If you need a simple and professional way to document cash transactions in India, a cash receipt template in Word format is an excellent option. These templates provide a clear and structured way to record payments, making it easier to track financial activity and maintain accurate records. Whether you’re a small business owner or handling personal transactions, using a Word doc template ensures the receipt is both legally sound and easily customizable.

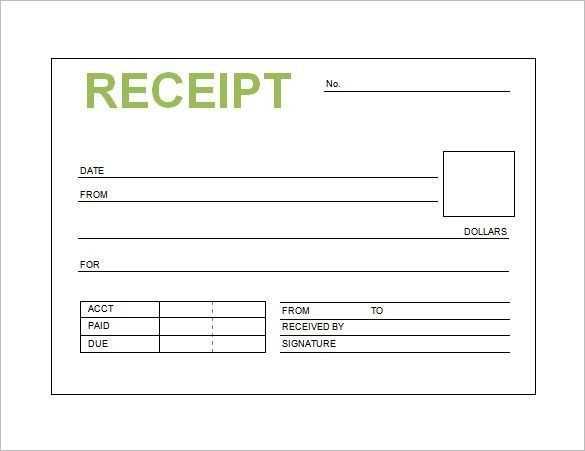

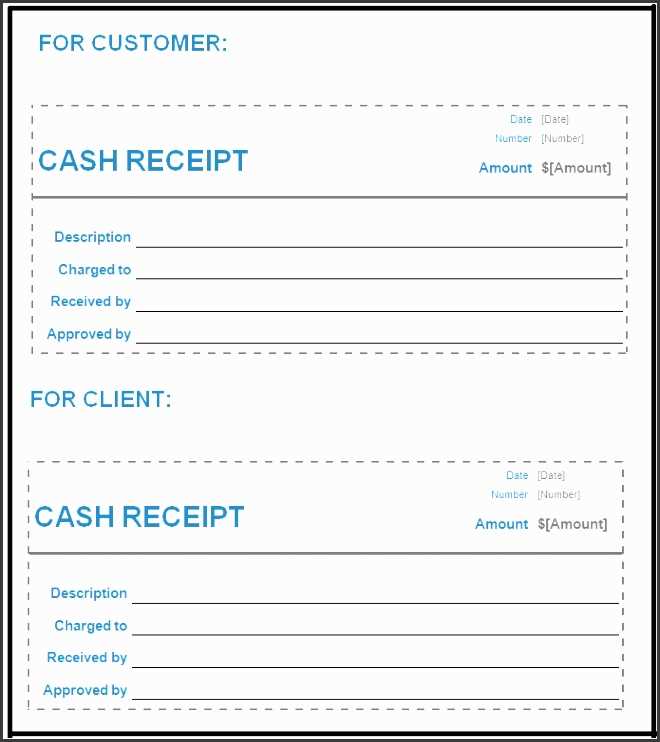

The template is designed to capture all the necessary details, including the amount received, the payer’s information, and the purpose of the transaction. You can personalize it with your business name, logo, and other specifics. This format allows for quick edits and printing, saving you time and effort compared to manually drafting receipts each time.

By using a Word document template, you streamline your accounting process. It’s a quick and professional solution for managing cash payments, and it helps avoid any confusion between parties involved in the transaction. Once filled out, you can save and print the receipt for both your records and for providing a copy to the payer.

Here is the corrected version:

Ensure the template is in a compatible format with Word for easy editing. Adjust the layout for accurate reflection of transaction details. Include a field for the date and a clear space for the payment amount. Make sure to specify the name of the payer, the recipient, and the reason for the payment. Use simple, legible fonts to ensure clarity. For added professionalism, align text properly and maintain consistent spacing throughout. Customize the template to suit your specific needs by adding additional fields, if necessary.

Key adjustments: Confirm that all sections are appropriately labeled. Double-check the alignment and font consistency. Avoid overcrowding the template with unnecessary information. If you need to make further changes, save the document as a new file to preserve the original format.

Keep the design clean and intuitive for quick access during use.

- Cash Receipt Template in Word for India

To create a cash receipt template in Word for use in India, follow these guidelines for a simple, professional document. Begin by including a header with the title “Cash Receipt” and relevant details such as the date of transaction, the amount received, and the purpose of the payment. Be specific about the payment method, whether it is in cash, cheque, or online transfer.

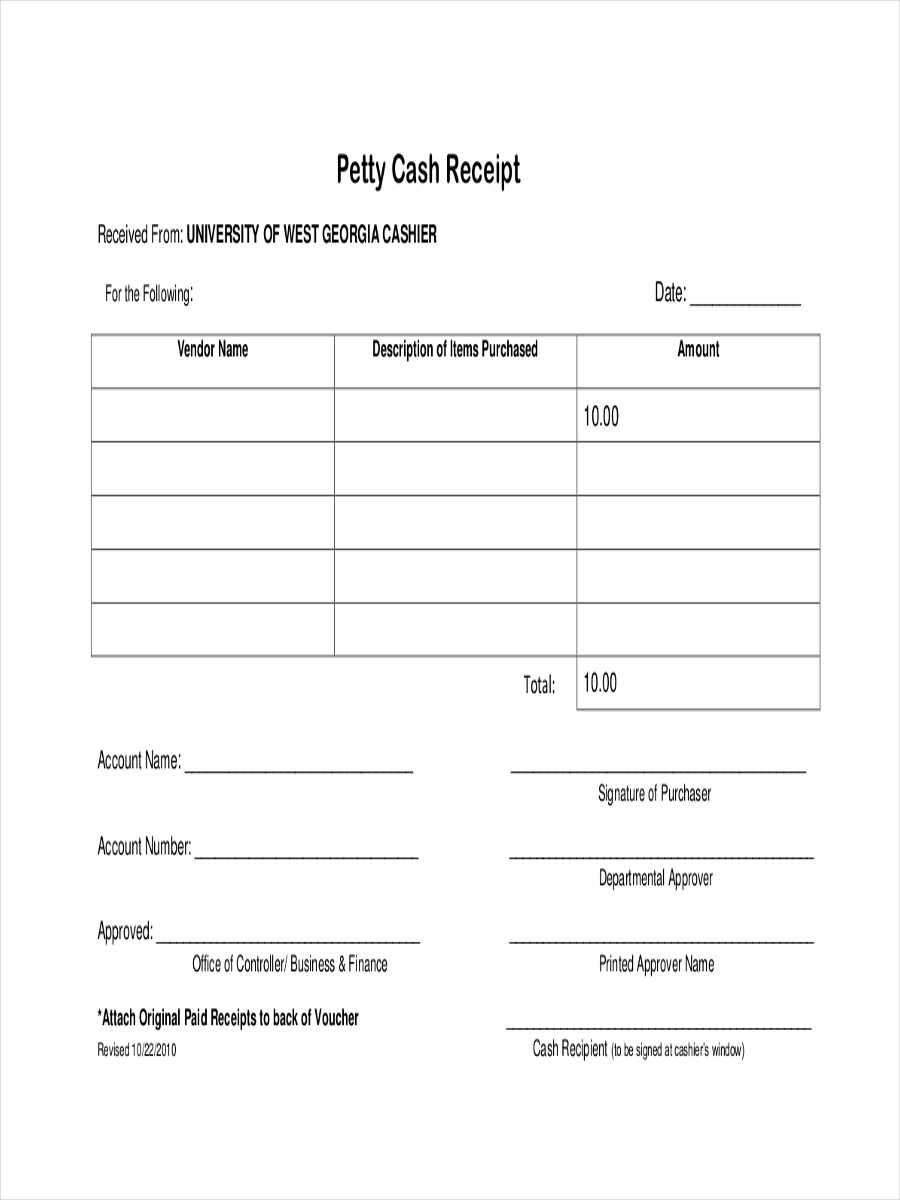

In the body of the template, include sections for the payer’s details, including their name and address. Under the amount section, clearly list the denomination and total amount received, along with the currency (INR). You can add a receipt number for easy tracking, which is especially helpful for accounting purposes.

At the bottom of the receipt, include a signature area for both the payer and the recipient. This helps authenticate the transaction and provides proof of payment. Ensure that the template is structured clearly, using lines or tables to separate different sections of the receipt for a clean, easy-to-read layout.

Using this simple Word template will help in documenting cash transactions in India efficiently, while meeting local requirements. Customize it further based on specific business needs or compliance standards in India.

Select a format that matches the purpose of the transaction. A well-organized receipt ensures clarity and avoids confusion. For personal transactions, a simple format with the date, amount, and payer’s details will suffice. For business transactions, provide a detailed breakdown of the goods or services paid for, payment method, and any applicable taxes.

Organizing the Information

Include the date of the transaction, the payer’s name, the amount received, and the reason for the payment. If the transaction is business-related, provide a list of items or services purchased along with individual amounts. Clearly label each section and use simple, readable fonts.

Formatting for Clarity

Use a consistent layout with clear headings for each section, such as “Payment Details,” “Transaction Information,” and “Items/Services Provided.” Ensure that the document is easy to follow by keeping margins balanced and text appropriately spaced. Avoid overloading the receipt with unnecessary graphics or excessive text.

Begin with a clear, accurate date and time of the transaction to establish when it occurred. Include the name and address of the business or service provider to ensure the receipt is traceable. Ensure the buyer’s details, such as name and contact information, are listed, along with a unique transaction or receipt number for identification. Specify the items or services purchased, with their individual prices, quantities, and applicable taxes. Don’t forget the total amount, including any discounts or surcharges applied to the transaction. Finally, make sure to add a payment method used, whether it’s cash, card, or digital transfer, for complete clarity.

Ensure your receipt template reflects key details specific to Indian transactions, such as GST information and payment methods commonly used in the region. Start by including the GSTIN (Goods and Services Tax Identification Number) of both the buyer and seller. This is mandatory for businesses that are registered under GST in India.

Key Information to Include

List the transaction date, item or service description, and the total amount paid, clearly breaking down the amount before and after tax. Specify the applicable GST rate, whether it’s 5%, 12%, 18%, or 28%. This provides transparency in the transaction and complies with tax regulations.

Payment Methods and Currency

For added clarity, mention the method of payment, such as cash, bank transfer, cheque, or digital wallet. Use INR (Indian Rupee) as the currency, and ensure that any conversions from foreign currencies are stated, if applicable. This helps avoid any ambiguity for the customer.

Finally, include space for both parties to sign the receipt, affirming the transaction’s validity. Customizing your receipt this way provides clear and accurate records for both business and legal purposes in India.

Cash receipts in India are governed by specific rules to ensure transparency and prevent tax evasion. Businesses must follow these guidelines to stay compliant with the law. Ensure that every cash receipt issued is properly documented and includes the necessary details, such as the amount, date, and reason for the transaction.

Tax Implications of Cash Receipts

Under Indian tax law, cash receipts are taxable under the Goods and Services Tax (GST) if the transaction meets the threshold limit for registration. Even small businesses need to maintain records of cash transactions, as the Income Tax Department mandates the disclosure of all income, including cash receipts.

Documentation Requirements

For a valid cash receipt, businesses must issue receipts that include the name of the payer, the payer’s address (if applicable), the amount paid, and the date of the transaction. Failing to provide proper receipts can lead to penalties or fines during tax audits.

| Document | Description |

|---|---|

| Cash Receipt | A formal document acknowledging the receipt of cash, including the amount, payer’s details, and transaction date. |

| GST Invoice | Required for GST-registered businesses, showing the tax details on the cash transaction. |

| Payment Record | A record in the company’s books that ensures the receipt is captured for accounting purposes. |

By adhering to these guidelines, businesses in India can avoid legal complications and maintain clear financial records for auditing purposes.

Adjust the margins and page layout first. Ensure the content fits neatly within the printable area. Most word processors, including Microsoft Word, allow you to set custom margins that suit your template. Typically, a 1-inch margin on all sides works well for standard prints.

1. Review the Font Size and Style

Make sure the font is readable at the printed size. Fonts like Arial or Times New Roman are reliable choices, ensuring clarity even when printed. Keep the font size consistent throughout the document for a polished look. Avoid using excessively large or small fonts that may disrupt the layout when printed.

2. Check for Orphaned Text

Ensure that no text is cut off or orphaned at the bottom of a page. If needed, adjust the spacing or move sections around to avoid awkward breaks. Most word processors have a feature to automatically adjust or remove orphaned lines, but manually checking can ensure accuracy.

3. Adjust Table and Image Layouts

- Ensure tables and images are within the page boundaries.

- For images, use the “wrap text” option to control how text flows around them.

- Consider resizing images to fit the page without distortion.

4. Set the Correct Print Area

Before printing, check your print area. Select the part of the document you want to print, ensuring it aligns correctly with the page dimensions. If you’re working with large templates, consider using the “Fit to Page” option in your print settings to scale the content appropriately.

Ensure that the receipt includes all the required details without overcrowding the layout. Leaving out essential elements like the transaction date, amount, and payment method can lead to confusion. Avoid making the text too small or too close together, which can make it difficult for customers to read the details clearly.

Unclear Formatting

Use consistent fonts and sizes throughout the receipt. Mixing multiple font types can distract the reader and make important information hard to find. Stick to simple, professional fonts and maintain a logical flow of information from top to bottom.

Lack of Legibility

Avoid using colors that clash or create a poor contrast between text and background. This can reduce the visibility of key information. Always ensure that the text stands out clearly, whether printed in black and white or color, to make the receipt readable under different lighting conditions.

To create a cash receipt template in Word for India, follow these steps:

- Open Microsoft Word and select a blank document.

- Insert a table to structure the receipt. Typically, a 3-column table works well for organizing fields like item description, quantity, and price.

- Label the first section with the title “Cash Receipt” or similar. Ensure the text is bold and centered for clarity.

- Include the name and address of your business at the top, along with a receipt number for record-keeping.

- Incorporate the payment date and the total amount received in clearly marked fields.

- Ensure there’s space to list items or services provided, with individual pricing and totals. This helps both the customer and business maintain accurate records.

- At the bottom, add fields for the payer’s name, signature, and any additional remarks if needed.

- Finally, add a footer with your business’s contact details and GST registration number, if applicable. This is especially important for legal and tax purposes in India.

This format will ensure that all necessary information is captured and easy to read.