If you’re providing child care services and need a simple, clear, and professional way to document payments, using a child care receipt template in Word format is an excellent solution. A well-designed template helps ensure that all the necessary information is captured and that your records remain organized for tax purposes or any future reference.

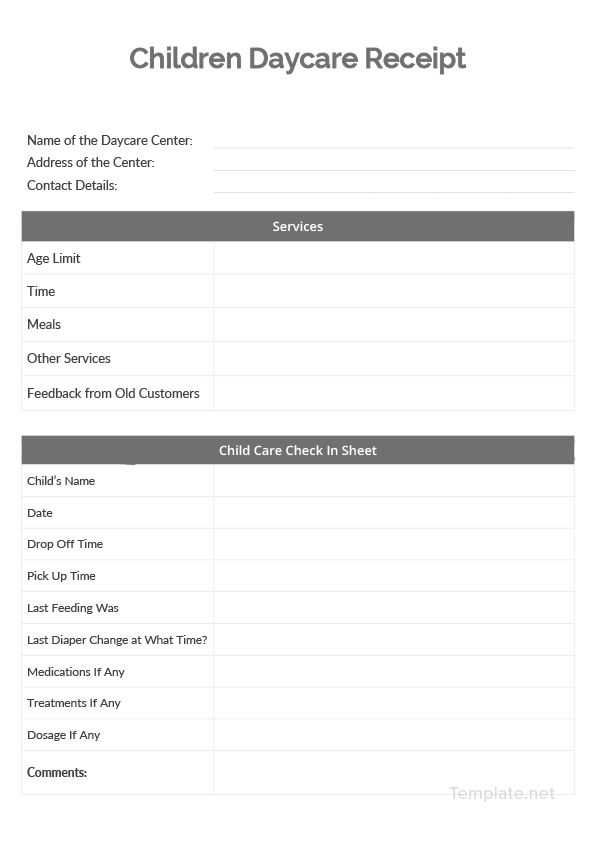

The template should include the child’s name, the date of service, the amount paid, and a breakdown of the services provided. Make sure to include both the payer’s and receiver’s contact details for easy follow-up if needed. This information provides clarity and transparency for both parties involved, reducing the likelihood of any misunderstandings.

Creating your own receipt from scratch might take time, but with a Word template, you can easily customize it to suit your specific needs. Adjust the layout, font, and design elements to make sure it aligns with your branding or personal preferences. Whether you offer part-time or full-time child care services, having a reliable receipt template will save you time and ensure professionalism in your transactions.

Here’s the corrected text:

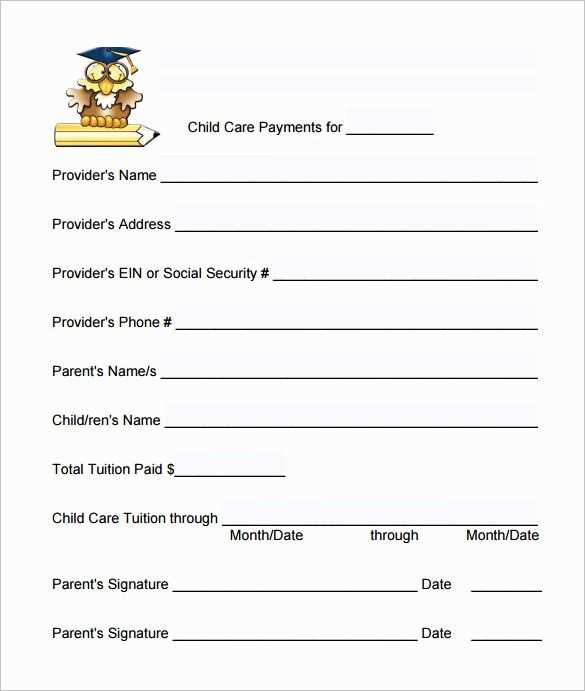

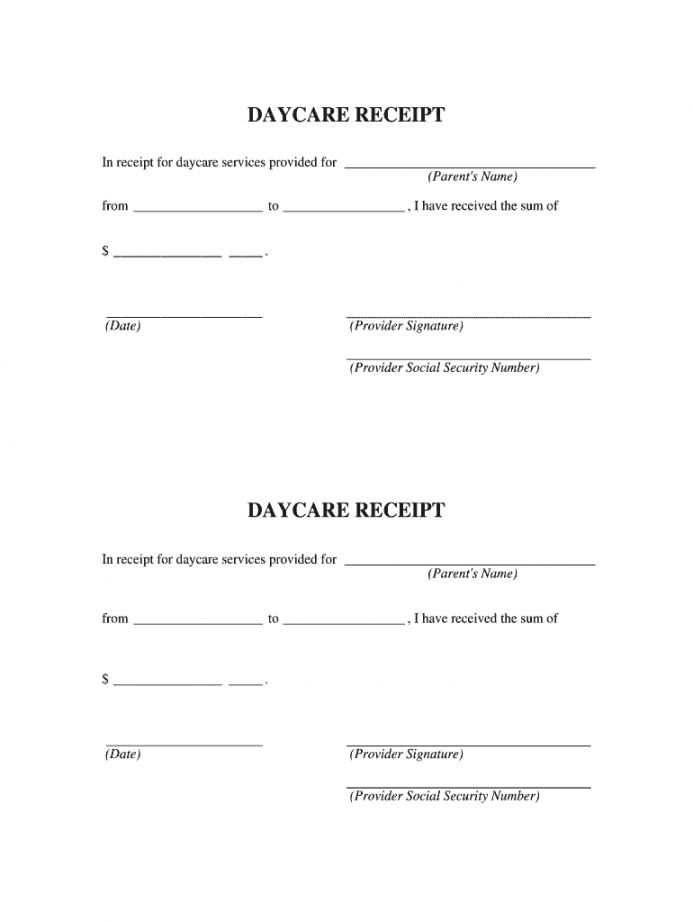

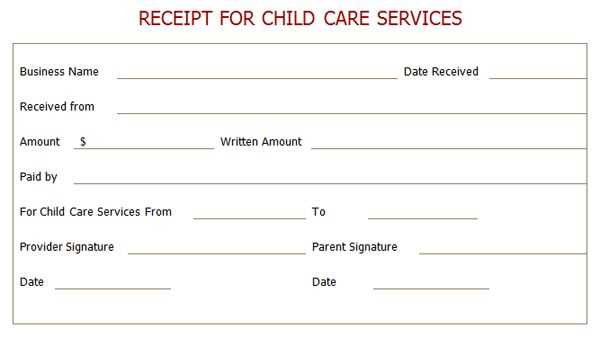

Ensure that the child care receipt template includes all the necessary details to make it valid and clear. Start by including the date of the transaction, the name of the child care provider, and their contact information. Specify the amount paid for services and the period it covers. Make sure the payment method is also documented–whether it was cash, check, or credit card. A detailed description of the services provided should follow, highlighting any specific care or activities during the period.

Additional Information to Include

List any tax-related information, if applicable, such as the provider’s tax ID number. This is especially important for parents who will use the receipt for tax deductions. Don’t forget to include a signature line for the child care provider, confirming the receipt of payment. This can help resolve any potential disputes later.

Formatting Tips

For better readability, keep the receipt organized and easy to read. Use a clean font and separate sections for each piece of information. A professional and well-structured template will ensure clarity and make the document more useful for future reference.

- Child Care Receipt Template in Word: A Practical Guide

To create a child care receipt template in Word, begin by setting up a clear structure with essential details. Ensure that the receipt includes the name of the provider, the child’s name, the care dates, and the total amount paid. Follow these steps for a smooth process:

1. Set Up Document Structure

Start with a header that includes the child care provider’s name, business name, and contact information (address, phone number, email). Below the header, add fields for the parent’s or guardian’s name, the child’s name, and the date range for the child care provided.

2. Include Payment Information

Clearly list the total payment amount, any breakdown of fees (if applicable), and the payment method (check, cash, etc.). You may also want to add a field for notes regarding any additional charges or discounts.

| Provider’s Name | Child’s Name | Date Range | Total Amount | Payment Method |

|---|---|---|---|---|

| John Doe Daycare | Jane Smith | 01/01/2025 – 01/31/2025 | $500.00 | Credit Card |

By using this structure, you ensure that all required information is easily accessible and formatted correctly. The clarity of your child care receipt template will help both the provider and the recipient keep accurate records for future reference. Save the template and reuse it for future transactions, saving time while ensuring consistency.

Create a clear and professional child care receipt template in Microsoft Word by following these steps:

1. Set up a blank document: Open Microsoft Word and create a new blank document. Adjust the page size if needed to fit your preferences (A4 or Letter size is typical for receipts).

2. Add a header: Include the name of your child care service or business at the top. This should be bold and large enough to stand out. You can also include your logo or business address underneath if desired.

3. Insert receipt title: Center the text and add a title like “Receipt for Child Care Services” or simply “Receipt.” Make it bold for easy identification.

4. Include receipt number: For record-keeping purposes, create a receipt number system. This helps track payments efficiently. You can add “Receipt No.” followed by the number, such as “Receipt No. 001” or use a dynamic numbering system if desired.

5. List the child’s name and care dates: Below the title, include a section where you enter the child’s name. Then, provide the dates for which care was provided, such as “Service Dates: [Start Date] – [End Date].”

6. Add a breakdown of services: Create a table with columns such as “Service Description,” “Quantity,” “Rate,” and “Total.” In the rows, list details like “Full-day care” or “Hourly rate” and the respective costs.

7. Calculate total amount: At the bottom of the service table, add a row for the total amount due. Use the “Sum” function in Word’s table tools if you want automatic calculations for totals.

8. Provide payment details: Clearly state the payment method received (e.g., cash, check, online payment). If applicable, include transaction details or the date payment was made.

9. Add a thank-you note: End the receipt with a short note of appreciation. Something like, “Thank you for choosing our child care services. We look forward to working with you again!”

10. Save as a template: Once your receipt layout is complete, save it as a Word template (.dotx). This way, you can easily reuse the design for future receipts without recreating it from scratch.

By following these steps, you’ll have a functional, professional receipt template tailored to your child care services that can be reused for each transaction.

Tailor your child care receipt template to match your business needs. First, ensure your template reflects the specific services you offer, such as full-time care, part-time care, or after-school programs. Update the service description section to make it clear and concise for parents. Including hourly rates, weekly totals, or even a separate field for overtime charges will make invoicing more transparent.

Include Custom Fields for Special Services

Consider adding fields for any special services or one-time charges, like field trips, supplies, or meals. This makes it easier to itemize costs and helps clients understand where their money is going. Providing a space for notes can also be helpful for both you and the parents to track important details, such as special requests or changes in schedule.

Adjust Payment Information

Modify the payment section to include your preferred payment methods. If you accept checks, credit cards, or online payments, specify this clearly. You may also want to include any late payment fees or discounts for early payments. Including your business’s tax identification number and other relevant legal information will ensure everything is properly documented for both parties.

Lastly, personalize the receipt with your business logo, name, and contact details. This creates a professional appearance and makes it easier for parents to reach you with any questions. By customizing the template, you create a seamless process for both invoicing and maintaining good communication with clients.

Include the child’s name and the provider’s contact information. This confirms both parties involved in the service. Clearly state the service period–dates and hours worked. This helps identify the exact duration for which the payment is made.

Payment Details

Specify the amount paid for each service rendered. Include hourly rates if applicable, as well as any applicable taxes or discounts. Mention the payment method (cash, check, online transfer) to clarify how the transaction was completed.

Provider’s Signature

End the receipt with the provider’s signature. This confirms that the service was provided and payment received. If possible, include an additional note confirming the payment was processed and accepted in full.

To provide a clear and detailed payment breakdown on the receipt, follow these steps:

- Include Itemized Services: List each service provided with a clear description, such as “Child care for 4 hours” or “Early drop-off fee.” This helps parents understand exactly what they are being charged for.

- Specify Payment Amounts: Show the cost for each individual service, followed by the total amount due. For example, if the child care service costs $20 per hour, list the total based on the number of hours used.

- State Payment Method: Include the method used for payment (e.g., cash, credit card, bank transfer) to make it easy to track financial transactions.

- Provide Discount or Adjustment Details: If a discount or adjustment applies, state it clearly. For example, “10% discount for early payment” or “Adjustment for late pickup” to ensure transparency.

- Tax Breakdown: If applicable, include a separate line showing any taxes or fees that apply to the total charge. This helps clarify the final amount the client is required to pay.

By following these steps, you ensure your receipt is clear, professional, and informative for the parent, making it easier to track payments and services rendered.

To avoid any potential legal issues, always include necessary details in a child care receipt, such as the caregiver’s name, the amount paid, the date of the service, and a description of the care provided. A properly issued receipt can serve as evidence of payment if disputes arise.

Tax Implications for Caregivers

Caregivers who issue receipts must report income on their tax returns. Income earned from child care services is taxable, even if provided informally. This applies to both professional caregivers and individuals offering care on an occasional basis. If the caregiver is registered as a business, they may need to collect sales tax, depending on local tax laws.

Tax Deductions for Parents

Parents may be eligible for tax credits, such as the Child and Dependent Care Credit, based on child care expenses. Receipts are required to support claims for these credits. Ensure that the receipt includes the caregiver’s Taxpayer Identification Number (TIN) or Employer Identification Number (EIN) to qualify for such deductions.

To save your receipt template for future use, start by saving it in a commonly used format like .docx or .pdf. These formats are widely compatible with most devices and software. By using .docx, you can easily edit the template if needed later, while .pdf ensures it remains unchanged.

Saving Your Template

- Click on the “Save As” option in your word processor.

- Choose the appropriate file format (.docx or .pdf) from the options available.

- Pick a location on your device where you can easily find it, like a “Documents” or “Receipts” folder.

- Consider using a descriptive file name, such as “Child_Care_Receipt_Template” for easy identification.

Sharing Your Template

- To share the template with others, you can email it as an attachment. Most email services allow you to send files up to a certain size limit.

- If the file is too large, upload it to a cloud storage service like Google Drive or Dropbox, then share the link with others.

- If you’re working within a team or a company, consider saving the template in a shared folder for easy access.

- Ensure that everyone using the template knows where to find the latest version to avoid confusion.

Child Care Receipt Template

Creating a child care receipt is simple with a well-structured template. Ensure the template includes the following details for clarity and proper documentation:

- Provider’s Information: Full name, business name, contact details, and address.

- Parent/Guardian Details: Name, address, and contact information of the person receiving child care services.

- Child Information: Full name and age of the child receiving care.

- Service Dates: Clearly specify the dates the care was provided, including start and end times if necessary.

- Payment Amount: Total payment for services, including a breakdown if applicable (e.g., hourly rates, discounts).

- Payment Method: Indicate how the payment was made (cash, check, bank transfer, etc.).

- Provider’s Signature: Space for the provider’s signature to verify the receipt.

A basic child care receipt template should look like this:

| Item | Details |

|---|---|

| Provider’s Name | [Name of Provider] |

| Provider’s Contact | [Phone Number, Email] |

| Parent/Guardian Name | [Parent’s Name] |

| Child’s Name | [Child’s Name] |

| Care Dates | [From Date] to [End Date] |

| Payment Amount | [Amount in USD] |

| Payment Method | [Cash, Check, etc.] |

| Provider’s Signature | [Signature] |

Using this template will ensure accurate and professional documentation for both the provider and the parent. It helps avoid misunderstandings and makes record-keeping easier.