Need a structured and reusable way to document payments? A cash receipt template in Word simplifies record-keeping, ensuring every transaction is clearly documented. Whether you run a small business, manage rental payments, or track expenses, a well-designed template saves time and reduces errors.

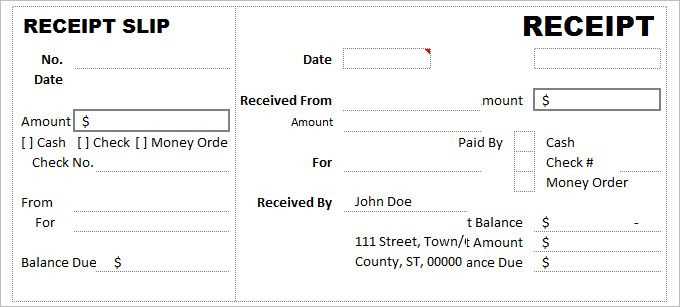

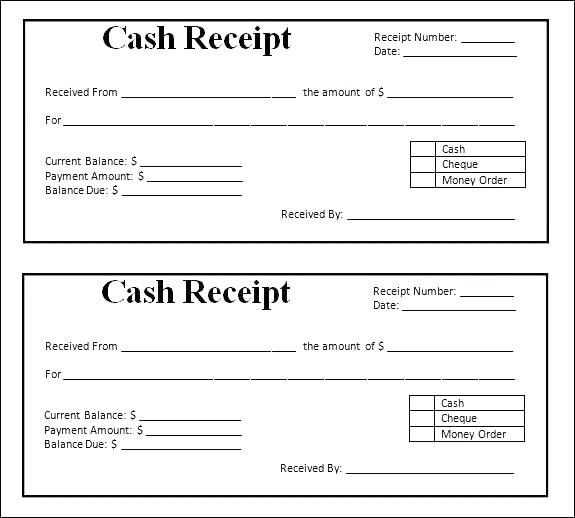

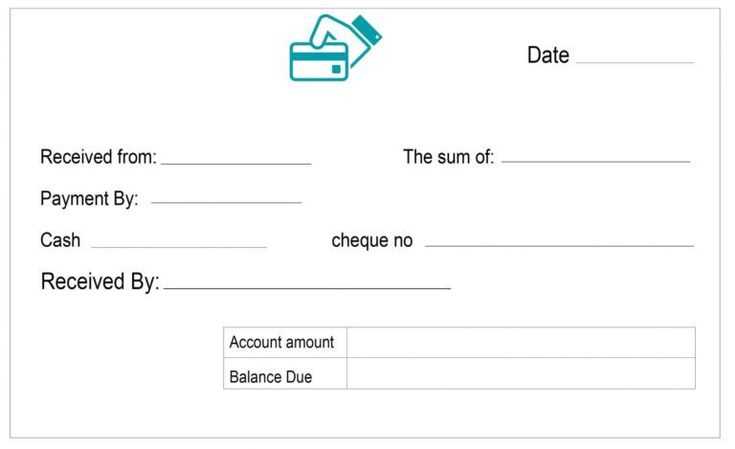

Customize the layout to match your needs. Add fields for date, payer details, amount received, payment method, and purpose. Use tables for a clean format, ensuring information is easy to read and verify. Incorporate an automatic date field to speed up entry, and include a section for digital signatures if needed.

Maintaining clear records improves financial tracking and helps resolve disputes. With a properly structured template, every receipt remains consistent, professional, and legally compliant. Save your customized template for repeated use, making transaction management effortless.

Cash Receipts Template in Word

Choose a structured layout that includes date, amount, payer details, and payment method. A well-organized template saves time and ensures accuracy. Use tables to align information clearly, making it easier to read and verify.

Enable auto-calculation for totals by inserting formulas in table cells. This reduces manual errors and speeds up record-keeping. Adding predefined fields for customer names and transaction numbers improves consistency and tracking.

Customize the template with a logo, business details, and unique numbering. This adds professionalism and simplifies retrieval when referencing past transactions. Protect the document by restricting editing to specific fields, preventing unintended changes.

Choosing the Right Layout for Your Needs

Pick a format that matches your business structure and transaction volume. A simple one-column layout works best for personal use or small businesses, while a multi-section design suits detailed records with tax or category breakdowns.

- Minimalist Format: Ideal for quick transactions. Includes date, amount, and recipient.

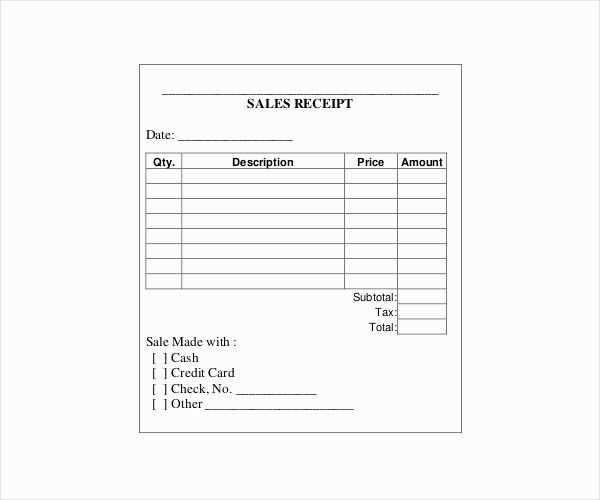

- Detailed Breakdown: Useful for businesses tracking taxes or itemized sales. Sections for descriptions, quantities, and subtotals help organize data.

- Multi-Page Layout: Necessary for high-volume sales or detailed reporting. Includes summaries, payment methods, and signatures.

Ensure essential fields are clear and easy to read. Consistent spacing and logical organization reduce errors. If digital storage is a priority, opt for a format that prints well and converts neatly to PDF.

Customizing Fields for Different Transactions

Adjust field labels to match the type of transaction. For sales, include “Product Description” and “Unit Price.” For services, replace these with “Service Type” and “Hourly Rate.” Modify tax fields based on regional requirements.

Set optional fields for client details. Retail transactions may only need a name, while B2B transactions benefit from “Company Name” and “Tax ID.” Add “Payment Method” to track cash, card, or bank transfers.

Ensure totals update automatically by linking quantity, price, and applicable taxes. Use formulas to prevent errors and speed up calculations. Save customized templates for quick reuse, avoiding manual adjustments each time.

Adding Company Details and Branding

Include your company’s name, logo, and contact details at the top of the receipt. This ensures recognition and provides customers with easy access to your information.

Use a table to structure essential details clearly:

| Company Name | ABC Enterprises |

| Address | 123 Business Road, Suite 100, City, State, ZIP |

| Phone | (123) 456-7890 |

| [email protected] |

Place the table near the top for visibility. Ensure the logo is high-quality and positioned where it does not interfere with text readability.

To align branding with your corporate identity, match fonts and colors with existing materials. Maintain consistency across all customer-facing documents.

For added professionalism, include a tagline or a brief thank-you message below the table. This enhances customer experience and reinforces your brand identity.

Automating Calculations and Tax Entries

Use built-in formulas to ensure accurate totals without manual input. Set up automated fields for summing item costs, applying discounts, and calculating taxes based on predefined rates.

- Define tax percentages in separate fields to allow quick adjustments.

- Utilize conditional formatting to highlight discrepancies or missing data.

- Incorporate drop-down lists for tax categories to standardize entries.

Link tax calculations to regional requirements by integrating lookup tables. This prevents errors when handling multiple tax rates across different locations.

Save time by enabling auto-fill for frequently used descriptions and amounts. This minimizes redundant data entry while maintaining consistency.

Ensure compliance by generating summaries that separate taxable and non-taxable items. This simplifies reporting and prevents miscalculations.

Saving, Printing, and Sharing Documents

Save the receipt file in DOCX format to preserve formatting. Choose a clear filename, such as “Cash_Receipt_MM_DD_YYYY.docx,” for easy identification. Store files in a dedicated folder to maintain order.

For printing, adjust margins and page orientation before sending the document to the printer. Use print preview to check alignment and avoid unnecessary reprints. Select high-quality paper if a physical copy is needed for official records.

To share the document, export it as a PDF to ensure compatibility. Attach the file to an email or upload it to a cloud service for easy access. If sharing frequently, use templates to streamline the process and maintain consistency across receipts.

Ensuring Compliance with Accounting Standards

Adhere to specific accounting regulations by incorporating standardized formats in all cash receipt templates. Customize fields such as transaction date, payer name, amount, and payment method to align with reporting requirements. Maintain a clear and consistent structure to ensure accuracy during audits.

Use Standardized Terminology

Incorporate commonly recognized accounting terms to avoid confusion. For example, clearly distinguish between gross and net amounts, taxes, and discounts. This helps ensure that receipts meet legal expectations and financial reporting guidelines.

Maintain Proper Documentation

Keep a detailed log of all transactions by adding sections for transaction IDs, receipt numbers, and references. This allows for easy tracking and confirms compliance with record-keeping regulations. Ensure that each entry is supported by valid documentation and receipts.