Need a clear and professional taxi receipt? Whether for business reimbursements or personal records, a well-structured receipt ensures transparency and accuracy. In the Philippines, an official receipt typically includes key details such as the driver’s name, plate number, fare breakdown, and tax identification number (TIN), especially when used for corporate claims.

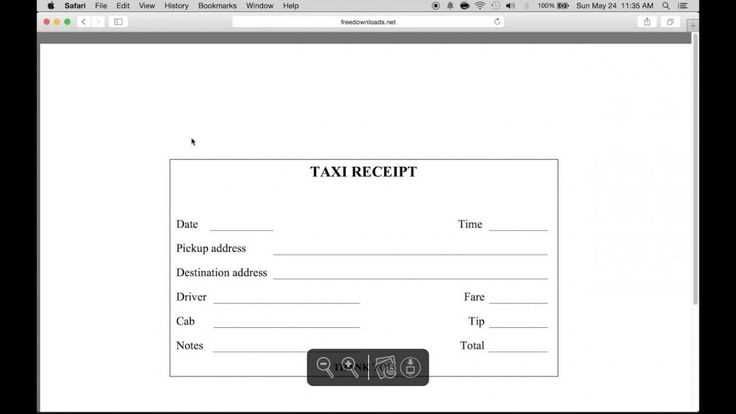

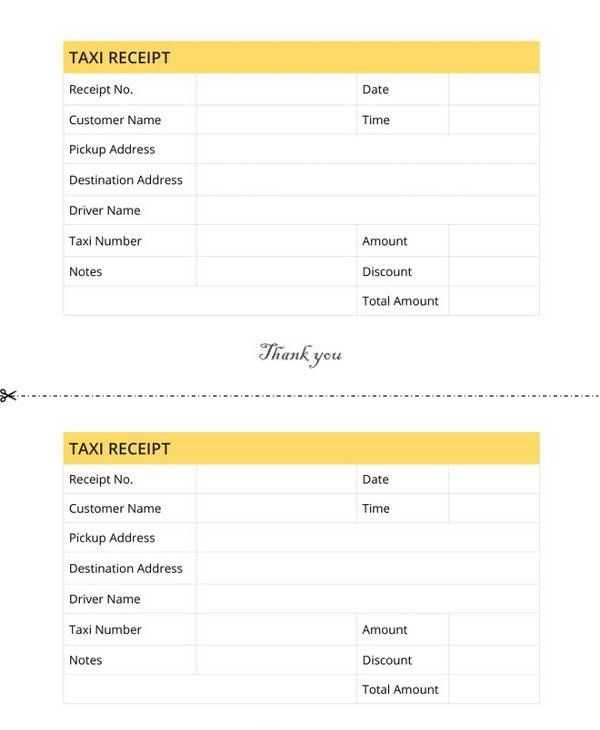

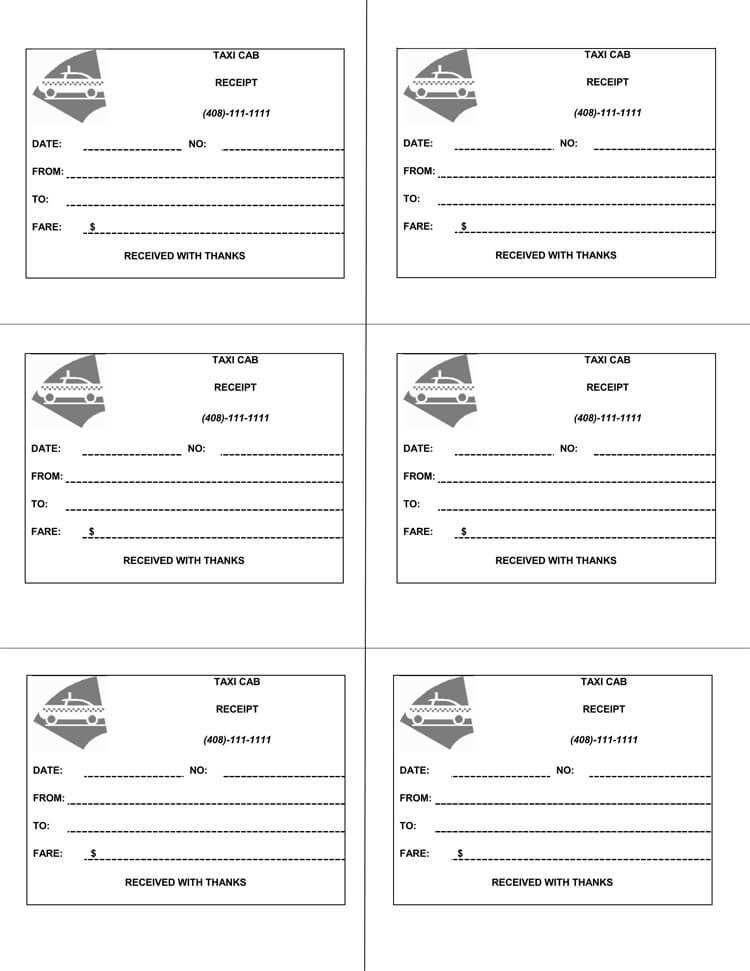

What should a proper template contain? At a minimum, it must display the date, time, pickup and drop-off locations, fare calculation, and applicable taxes. If the receipt is issued for business purposes, it should also feature a company logo and official receipt number for compliance with local regulations.

For digital receipts, many ride-hailing apps provide automated invoices, but traditional taxis may still rely on handwritten or printed forms. A well-designed template ensures consistency, making it easier for passengers and businesses to track expenses accurately.

Here is the corrected version without redundant repetitions of words:

For a well-structured taxi receipt template in the Philippines, focus on clarity and organization. Each section should serve a clear purpose and avoid unnecessary overlap. Begin with the essential details, then move to itemized charges.

Key Elements of a Taxi Receipt:

- Taxi Name and Contact: Include the taxi service name and a contact number at the top.

- Date and Time: Clearly state the date and time of the ride.

- Pick-up and Drop-off Locations: Provide the starting and ending addresses of the ride.

- Fare Breakdown: List each charge, such as base fare, distance, and any surcharges.

- Total Amount: Clearly display the total charge at the bottom of the receipt.

Formatting Tips:

- Ensure the text is legible with appropriate font size and spacing.

- Avoid using decorative fonts or excessive bold/italics that may distract from the key details.

- Use a simple and consistent layout to maintain readability across all receipts.

- Taxi Receipt Template in the Philippines

For a valid taxi receipt in the Philippines, ensure it includes the following key details:

- Taxi company name and logo

- Driver’s name and identification number

- Taxi registration number

- Fare breakdown: base fare, distance charge, waiting time, and any additional charges

- Date and time of the ride

- Pickup and drop-off locations

- Payment method (cash, credit/debit card)

- Receipt number for tracking purposes

Ensure the template adheres to the requirements set by the Land Transportation Franchising and Regulatory Board (LTFRB) to maintain consistency and transparency in fare reporting. This will help you avoid confusion and ensure accountability in the transaction.

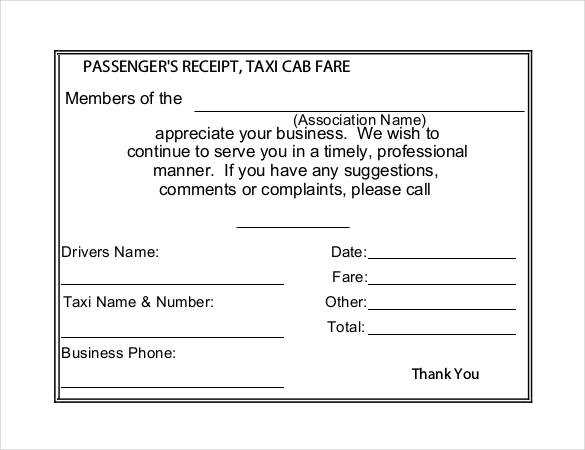

A fare document should clearly display relevant details for both the passenger and the driver. Below are the key elements that should be included:

- Passenger’s Information: Full name and contact details should be provided. This ensures any follow-up or issues can be addressed promptly.

- Driver’s Information: The driver’s name, vehicle details, and contact number are essential for transparency and accountability.

- Taxi Details: Vehicle registration number, model, and license number should be visible. These confirm the legitimacy of the ride.

- Fare Breakdown: A clear breakdown of charges–base fare, distance, time, and any additional fees–should be listed.

- Date and Time: The exact time and date of the ride ensure accurate record-keeping and prevent disputes over fare discrepancies.

- Route Taken: Some fare documents include the route for reference, especially if the distance seems unusually long or short.

- Payment Method: This includes cash, card, or mobile payment options, with a transaction number if applicable.

- Tax Information: Any applicable taxes or government-imposed charges should be outlined to comply with local regulations.

- Receipt Number: Unique receipt numbers should be assigned to each transaction for easy tracking and reference.

By including these elements, a fare document becomes a reliable and transparent record of the transaction for both the passenger and driver.

Taxi receipts in the Philippines must comply with specific regulations to ensure legal validity and transparency. The Bureau of Internal Revenue (BIR) mandates that taxi operators issue official receipts for all transactions. This includes the inclusion of essential details such as the driver’s name, the vehicle’s plate number, the fare amount, and the date of service. It’s critical that the receipt also reflects the correct VAT and withholding tax, if applicable, in accordance with BIR standards.

Key Requirements

Every taxi receipt must feature the following elements: the BIR-issued Tax Identification Number (TIN) of the taxi operator, the exact fare paid, and the appropriate tax breakdown, if applicable. Taxi operators should also ensure that the receipt contains an authorized BIR print number and follows the correct format prescribed by local authorities. Failure to comply with these requirements may lead to fines or penalties.

Tax Compliance and Record-Keeping

Operators are obligated to maintain proper records of all transactions, including the issuance of receipts. These records should be accessible for inspection by BIR officers during audits. It’s advisable for operators to regularly update their systems and ensure that the receipts are printed and distributed in compliance with tax rules. By doing so, they not only adhere to legal standards but also foster trust and transparency with passengers.

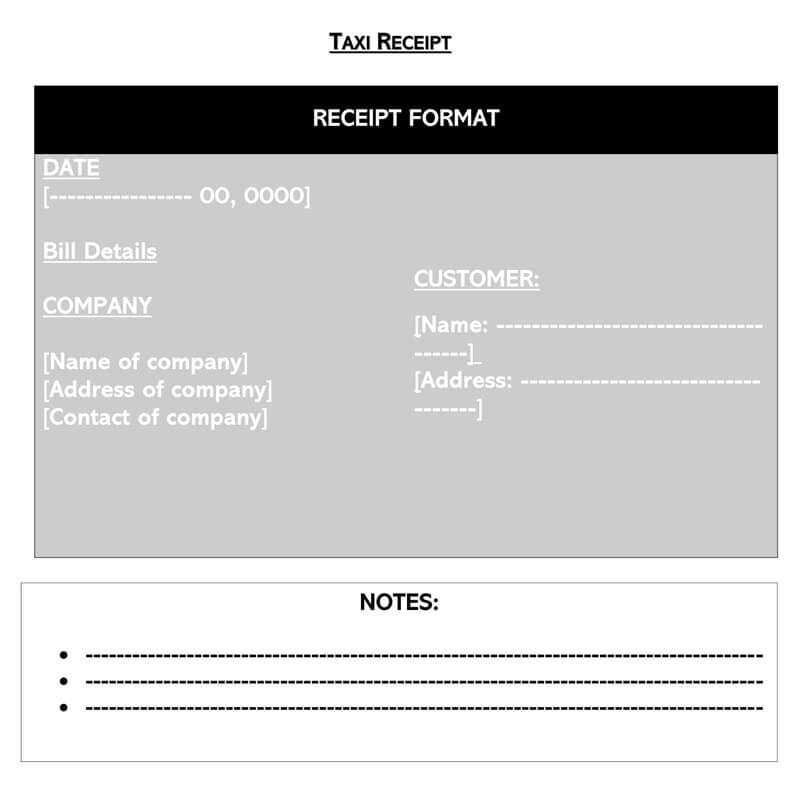

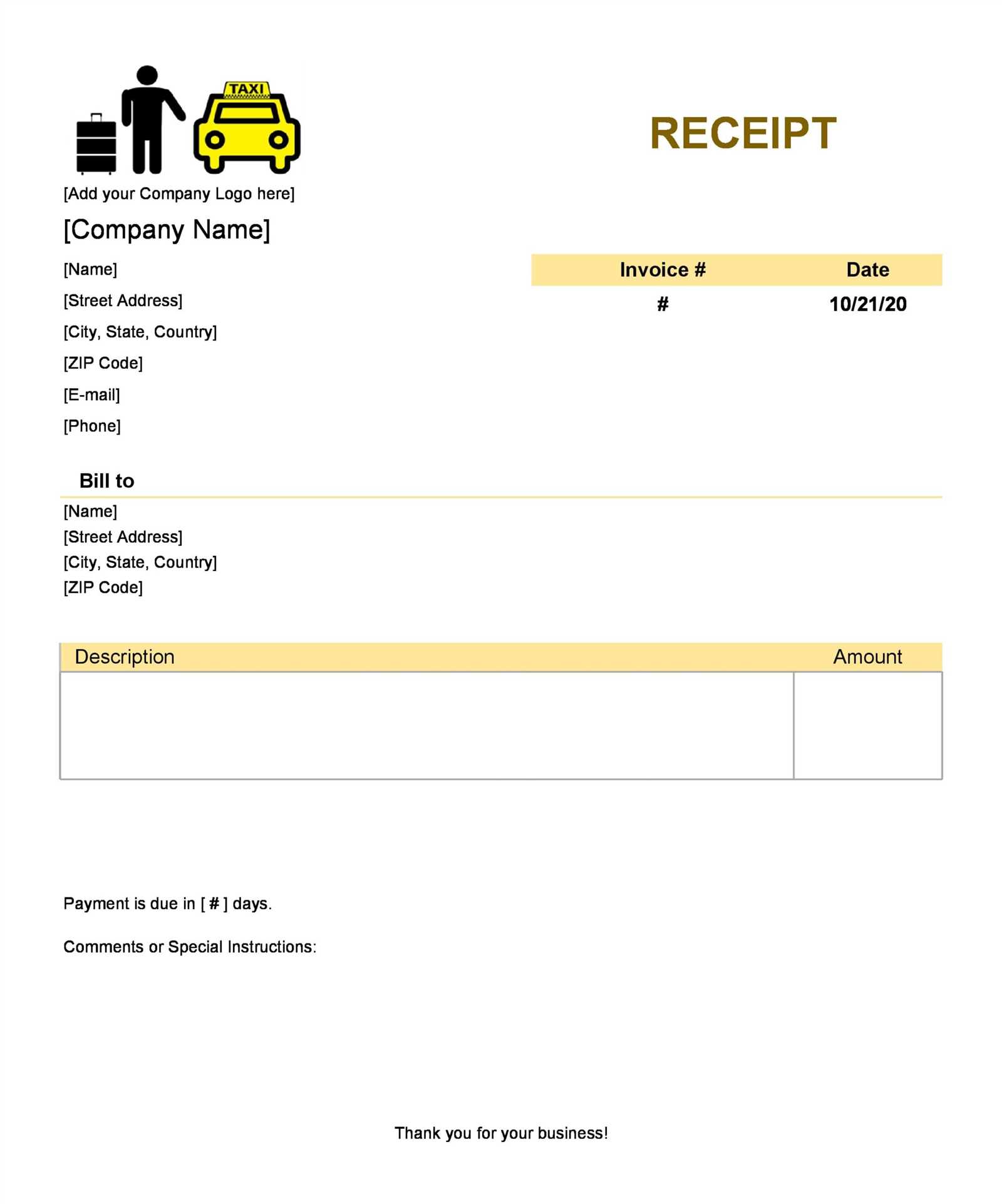

Tailor your taxi receipt form to meet specific business needs by incorporating elements that align with your operations. Start by adding your business logo and contact information at the top. This gives a professional touch while ensuring customers can easily contact you if necessary.

Incorporate Key Business Details

Make sure to include fields for the taxi driver’s name, vehicle number, and license plate. This information is crucial for tracking and accountability purposes. Also, add a space for the fare breakdown, including distance traveled, time, and any applicable discounts or surcharges. This helps maintain transparency with customers.

Legal and Tax Information

Ensure your form includes a tax identification number (TIN) and other relevant legal data required in the Philippines. This will help keep your receipts compliant with local regulations and tax requirements. Offering a clear and professional format enhances the credibility of your business.

Lastly, make the form printable or available in a digital format, depending on your business model. You can create a system where receipts are automatically sent via email after the ride, streamlining the process for both customers and your business.

Choosing between digital and paper taxi receipts depends on specific needs. Both versions have advantages, but each offers a different set of benefits based on convenience, cost, and environmental impact.

Digital Version

Digital receipts are convenient and easy to store. They are automatically sent to your email or mobile app, eliminating the need for physical storage. The data can be easily organized and retrieved for future reference. For businesses, digital receipts reduce printing costs and paper waste. They also provide a more secure way to track transactions, as they can be backed up and encrypted. However, a downside is the dependency on devices and internet access for retrieval.

Paper Version

Paper receipts provide a tangible record of a transaction that doesn’t require technology to access. This is beneficial for individuals who may not have access to smartphones or who prefer physical documentation. However, they take up physical space and can be easily lost or damaged. Businesses also face additional costs for printing and paper. Environmental concerns about paper waste can make this less appealing in the long run.

One common mistake is neglecting to include all necessary details. A receipt must clearly state the date, time, fare amount, and the taxi’s details such as the driver’s name and license number. Leaving out even one of these details could cause confusion or legal issues in the future.

Another issue is poor readability. Using fonts that are too small or difficult to read makes it harder for the customer to understand the information. Opt for a legible font size and spacing that ensures clarity.

Misplaced or Missing Tax Information

Omitting tax information is another frequent oversight. Many receipts fail to show the breakdown of taxes applied to the fare. This can create misunderstandings, especially for customers who need receipts for reimbursement or tax purposes. Always provide a clear tax summary, especially if your business operates in areas with specific tax rates.

Inaccurate Fare Calculation

Incorrect fare amounts or surcharges can lead to disputes. Double-check the fare calculation to ensure accuracy. Also, include a breakdown of additional fees, such as tolls or waiting charges, to prevent confusion.

| Common Mistake | How to Avoid |

|---|---|

| Missing or Incorrect Details | Always list all required information, such as date, time, and driver’s details. |

| Poor Readability | Use a clear font with an appropriate size for better readability. |

| Missing Tax Information | Provide a clear tax breakdown on the receipt. |

| Incorrect Fare Calculation | Check the fare calculation and include breakdowns of any extra charges. |

Many online platforms offer ready-to-use taxi receipt templates, designed for the Philippines market. Websites like Canva and Template.net allow you to browse a range of customizable options. These sites provide templates that can be tailored with specific details, such as company name, fare, and payment method. Templates can be downloaded and printed directly from the platform or edited on your computer for personal use.

For a more tailored approach, you can also generate a template using tools like Google Docs or Microsoft Word. Both programs have pre-designed receipt templates that can be adjusted to fit the needs of a taxi business in the Philippines. Simply modify the fields to include necessary information, such as passenger details and fare breakdowns.

If you prefer creating your own template from scratch, there are various free and paid software options like Adobe Acrobat or WordPress plugins for receipt generation. These tools let you design a completely customized template with company logos, unique layouts, and other branding elements.

Include these key details in a taxi receipt template for the Philippines: company name, contact information, taxi number, and fare breakdown. Clear and concise information ensures transparency and avoids confusion.

Important Elements

| Element | Details |

|---|---|

| Company Name | Place the name of the taxi company at the top of the receipt. |

| Taxi Number | List the unique identifier for the taxi used for the ride. |

| Fare Breakdown | Clearly state the base fare, any surcharges, and the final amount. |

| Payment Method | Indicate whether payment was by cash or card. |

| Date and Time | Include the date and time of the service. |

| Driver’s Name | Provide the driver’s name for reference. |

Receipt Layout Tips

Ensure all text is aligned properly and the layout is clean. Use larger fonts for critical information like the total amount and payment method. Keep the format consistent, especially for multiple receipts issued by the same company.