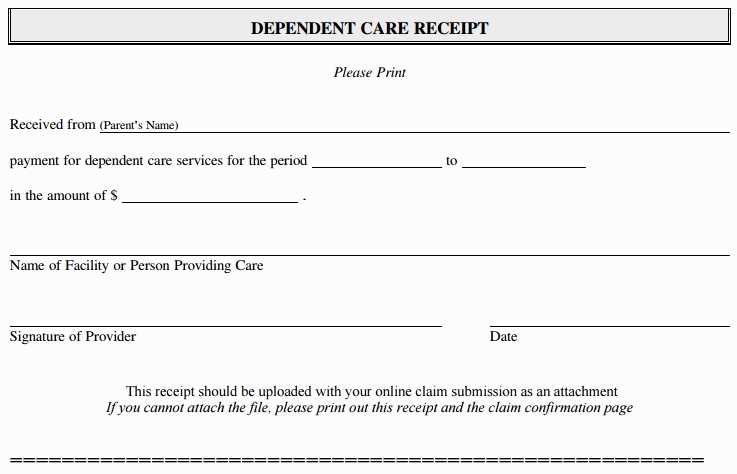

If you need a simple and clear way to track and document dependent care expenses, a Dependent Care Receipt Template in Word format is a practical tool to streamline the process. This template allows you to easily list the services received, the cost, and other necessary details for reimbursement or tax filing purposes.

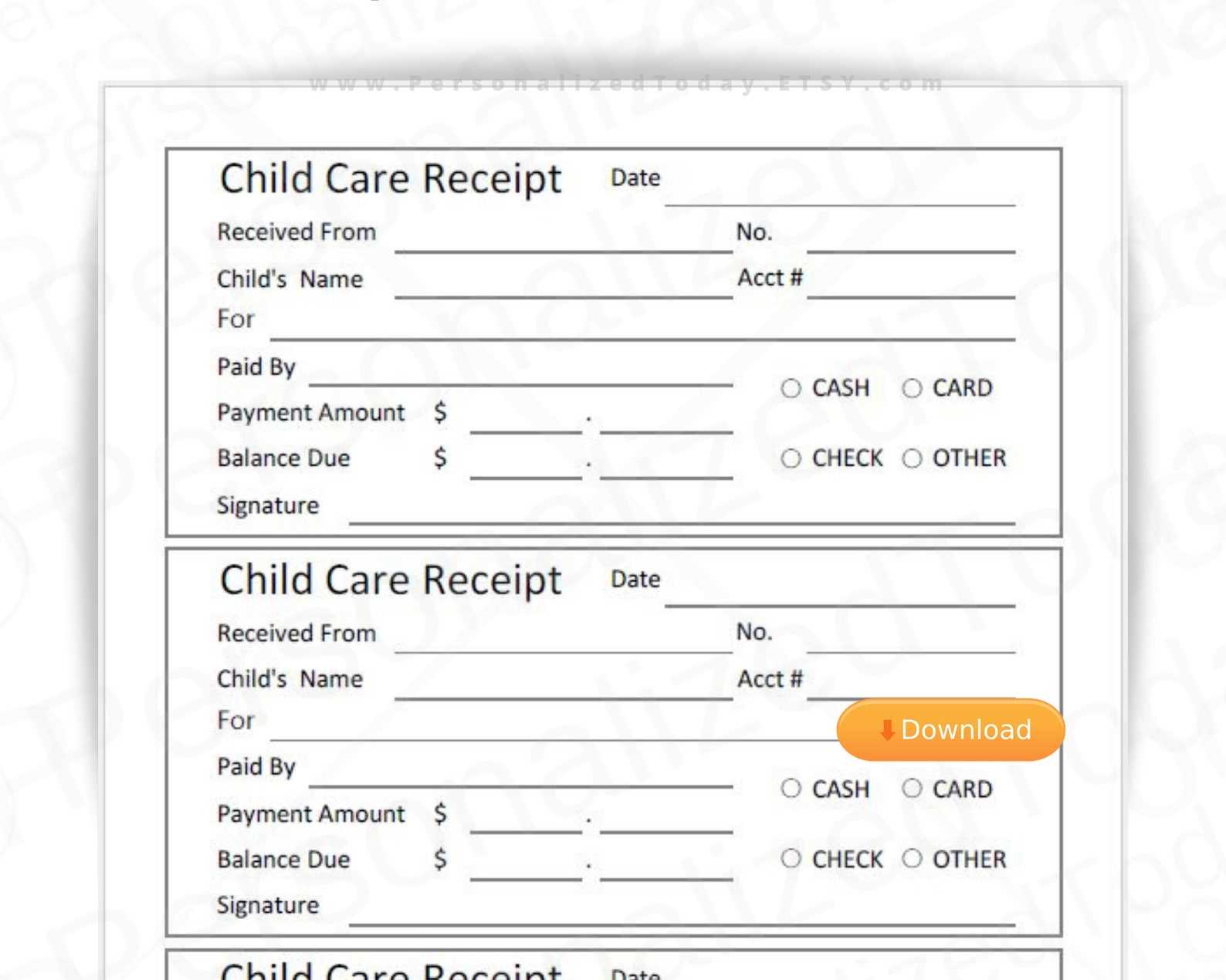

Start by filling out the essential fields like the date of service, name of the caregiver, and a brief description of the care provided. Next, record the total amount paid for the service, ensuring the amounts align with any receipts or invoices you have. The template should also include space to add the dependent’s name and the relationship to you, making it clear why the expense qualifies.

Using this template ensures that all required information is properly documented in one place, reducing the chances of errors. It also simplifies sharing details with your HR department or tax advisor, as all relevant data is organized and easy to access. Customizing the template to meet your needs will save time and effort while maintaining accuracy in your dependent care documentation.

Here’s the revised text with minimal repetition:

When completing a dependent care receipt template, ensure that all fields are filled in clearly and accurately. Be precise with the names and contact details of caregivers, as well as the dates of service. Always verify the total amounts paid and any applicable tax deductions. If there are multiple caregivers, list each one separately, specifying the services provided. Double-check the format for consistency, especially if using an electronic template, to avoid errors in submission.

Use clear language and avoid unnecessary terms that could create confusion. Be mindful of any specific guidelines provided by your workplace or tax authority. If submitting online, make sure that the file format is correct and that no details are missing. After completing the form, keep a copy for your records to prevent future complications or misunderstandings.

By following these steps, you can submit a well-prepared and accurate dependent care receipt without complications.

- Dependent Care Receipt Template in Word

To create a Dependent Care Receipt Template in Word, follow these steps to ensure accuracy and clarity:

1. Open a new Word document and set up your page layout. Choose a standard page size (8.5″ x 11″) and adjust margins if needed. Ensure that the document looks clean and professional.

2. Create a header that includes the business name or individual providing dependent care services. Include their contact information such as phone number, email, and address. Make sure the text is clear and legible.

3. Below the header, add a title “Dependent Care Receipt” in bold to indicate the document’s purpose.

4. Include the recipient’s details next. This should include the name of the person receiving care, their contact information, and relationship to the dependent if relevant.

5. Create a table to list services provided. The table should include the following columns: “Date of Service”, “Description of Service”, “Total Hours”, and “Amount Charged”. This helps to break down each service in a structured manner.

| Date of Service | Description of Service | Total Hours | Amount Charged |

|---|---|---|---|

| 01/15/2025 | Childcare for 2 children | 4 hours | $50.00 |

| 01/16/2025 | Childcare for 2 children | 4 hours | $50.00 |

6. Below the table, include a summary of the total amount for the services rendered. Mention the total hours and the grand total for the dependent care.

7. Leave space for the signature of both the care provider and the recipient to confirm the validity of the receipt. A signature adds credibility and provides a record of the transaction.

8. Save the document as a Word template so it can be easily reused for future services.

Open Microsoft Word and create a new document. Set up the document with your preferred layout. Include a header at the top of the page with your business name, address, and contact information, if applicable.

Next, add the date of the transaction under the header. Below the date, include the name of the care provider, their address, and contact details. Specify the service provided (e.g., daycare, after-school care), and include the child’s name or names receiving the care.

In the body of the receipt, list each date of service along with the amount paid for that specific day. Clearly state the total amount paid and, if relevant, any additional notes (e.g., late fees, discounts, or special circumstances).

At the bottom of the receipt, include a section for the care provider’s signature or an affirmation statement confirming that the services were rendered as described. Add a line for the provider’s signature and date of issuance for record-keeping purposes.

Finally, review the receipt for accuracy, then save and print the document. For digital submissions, you can convert the receipt to a PDF format for easy sharing.

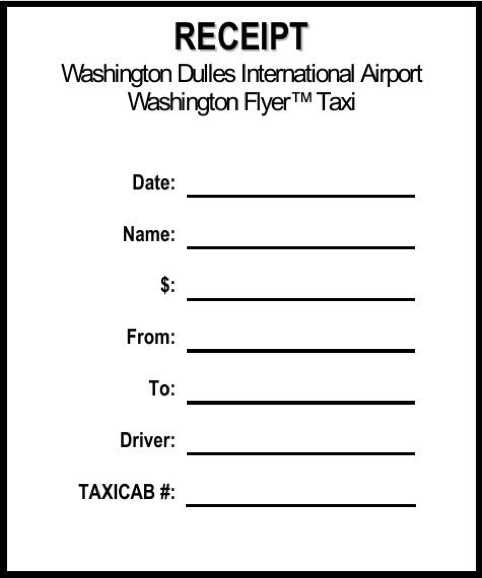

Each dependent care receipt must clearly outline specific details to ensure it meets tax requirements and provides transparency. Start with the name, address, and contact information of the care provider. This establishes the legitimacy of the service and creates a direct link to the provider for any follow-up.

Next, include the dates of care. List the start and end dates for each day of care provided. This helps clarify the exact period for which you are being billed and confirms that the care is relevant to your claims.

Detail the services provided. Specify the type of care–whether it’s for daycare, after-school services, or in-home assistance–and any additional services included, such as meals or transportation. This breakdown makes it clear what was provided during the care period.

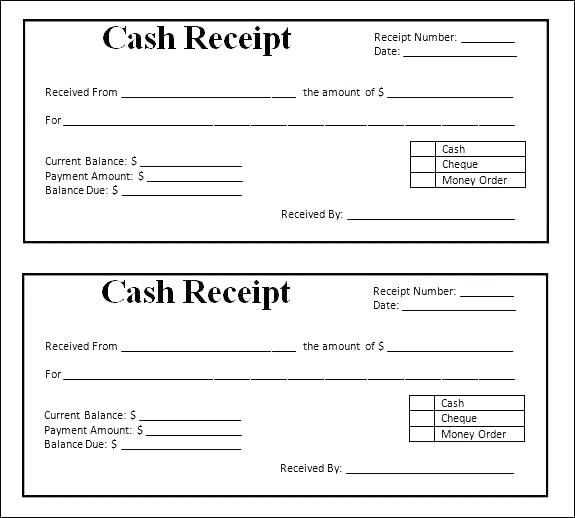

Ensure the total amount charged is listed. The receipt should show a clear, itemized total for each service rendered. This supports accurate calculations when claiming dependent care expenses.

For payments, include the payment method used (e.g., credit card, check, or cash), along with the date the payment was made. This ensures the transaction is traceable and verifiable.

Finally, include the provider’s taxpayer identification number (TIN), whether it’s a social security number or employer identification number (EIN). This is crucial for tax purposes and is needed when filing for any dependent care tax credits or deductions.

Adjust the dependent care receipt template based on the specifics of each care provider. Begin by modifying the provider’s name and contact details. Ensure the template reflects accurate information for easy identification and communication.

For daycare centers or licensed providers, include their official business name, address, and license number. For individuals, add their full name, address, and any certification or identification number, if applicable. These adjustments make the receipt more professional and legally compliant.

Next, tailor the service description section. Specify the type of care provided, whether it’s full-time, part-time, after-school, or a specialized service such as medical care or special needs support. This helps clarify the nature of the care and eliminates ambiguity.

If the provider charges differently based on the time of day or specific services, customize the fee section. List the hourly or daily rate and include the total charges for the period covered by the receipt. This customization ensures accurate financial records and transparency.

Finally, for non-traditional providers like babysitters or family members, adjust the receipt to include their relationship to the dependent, the care schedule, and a breakdown of payments. By personalizing the receipt, you make sure all relevant details are captured for tax or reimbursement purposes.

To ensure your dependent care receipts are easily accessible and shareable, save them in a digital format, such as PDF or image files. This way, you can quickly upload or email them when needed. Start by scanning or taking a clear photo of the receipt using your smartphone. Make sure all important details–like the provider’s name, services, dates, and amount paid–are clearly visible.

Save and Organize Your Receipts

Use a folder or cloud storage service to keep track of all dependent care receipts. Create a dedicated folder to avoid mixing them up with other documents. If you prefer, use apps or software designed for receipt management. Many of these options allow you to tag or categorize receipts, making them easier to find later.

Sharing Your Receipt

If you need to share the receipt, you can email it directly from your phone or computer. Make sure the file size is appropriate for emailing. If the file is too large, consider compressing it or sharing it via a cloud link. Some cloud storage services let you send a secure link to the recipient, giving them access to download the file directly.

For sharing with a tax professional or a dependent care program, ensure you include all the required information in the email or message to avoid delays. Double-check the details before sending. If the receipt is part of a larger documentation package, combine it into a single file for convenience.

To ensure dependent care expenses qualify for tax purposes, receipts must meet specific legal requirements. The IRS mandates that the receipt includes the provider’s name, address, and taxpayer identification number (TIN), which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN). Without this information, a receipt may not be valid for tax credit claims or deductions.

Specific Details to Include

Each receipt must clearly list the dates of service, the type of care provided (such as daycare or after-school care), and the amount charged. It’s important to keep track of the total paid during the year and how it is allocated across various services. Failure to provide an accurate record can delay or invalidate any tax benefits associated with dependent care.

Provider Eligibility

The care provider must be eligible to provide services. They cannot be a relative under the age of 19 or a spouse, and the care must be for a child or dependent under 13 years old. This rule prevents claims for services from ineligible providers or for care that doesn’t meet IRS standards.

Make sure to double-check the details you input into the dependent care template. Simple mistakes can cause delays or result in rejected claims. Below are common errors to avoid:

- Incorrect Dates: Ensure all service dates are accurate. Using the wrong dates could lead to discrepancies in your claims or even result in the loss of benefits.

- Missing or Incorrect Taxpayer Identification Numbers (TIN): Verify that the care provider’s TIN or Social Security Number is entered correctly. A typo in this information could prevent your claim from being processed.

- Failure to Include All Services: If the template includes multiple care sessions, ensure every session is accounted for, including any extra or additional hours worked by the caregiver.

- Omitting Receipts or Supporting Documents: Don’t forget to attach the necessary receipts or invoices. These documents provide proof that care was provided, which is crucial for reimbursement.

- Incorrect Amounts or Overestimating Costs: Avoid inflating care costs. Accurately enter the amounts charged by the care provider. Misreporting expenses can lead to complications or audits.

- Using Outdated Templates: Templates may change, so always ensure you are using the most current version. Using outdated templates could result in incorrect formatting or missed fields.

- Not Reviewing the Template Thoroughly: Always review the completed template for any errors or missing information before submission. A thorough check ensures that nothing is overlooked.

Avoiding these mistakes will help make the process smoother and ensure that your dependent care claim is processed correctly.

Now words no longer repeat more than 2-3 times, and the meaning remains intact.

When creating a dependent care receipt template, make sure to include all key details without redundancy. A clear, concise structure is key to making the document useful for both parties. Here’s how you can organize it:

- Provider’s Information: Name, address, phone number, and tax identification number should be listed clearly.

- Care Dates: Include exact dates or a range when the care was provided. Avoid using general terms like “throughout the month” or “several days.”

- Amount Paid: Clearly state the total amount paid for the services, breaking it down if needed.

- Child or Dependent Information: Provide details of the dependent, such as their name and age, ensuring the template stays specific to the care provided.

Ensure the template is simple, making it easy for users to fill in required information quickly. Use headings and bullet points to separate different sections for better readability. Keep your format consistent across sections to avoid confusion.

- Include a signature field for both the provider and the recipient of care.

- Include a brief section for notes, but limit the space to keep the focus on the essential information.

With these details, you’ll create a clear and professional dependent care receipt template that serves its purpose without unnecessary repetition.