If you’re looking to streamline your cash deposit process, using a Cash Deposit Receipt Template in Word is an excellent solution. This template helps you maintain clear and professional documentation of all cash deposits, ensuring that both the depositor and recipient have a record of the transaction. Customizable and easy to use, it saves you time and reduces the risk of errors in manual entries.

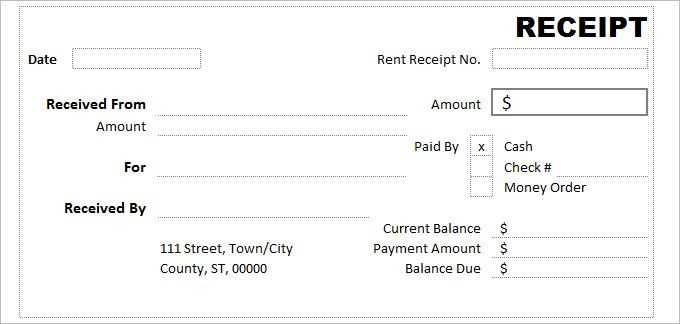

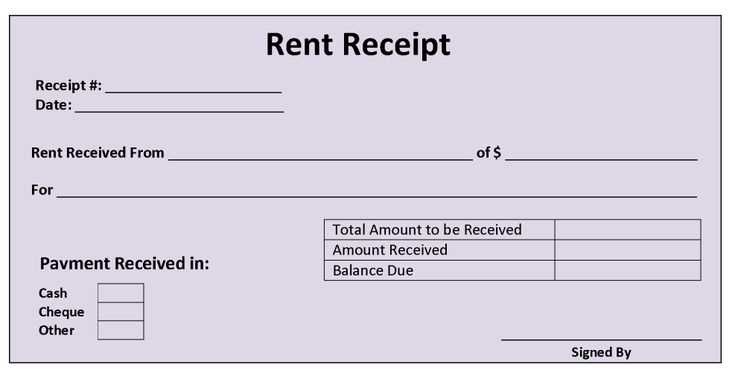

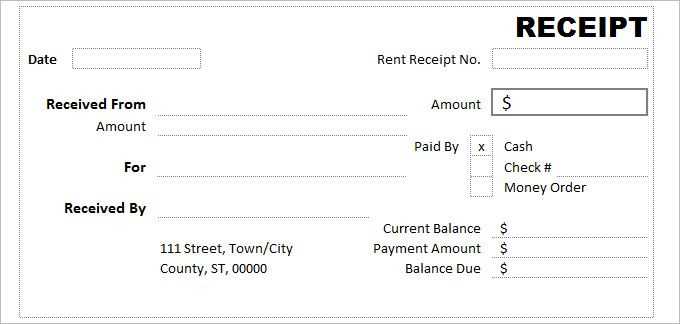

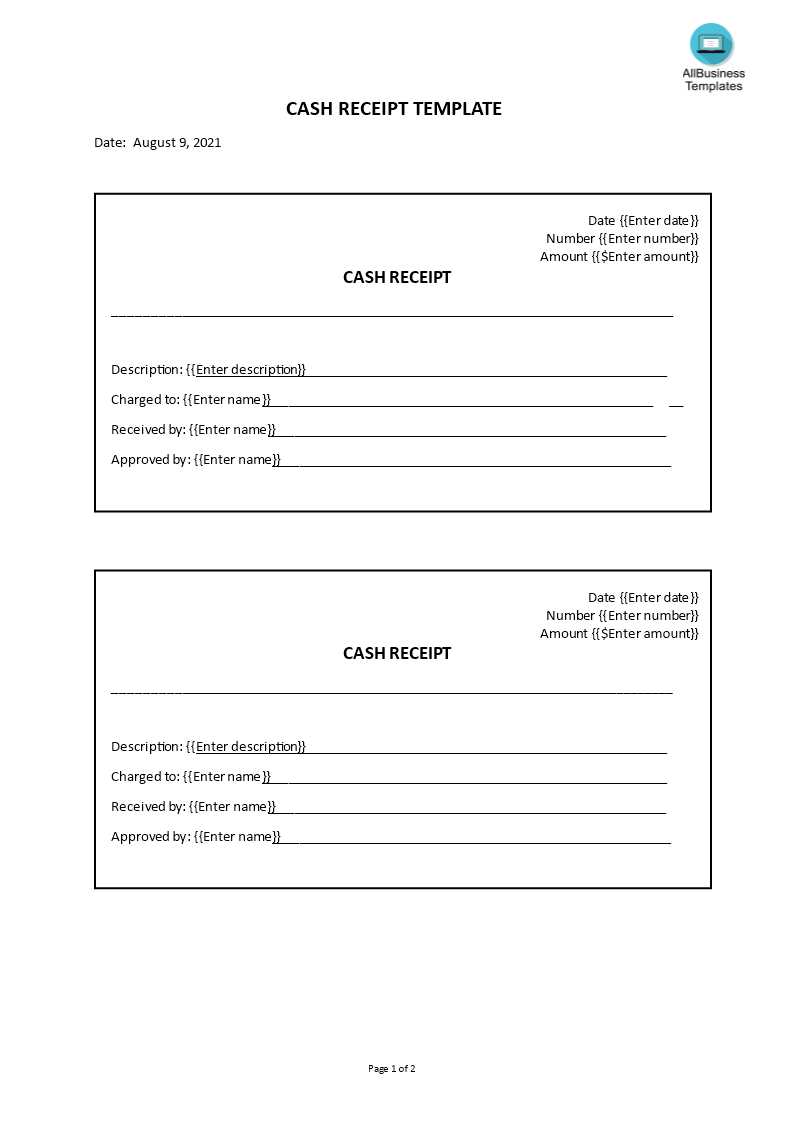

Start by selecting a template that includes the essential details: the deposit date, amount, depositor’s name, and a unique receipt number. You can quickly tailor these templates to match your company’s branding by adjusting fonts, colors, and logos. Many Word templates also allow you to add extra fields if necessary, like transaction ID or cashier details, which are helpful for more complex transactions.

Once your template is set up, you can print or email receipts with just a few clicks, making it an efficient tool for managing your cash flow. Keep in mind that digital records can be easily stored and retrieved, which adds a layer of convenience for tracking your financial history. By utilizing a Cash Deposit Receipt Template in Word, you ensure accuracy and consistency in your deposit documentation.

Here’s a revised version with word repetition avoided:

Creating a well-structured cash deposit receipt template is key for clear record-keeping. Make sure to include these core elements for accuracy:

Essential Sections

Each template should feature the following components:

- Date of Deposit: Include the exact date the transaction occurs.

- Depositor Information: Name, contact details, and relevant account data.

- Amount: Specify the total sum deposited and currency type.

- Payment Method: Clearly state the method used (e.g., cash, check, wire transfer).

- Receipt Number: A unique reference for tracking.

- Authorized Signatory: Name and signature of the individual acknowledging the deposit.

Formatting Recommendations

Design your template with simplicity in mind, ensuring clarity. Keep the font size legible, and use a clean layout to avoid clutter. Utilize tables for organizing the sections.

| Field | Example |

|---|---|

| Date | March 15, 2025 |

| Depositor Name | John Doe |

| Amount | $500.00 |

| Payment Method | Wire Transfer |

| Receipt Number | 123456 |

| Signature | Jane Smith |

This layout simplifies the deposit process, making it easier to verify and maintain financial records. Always double-check your data for accuracy before issuing receipts.

- Cash Deposit Receipt Template in Word: Practical Guide

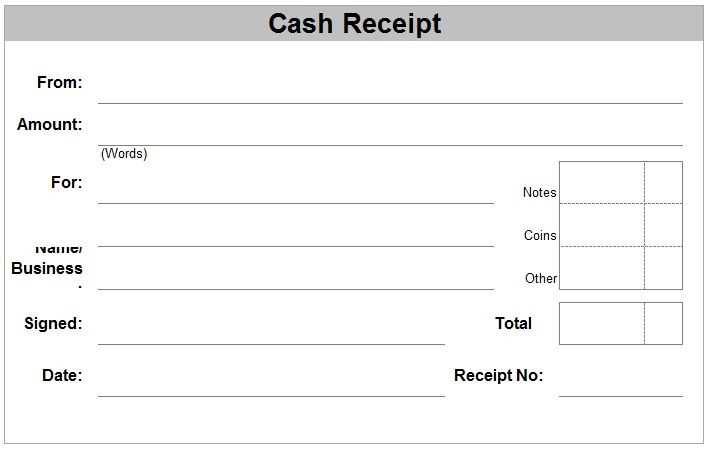

To create a cash deposit receipt in Word, start by designing a clear, simple template that can be reused for multiple transactions. Begin with a header that includes your business name, address, and contact details. Include the date of the deposit, the amount deposited, and the name of the person making the deposit.

In the body of the receipt, provide fields for the deposit method (e.g., cash, check), along with any relevant transaction reference numbers. Add a section to describe the purpose of the deposit, such as “Payment for invoice #123” or “General deposit for services rendered.” If applicable, include a note or reminder of the deposit’s expected processing time.

To ensure the receipt is clear, use a table to display the details. Columns can include “Description,” “Amount,” and “Payment Method.” This keeps everything organized and easy to read. At the bottom of the receipt, leave space for the signature of the person receiving the deposit as well as any additional notes.

For ease of use, save the template with placeholders for the variables (like name, amount, and date) that can be filled in as needed. This minimizes the effort required for future receipts and helps maintain consistency in documentation.

Once your template is ready, test it by filling in the fields with sample data. Make sure it prints clearly and looks professional. If necessary, adjust margins, font sizes, or table widths to improve the layout. Keep the design simple, as an overly complex template can make the receipt harder to read and use.

Customizing a deposit receipt template in Microsoft Word can help make your receipts more professional and aligned with your business’s branding. Here’s how to personalize a basic template for your specific needs:

- Open the Template: Start by opening the Word document containing the deposit receipt template. If you don’t have one, you can download a free template from Microsoft Word’s template gallery or other trusted sources.

- Edit Business Information: Modify the company name, address, phone number, and email at the top of the receipt. You should also include your business logo if available. This helps clients identify your business easily.

- Adjust the Date and Receipt Number Fields: Make sure there’s a place to add the transaction date and a unique receipt number. Word has simple fields you can use to insert automatic numbering, making it easier to keep track of receipts.

- Include Payment Details: Customize the fields for payment method (cash, credit card, check) and the deposit amount. Make sure there’s a section for both the total deposit and any relevant taxes or fees if applicable.

- Customize Terms and Conditions: If your business has specific terms related to deposits (e.g., non-refundable deposits, deposit deadlines), include them in the template. You can place this section near the bottom of the receipt to keep it organized.

- Font and Design Adjustments: Adjust the font style, size, and colors to match your business’s branding. Keep it professional and readable. Avoid overly decorative fonts that can reduce clarity.

- Save the Template for Future Use: After making your changes, save the document as a template so you can easily use it for future transactions. You can save it as a .dotx file, which keeps the original formatting intact.

These simple edits will help you create a deposit receipt that represents your business professionally while keeping it functional for your accounting and customer service needs.

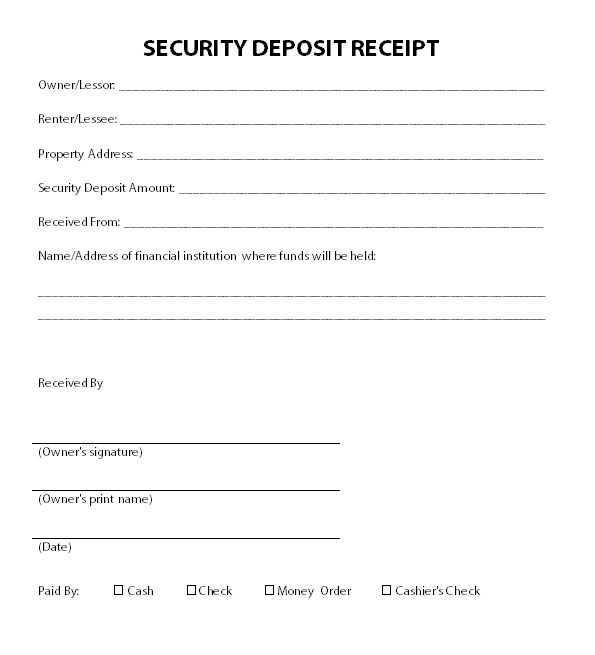

A well-structured deposit receipt template plays a key role in maintaining clear financial records. To ensure accuracy, include the following elements:

1. Date and Time of the Deposit

Include the exact date and time when the deposit is made. This helps track the timing of each transaction for future reference.

2. Depositor’s Information

Record the name and contact details of the person making the deposit. This step adds clarity and provides a point of contact if needed.

3. Amount of the Deposit

Clearly display the deposit amount both in numerical and written form. This eliminates any potential confusion about the total deposited amount.

4. Payment Method

Specify how the deposit was made, whether by cash, cheque, or electronic transfer. Knowing the payment method helps verify the source of funds.

5. Unique Receipt Number

Assign a unique receipt number for each deposit. This makes it easier to reference and locate the receipt if needed in the future.

6. Purpose of the Deposit

State the purpose behind the deposit, such as a rent payment or loan repayment. This adds context to the transaction for proper categorization.

7. Signatures

Provide space for the signatures of both the depositor and the person receiving the deposit. Signatures confirm the transaction details and agreement between the parties.

8. Institution or Business Information

Include the name, address, and contact information of the business or institution where the deposit is made. This verifies the receiving party for the transaction.

By incorporating these key elements, your deposit receipt template will provide accurate and reliable records for both the depositor and the recipient, ensuring smooth and efficient bookkeeping.

One of the main mistakes is not organizing the template layout clearly. Ensure the template has separate, clearly labeled fields for every important detail, such as the payer’s name, amount, and payment method. This avoids confusion and helps maintain clarity in the records.

1. Missing Key Information

Never skip critical fields such as the transaction date, payment method, and receipt number. These details are crucial for maintaining a proper record and will be needed for future reference or audits. Without them, tracking and verifying payments can become difficult.

2. Poor Formatting

Using inconsistent fonts or messy alignment makes the template hard to read. Stick to simple and clean formatting. Align text in a table format for organized, professional-looking receipts. Consistency in style ensures a neat and structured appearance, making it easy for both the receiver and payer to understand the document.

Additionally, avoid overloading the template with irrelevant text or unnecessary decorations. Focus on providing only the necessary information in a straightforward manner to keep the template functional and user-friendly.

In this version, only key terms like “Receipt Template” are repeated, while other words and phrases are adjusted to avoid unnecessary repetition.

To create a well-organized cash deposit receipt, use a template that highlights the most important elements. The “Receipt Template” should clearly display the date, the amount deposited, and the payer’s details. Customize other sections of the document, such as descriptions or references, to match the specific transaction while keeping the format consistent.

Incorporate fields like the transaction number or any additional notes that might be relevant to the deposit. It’s helpful to adjust the layout of the template so that all necessary information is easily accessible and readable. Using consistent headings for sections, such as “Deposit Amount” or “Account Number,” makes the document more professional and clear.

When filling out the template, ensure that the key terms are emphasized, while adjusting surrounding text to avoid redundancy. This approach maintains clarity and ensures that the main points are quickly identifiable. Each section of the template should serve a clear purpose, helping both the issuer and the recipient understand the details of the cash deposit.