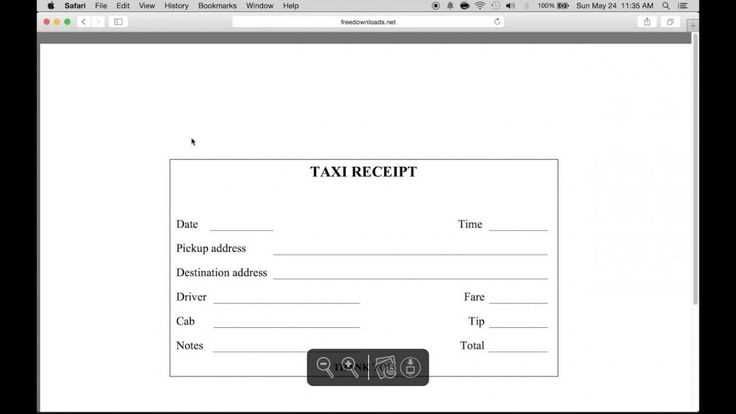

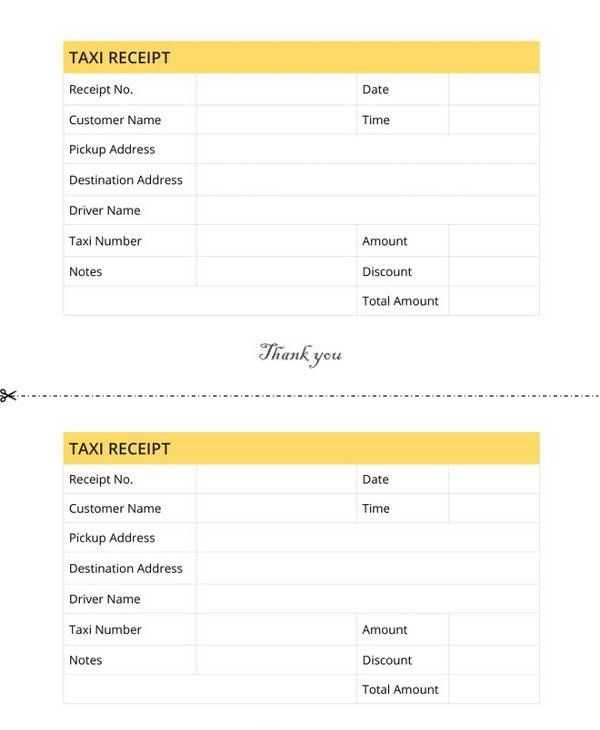

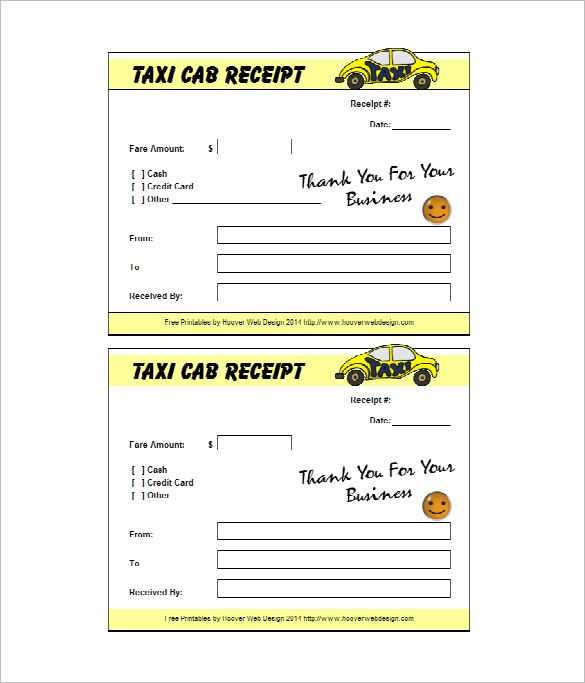

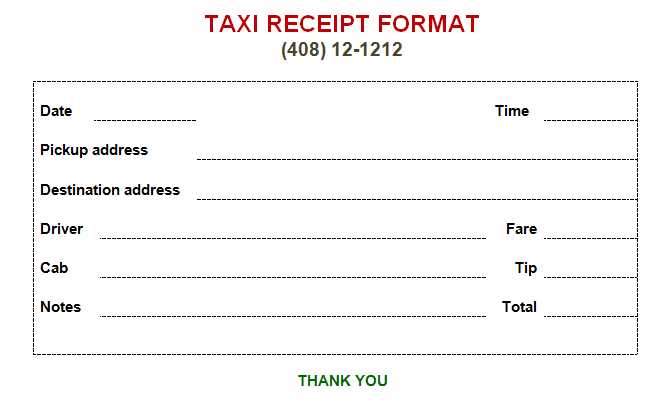

For quick and clear documentation of your taxi ride in Atlanta, using a reliable taxi receipt template is a practical solution. This template simplifies the process of generating receipts, ensuring you capture all the necessary details such as the fare, date, time, and vehicle information. With an organized layout, you can easily keep track of transportation expenses for both personal and business purposes.

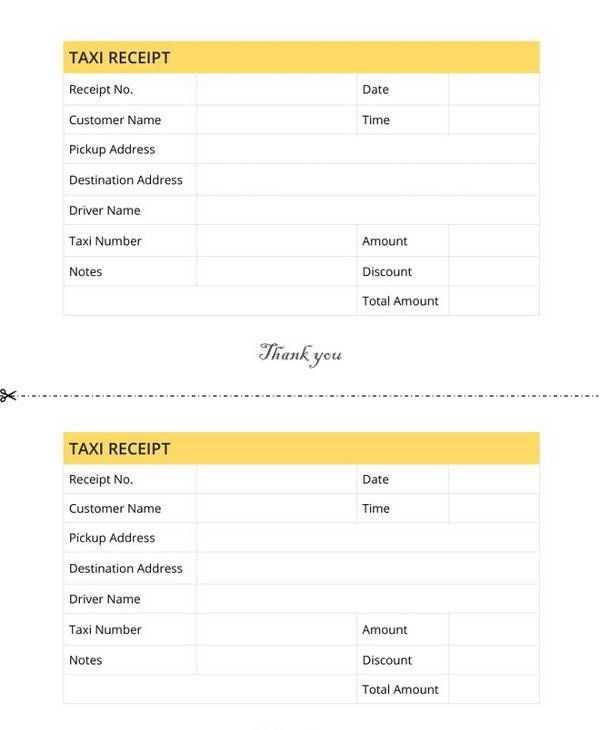

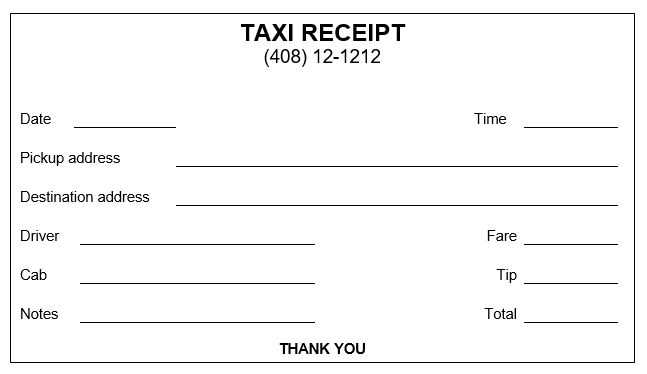

Customize your template to include fields like pickup and drop-off locations, taxi driver’s name, and payment method. Adding these elements creates a comprehensive record for your ride, helping you maintain transparency and accountability in your financial records. Whether you’re a frequent traveler or simply need a receipt for reimbursement, having a template makes it quick to generate professional-looking receipts.

By using a simple yet effective template, you can save time and effort while ensuring all relevant information is accurately documented. Be sure to check the template’s compatibility with your preferred tools, whether it’s for printing or digital storage. With the right template, managing your taxi receipts in Atlanta has never been easier.

Here’s the corrected version based on your requirements:

To create a proper Atlanta taxi receipt template, make sure to include the following key details:

- Taxi Company Information: Include the company name, address, and contact number. This helps the customer easily reach out if needed.

- Receipt Number: Each receipt should have a unique number for tracking purposes. This ensures clarity in case of any disputes or refunds.

- Passenger’s Details: Add the passenger’s name and contact information, especially for corporate rides or special requests.

- Taxi Details: Include the vehicle’s license plate number and the driver’s ID or name for verification and safety purposes.

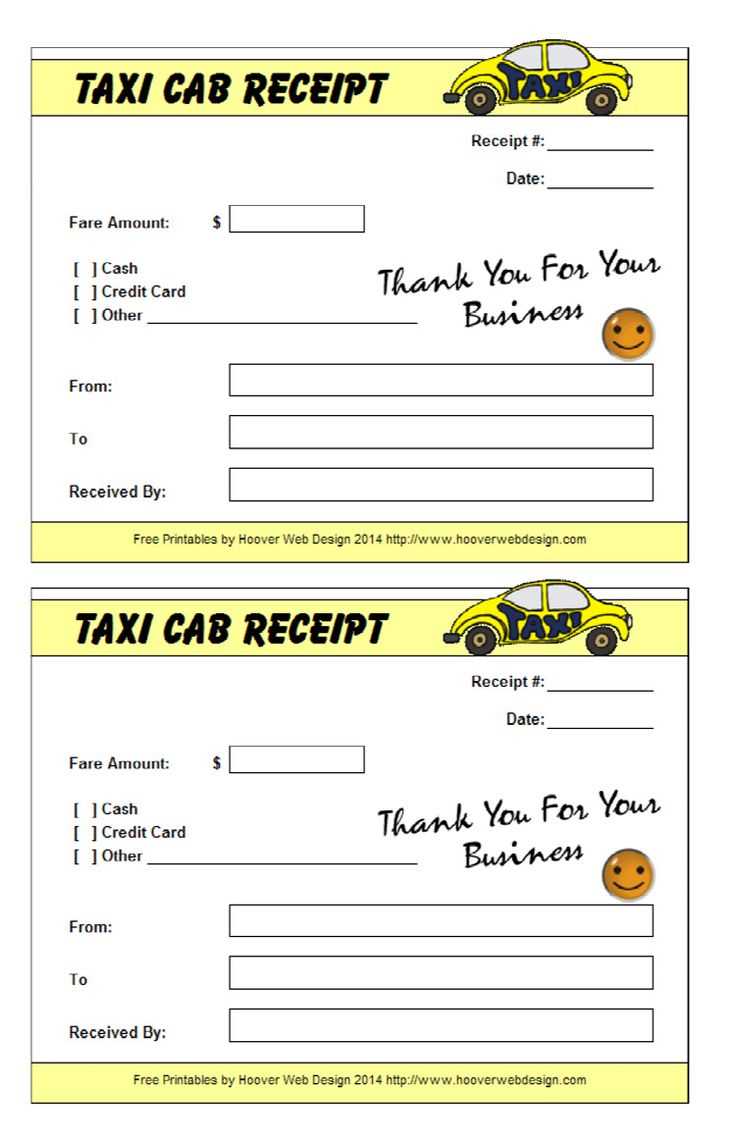

- Fare Breakdown: List the base fare, any additional charges (e.g., tolls, surcharges), and the total amount paid. Transparency is key.

- Trip Information: Specify the date, time, pick-up, and drop-off locations. This ensures the receipt reflects the correct details of the journey.

- Payment Method: Indicate how the fare was paid (cash, card, etc.). Include the last four digits of the card number if applicable.

- Tax Information: Make sure to show any applicable taxes and how they were calculated.

Ensure the template is clear, professional, and easy to read, with a layout that highlights the most important information. Keep the design simple and functional, without overcrowding it with unnecessary details. It helps both the driver and passenger to reference key information quickly if needed.

- Atlanta Taxi Receipt Template: A Practical Guide

To create an Atlanta taxi receipt, ensure it includes key elements that comply with city standards. These details help passengers verify fare charges and support any claims or reimbursements. Start with a clear header that includes the taxi company’s name and contact information. This is followed by the date and time of the ride, which establishes when the trip occurred.

Next, list the pickup and drop-off locations. This is essential for transparency and any disputes. Include the total fare amount and break down the fare, such as base rate, additional charges (e.g., tolls or surcharges), and tips. Each component should be clearly itemized to avoid confusion.

Incorporate a unique ride identification number to track the transaction, which adds a layer of accountability. Also, provide the driver’s name or ID number for reference. Make sure the receipt is legible and printed on high-quality paper to prevent fading over time.

If the ride includes any discounts or promotional offers, detail them clearly so passengers can see how they affected the final fare. Include payment method details, such as credit card type or cash, to cover all payment options available during the ride.

Finally, conclude the receipt with a polite note of thanks or an invitation to leave feedback, showing attention to customer service. These elements, properly formatted and clear, ensure both passengers and drivers are on the same page and help avoid issues down the line.

Customizing your taxi receipt in Atlanta requires a few straightforward adjustments to ensure it meets your specific needs, whether personal or business-related. The key is including relevant details that can be quickly referenced, tracked, or submitted for reimbursement or tax purposes.

Personal Use Customization

For personal use, focus on the basic components of the receipt, such as the date, time, and fare breakdown. Ensure the taxi number and driver’s name are included for easy identification. If you’re tracking transportation expenses for personal reference, adding a section for payment method (cash, card, etc.) can be helpful. Many taxi services offer receipts via email, so it’s also beneficial to include your email address for a digital copy.

Business Use Customization

For business purposes, your taxi receipt must provide more detailed information. This includes not only the fare and payment method but also the starting and ending addresses for the trip. Adding a field for the purpose of the trip (e.g., “business meeting,” “client visit”) makes it easy to track expenses for tax deductions or reimbursements. Include your company’s name and contact details if possible, as well as any custom identifiers that can be linked back to specific projects or employees. For businesses with multiple employees using taxi services, integrating a unique employee ID or department code can further streamline expense reporting.

Customize your receipt format to include your business logo or branding for a more professional appearance. Depending on the software or service you’re using to generate receipts, consider creating templates that automatically fill in information like dates, addresses, and payment methods to minimize errors and save time.

To ensure your taxi receipt complies with local regulations and provides complete information to customers, follow these steps:

1. Include Business Information: At the top of the receipt, list your business name, address, and contact details. This information ensures customers can identify the service provider. In Georgia, it’s important to add your state-issued business license number if required.

2. Add Legal Disclaimers: Insert legal disclaimers regarding the service. For example, “Prices are subject to change without notice” or any local taxes that apply to the service. Ensure this statement is visible but not overwhelming, and it complies with local laws.

3. Incorporate Tax Information: Include the total amount of tax applied to the fare. You can display this as a separate line item, such as “Sales Tax (X%)”. This line item should be accompanied by the percentage and the total tax amount, clearly distinguishing it from the fare total.

4. Detail the Fare Breakdown: If applicable, show a detailed breakdown of the fare components (base fare, distance, waiting time, etc.). This transparency helps your customer understand how the final total is calculated and ensures compliance with local fare regulations.

5. Use Correct Tax Rates: Ensure you use the correct tax rate applicable in your area. The standard tax rate in Atlanta for services may differ from other regions, so check with local authorities or consult a tax professional to determine the exact rate to apply.

6. Display License or Permit Number: If your business is required to display a specific permit or license number, include it on the receipt. This can be crucial in regions where taxi services must be regulated or licensed to operate legally.

| Description | Amount |

|---|---|

| Base Fare | $10.00 |

| Distance Charge | $5.00 |

| Waiting Time | $2.50 |

| Sales Tax (8%) | $1.50 |

| Total Fare | $19.00 |

7. Provide Payment Method Information: Record the payment method used (cash, credit card, etc.), which helps track transactions and ensures customers can easily reference the payment method used for future inquiries or disputes.

8. Include a Statement of Compliance: Depending on local laws, you may need to state that your service is licensed or that the transaction follows local transportation laws. A simple statement like “Service complies with Atlanta Taxi Regulations” can be useful.

By following these steps, you will create a taxi receipt that not only looks professional but also adheres to legal standards, providing transparency to both your customers and the authorities.

To guarantee that your taxi receipt template integrates seamlessly with accounting software, follow these key steps:

1. Stick to Standardized Formats

- Use common file formats like CSV, PDF, or XML, which are widely supported by most accounting tools.

- Ensure that your data structure aligns with the typical data fields required by accounting software, such as date, amount, and payment method.

2. Include Consistent Data Fields

- Ensure your template includes the necessary fields like date, passenger details, fare breakdown, and taxes.

- Verify that the format of numeric data (e.g., fare, tax, total) matches the software’s requirements, such as decimal points or currency symbols.

3. Utilize Clear Labeling

- Clearly label each data field (e.g., “Total Fare,” “Tip,” “Payment Method”) to avoid confusion when imported into the software.

- Use consistent naming conventions that match the categories in your accounting software for easy mapping during imports.

4. Test Compatibility

- Before finalizing the template, test it with your accounting software to ensure accurate data transfer without errors.

- Check that the software recognizes and processes the imported data without issues, particularly in terms of tax calculation and categorization.

5. Automate Import Process

- If possible, automate the import process by setting up a template that matches your accounting software’s import specifications.

- Use scripts or integration tools to ensure your receipt data flows directly into your financial records without manual intervention.

By following these guidelines, you can ensure that your taxi receipt template is fully compatible with accounting software, streamlining your financial management process.

Key Elements of an Atlanta Taxi Receipt Template

Focus on including the following details to create a functional and clear taxi receipt template for Atlanta:

- Taxi Company Information: Include the company’s name, address, and phone number for easy reference.

- Driver Details: Add the driver’s name and ID number to ensure accountability and transparency.

- Date and Time of Service: Specify the date and exact time of the ride to avoid any confusion about the service provided.

- Pickup and Drop-off Locations: Clearly indicate the starting and ending points of the trip, as well as any intermediate stops.

- Fare Breakdown: List the fare, including base rate, distance charge, time charge, and any additional fees (e.g., tolls, surcharges).

- Payment Method: Indicate how the payment was made (cash, credit card, or mobile payment) and include the transaction details if available.

- Tax Information: Include any relevant taxes applied to the fare to comply with local regulations.

- Receipt Number: Assign a unique receipt number for easy tracking and reference in case of disputes or inquiries.

Including these elements ensures the receipt is complete and provides all necessary details for both the passenger and taxi service provider.