Every service-based business needs a well-structured service receipt template to document transactions, provide proof of payment, and ensure transparency with clients. A well-designed receipt includes key details that protect both the service provider and the customer.

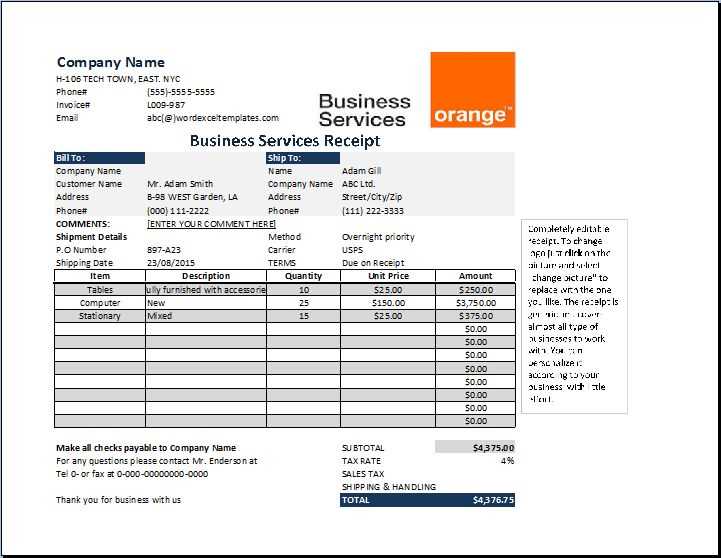

The essential components of a service receipt include:

- Business Information: Company name, address, contact details, and logo.

- Customer Details: Name and contact information of the client.

- Service Description: Clear breakdown of the services provided, including dates and relevant details.

- Pricing: Itemized costs, subtotal, taxes (if applicable), and total amount paid.

- Payment Details: Method of payment, transaction ID, and confirmation of the completed payment.

- Terms and Notes: Any warranties, refund policies, or additional information the client should be aware of.

Using a standardized template ensures consistency, reduces disputes, and enhances professionalism. Digital formats, such as PDFs or editable Word documents, allow easy customization for different business needs. Many businesses integrate automated receipt generation into their invoicing systems for efficiency.

Whether you’re a freelancer, contractor, or small business owner, having a structured receipt template simplifies record-keeping and builds trust with clients. Consider using templates in spreadsheet software or dedicated invoicing tools to streamline the process.

Here’s the revised version with reduced repetitions of the term “Service Receipt”:

To avoid redundancy, consider varying the phrasing when referring to a service transaction. For instance, instead of repeating “service receipt” multiple times, you can interchange it with terms like “transaction confirmation” or “repair acknowledgment.” This keeps the text concise while maintaining clarity.

Example: After the service is complete, the customer receives a repair acknowledgment outlining the performed tasks. The transaction confirmation includes all relevant details like date, costs, and warranty information, ensuring transparency.

Additionally, when mentioning the document, focus on specific sections like the summary of services rendered or the breakdown of charges. This method naturally reduces repetitive use of the term and enhances readability.

Incorporating various synonyms or shifting the phrasing based on the context ensures that the receipt’s meaning remains clear without overusing the same words. It also improves the overall flow of the document, making it more engaging for the reader.

- Service Receipt Template: A Practical Guide

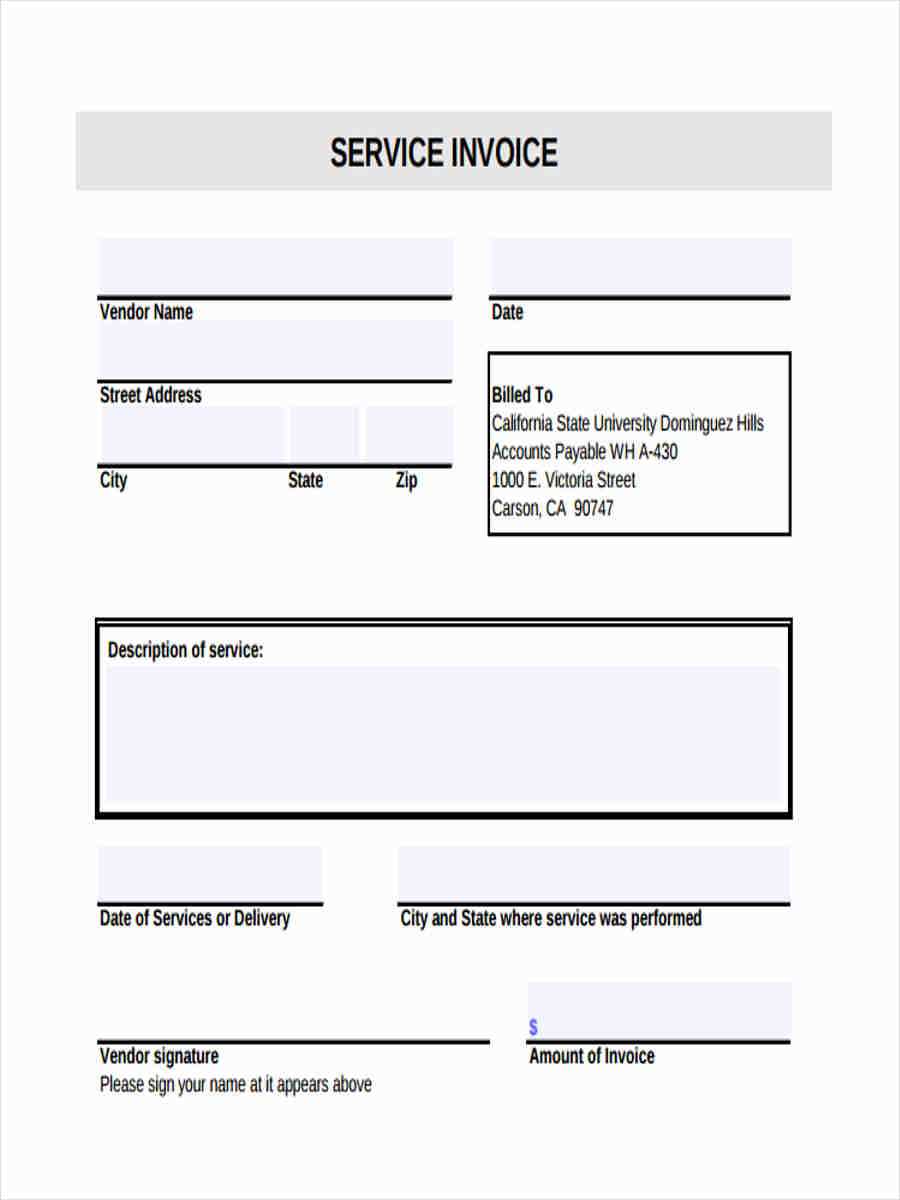

Design a service receipt template that includes all the necessary details for both the service provider and the customer. Follow these steps to ensure clarity and accuracy:

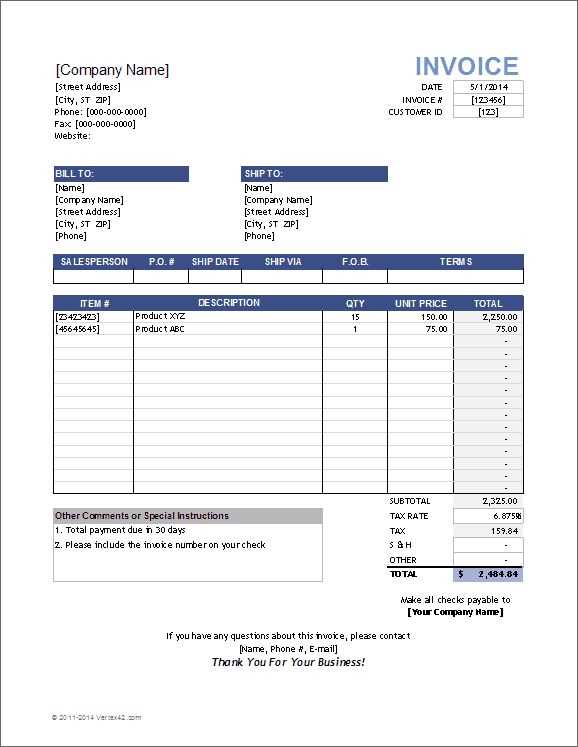

- Header Section: Include your business name, logo, and contact details at the top. This establishes a professional appearance and provides easy access to your information.

- Date and Receipt Number: Always add the date of service and a unique receipt number. This helps with record-keeping and allows for quick reference if needed later.

- Customer Information: Include the customer’s name, address, and contact number. This ensures the receipt is linked to the correct client.

- Service Description: Provide a detailed list of the services rendered. Break down each service with a brief description and the amount charged for transparency.

- Pricing Breakdown: List the price for each service or product separately. If there are any discounts, taxes, or additional fees, include them as line items with their respective amounts.

- Total Amount Due: Clearly show the total amount due at the bottom of the receipt. This is the most important figure and should be easy to locate.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, bank transfer). This helps clarify the transaction and ensures that both parties agree on the payment method.

- Terms and Conditions: Include any relevant terms related to refunds, returns, or warranties, if applicable. This ensures both parties are aware of the rules.

- Signature Line: A space for both the service provider and customer to sign, acknowledging the completion of the service and agreement on payment.

With these elements in place, you can create a service receipt template that’s easy to use, legally sound, and helps avoid confusion down the road.

Begin with the business name and logo. This identifies the seller, making the receipt instantly recognizable. Include the business address, phone number, and email for contact purposes. These details should be easy to find, usually at the top or bottom of the receipt.

Clearly state the transaction date and time. This helps both the buyer and seller track when the exchange occurred. You might also want to add the receipt number for reference in case of future inquiries or returns.

List the items or services purchased. Include a description of each item, the quantity, unit price, and total price for each product or service. This ensures clarity and transparency for both parties.

Show applicable taxes. Specify the tax rate applied to the purchase and the total amount of tax charged. This ensures compliance and helps the buyer understand how the total amount was calculated.

Provide the total amount paid. Make it clear by highlighting the final sum, which should include the subtotal, taxes, and any discounts or additional charges. This avoids confusion and confirms the final payment.

If there were any discounts, list them separately. Whether a promotional discount or a loyalty offer, showing the amount or percentage off helps clarify the final price calculation.

Indicate the method of payment used, such as cash, credit card, or mobile payment. This confirms how the transaction was completed and can be helpful for the buyer’s records.

Include any return or exchange policy. A brief note on the policy gives the buyer information on how to handle any future concerns or issues with the purchased items.

Finally, consider adding a thank you note or a reminder for future promotions. This leaves a positive impression and encourages repeat business.

Use clear headings and subheadings to structure your receipt. This helps both the customer and service provider quickly locate the necessary details. Start by clearly stating the service provided, the date, and any relevant identifiers like service order numbers.

1. Organize Information Logically

- Place service details at the top, followed by itemized charges.

- List payment information clearly at the bottom to avoid confusion.

- Group related information under concise headings, like “Service Provided,” “Charges,” and “Payment.” This keeps everything organized.

2. Be Specific with Dates and Prices

- Always include the exact date of service, and if applicable, the time.

- Break down charges into individual services or items with clear amounts next to each description.

- Specify the total amount due, including any applicable taxes or discounts.

Use straightforward language to prevent any misunderstanding. Avoid jargon or unclear abbreviations, and be precise with each term. Consistency in formatting, like font size or type, creates a professional and readable appearance.

3. Double-Check for Accuracy

- Verify that all amounts are correctly calculated and listed.

- Ensure that service descriptions match exactly what was provided.

- Check for any missing or misplaced details, such as customer names or service dates.

Ensure your receipt includes necessary information like the date, transaction details, and business identification to comply with tax laws. Depending on local tax regulations, receipts may need to reflect specific language, such as itemized costs and taxes collected. Failing to do so could lead to issues with both customers and tax authorities.

If you’re operating in a jurisdiction that mandates tax collection, the receipt should clearly state the tax rate and amount. This will support your ability to report taxes accurately and avoid penalties. For businesses that operate internationally, be aware that tax regulations and receipt requirements vary significantly across borders, so always verify the correct format based on your location.

Store receipts securely for record-keeping purposes. Tax authorities often require businesses to retain receipts for several years in case of audits. Make sure your system allows easy access to these documents for both your business’s financial reporting and legal obligations.

Depending on your local laws, you may be required to issue receipts for every transaction, or only for specific amounts. Stay updated on your local tax authority’s requirements to avoid non-compliance issues.

Decide whether digital or paper format fits your business needs based on convenience, cost, and accessibility. Digital receipts offer instant delivery, saving time for both parties, and are easier to store or retrieve for future reference. They also allow for automatic integration with accounting software, streamlining record-keeping processes.

Paper receipts, on the other hand, remain valuable in certain situations. They are tangible, which some customers prefer, and can serve as a backup if digital systems fail. Paper can also be more reliable for customers who are not tech-savvy or lack access to digital devices.

- Digital Format Advantages:

- Instant delivery to customers via email or SMS

- Simple to store and search digitally

- Easily integrates with accounting systems and inventory management

- Environmentally friendly, reducing paper waste

- Paper Format Advantages:

- Preferred by customers without reliable internet access or digital devices

- Provides a physical record, which some may find more secure

- No reliance on technology or electronic systems

Choose based on customer demographics and how your business handles receipts. A hybrid approach, offering both options, might suit businesses with varied clientele.

Tailoring your service receipt template to fit various service types can enhance clarity and meet customer expectations. Here are a few ways you can adapt it for different services.

1. Specific Service Details

For each service type, ensure the receipt includes the specific service performed. For example, if it’s a car repair service, specify the repairs done, parts replaced, and labor charges. For a cleaning service, list the areas cleaned and the cleaning products used. Providing clear service descriptions minimizes misunderstandings.

2. Pricing Flexibility

Consider offering pricing options based on the scope of the service. For example, a salon could have tiered pricing for different haircuts or styling packages, while a repair shop might have different rates for labor depending on the complexity of the issue. Including detailed pricing options can make your receipt more transparent.

3. Time Tracking

Some services, such as consulting or freelancing, may require you to track the time spent. Include a time log on the receipt, indicating the start and end times for each service segment. This option is particularly valuable for services billed by the hour.

4. Additional Services or Add-Ons

If your service includes optional add-ons, list them separately. For example, a web design service might include optional SEO optimization or additional design elements at extra cost. Make sure the receipt reflects all additional services for transparency.

5. Discounts and Promotions

Incorporate sections for any applied discounts or promotional offers. For instance, a retail store might offer a discount on a service after a purchase, or a spa could apply seasonal promotions. Clearly listing discounts will avoid confusion about the final price.

6. Payment Methods

Specify payment methods used for the service. Whether it’s credit cards, cash, or digital payments, documenting these details ensures clarity for both you and the customer. It’s especially helpful when dealing with multiple forms of payment.

Table Example of a Service Receipt

| Service | Description | Price |

|---|---|---|

| Car Repair | Engine Diagnostic and Replacement of Spark Plugs | $200 |

| Salon Haircut | Basic Cut | $50 |

| Cleaning | Standard Home Cleaning | $100 |

| Discount | 15% off for First-Time Customers | -$15 |

| Total | $335 |

Customizing your service receipts in these ways not only provides detailed information to customers but also improves the professionalism and transparency of your business.

Accurate and clear receipts are a must for both businesses and customers. Here are some common mistakes to avoid:

1. Missing Key Information

Always include the following details: business name, contact information, date of transaction, description of the goods/services, total amount, and payment method. Omitting any of these can lead to confusion and complicate future reference or returns.

2. Unclear or Incorrect Item Descriptions

Provide precise and readable descriptions of the items or services. Generic terms or incomplete details may cause misunderstandings or disputes. Avoid vague wording like “product” or “service”; be specific about what was sold.

3. Inaccurate Pricing

Double-check prices, taxes, and discounts to avoid discrepancies. Ensure that the total matches the sum of individual items, including any applied taxes or promotions. Even small errors can create frustration for both parties.

4. Not Including Payment Method

Record the payment method (cash, credit card, etc.). This helps track financial records and clarify the method of payment in case of a refund or dispute. Missing this information can complicate transactions.

5. Overcrowding the Receipt

Too much information on a receipt can overwhelm the recipient. Stick to the essentials, and avoid unnecessary details that don’t serve a purpose. A clean, organized layout improves readability and reduces confusion.

6. Failure to Include Return/Refund Policy

Customers appreciate clear terms regarding returns or refunds. If you don’t include this on the receipt, it can cause confusion if they need to return an item or inquire about your policy later.

| Common Mistakes | How to Avoid |

|---|---|

| Missing Key Information | Ensure all necessary details are included such as business name, date, total, and payment method. |

| Unclear Item Descriptions | Use specific, clear descriptions for each product or service. |

| Inaccurate Pricing | Verify all prices, taxes, and discounts before finalizing the receipt. |

| Overcrowding the Receipt | Keep the receipt simple, listing only important information in a clear format. |

| Missing Payment Method | Include the payment method used in the transaction. |

| No Return/Refund Policy | Clearly state the return/refund policy on the receipt. |

Service receipt template

Saved meaning, and there are fewer repetitions now. If anything needs adjustment, let me know!

Why Streamline Your Service Receipts?

By reducing redundancy, you enhance clarity and minimize mistakes. A well-organized template ensures you capture the essential details without overwhelming your client or team. This cuts down on confusion and improves overall communication.

Key Elements of a Service Receipt

A basic template should include the following:

- Service Provider Name: Make sure the name of the service provider or business is clearly indicated.

- Client Name: Identifying the client is crucial for accurate record-keeping.

- Date of Service: Always include the exact date the service was provided to avoid ambiguity.

- Itemized List of Services: Provide a detailed breakdown of the services rendered and their costs.

- Total Amount: Clearly state the total cost to ensure no confusion about the final charge.

- Payment Method: Specify how the payment was made, whether by card, cash, or another method.

- Receipt Number: Assign a unique identifier to each receipt for easier tracking.

These elements will ensure your service receipt template is straightforward and easy to understand. Customize it further to match your business needs, but keep it simple enough for the customer to grasp quickly.