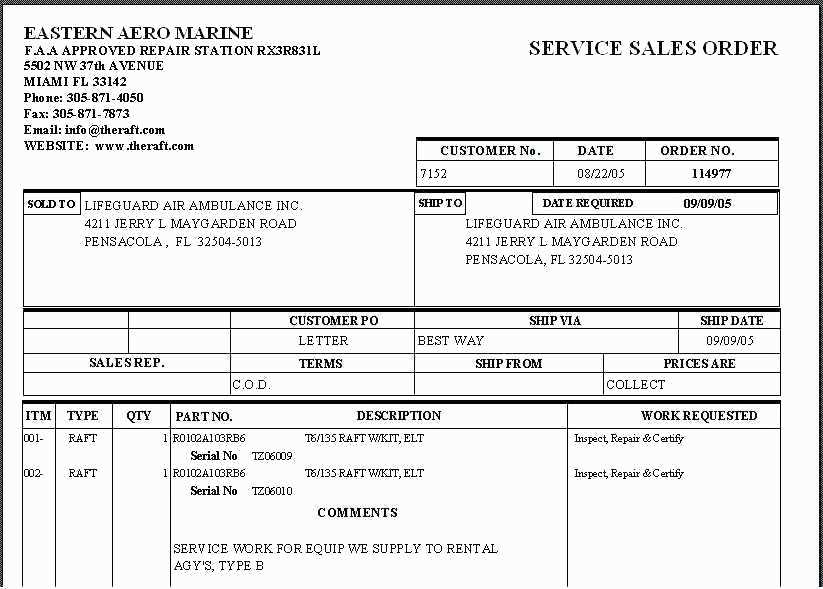

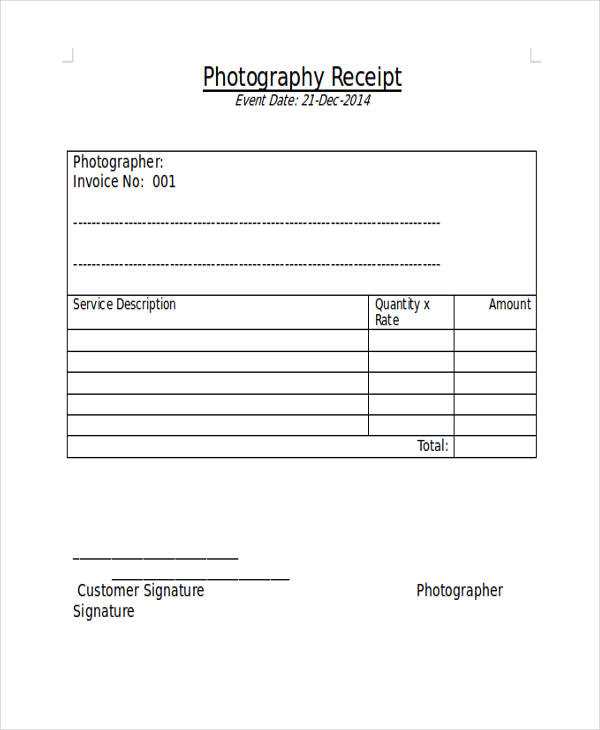

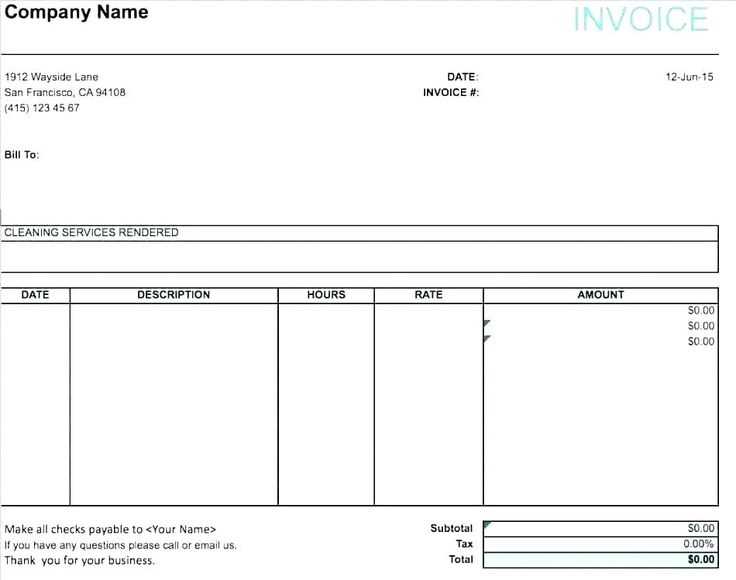

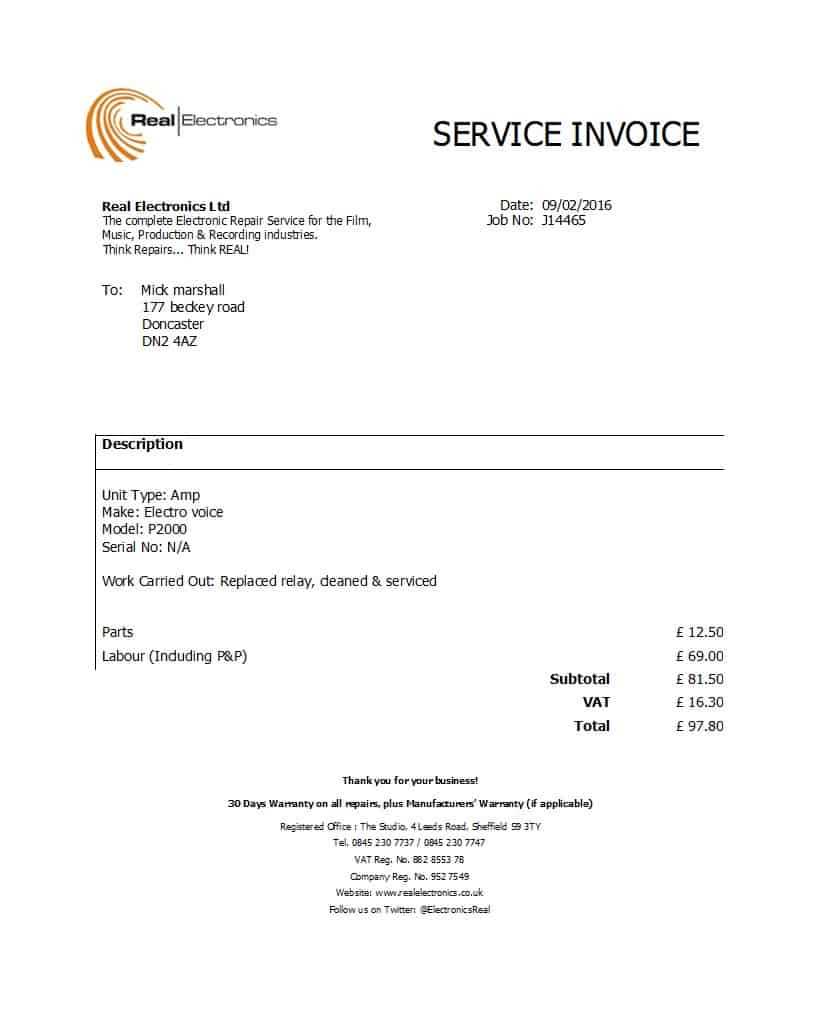

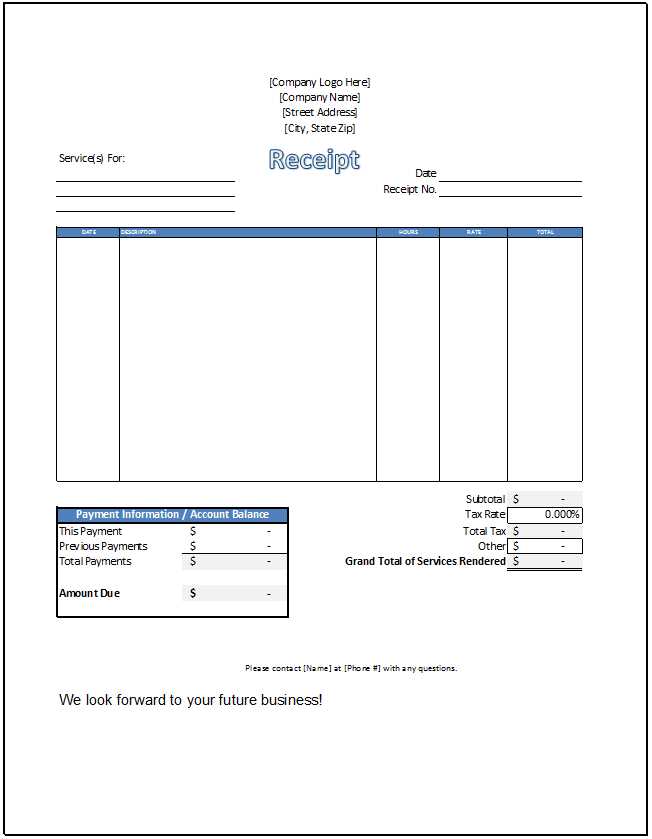

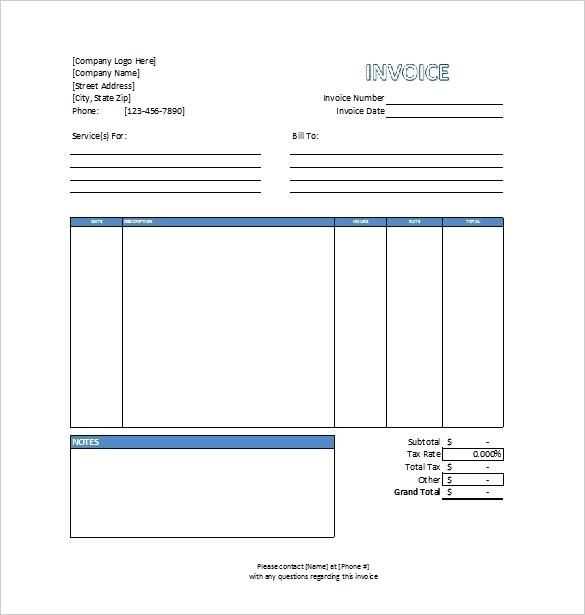

Creating a template receipt for services rendered simplifies the process of documenting transactions between service providers and clients. It should include key details like the date of service, description of services provided, amount charged, payment method, and any relevant terms. This ensures clarity and avoids confusion when both parties need a reference for the transaction.

Specify Service Details: Clearly outline the services provided. This may include a brief description, the quantity of hours worked, or specific tasks completed. Avoid ambiguity to prevent misunderstandings. For example, instead of writing “consulting,” specify “3 hours of business consulting on marketing strategy.”

Payment Information: Include the total amount due, any applicable taxes, and the method of payment (e.g., cash, credit card, bank transfer). If there were any discounts applied, list them separately to ensure transparency.

Terms and Conditions: If relevant, add payment terms, such as the due date for payment, late fees, or refund policies. This helps set clear expectations from the outset, reducing the risk of disputes later.

By following these steps, you create a professional, easy-to-understand receipt template that can be adapted for any service transaction.

Template Receipt for Services Rendered

Creating a clear and professional template for services rendered ensures both parties understand the transaction details. Include the following key elements:

1. Service Description

Clearly outline the services provided, including any relevant details such as scope, duration, and deliverables. Specify if the service was a one-time event or part of an ongoing agreement. Include any specific terms that might apply to the service.

2. Payment Details

State the agreed payment amount and the due date. If applicable, mention any deposit received or discounts applied. Specify the method of payment (e.g., credit card, bank transfer) and include payment terms, such as late fees or early payment discounts.

Be sure to format the receipt neatly, ensuring both parties can reference the terms with ease. Keep a copy for your records and send a copy to the client immediately after the transaction.

Creating a Clear Service Description in Your Template

Be specific about what your service entails. Include the exact tasks or deliverables you are providing. Avoid vague terms like “consulting” or “help” and instead, list concrete actions, such as “site audit,” “software installation,” or “weekly maintenance check.” This makes it easier for both parties to understand what is expected and avoids any misunderstandings.

Set clear time frames for each service. Mention the estimated duration for each task or the total time commitment for the project. For instance, “installation will take approximately 3 hours,” or “the contract covers a 12-month support period.” Clear timeframes help manage expectations.

Use simple, understandable language. Avoid jargon or overly technical terms unless they are necessary for clarity, and even then, define them clearly. The goal is to make sure anyone reading the receipt knows exactly what was done and when.

If applicable, mention any post-service support or follow-up actions. This ensures clients are aware of any ongoing responsibilities or benefits, such as “30-day follow-up for troubleshooting” or “complimentary revisions within 2 weeks.”

Finally, break down any associated costs in relation to the specific service. If different tasks are priced separately, list them with the price for each one. For example, “consultation fee: $100,” and “installation fee: $300.” This increases transparency and avoids confusion regarding billing.

How to Include Payment Terms and Conditions in Your Receipt

Clearly outline the payment terms on your receipt to ensure that both you and your customer are aligned on expectations. Include the payment due date, any penalties for late payments, and accepted payment methods. This transparency helps avoid confusion and ensures prompt payment.

1. State the Payment Due Date

Make it clear when the payment is due. This can be a specific date or a number of days from the receipt date, such as “Due 30 days from issue.” This helps set expectations for both parties.

2. Specify Late Payment Penalties

If applicable, mention any late fees that may be charged if the payment is not received on time. For example, “A 5% fee will be added for payments received after 30 days.” This encourages customers to pay on time.

3. List Accepted Payment Methods

- Bank transfer

- Credit card

- PayPal

- Cash

Providing a list of accepted payment methods ensures your customer knows how to pay and avoids any confusion later.

4. Add Refund or Exchange Policy (if applicable)

If you offer refunds or exchanges, include a brief summary of your policy. For example, “Refunds are available within 15 days of payment with a receipt.” This informs your customer of their rights and responsibilities.

5. Clarify any Discounts or Promotional Offers

If you are offering a discount or promotional deal, state it clearly on the receipt. For instance, “10% discount applied for payments made within 10 days.” This encourages timely payment and shows goodwill.

Ensuring Legal Compliance and Proper Record-Keeping

Ensure your receipts for services rendered meet the legal standards of your jurisdiction. Keep records that are clear, precise, and easily accessible for audits or disputes. Document all relevant details such as service dates, amounts, and terms agreed upon. Double-check that your receipt includes necessary business information, like your company name, address, and tax identification number, if applicable.

Maintain Accurate and Timely Documentation

Regularly update your records. Implement a filing system that organizes receipts by date or client. Avoid delays in recording transactions, as prompt documentation reduces the risk of errors and omissions that could complicate tax filings or legal claims. For digital records, ensure they are properly backed up and secure.

Stay Updated on Local Regulations

Review local laws governing financial transactions and receipts. Regulations can vary significantly, so make sure you’re aware of any specific requirements, such as the need for electronic receipt options or additional disclosures. Seek professional advice if necessary to stay in compliance with tax and business laws.