When creating a German taxi receipt, accuracy in detailing the fare and service information is key. The format typically includes important elements such as the driver’s details, company information, and the fare breakdown. Make sure to include a unique identification number for each receipt to avoid confusion and to maintain clear records for both customers and businesses.

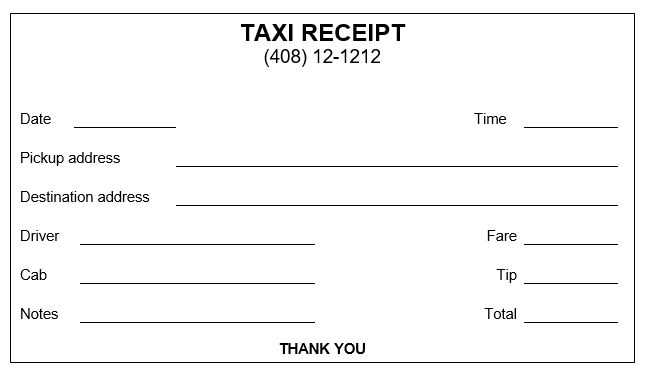

Each receipt should specify the total fare, broken down into base fare, additional charges, and any applicable taxes. In Germany, this is essential for compliance with local tax laws, as customers may need to submit receipts for expense claims. Include the time and date of the ride, as well as the pickup and drop-off locations, to provide transparency to the customer.

Don’t forget to include the driver’s contact details and license number. These details not only enhance customer trust but also serve as a reference point in case of disputes. Be sure to format the receipt clearly, making the information easy to read and easy for customers to understand, with a professional design that aligns with German tax regulations.

Here is the corrected version:

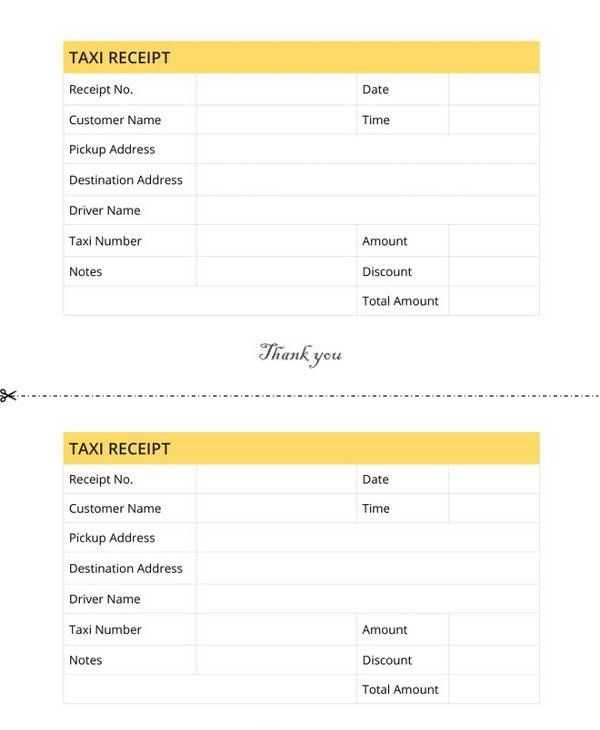

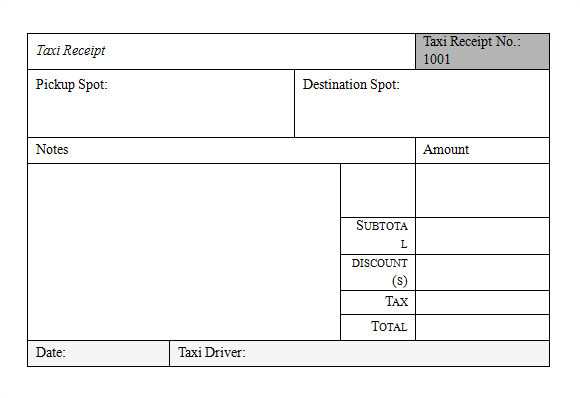

Ensure the template includes all necessary fields such as the taxi service provider’s name, vehicle details, and driver information. The date and time of the trip should be clearly stated, along with the total fare and any additional fees. Include a unique receipt number for easy tracking.

Key Elements of the Template

List the following items in a structured format: the departure and arrival addresses, distance traveled, and the payment method used. Add a field for tips, if applicable, and a breakdown of taxes, if required by local regulations. Clearly indicate the final total, which should match the payment amount.

Formatting Tips

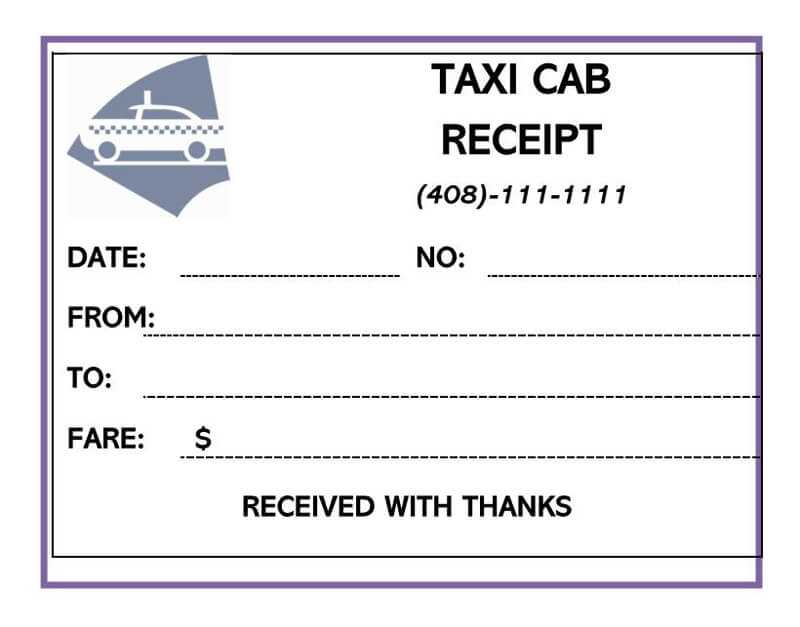

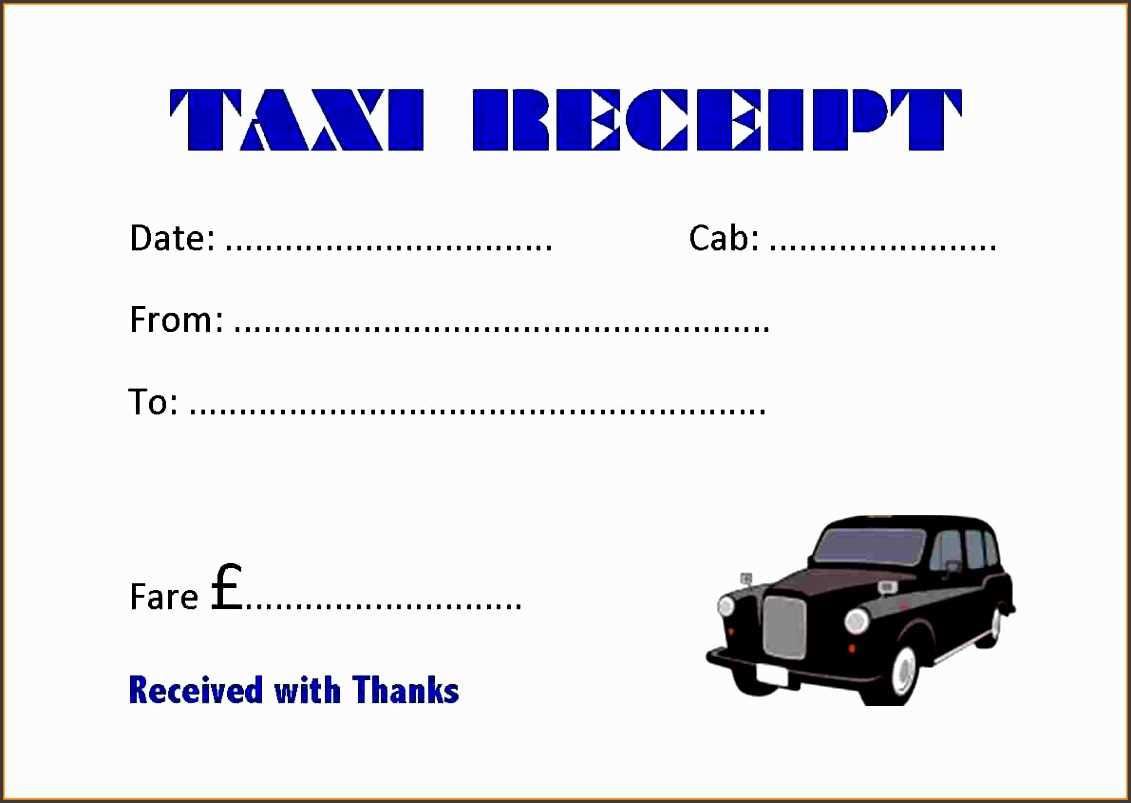

Keep the layout simple and readable. Use clear fonts and enough spacing between sections. Avoid unnecessary elements that can clutter the receipt. Ensure the company logo and contact details are visible at the top for easy identification.

German Taxi Receipt Template Overview

Creating a Simple Taxi Receipt Format

Essential Details to Include on Receipts

Designing a Clear Layout for Receipts

Incorporating Legal and Tax Information for Germany

Tailoring the Template for Business Purposes

Practical Advice for Taxi Receipt Usage

A well-organized taxi receipt plays a crucial role in providing clear and necessary information to the customer while meeting legal requirements. A simple, structured format can enhance both user experience and business credibility.

Creating a Simple Taxi Receipt Format

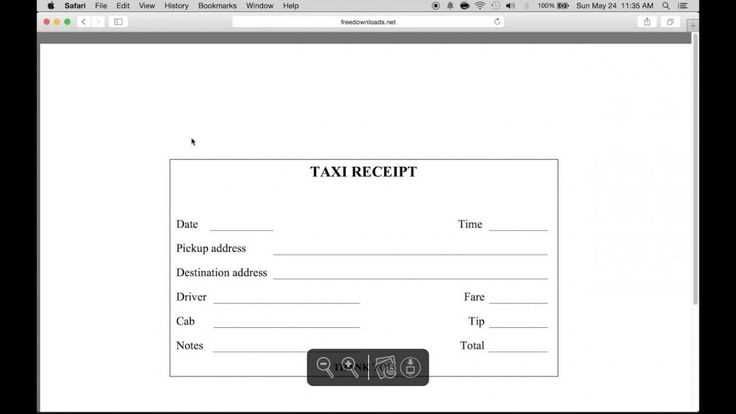

The receipt should be easy to read and organized. Start with the taxi company name, address, and contact details at the top. Include a unique receipt number and date of issue for tracking purposes. Below this, list the journey details such as pick-up location, drop-off destination, date and time, as well as the fare charged. Finally, the total cost should be displayed clearly at the bottom, with a breakdown of any applicable taxes or surcharges.

Incorporating Legal and Tax Information for Germany

German taxi receipts must comply with tax regulations. Ensure the receipt includes the VAT number, as taxi services are subject to VAT in Germany. If the customer is eligible for a tax refund, provide a space for them to enter any necessary refund details. Also, consider adding a note indicating the VAT rate applied (usually 19%) and whether the charge includes it.

For business purposes, tailor your template by including fields for business use, such as customer identification or company name if applicable. This can simplify expense reporting for clients who need to submit receipts for reimbursement.

Clear, professional taxi receipts will ensure both customers and businesses comply with regulations while maintaining a smooth transaction process. The template should allow easy customization for different pricing structures and tax scenarios.