To create a professional and accurate charitable receipt, a Word template can save time and ensure consistency. By using a template, you avoid the risk of missing crucial details required by tax authorities and your donors. This approach not only ensures compliance but also maintains a streamlined process for issuing receipts.

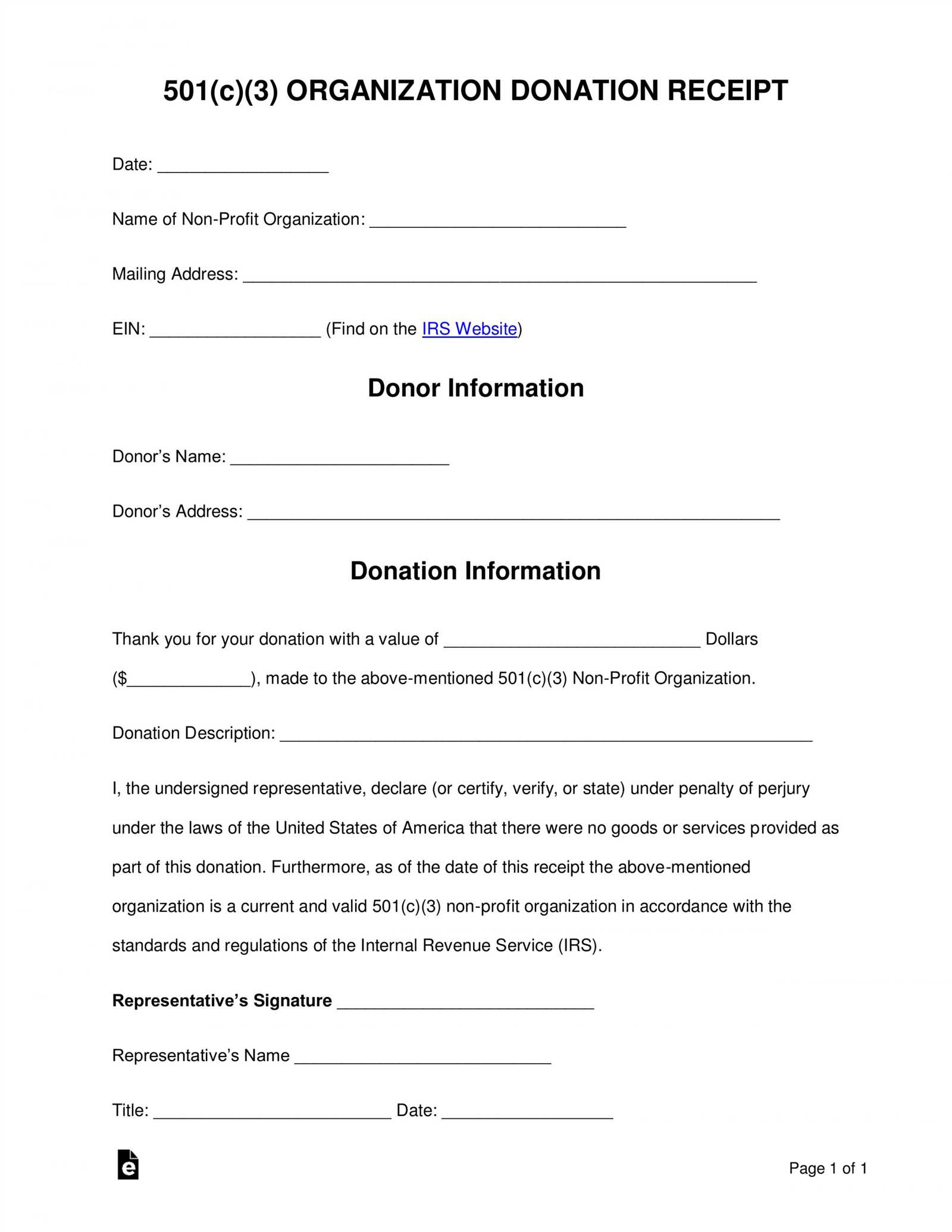

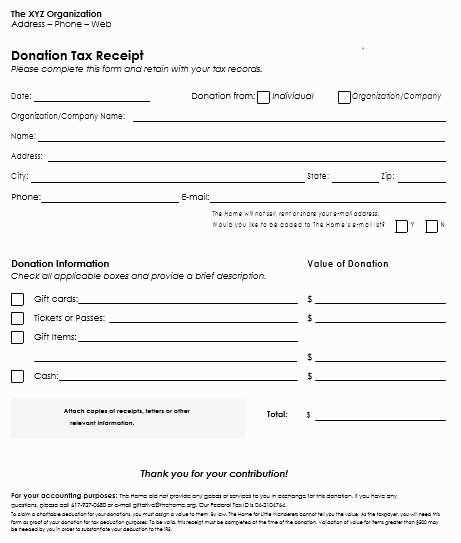

Make sure the template includes key information such as the charity’s name, address, registration number, donor’s name, donation amount, and the date. Additionally, it’s important to include a statement about whether the donation was cash, goods, or services. If applicable, specify that no goods or services were provided in exchange for the donation, as this is often necessary for tax purposes.

By using a Word template, you can customize the receipt to match your organization’s branding. Adding your logo or specific formatting elements helps maintain a professional appearance. Having a consistent template also makes it easier to issue receipts for multiple donations and ensures that your financial records remain accurate.

Here’s the corrected text with minimized repetitions:

To create a professional charitable receipt, start by including the donor’s name, address, and donation amount. Ensure the date and your charity’s details are clearly visible. Specify the donation type, whether it’s monetary, goods, or services. If applicable, mention any benefits the donor received, as this affects the deductibility of the donation. Provide a statement about the lack of goods or services in exchange for the donation, if true.

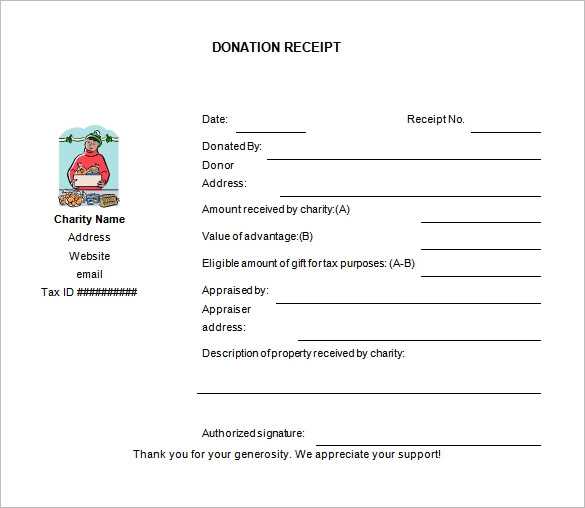

Below is a simple template example for a charitable receipt:

| Item | Details |

|---|---|

| Donor Name | [Donor’s Name] |

| Address | [Donor’s Address] |

| Donation Amount | [Amount Donated] |

| Date of Donation | [Date] |

| Donation Type | [Monetary/Goods/Services] |

| Receipt Number | [Unique Number] |

| Charity Name | [Charity’s Name] |

| Charity Address | [Charity’s Address] |

Make sure the receipt includes the correct tax-exempt status of your charity and complies with local regulations. By providing clear and concise information, you ensure both transparency and ease for the donor when filing their taxes.

- Charitable Receipt Template in Word

Creating a charitable receipt in Word is straightforward and ensures that donations are documented accurately. Follow these steps to craft a simple, professional receipt for donors.

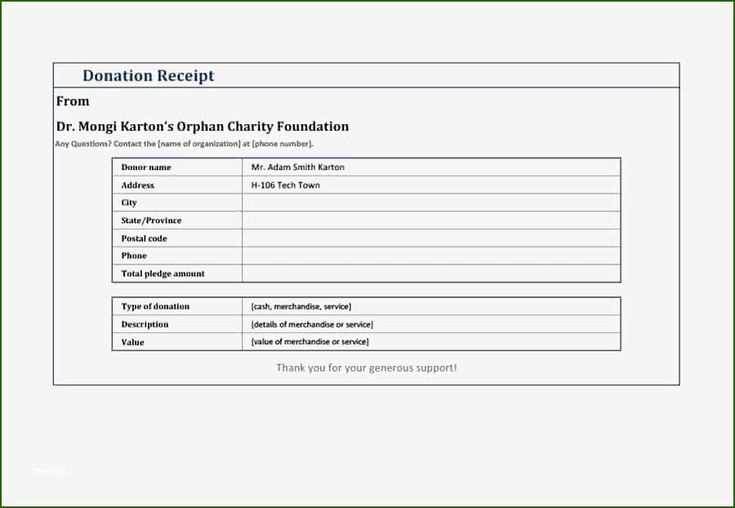

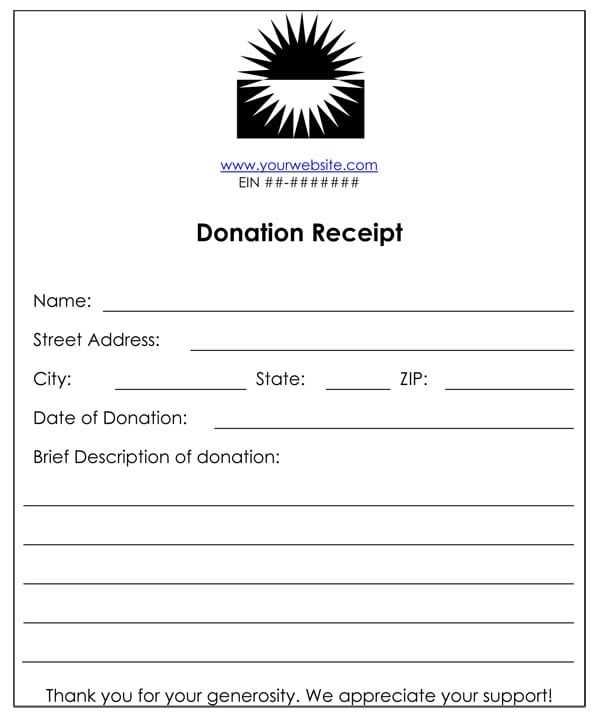

- Header: Start by adding the organization’s name, logo, and contact details at the top of the receipt.

- Title: Clearly label the document as a “Charitable Receipt” or “Donation Receipt” to avoid confusion.

- Donor Information: Include the donor’s full name, address, and email. This information helps track donations and provides the donor with necessary contact details.

- Donation Details: Specify the date of donation, the amount (in both figures and words), and whether the donation was monetary or in-kind. If in-kind, describe the donated items clearly.

- Tax Exemption Status: Mention whether the donation is eligible for a tax deduction. Ensure to include the charity’s tax-exempt number.

- Signature: Leave space for a signature or a printed name from the organization’s representative to authenticate the receipt.

Word templates often come with predefined sections that can be customized. Save the document as a template for future use, adjusting only the relevant information for each donor. This makes the process faster and reduces the chance of errors.

To create a charitable receipt in Word, open a blank document and set the layout to your preference. Start by inserting the organization’s name and logo at the top of the page, followed by its registered charity number. Make sure the organization’s contact information (address, phone number, and email) is clearly displayed.

Include the Donation Details

Next, add a section for the donor’s information. This should include their name, address, and email. Below that, include the date of the donation and a description of the donated item or monetary amount. For in-kind donations, describe the item donated along with its fair market value if possible. For monetary donations, specify the amount contributed.

Provide Legal Information

To ensure the receipt is valid for tax purposes, include a statement such as: “This receipt acknowledges the donation made. No goods or services were provided in exchange for this donation.” Finish by adding your organization’s authorized signatory or the person responsible for issuing receipts.

Once all the necessary details are in place, review the document for accuracy. Save the receipt as a template for future use. You can also customize it further with specific fonts or styles to match your organization’s branding.

Begin with the name and address of the charity. This ensures that both parties know exactly who is involved in the donation. Include the charity’s tax identification number (TIN) for verification purposes, which helps donors ensure their contribution is tax-deductible.

State the date of the donation clearly. This is crucial for the donor’s records, especially when filing taxes. Specify the amount or description of the donation. For monetary contributions, list the exact amount donated. For non-cash donations, provide a detailed description of the items donated along with their estimated value if applicable.

If the donation includes any goods or services in exchange, this must be noted. Include a clear statement about whether any goods or services were received in return for the donation, as this affects the tax-deductible amount. If applicable, mention the fair market value of these goods or services.

Provide a statement confirming that no goods or services were provided in exchange for the donation, if that is the case. This ensures clarity for the donor, especially if the donation is fully tax-deductible.

Include a clear statement specifying the purpose of the donation if it is for a specific project or cause. This transparency helps both the donor and the charity track how funds are being used.

End the receipt with a signature from an authorized representative of the charity, validating the document as an official receipt.

Use a clean, organized layout to ensure readability. Align your text left and avoid clutter. Start with the donor’s name and address clearly positioned at the top, followed by your organization’s information. Make sure the donation amount stands out–use bold or a larger font size to highlight this detail. Include a section for the donation date and method (cash, check, credit card) to provide full transparency.

Ensure your receipt includes a clear statement that no goods or services were provided in exchange for the donation. This is a key point for tax purposes. Use concise, direct language to avoid any confusion. You may also include a thank-you note, reinforcing the donor’s impact while keeping it brief.

Consider using a professional, simple font like Arial or Times New Roman for readability. Stay consistent with font sizes and spacing, using a larger size for headings and a smaller size for detailed information. This consistency makes the receipt more approachable and formal.

Finally, add your organization’s logo and any legal disclaimers at the bottom. These elements should be unobtrusive but clearly visible. Make sure the receipt looks polished and aligns with your nonprofit’s brand guidelines for a cohesive appearance.

Begin by adjusting the header to include your organization’s name, logo, and contact information. This ensures that the receipt is clearly associated with your entity and makes it easy for donors to recognize where the receipt comes from. Use a clean, professional font to make the details easily readable.

Next, customize the receipt fields to include essential donation information, such as the donor’s name, donation date, and amount donated. Make sure the donation type (one-time, monthly, etc.) is specified clearly to avoid confusion. A unique receipt number for tracking purposes adds an extra layer of organization to your records.

Incorporate your organization’s tax identification number and any other legal details required for tax purposes. Donors will need this information when claiming deductions. Adjust the footer with a message of appreciation and your organization’s website or donation page URL, offering donors a way to get involved further.

Finally, test your customized template to ensure all fields are correctly aligned and easy to understand. A clean layout and accurate information will help reinforce your organization’s credibility and make the receipt more user-friendly for your donors.

Ensure that your donation receipts include accurate details. Incorrect information can lead to confusion or even legal issues. Below are some key mistakes to avoid:

- Missing Donor Information: Always include the donor’s full name and address. Without this, it may be difficult to confirm who made the donation.

- Failure to Specify the Date: Include the exact date the donation was received. This is crucial for both tax reporting and tracking donations.

- Omitting the Donation Amount or Description: Make sure the amount is clear. If the donation is in-kind, describe the items or services donated.

- Not Stating the Organization’s Tax-Exempt Status: Indicate that your organization is tax-exempt (if applicable), and include your tax ID number. This allows donors to claim deductions.

- Not Clarifying Whether Goods or Services Were Provided: If a donor received something in exchange for their contribution, this must be noted, along with the value of the benefit received.

- Failing to Sign the Receipt: The receipt should be signed by an authorized individual from your organization. An unsigned receipt lacks validity.

- Incorrect Valuation of Non-Cash Donations: If the donation is a gift of property, ensure it’s properly valued. If you can’t determine the value, let the donor know that it is their responsibility to do so.

- Unclear or Vague Descriptions: Avoid generic terms like “miscellaneous.” Be specific about the donated items or services to help the donor when filing taxes.

By paying attention to these details, your organization will provide clear, accurate, and legally sound donation receipts that ensure smooth communication with donors and tax authorities.

To save your charitable receipt in Word format, first ensure that your document is complete and ready for distribution. After finalizing your receipt, click on “File” in the top-left corner of Microsoft Word. Select “Save As” and choose the location on your computer where you wish to store the file. In the “Save as type” dropdown menu, select “Word Document (*.docx)” and click “Save.” This will preserve your receipt in the Word format, making it easily accessible and editable for future needs.

When it comes to distributing your receipt, you have several options. For digital distribution, open the saved document and attach it to an email. If you need to send the receipt to multiple recipients, consider using a group email or an automated email system to streamline the process. If sending physical copies, print the Word document and mail it to the recipient. Ensure that the document maintains its format when printing by previewing the document before printing to avoid any layout issues.

For added security, you can also password-protect the document. To do this, go to “File” > “Info” > “Protect Document” > “Encrypt with Password.” This will prevent unauthorized access to the receipt while still allowing for easy distribution to the intended recipient.

To create a charitable receipt, structure it with clarity and precision. Begin with the organization’s name, logo, and contact details at the top. Include the donor’s name and the donation date for accurate record-keeping. Be sure to specify the donation amount and method–cash, check, or in-kind–and provide an acknowledgment statement for tax purposes.

List the value of any non-monetary contributions, such as goods or services, and describe their condition or type. Acknowledge the absence of goods or services provided in exchange for the donation if applicable. If the donation is for a specific purpose, note that as well.

Ensure the receipt complies with local tax laws. Include the charity’s tax identification number and a statement confirming its tax-exempt status. This will help donors claim deductions on their taxes.

To finish, end with a thank-you message, emphasizing the impact of the contribution on the cause. This shows appreciation and strengthens the relationship with your supporters.