A well-structured service receipt confirms payment completion and serves as a critical document for both businesses and customers. To ensure clarity, include key details such as the service provider’s name, customer information, a breakdown of services rendered, the total amount, and a clear “Paid in Full” statement.

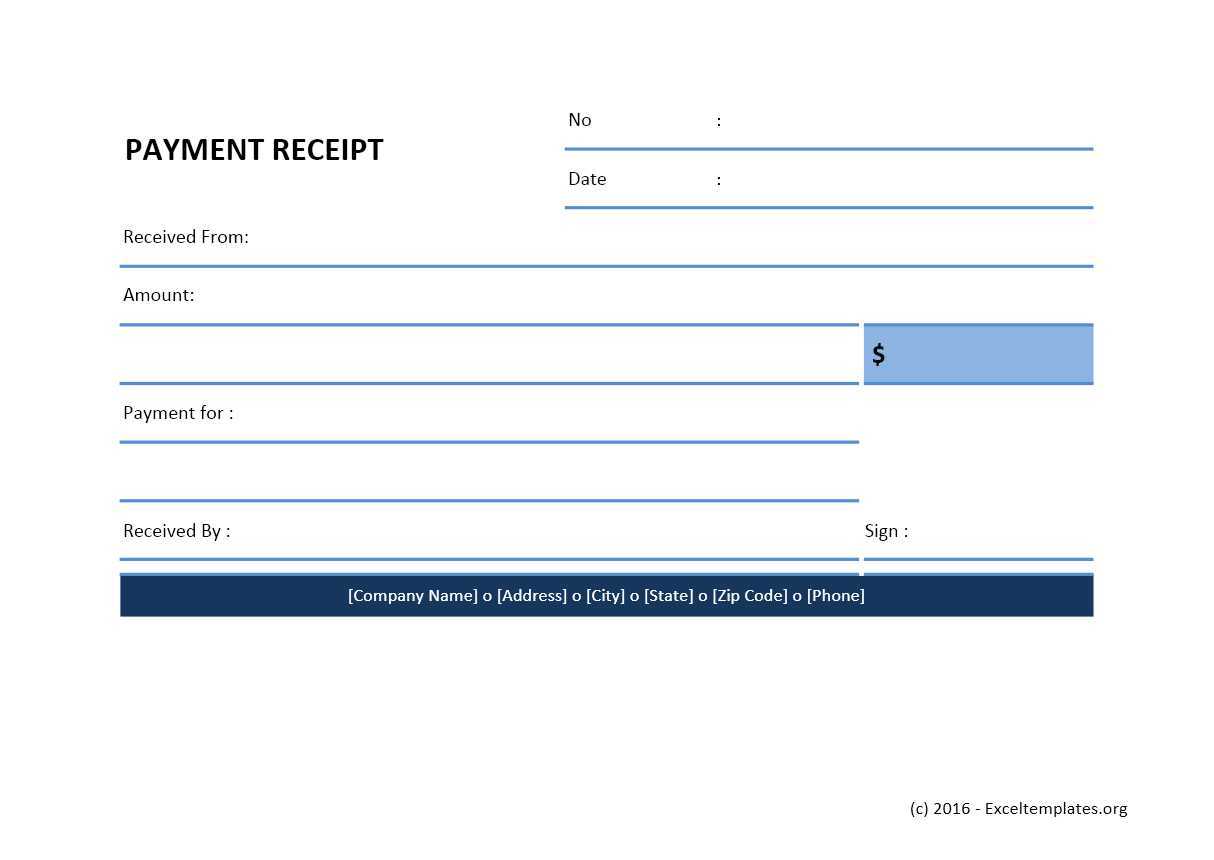

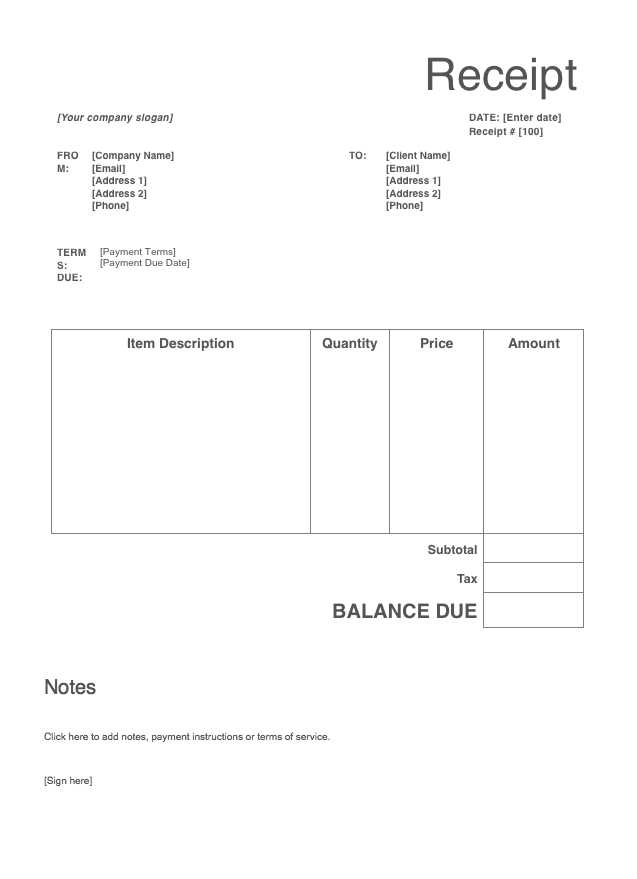

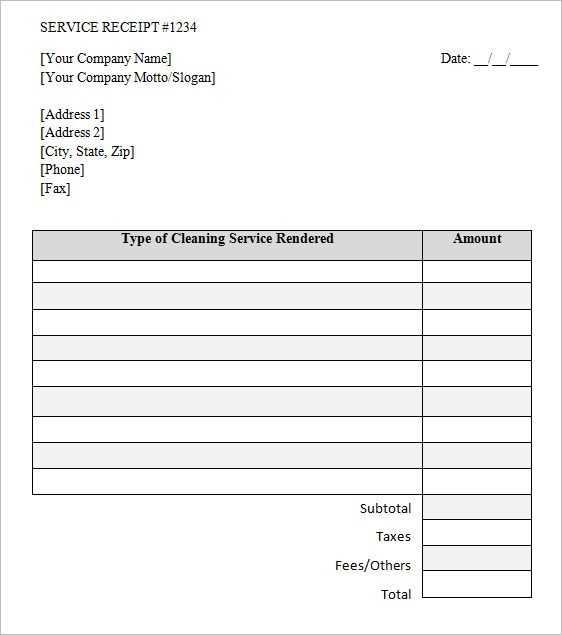

Using a service receipt template simplifies the process, ensuring consistency and professionalism. Choose a format that aligns with your business needs–whether a simple PDF, an editable Word document, or a dynamic Excel sheet with automatic calculations.

For added security, include a unique receipt number, payment method, and date of transaction. If applicable, mention warranty terms or refund policies. Digital signatures or company stamps add credibility and prevent disputes.

A well-prepared receipt not only serves as proof of payment but also strengthens trust between service providers and clients. Ensure accuracy, keep a copy for records, and provide the customer with a digital or printed version for their reference.

Here is the corrected version without redundant repetitions of words:

For a service receipt marked “Paid in Full,” it is important to state payment clearly and concisely. Use the phrase “Paid in Full” only once, and avoid repeating it throughout the document.

Specific changes to make:

- Instead of using “Paid in Full” multiple times, use “Payment received in full” in one clear sentence.

- Focus on other necessary information, such as service details and dates, without repeating the payment status unnecessarily.

- Be concise. If the payment status is already clear in the header, there’s no need to repeat it in the body of the receipt.

By eliminating excess repetition, the receipt will be clearer and more professional.

- Service Receipt Template: Paid in Full

When creating a “Paid in Full” service receipt, clarity is key. Ensure the receipt reflects that the transaction is complete and no further payments are due. This can be done by explicitly stating “Paid in Full” at the top of the document and including details that confirm the transaction was finalized.

Key Elements of a Paid in Full Receipt

- Receipt Title: Start with a clear heading such as “Paid in Full Receipt” or “Receipt for Services Rendered – Paid in Full”.

- Service Details: Include a description of the services provided, including any specific work done or products delivered.

- Payment Information: Clearly note the total amount paid, payment method, and date of payment.

- Paid Status: Add “Paid in Full” to confirm the balance is cleared. This can be placed at the top or next to the amount.

- Receipt Number: Assign a unique receipt number for easy tracking and reference.

- Vendor Information: Include your business name, address, and contact details, ensuring customers can reach you if needed.

Formatting Tips

- Use a professional, readable font and size.

- Ensure there is enough space between sections to avoid clutter.

- If the receipt is issued digitally, make sure it is easily printable and includes the necessary details in an organized manner.

By following these guidelines, your “Paid in Full” service receipt will provide clear, professional confirmation to both you and your customer that the transaction is complete.

A “Paid in Full” receipt serves as clear evidence that a payment has been completed for a specific transaction. It should contain key information to ensure both parties have an accurate record of the payment. Here are the necessary elements:

1. Payment Details

- Amount Paid: Clearly state the total amount the customer has paid.

- Payment Method: Include how the payment was made, whether by cash, credit card, bank transfer, or another method.

- Payment Date: Specify the exact date when the payment was completed.

2. Transaction Information

- Invoice Number: Link the receipt to the relevant invoice or order number for easy reference.

- Service Description: Briefly mention what service or goods the payment covered.

- Payment Status: Clearly state that the balance is “Paid in Full” to avoid confusion about any outstanding amounts.

By including these elements, both the payer and the payee can maintain clear records of the completed transaction, helping prevent any disputes in the future.

Use a structured format that clearly communicates all transaction details. Start with your business name, logo, and contact information at the top for easy identification. This should be followed by the receipt number, date, and payment method for reference.

Include Transaction Details

Break down the transaction into itemized sections. List each product or service, along with the price, quantity, and any applicable taxes. This creates transparency for both the seller and the customer. Add the total amount paid at the bottom, ensuring it’s clear and visible.

Highlight Payment Status

Clearly state whether the payment is “Paid in Full” or “Partial Payment” if applicable. This should be prominently displayed to avoid any confusion. A payment status section helps manage expectations and keeps all parties informed of their financial obligations.

To ensure a paid in full receipt is legally valid, make sure it clearly states that the payment has been completed in full. This protects both parties from future disputes. Always include the payment date, amount, method, and a description of the goods or services provided. Without these details, the receipt may not provide sufficient proof of payment in case of disagreements.

If your business is subject to tax regulations, include any relevant tax information on the receipt. This helps ensure compliance with local laws and provides transparency for both parties. For example, in some jurisdictions, you may need to specify the tax rate or include a tax identification number.

Be cautious about issuing “paid in full” receipts for transactions that may be disputed later. If the payment is tied to a contract or service agreement, make sure the receipt reflects the terms of that agreement. In case of refund requests, a receipt that does not specify the agreement may complicate matters.

For protection, store a copy of all receipts issued, especially for large transactions. This helps with record-keeping and provides evidence should a legal issue arise. Keep digital records of receipts when possible for easier retrieval and to avoid losing important information.

Lastly, consult with a legal expert to ensure your receipt format aligns with local laws, especially in cases involving significant transactions or complex contracts. This will minimize the risk of challenges to the receipt’s legitimacy.

Wave is a highly recommended tool for creating professional receipts. It allows you to customize your receipts, track payments, and even generate invoices, all for free. You can quickly send receipts to clients directly from the software, streamlining the process.

Another great option is Zoho Invoice, which provides a user-friendly interface and customizable templates. With Zoho, you can create and manage receipts in a few clicks, integrate with your accounting systems, and track payment statuses seamlessly.

For those seeking a more comprehensive solution, QuickBooks offers an advanced receipt creation tool that integrates with bookkeeping and accounting features. This software is ideal for small businesses needing a full range of financial management tools, including receipt generation and expense tracking.

- Invoice Ninja: Invoice Ninja offers a free plan that includes customizable receipt templates. It supports multiple languages and currencies, making it a great choice for international businesses.

- FreshBooks: FreshBooks is well-known for its easy-to-use interface and powerful features. With it, you can create receipts in seconds and organize your financial transactions effectively.

- PayPal: PayPal’s receipt tool automatically generates detailed receipts for transactions, making it easy for businesses to provide proof of payment instantly. This is a convenient choice for businesses that already use PayPal for payments.

Each of these tools offers a range of features suitable for businesses of all sizes, ensuring you can create and manage receipts without hassle.

One of the most common mistakes in receipts is failing to include a clear description of the services or products provided. Be specific about what was purchased to avoid confusion later. For instance, instead of listing just “service,” break it down by type, such as “consulting session” or “repair work.” This helps ensure both the seller and the buyer are on the same page.

Another mistake is neglecting to include the payment method. It’s crucial to clearly state whether the payment was made by cash, credit card, or other means. Omitting this detail can cause disputes about the transaction’s nature. Always specify the payment method alongside the total amount paid.

Incorrect or missing dates can also lead to confusion. Make sure to include both the transaction date and the service date. A receipt that only shows one of these can create ambiguity about when the payment was made and when the service was rendered.

Errors in spelling or numerical mistakes, such as incorrect totals or quantities, can invalidate a receipt. Double-check all amounts and figures before finalizing the receipt. It’s a small step that prevents much larger issues in the future.

Lastly, receipts without a clear return or refund policy can create frustration for both the buyer and the seller. Clearly state any terms related to returns, exchanges, or refunds. This sets expectations upfront and can save time if a situation arises where a return is necessary.

| Common Mistake | How to Avoid |

|---|---|

| Unclear service description | Provide specific details about the service or product |

| Missing payment method | Always list the payment method (e.g., cash, card) |

| Incorrect or missing dates | Ensure both the transaction and service dates are included |

| Spelling or numerical errors | Double-check all numbers and words |

| Lack of return policy | State return, exchange, or refund policy clearly |

Printable and digital receipt templates each come with their own strengths and weaknesses. Choosing between the two depends on your needs and preferences.

Printable Receipts

Printable receipt templates provide a tangible, physical record of transactions. They are useful when you need to provide customers with a hard copy for their records or for reimbursement purposes.

| Pros | Cons |

|---|---|

| Physical evidence for customers. | Requires paper and ink, which adds to operating costs. |

| Useful for in-person transactions. | Can be easily lost or damaged. |

| Simple for small businesses without digital infrastructure. | Not easily accessible for customers who prefer digital records. |

Digital Receipts

Digital receipt templates are sent electronically, providing a convenient and eco-friendly option. These templates can be stored in cloud storage, offering easy access and organization.

| Pros | Cons |

|---|---|

| Easy to store and organize without physical space. | Relies on the customer having an internet connection and a device. |

| More eco-friendly, reducing paper waste. | Can be overlooked or deleted by customers if not properly archived. |

| Easy to share via email or messaging platforms. | Security risks related to online storage or sharing. |

Ultimately, the choice depends on your business model and customer preferences. While digital receipts offer convenience and eco-friendliness, printable receipts may still be necessary in specific industries where hard copies are required.

Meaning Is Preserved, and Unnecessary Repetitions Are Removed. This Version Feels More Natural.

Remove redundant phrases that don’t add new information. Instead, focus on clarity and conciseness. When writing a service receipt or any official document, stick to the point without over-explaining. For instance, instead of repeating the total payment amount in every line, mention it once clearly at the bottom.

Streamlining Your Receipt

Be mindful of unnecessary restatements. If the payment is marked as “Paid in Full” at the top, there’s no need to mention it again in the body. It’s enough to confirm once that the transaction is complete. This ensures the document remains clean and easy to read, while keeping all important details intact.

How to Maintain Clarity

Instead of including redundant phrases like “Amount Paid in Full” multiple times, emphasize the key details–such as the date and service provided. Highlight what the customer needs to remember: the transaction is complete, and the receipt serves as proof of payment. This keeps everything clear without unnecessary repetition.