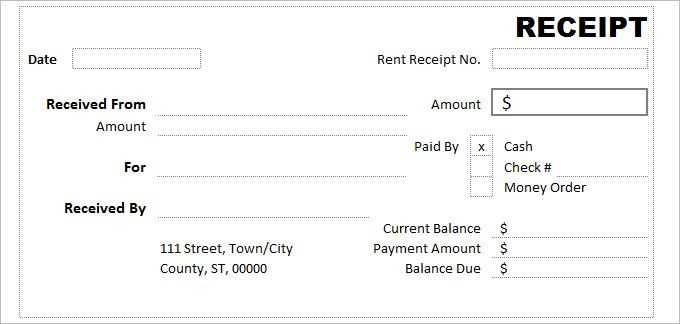

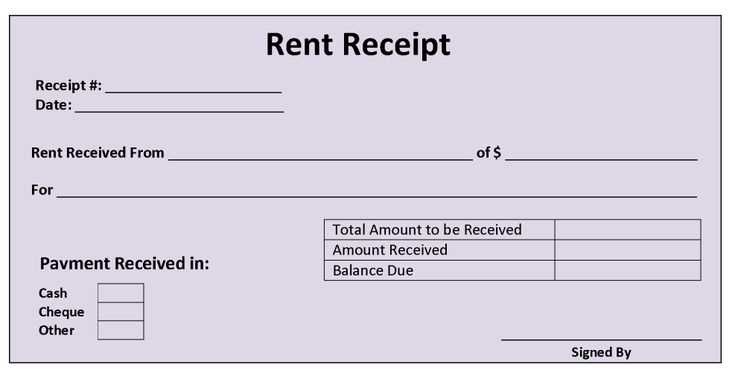

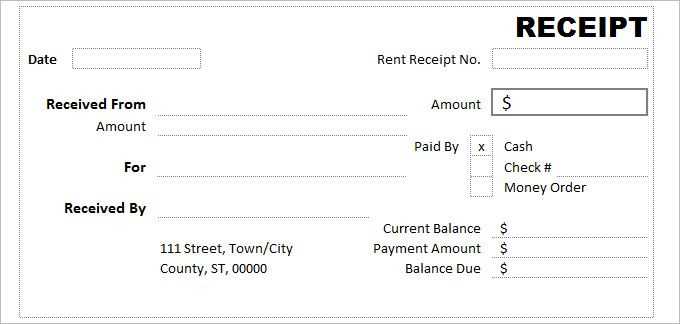

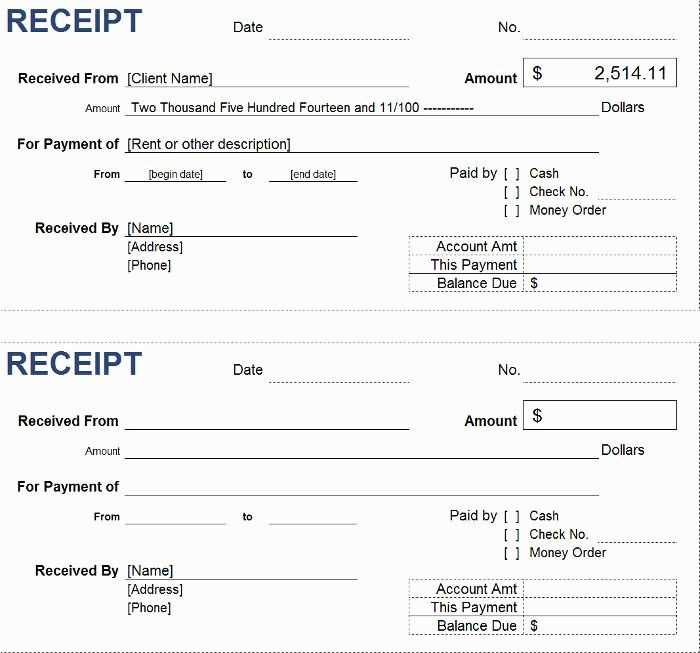

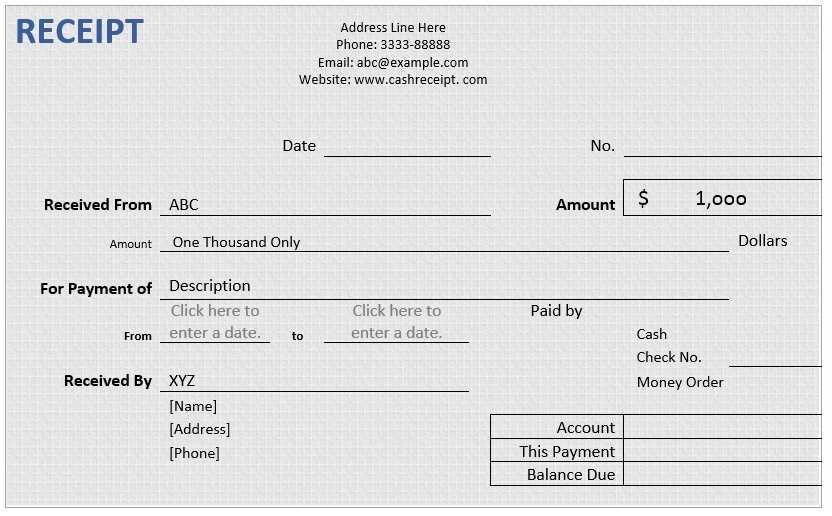

Use this cash payment receipt template in Word to quickly create clear and professional receipts for cash transactions. The template is simple to customize and ensures all necessary details are included for accurate documentation.

Begin by entering the date and amount paid. Then, specify the service or product the payment covers. This helps keep track of both the payment and the transaction purpose, ensuring a smooth record-keeping process.

Don’t forget to add both the payer’s and recipient’s names along with any relevant contact details. Including these will help verify the transaction if any questions arise later.

For added clarity, consider including a unique receipt number. This will help with organizing and referencing past transactions. With this template, you’re set to create a professional, easy-to-understand record every time.

Here’s the improved version of your list with reduced repetition of words:

To streamline the list and minimize word repetition, consider using the following techniques:

- Use synonyms to replace similar terms that appear too frequently.

- Remove redundant words that don’t add new information to the message.

- Group related items under a single heading or point for clarity.

Synonym Suggestions

- Replace “payment” with “transaction” or “settlement” if applicable.

- Use “receipt” instead of “proof of payment” or “voucher” in certain cases.

- Consider alternatives like “customer” for “client” to vary terminology.

Concise Structuring

- Organize related details into fewer points to avoid excessive listing.

- Use bullet points effectively to highlight key information without repetition.

By implementing these tips, you can make your document more engaging and easier to read. This method ensures clarity while maintaining a professional tone.

- Cash Payment Receipt Template in Word

To create a clear and professional cash payment receipt in Word, follow these steps:

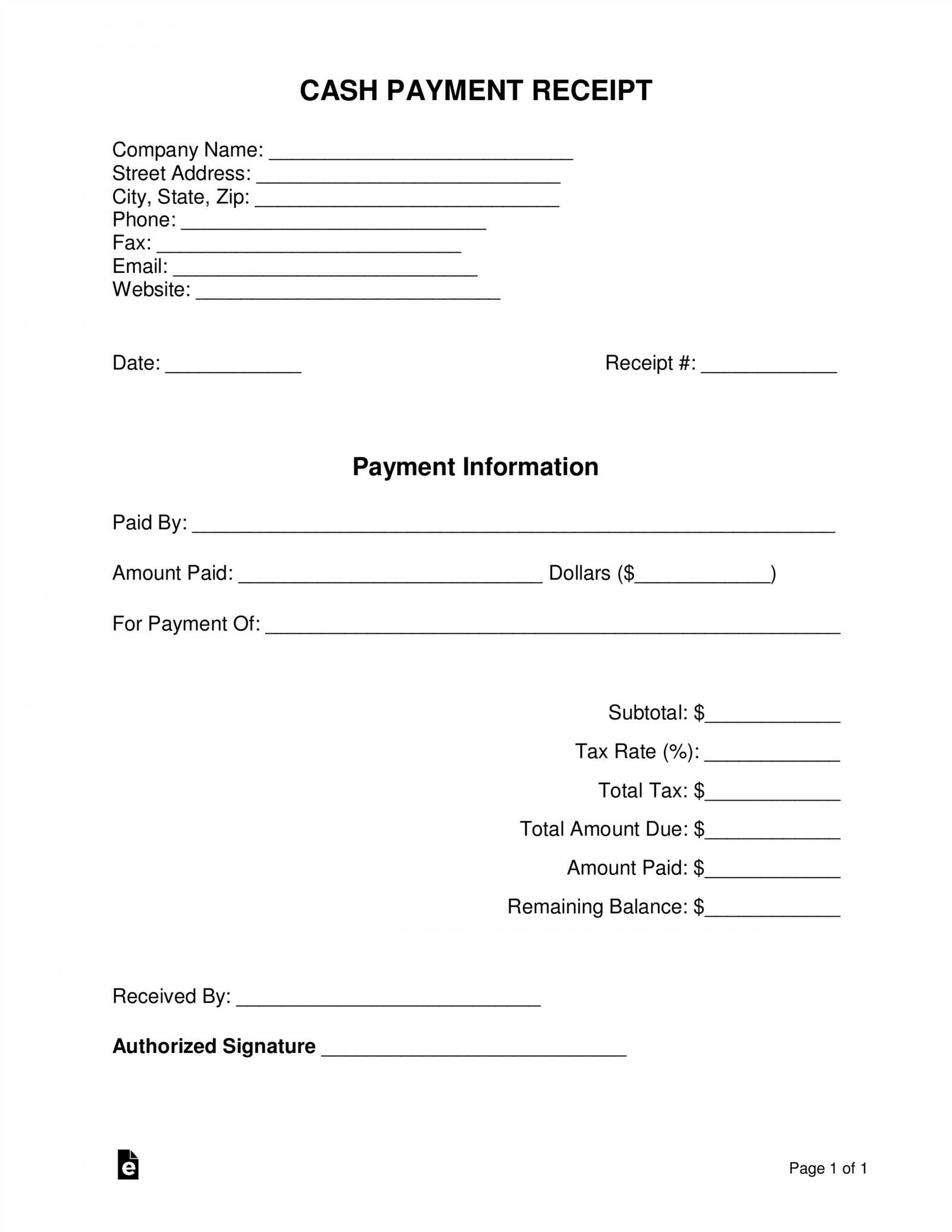

- Title and Date: At the top of your receipt, add a title such as “Cash Payment Receipt” or “Receipt for Payment” followed by the date of the transaction.

- Transaction Details: Include the name of the payer and the recipient, as well as a brief description of the payment (e.g., for goods or services rendered).

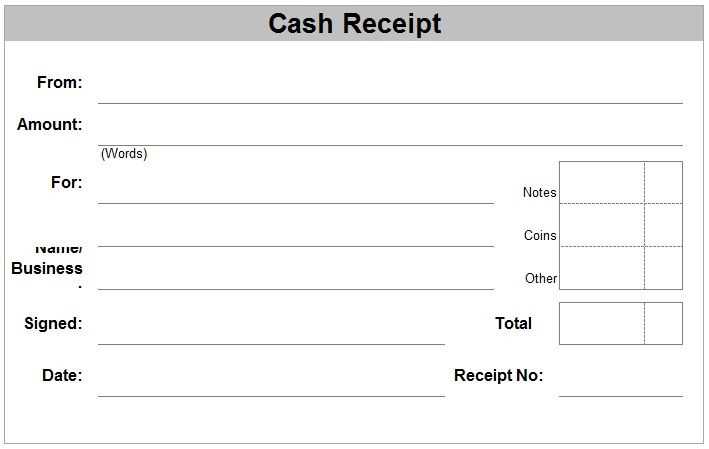

- Amount Paid: Clearly state the total amount paid, both in words and numbers. Make sure the currency is specified (e.g., USD, EUR).

- Payment Method: Specify that the payment was made in cash and include any other relevant payment information, such as a receipt number for tracking purposes.

- Signatures: Provide spaces for both the payer and the recipient to sign, confirming the transaction.

Save the template to reuse it for future transactions. Using Word’s formatting tools, ensure the document is easy to read and professional in appearance.

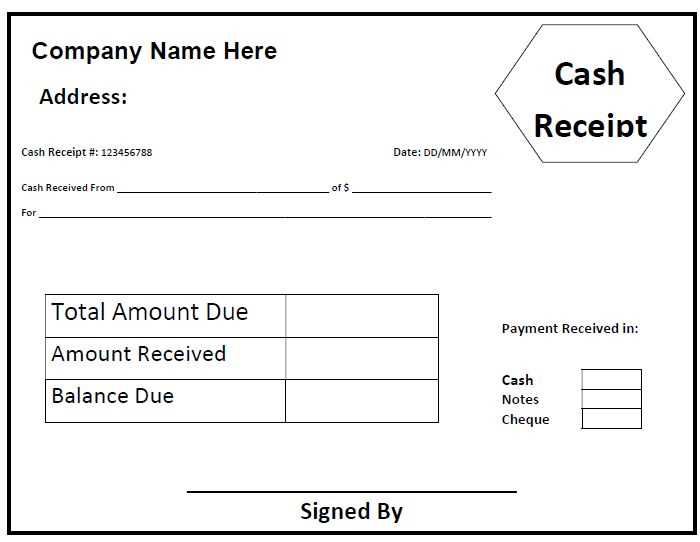

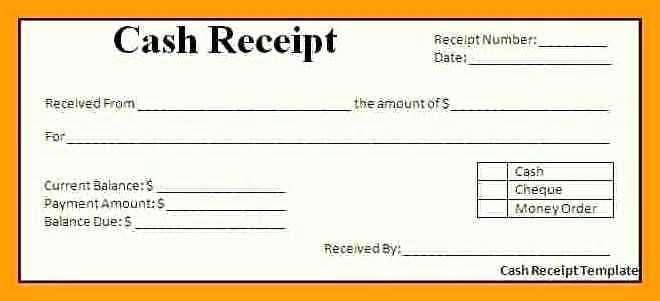

Choose a format that aligns with your business needs. A clean and easy-to-read template ensures customers can quickly understand the details of their payment. A basic layout with sections for the transaction date, total amount, and items purchased should be prioritized. Make sure your receipt is clear and doesn’t overwhelm the reader with unnecessary information.

If you run a business where multiple payment methods are used, select a format that accommodates both cash and card payments. A receipt template with checkboxes or clearly labeled payment method fields can make this task simpler for both you and your customer.

Consider including a return policy or contact information at the bottom of the receipt. This is especially useful for businesses in retail or services where customers might need assistance later. Keep the extra details to a minimum, ensuring they don’t crowd the main information.

To personalize a receipt template in Word, focus on adjusting key sections like the header, item list, and footer. Customize the header by replacing the company name, logo, and contact details with your own. Use the “Insert” tab to add your business logo and adjust its size accordingly.

Modify Text Fields

Replace generic text with your specific information. For example, update fields such as “Date,” “Receipt Number,” and “Amount” with relevant data. You can add more fields if necessary by selecting “Insert” > “Text Box” and placing it where needed in the document. This allows flexibility in adjusting the structure as required.

Change Font and Style

To match your brand identity, modify the font style, size, and color. Go to the “Home” tab and use the available font options to change text appearance. Ensure that your font choices are clear and easy to read for your customers.

Lastly, adjust the footer to include any additional information such as tax details, refund policies, or terms and conditions. Personalizing these areas ensures the receipt reflects your brand and business operations effectively.

To create a well-structured cash payment receipt template, include specific fields that capture all the necessary information. Begin by adding a clear “Receipt Number” field to help with tracking and referencing payments. Ensure that both the date and time of the transaction are listed, as this is crucial for record-keeping and verification purposes.

Include a “Payer’s Name” section to identify the person or entity making the payment. This should be followed by a “Payment Amount” field where the total amount paid is clearly stated. For added clarity, you might want to include separate sections for “Item Description” and “Quantity” in cases where the payment is for goods or services.

Additionally, include a “Payment Method” field to specify whether the payment was made in cash, by card, or through another method. Don’t forget to add a “Receiver’s Name” or “Authorized Signature” space to confirm the receipt of the payment. Finally, a “Notes” section can be used for any additional information, like special conditions or transaction references.

| Field | Description |

|---|---|

| Receipt Number | Unique identifier for each receipt |

| Date & Time | Exact date and time of the transaction |

| Payer’s Name | Name of the person or company making the payment |

| Payment Amount | Total amount of the payment |

| Item Description & Quantity | Description and quantity of items or services paid for |

| Payment Method | Method used for the payment (e.g., cash, credit card) |

| Receiver’s Name/Signature | Name or signature of the person receiving the payment |

| Notes | Additional information related to the payment |

To ensure receipts meet legal standards, include key details such as the date, transaction amount, and both buyer and seller information. Each receipt should clearly identify the business name, address, and tax identification number. If applicable, provide an itemized list of purchased goods or services. Additionally, include the payment method, whether it’s cash, credit, or debit. Depending on your region, you may also need to show tax rates or exemptions, especially for VAT. Keep receipts organized and available for auditing or legal inquiries.

For businesses issuing receipts, stay updated with local regulations. Certain jurisdictions may have specific formatting or mandatory information that must be included. It’s also beneficial to integrate automated systems for generating receipts, ensuring compliance and accuracy.

Save your payment receipt in a widely accepted format such as PDF for easy sharing and storage. Most word processors, including Word, offer an option to save or export documents as PDFs. This ensures the format remains unchanged, whether shared by email or stored for future reference.

If you’re using a receipt template in Word, make sure to customize it with the payment details before saving. After that, choose the “Save As” option and select PDF as the file type. This will create a secure, universally accessible file.

Sharing your receipt can be done via email or cloud storage services like Google Drive or Dropbox. Simply upload the file and share the link with the recipient or attach the document directly to an email. If sending via email, add a brief message outlining the transaction details for clarity.

For physical sharing, print the saved receipt. Ensure the print quality is clear, especially for important details like the payment amount and date. Keep a copy for your records in case you need to reference it later.

Always double-check the template fields before using it. Incorrectly filled fields, such as dates, amounts, or company details, can lead to confusion and errors in financial records.

1. Leaving Unnecessary Fields Blank

Do not leave required fields empty, especially when the template has mandatory spaces for transaction details. Missing information can make the receipt incomplete and unprofessional.

2. Failing to Adjust Formatting

Templates come with default formatting, but it may not always suit your specific needs. Ensure the text size, font, and alignment are appropriate for clarity and consistency.

3. Overlooking Customization Options

Many templates offer customization options. Failing to personalize your receipt with your company logo or specific terms can make it look generic and unidentifiable. Customize to ensure it reflects your brand.

4. Ignoring Legal Requirements

Different regions may have specific requirements for receipts. Ensure your template complies with local tax laws and regulations by including necessary details such as tax numbers, transaction descriptions, or signatures.

Cash Payment Receipt Template Word

Be clear and concise: Use a simple format that focuses on key payment details such as the date, amount, payment method, and the names of the payer and payee. Avoid clutter by leaving out unnecessary fields. This ensures the document stays organized and readable.

Include a payment description: Provide a brief summary of the transaction. Specify whether it’s for goods or services, which helps both parties understand the purpose of the payment.

Use consistent formatting: Ensure fonts and spacing are uniform throughout the document. This not only looks more professional but also makes the receipt easier to follow.

Track payments effectively: If you issue receipts frequently, number them sequentially. This adds clarity and helps with future reference or audits.

Provide space for signatures: Include a designated area for both the payer and payee to sign. This adds authenticity to the receipt and confirms that both parties acknowledge the transaction.