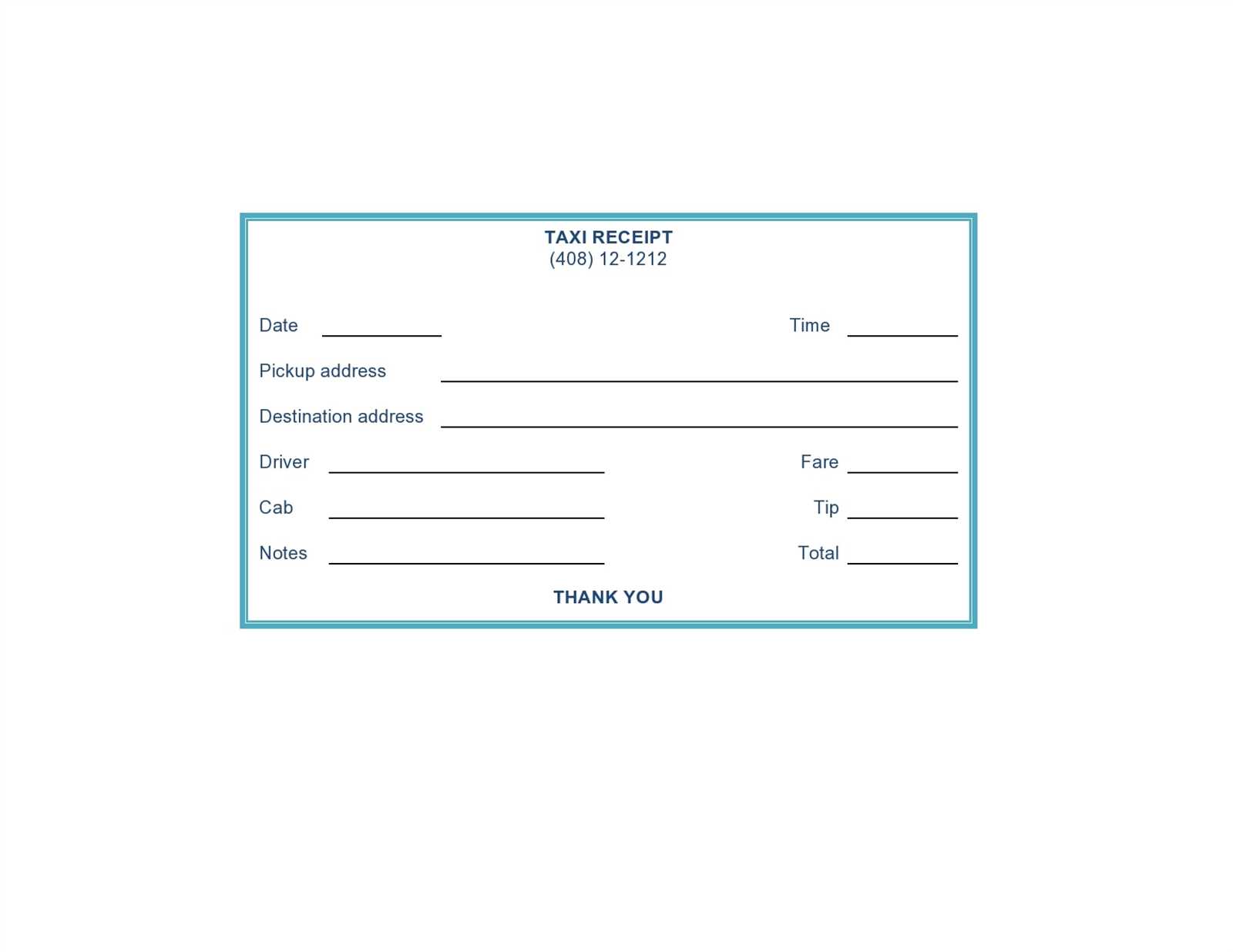

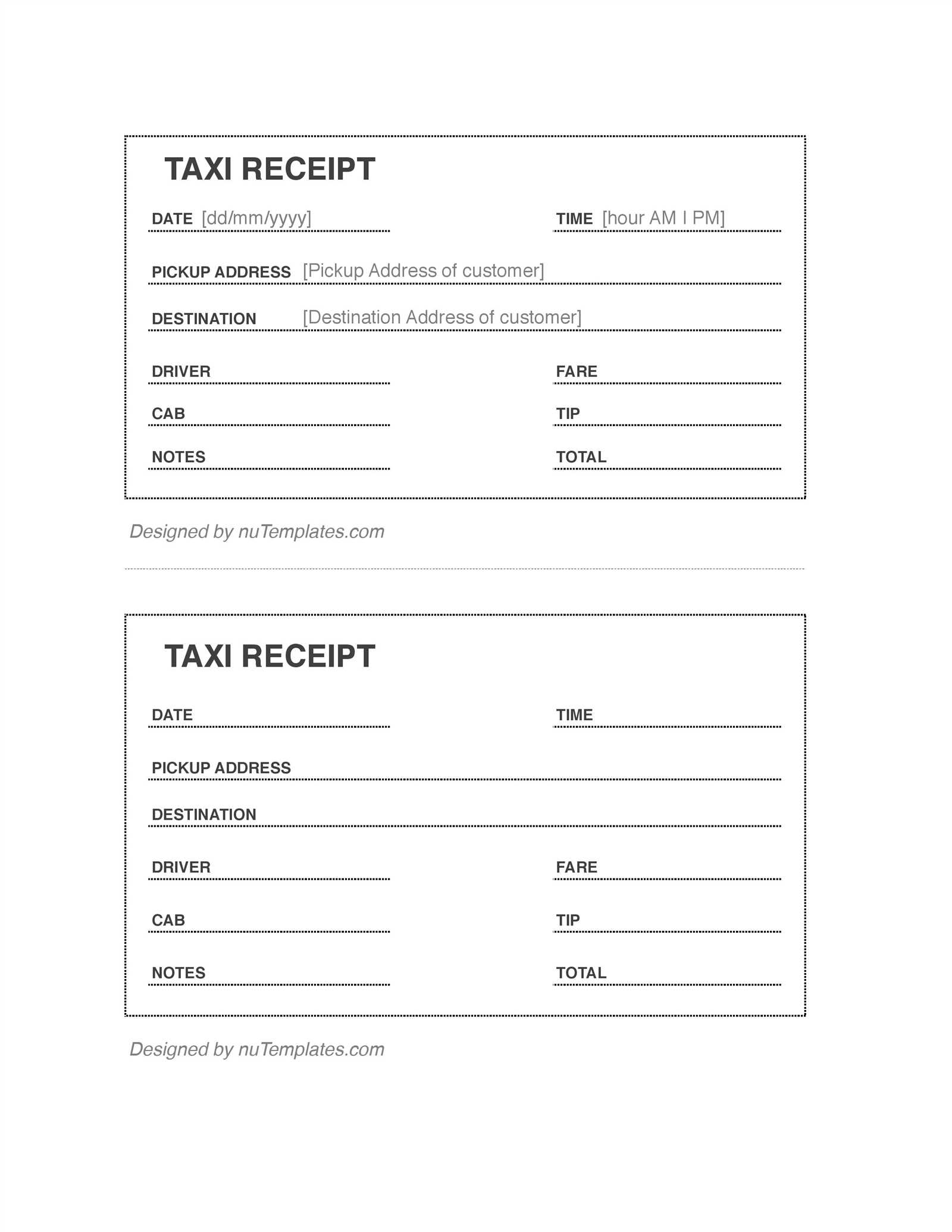

To create a clear and organized taxi receipt, start with a simple and structured layout. Begin with the taxi company name, clearly positioned at the top. Include the license number of the taxi, so customers can easily identify the service. This is especially helpful for both legal and customer support purposes.

Next, add the date and time of the ride, alongside the pickup and drop-off locations. Providing these details not only increases transparency but also allows the passenger to quickly verify the information. Make sure the ride duration or total distance covered is included, either in minutes or kilometers.

Include a fare breakdown to clearly display the charges. This could include the base fare, additional charges (like tolls or airport fees), and the total fare. A payment method section should be included at the bottom, listing whether the payment was made via cash, credit card, or another method. This adds a layer of clarity to the transaction.

End the receipt with a customer service contact section, including an email or phone number for any questions or concerns. This demonstrates professionalism and ensures customers can easily reach out for any issues related to their ride.

Here’s the corrected version:

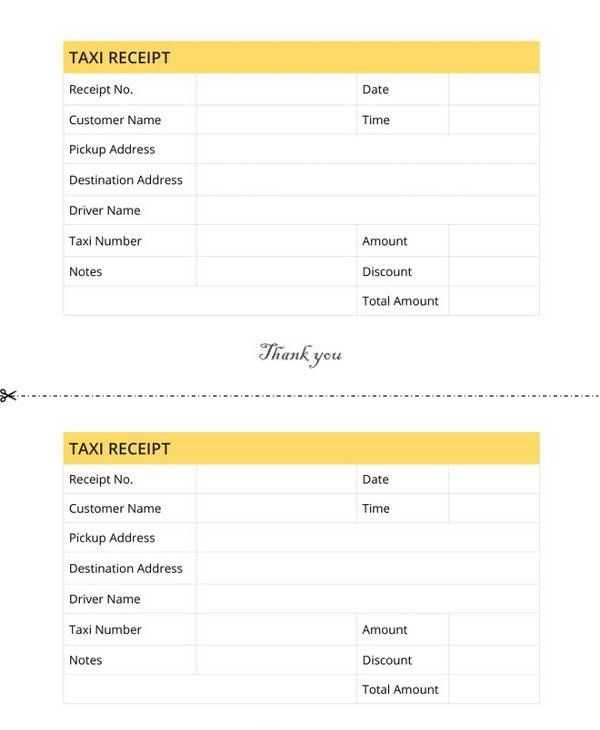

Ensure your taxi receipt includes clear information about the ride. The essential details are the date, time, pick-up and drop-off locations, and the total fare. These pieces of information provide transparency and help both the passenger and driver keep track of the transaction.

Passenger details: Always include the name of the passenger or at least a reference number for easy identification. This helps in case of disputes or lost receipts.

Fare breakdown: Make the fare structure visible, such as base fare, distance traveled, surcharges (if applicable), and any tips included. This makes the receipt understandable and avoids confusion.

Driver information: Include the driver’s name and license number for accountability. A unique taxi ID can also be added for additional traceability.

Payment method: Clearly show whether the ride was paid in cash or via card. If paid by card, note the transaction or reference number.

Tax information: If required, provide VAT or other applicable taxes. This is particularly relevant for business trips where the passenger might need the receipt for expense claims.

Legibility: Ensure the text is clear and legible. A well-organized receipt is much easier to process and store for future reference.

Taxi Receipt Template

How to Create a Simple and Customizable Template for Taxi Receipts

Key Information to Include in a Taxi Receipt Document

How to Use Taxi Receipt Templates for Tax and Accounting Purposes

To create an efficient taxi receipt template, focus on simplicity and clarity. Include the following key details:

Key Information to Include in a Taxi Receipt Document

Each taxi receipt should include the following essential data:

- Taxi Company Name – The business name for easy identification.

- Driver’s Name – Helps identify the driver for any follow-up needs.

- License Plate Number – Key for verifying the vehicle.

- Trip Date and Time – Documents the time the service was provided.

- Pickup and Drop-off Locations – Specify the origin and destination addresses.

- Distance Traveled – Useful for confirming the length of the ride.

- Total Fare – Include a breakdown of charges (base fare, additional fees, etc.).

- Payment Method – Indicate whether payment was made by cash, card, or another method.

- Tax Information – If applicable, include tax rates and total tax paid.

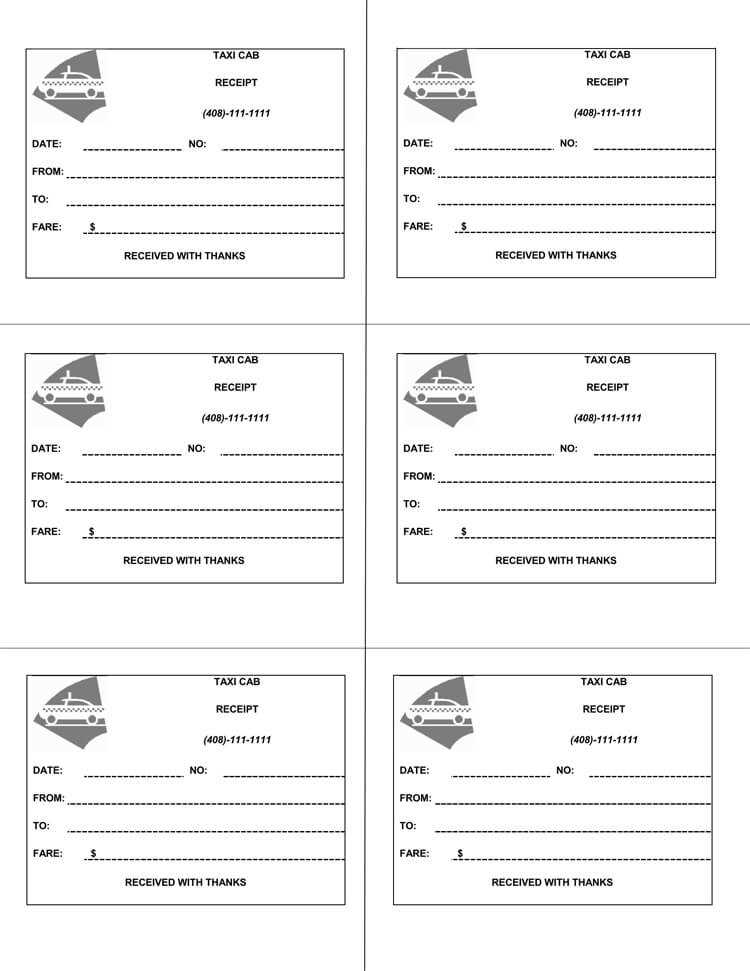

How to Use Taxi Receipt Templates for Tax and Accounting Purposes

Taxi receipt templates are valuable tools for both drivers and customers during tax season. Drivers can use these receipts to document income and expenses, while customers can submit them for business-related reimbursements. Make sure to store receipts systematically to avoid confusion when referencing past trips. Keep copies for your own records, especially for trips that involve business-related travel, as they might be deductible.