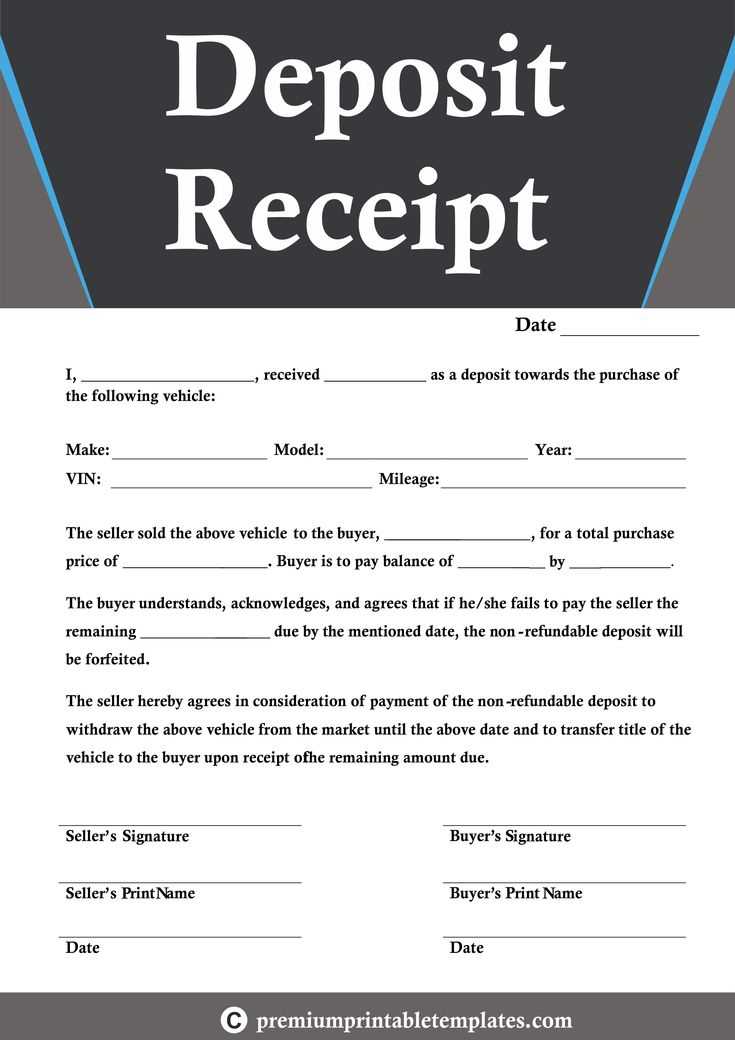

When creating a car deposit receipt, it’s important to include all the necessary details to ensure both parties are protected. A template for Word allows you to quickly generate a professional-looking document that serves as proof of payment and agreement between the buyer and seller.

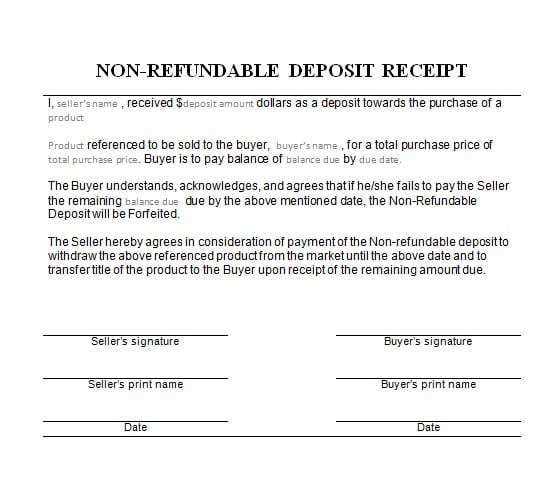

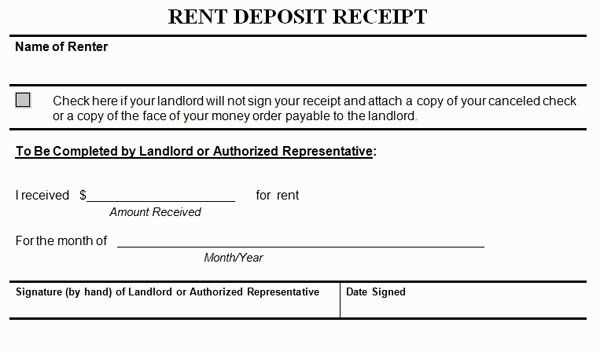

Include the date of the transaction, the amount of the deposit, and a brief description of the vehicle involved. Make sure to mention the terms for the deposit, such as whether it’s refundable or non-refundable, and specify the balance due upon final payment. It’s also helpful to outline any relevant deadlines for payment or delivery.

By using a car deposit receipt template in Word, you can customize the document with your details and create a clear, concise record of the transaction. This not only ensures transparency but also helps both parties avoid confusion down the line.

Here are the corrected lines:

Make sure to include the name of the car owner along with their contact information. This will ensure clear identification for both parties involved. Double-check that the date and the amount of the deposit are accurate, as this information is critical for the receipt’s validity.

Details to Verify

Include the vehicle’s make, model, and year to avoid any confusion about which car the deposit pertains to. If the deposit is refundable or non-refundable, clarify this point to prevent misunderstandings.

Final Checks

Ensure that both parties’ signatures are present, confirming their agreement to the terms listed in the document. Lastly, review the formatting for readability, ensuring that all necessary details are clear and easy to understand.

Car Deposit Receipt Template: A Practical Guide

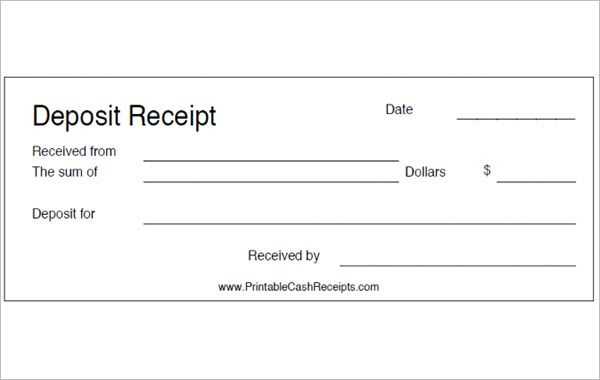

Use this template for a clear and organized car deposit receipt. It ensures both parties have the necessary details on record, reducing misunderstandings. Here’s what should be included:

- Receipt Title: “Car Deposit Receipt” should be at the top for clear identification.

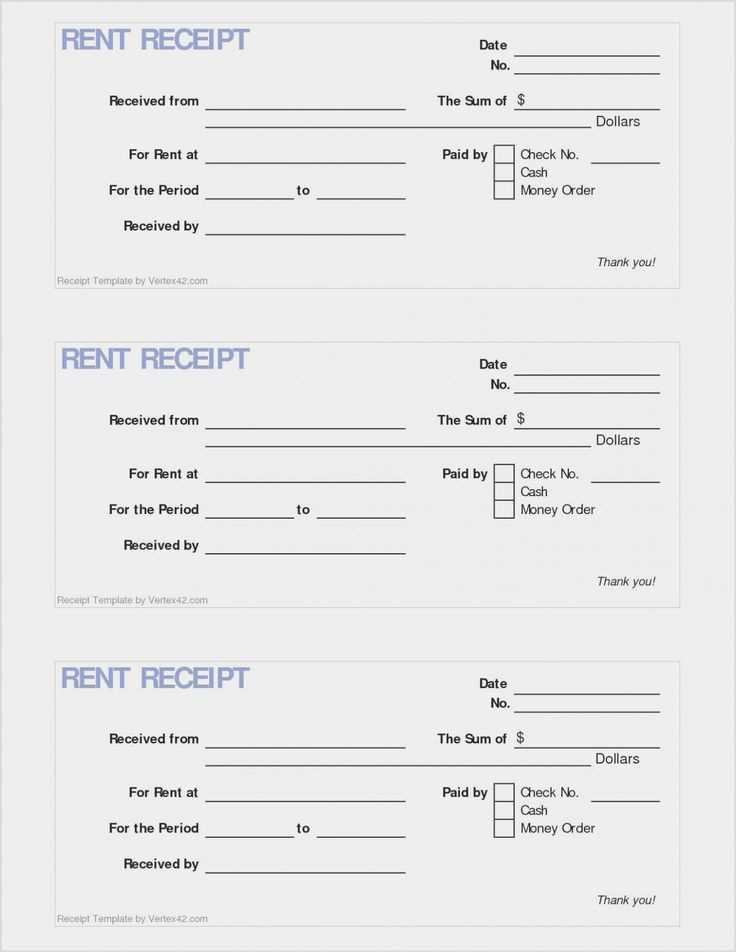

- Transaction Date: Include the exact date of the deposit payment.

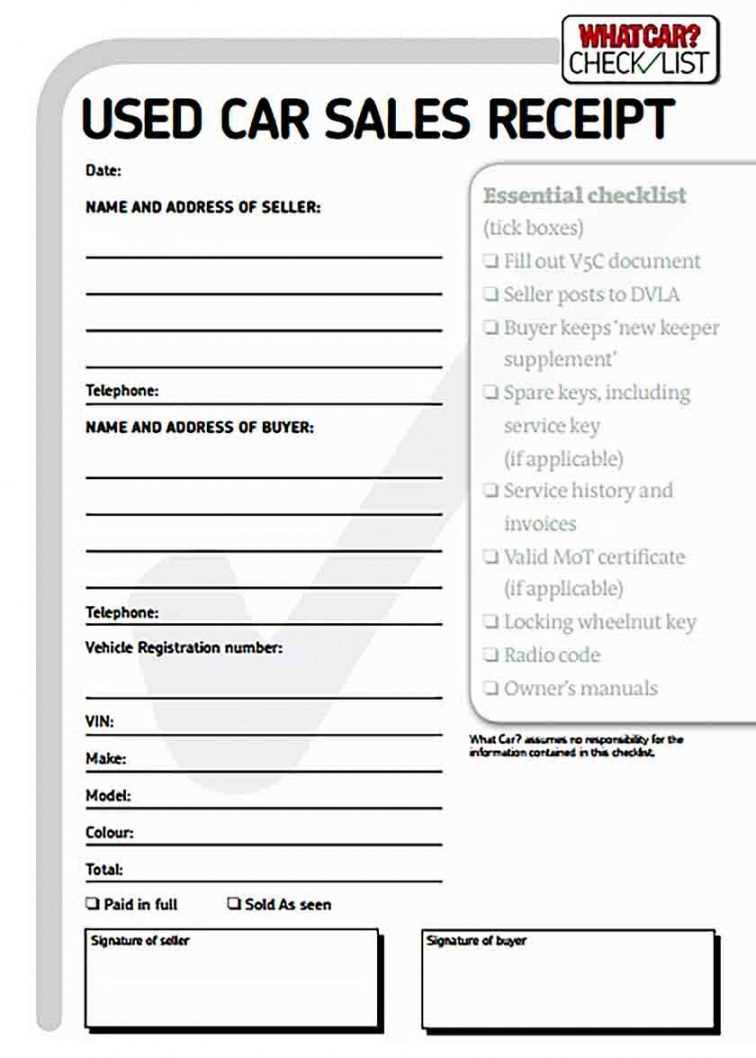

- Buyer Information: List the buyer’s full name, address, and contact details.

- Seller Information: Include the seller’s name, dealership name, and contact information.

- Vehicle Information: Mention the car’s make, model, year, VIN (Vehicle Identification Number), and any relevant details about the car.

- Deposit Amount: Clearly state the amount received as a deposit.

- Total Price: Include the total price of the car, with the deposit deducted.

- Payment Method: Specify how the deposit was paid (e.g., cash, check, credit card).

- Agreement Terms: Outline the next steps, including when the full payment is due and any conditions attached to the deposit (e.g., non-refundable).

- Signatures: Both the buyer and seller should sign to acknowledge the transaction.

Ensure this document is printed and stored for future reference, especially if any disputes arise. Having a structured template saves time and provides both parties with a professional record of the transaction.

Open a blank document in Microsoft Word to create a customizable receipt. Begin by setting the page layout to your preferred size, such as A4 or Letter, for easy printing. Use the “Insert” tab to add a table for organizing the receipt details. This allows precise placement of elements like the company name, customer details, and the list of items.

For the header, insert the company’s logo and contact information. Adjust the font size and style for visibility, ensuring it aligns with your branding. Underneath, include fields for customer name, address, and date, ensuring that the spacing is sufficient to accommodate different lengths of text.

In the body of the receipt, use a table to list the purchased items, including columns for the item description, quantity, unit price, and total amount. Use formulas within the table to automatically calculate totals, ensuring accuracy with every use. For a cleaner look, apply alternating row colors or bold lines to separate sections.

For customization, add placeholders like “[Customer Name]” or “[Date]” to make the template reusable. Adjust these fields manually each time you issue a receipt, or use Word’s mail merge feature for automated population of these fields from a database.

Lastly, add a footer with payment methods accepted and any return policy or disclaimer text. Once satisfied with the layout, save your receipt template for future use. You can also convert it into a PDF for easier distribution via email or print. This streamlined process ensures each receipt is both professional and adaptable.

Begin with clear identification of the buyer and seller. Include their full names, contact information, and addresses. This ensures that both parties are easily recognizable should any issues arise later.

Transaction Details

List the total deposit amount and the purpose of the deposit, such as holding the vehicle. Specify if it’s refundable or non-refundable. Be precise about the payment method, whether it’s cash, check, or electronic transfer, along with any reference numbers for clarity.

Vehicle Information

Include the car’s make, model, year, VIN (Vehicle Identification Number), and color. This ensures there’s no confusion about the specific vehicle involved in the agreement.

| Detail | Information |

|---|---|

| Buyer Name | [Buyer Full Name] |

| Seller Name | [Seller Full Name] |

| Deposit Amount | [Deposit Amount] |

| Payment Method | [Payment Method] |

| Vehicle Description | [Make, Model, Year, VIN] |

| Deposit Refundability | [Refundable/Non-refundable] |

End the receipt with signatures from both parties. This adds legal weight to the agreement and confirms that both parties acknowledge and accept the terms laid out in the document.

1. Incorrect Data Entry: Always double-check the details. Missing or incorrect information, such as the buyer’s name, item description, or payment amount, can cause confusion and may lead to legal issues. Ensure all fields are filled out accurately before finalizing the receipt.

2. Failing to Customize the Template: Using a generic receipt template without adapting it to your specific needs is a common mistake. Include business name, contact details, and any terms and conditions that apply to your sale. Tailor it to reflect your brand identity.

3. Missing Dates and Reference Numbers: Without a clear date and reference number, tracking the transaction becomes difficult. Always include these elements to ensure both parties can easily reference the receipt when needed.

4. Overlooking Tax Details: If your transaction involves tax, ensure the receipt clearly lists the tax rate and total tax amount. Failing to do so can create confusion during tax season or audits.

5. Ignoring Payment Method: It’s vital to specify how the payment was made. Whether it was by cash, credit card, or another method, recording this information can help clarify any future disputes.

6. Not Saving or Archiving Receipts: Once you issue a receipt, ensure you have a copy for your records. Whether digitally or on paper, keeping receipts can help with refunds, warranties, or tracking financials.

Make sure to format the deposit receipt template properly to ensure clarity. The document should be concise and include all necessary fields, such as the buyer’s name, the vehicle details, the amount paid, and the date of the transaction. Using bullet points can help break down key information clearly.

Key Elements

- Buyer’s full name

- Vehicle make, model, and VIN

- Deposit amount and payment method

- Signature and date fields for both parties

Formatting Tips

Ensure the template is easy to read. Use a simple font and clear headings for each section. Avoid unnecessary text that may confuse the reader. Keep the language direct and to the point, providing a professional yet approachable tone throughout.