Essential Components

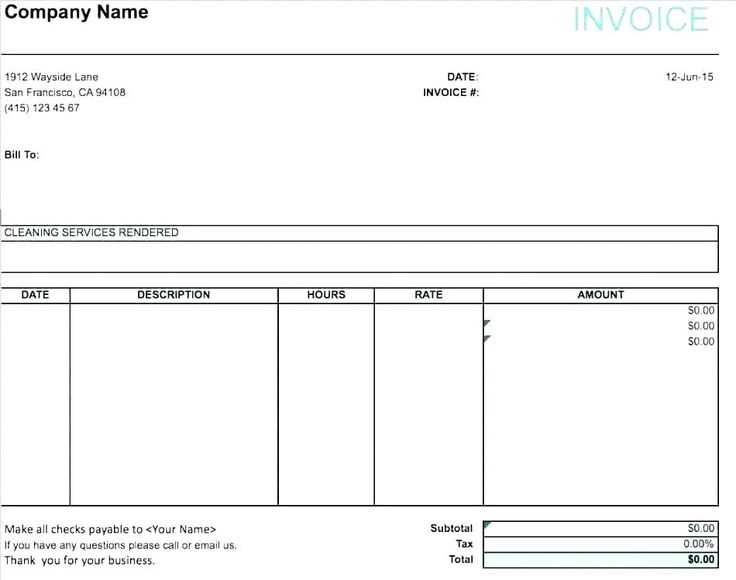

A well-structured service receipt provides clarity for both the service provider and the client. Include the following:

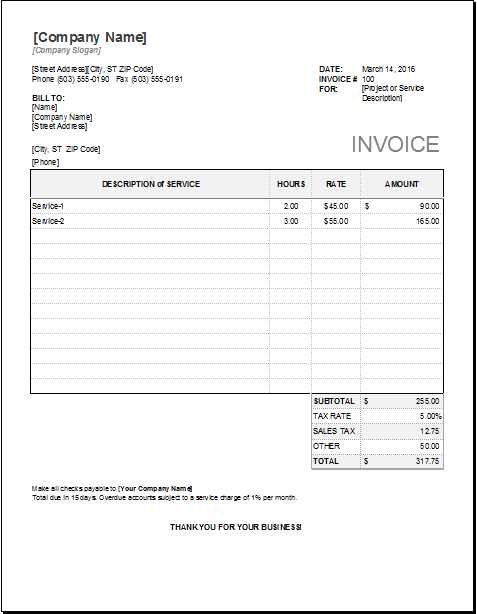

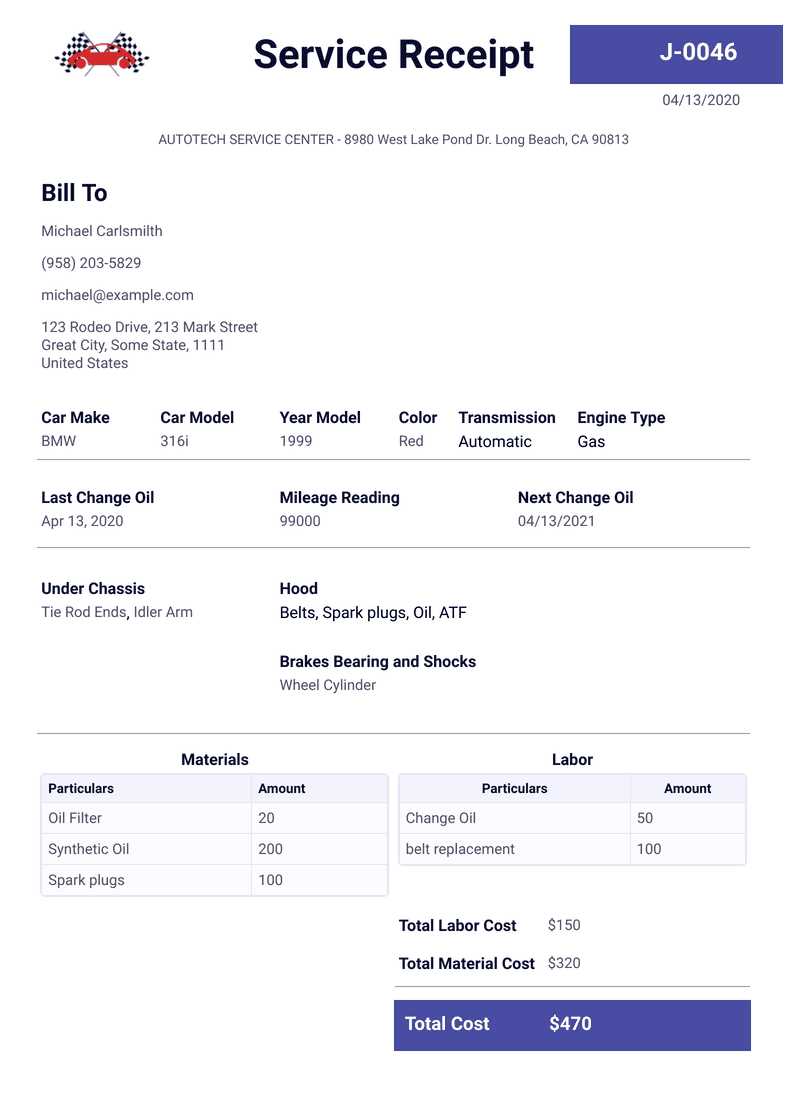

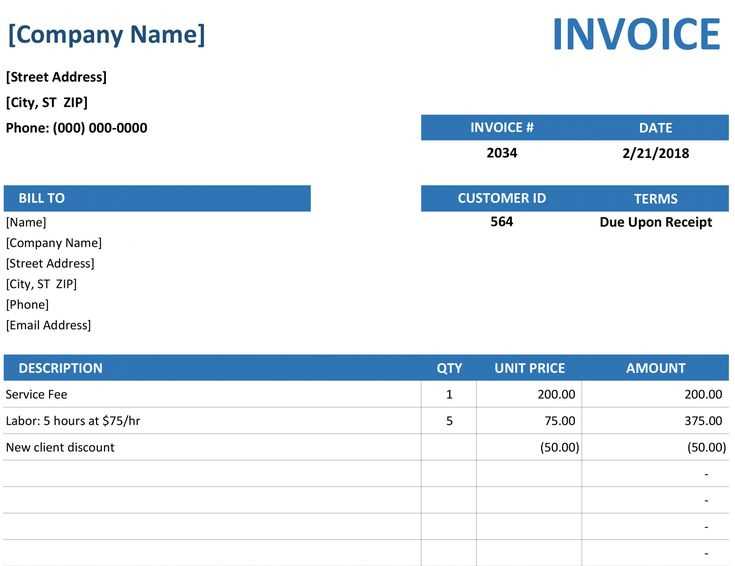

- Business Information: Company name, address, contact details, and tax identification number (if applicable).

- Client Details: Name, address, and contact information for proper record-keeping.

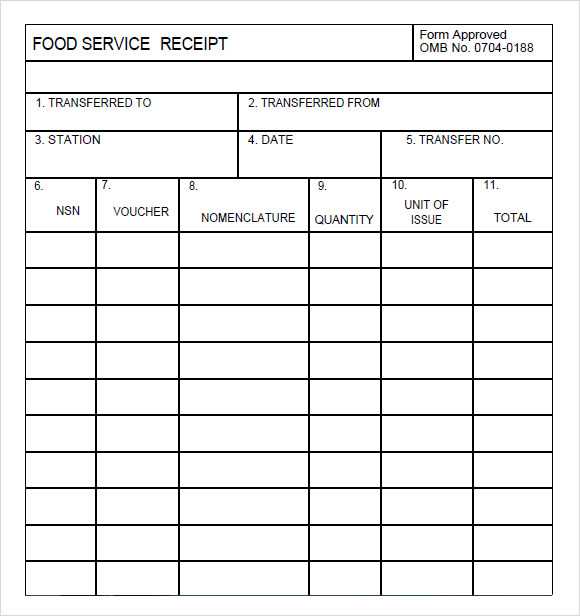

- Receipt Number: A unique identifier to track payments and services.

- Date of Service: The completion date of the service, ensuring accurate documentation.

- Service Description: A detailed list of services performed, including quantity and unit cost if applicable.

- Total Amount: Breakdown of individual charges, applicable taxes, and final sum.

- Payment Method: Specify whether the payment was made via cash, credit card, bank transfer, or another option.

- Terms and Conditions: Any relevant policies regarding refunds, warranties, or service guarantees.

Formatting for Clarity

Ensure readability by organizing details logically. Use clear section headings, consistent font sizes, and alignment. If printed, ensure high-quality paper and professional formatting.

Digital vs. Paper Receipts

Electronic receipts simplify record-keeping and reduce storage needs. PDFs, cloud-based invoicing systems, and email delivery streamline documentation. However, paper receipts remain useful in certain industries where physical proof of service is required.

Legal and Accounting Considerations

Compliance with local regulations prevents tax issues and disputes. Retain copies for the required period, typically several years. Digital backups add extra security.

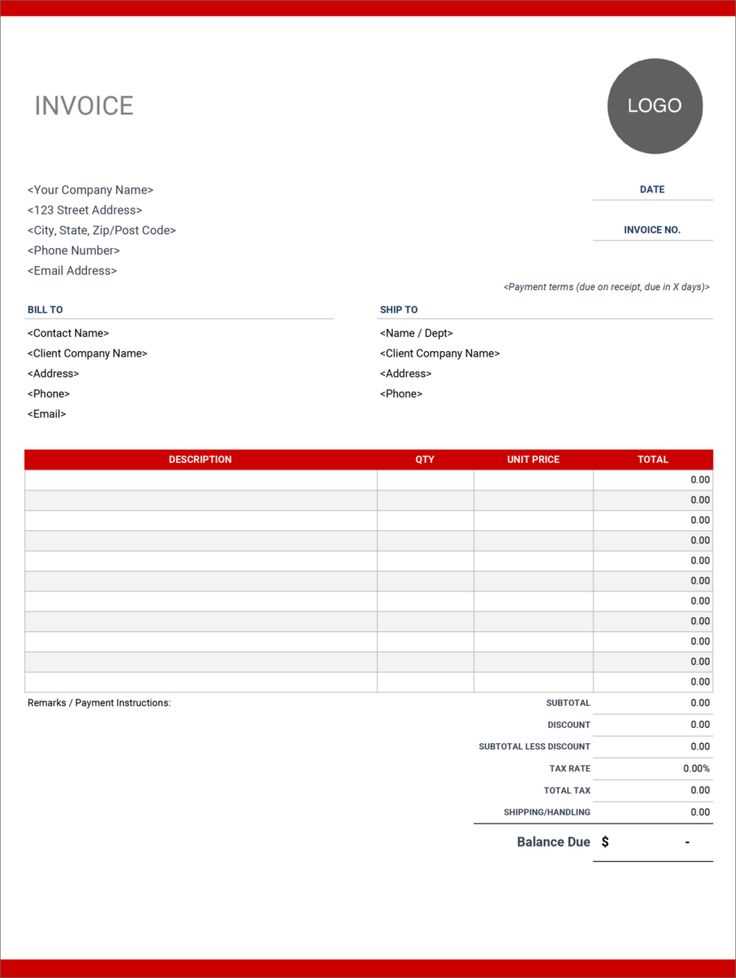

Customization and Branding

Incorporate logos, brand colors, and professional fonts to enhance credibility. A personalized touch reinforces brand identity and leaves a lasting impression.

A well-crafted receipt not only documents transactions but also builds trust and reinforces professionalism.

Service Receipt Template

Key Elements to Feature in a Receipt

Legal and Tax Aspects of Service Documentation

Creating a Clear and Readable Layout

Digital vs. Paper: Advantages and Drawbacks

Customization for Various Business Needs

Errors to Avoid in Receipt Creation

Key Elements to Feature in a Receipt

Include the business name, address, and contact details at the top. The receipt should clearly state the date, a unique transaction number, and a breakdown of the service provided. Specify the cost, taxes, and any applied discounts. The total amount must be easy to locate, ensuring transparency. Add payment details, including method used and confirmation number. If applicable, include warranty terms or return policies. Digital receipts should have clickable links to terms and support contacts.

Legal and Tax Aspects of Service Documentation

Ensure compliance with tax regulations by displaying applicable tax rates and collected amounts. Use legally recognized numbering for proper audit tracking. Retain copies for the required period based on local regulations. When issuing digital receipts, confirm that they meet e-documentation standards. If international transactions are involved, clearly state currency and tax jurisdiction details to prevent disputes.