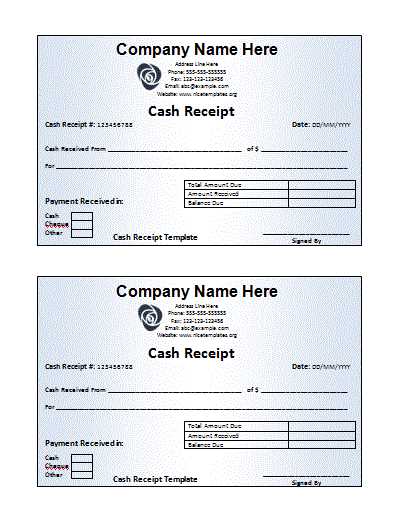

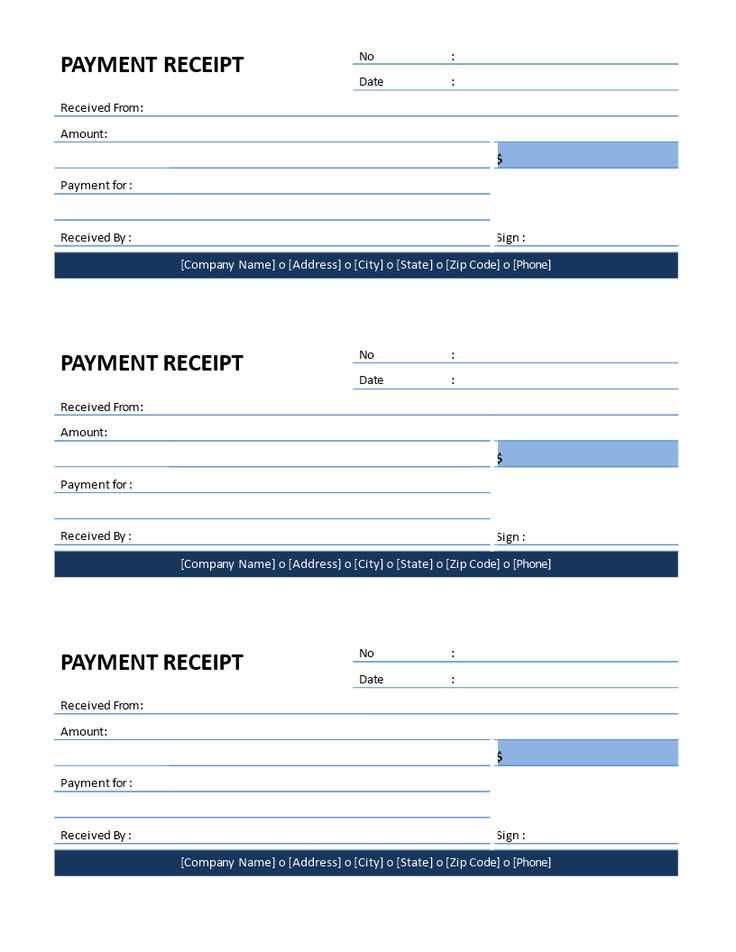

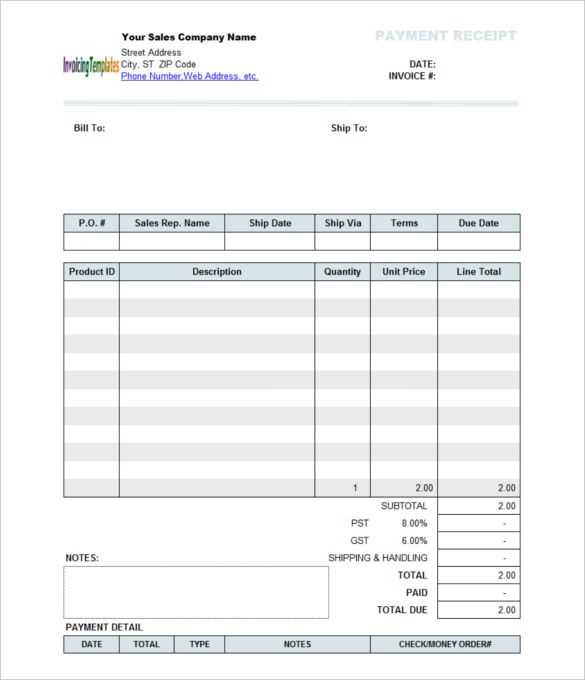

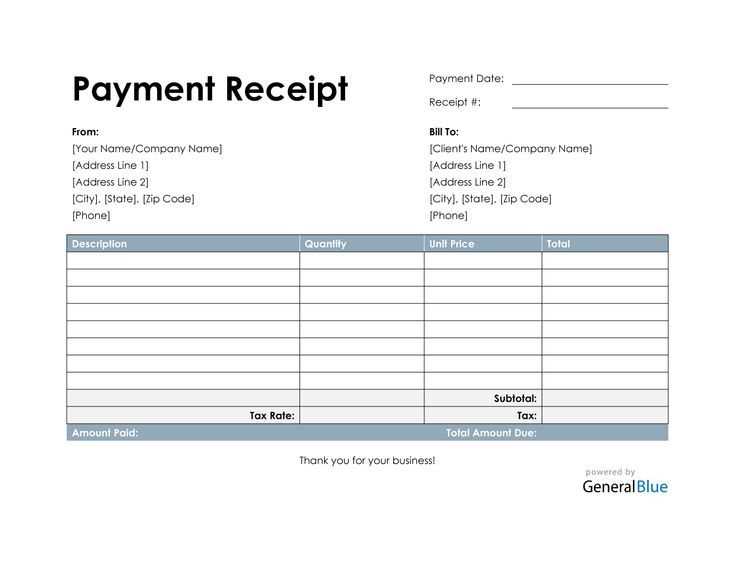

Start by including the service provider’s details, such as name, address, and contact information. This makes it easy for clients to identify the source of the service. Right next to it, provide the client’s information to establish clarity about the transaction.

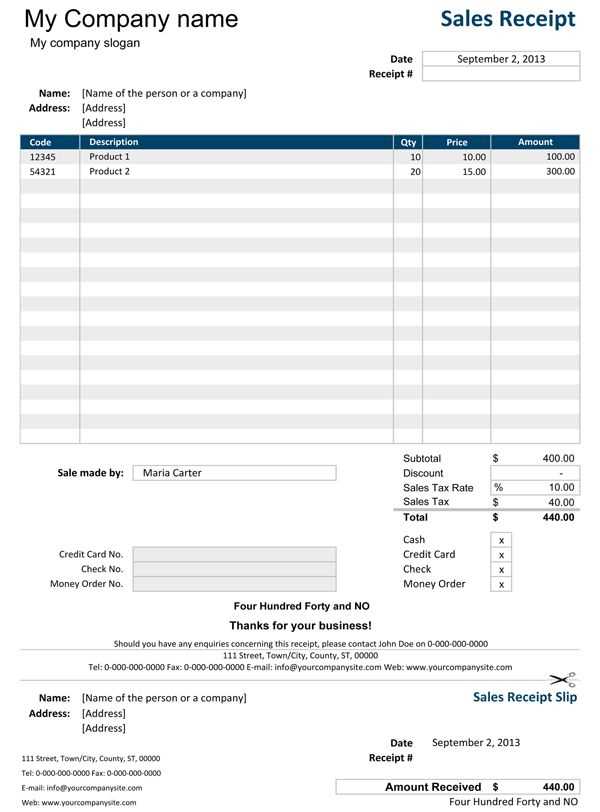

List the services rendered, with each service itemized separately. Include the date of service, a brief description, and the corresponding price. This gives transparency to the customer about what they’re paying for.

Include payment details such as the method of payment, total amount paid, and any applicable taxes or discounts. This section ensures both parties have a record of the financial transaction.

By keeping the receipt clear and organized, you help build trust with clients while ensuring accurate tracking for future reference. Make sure to keep a copy for your records to avoid any potential discrepancies later on.

Here is the corrected version:

Ensure your service receipt is clear and concise, outlining key transaction details. Below is a template designed for service-oriented businesses. This version includes all necessary information for both the service provider and the customer.

Service Receipt Template

This template includes a breakdown of the service, charges, and payment methods, all formatted for easy understanding:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service Name | 1 | $100.00 | $100.00 |

| Additional Service | 2 | $50.00 | $100.00 |

| Total | $200.00 |

The details include the total amount, service description, and a clear breakdown of the charges. You can customize this template to match specific services or pricing schemes.

Payment Details

Provide payment information including the method of payment and any transaction IDs or references:

| Payment Method | Transaction ID | Date |

|---|---|---|

| Credit Card | 123456789 | February 10, 2025 |

Include a clear indication of the transaction to ensure both parties are aware of the payment details.

Receipt Template for Services

For service providers, a clear and concise receipt template is crucial. It serves as both a record for transactions and proof of payment. Your receipt should include specific details to avoid confusion and ensure transparency with clients.

Key Elements of a Service Receipt Template

A well-structured receipt template for services should cover the following aspects:

- Business Information: Include the business name, address, contact details, and any applicable registration number.

- Receipt Number: Use a unique number for each receipt to easily track and reference transactions.

- Client Details: Include the client’s name and contact information for proper identification.

- Service Description: Clearly outline the services provided, including a brief explanation of each service offered and any associated terms.

- Payment Information: Specify the payment method, date of payment, and total amount paid. If applicable, mention tax and discounts.

- Terms and Conditions: List any relevant terms, such as refund policies or deadlines for service delivery.

- Signature: Add space for both the client’s and provider’s signatures, confirming agreement and transaction.

Design Tips for a Professional Look

Make sure the design is clean and easy to read. Use simple fonts and layout styles that help users focus on the key details. Avoid clutter and ensure that the information flows logically from top to bottom.

Having a receipt template ready for each service transaction helps establish trust and professionalism in your dealings. Whether you’re providing one-time or recurring services, this document will serve as an official acknowledgment of your work and payment received.

To tailor a receipt template to fit the specifics of your service, focus on these key areas:

- Service Description: Include a clear and detailed description of the service provided. For example, instead of “consulting,” specify “SEO consultation for website optimization.” This adds clarity and precision.

- Breakdown of Charges: For each service rendered, provide a breakdown of the cost. If you offered multiple services, list each separately, like “Website design: $400” and “SEO services: $150.” This avoids confusion and offers transparency.

- Hourly or Project-Based Rates: If you charge hourly, include the number of hours worked along with the rate. For instance, “3 hours at $100/hour.” If it’s a fixed-price project, indicate the total agreed amount, such as “Fixed price for logo design: $250.” This clarifies how the total amount is calculated.

- Discounts and Add-Ons: If applicable, include any discounts or additional charges. For example, “10% discount on consulting fee” or “Rush charge: $50 for expedited service.” This ensures the client is fully aware of any adjustments to the base price.

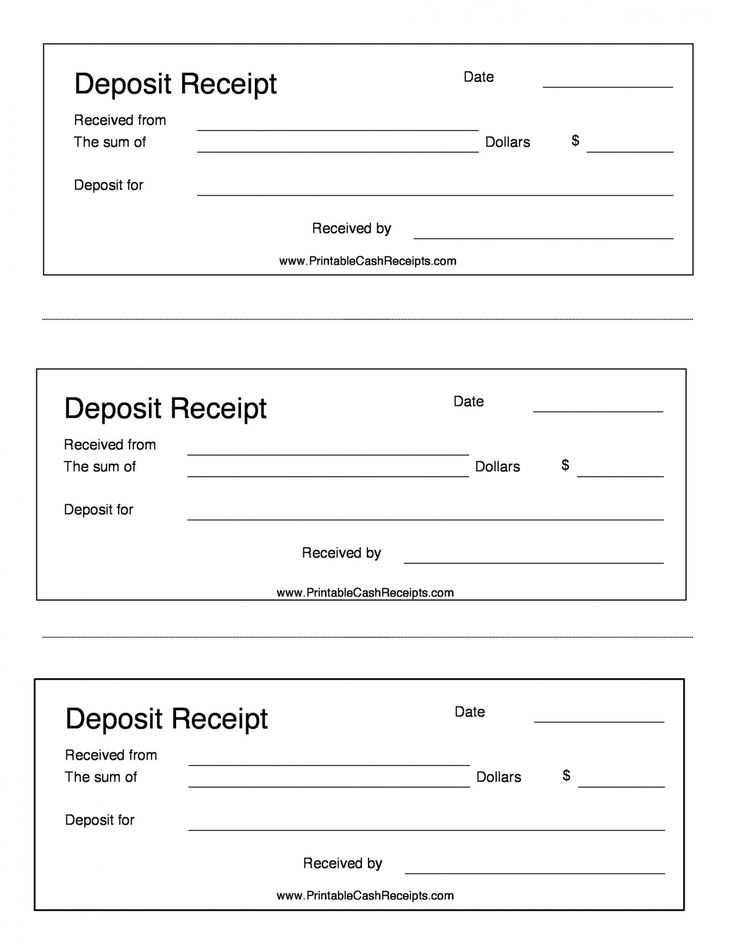

- Payment Terms: Specify when payment is due and any relevant terms. For example, “50% deposit required before project start” or “Final payment due within 30 days of invoice date.” This helps avoid misunderstandings about payment schedules.

- Method of Payment: Include the payment method used, such as “Paid by bank transfer” or “Paid via PayPal.” This is important for record-keeping and future reference.

- Service Timeline: If applicable, list the date the service was completed or provide the project timeline. Example: “Service completed on March 10, 2025.” This is especially useful for ongoing projects or recurring services.

- Contact Information: Make sure your contact details, including phone number, email address, or business website, are clearly displayed. This ensures that the client can easily reach you for any follow-up questions or clarifications.

By customizing these elements, your receipt will reflect the unique aspects of the service provided, ensuring clear communication and a professional appearance.

Receipts must contain specific details to comply with tax regulations. Start with the seller’s name or business name, along with the full address and contact details. This ensures the transaction can be traced back to the right entity.

Next, include the date of the transaction. This provides a clear record of when the service was provided, which is crucial for tax reporting.

Clearly state the amount paid, breaking it down if necessary. Include the tax rate applied and the total tax amount collected. Make sure the total amount reflects the cost before and after tax. If applicable, list any discounts or promotions used, as they affect the final price.

The description of the service provided must be detailed enough to demonstrate the nature of the transaction. Avoid vague terms to ensure transparency for both the customer and tax authorities.

Finally, include the receipt number or a unique identifier. This helps both parties track the transaction and serves as a reference in case of audits or inquiries.

Place key information in a clear, structured order. Position the service provider’s name, logo, and contact details at the top. Immediately below, add the client’s name and the date of service. Use separate sections for service details, payment terms, and totals, each clearly labeled for easy navigation.

Service Breakdown

Display each service in its own row with columns for the description, quantity, rate, and total amount. This breakdown allows clients to easily review what they’re being charged for. Highlight the total amount in bold or a larger font size so it stands out immediately at the bottom of the breakdown.

Design Consistency

Align text neatly across all sections for a polished look. Use consistent font sizes and styles for headings, subheadings, and body text to create visual harmony. Avoid clutter by keeping ample spacing between sections. Maintain balance between text and white space to ensure a clean, organized appearance.

Use one or two subtle accent colors for headings or totals. This helps guide the reader’s eye without overwhelming the layout. Stick to a minimalistic approach to ensure the focus remains on the information.

Ensure the document is legible by adjusting font size and line spacing appropriately. Large fonts for headings and clear, readable fonts for service descriptions make it easier to quickly scan through the receipt.

For services receipts, ensure that the structure is straightforward and easy to follow. Begin by including the service provider’s name, contact information, and any business registration details, such as a tax ID. Then, list the services provided with corresponding dates and prices.

Breakdown of Information

The receipt should clearly identify the client, detailing their full name, address, and any relevant identification numbers if applicable. Include an itemized list of services, including brief descriptions and quantities. Each item should be accompanied by its price, and a subtotal should be shown before taxes.

Tax and Payment Information

Be sure to clearly state the applicable taxes and total amount due. Indicate the payment method, whether it’s cash, card, or another option. If a partial payment was made, include the balance remaining.

Conclude with the service provider’s signature or an automated confirmation, along with a thank-you message for the transaction. Keep it concise and organized, so clients can easily reference the information when needed.