A donation form receipt is a valuable document for both the donor and the recipient organization. It serves as proof of the donation and can be crucial for tax purposes. Having a well-structured receipt template in Word ensures that you maintain consistency and professionalism in your documentation.

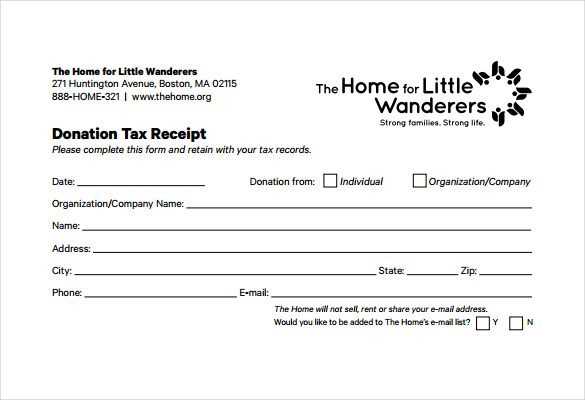

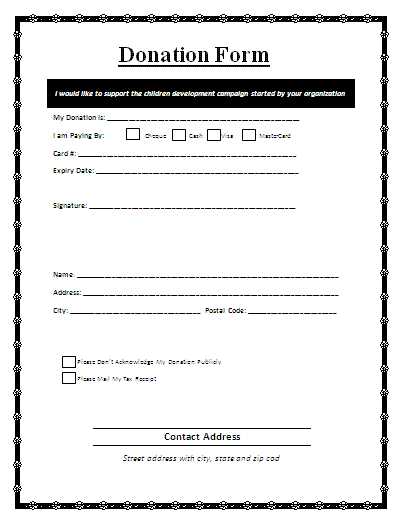

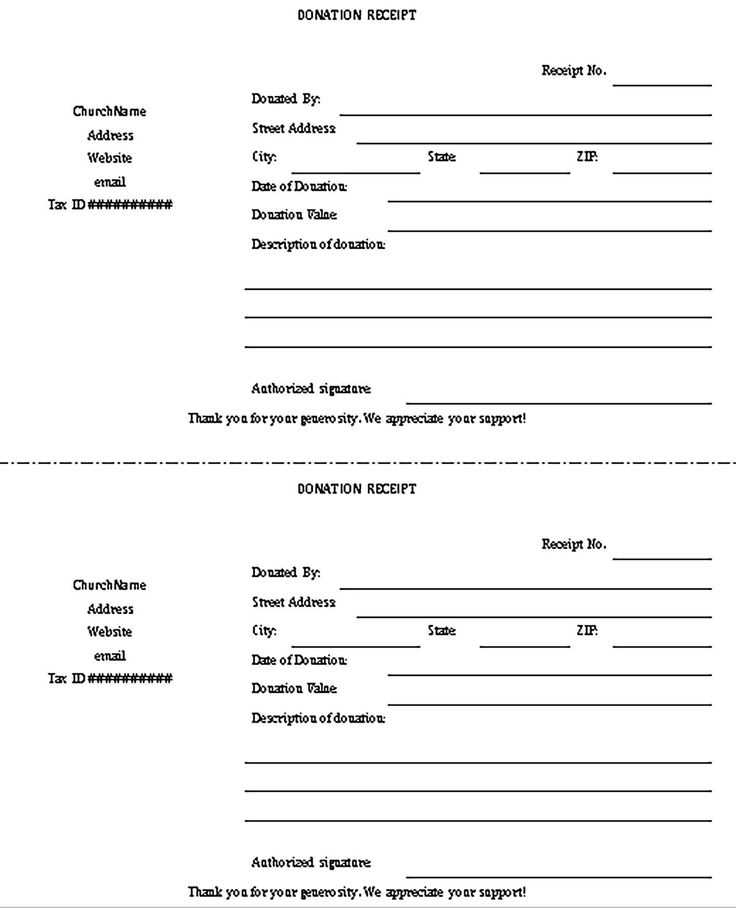

When creating a donation form receipt in Word, focus on the key information that needs to be included. This typically consists of the donor’s details, the donation amount, the date of the donation, and a brief description of the donation. It’s also a good idea to include a thank you note to the donor for their contribution. This adds a personal touch and strengthens your relationship with the donor.

To make the process even easier, consider using a ready-made template. Word offers various templates for receipts that can be customized to suit your specific needs. These templates already include the essential fields, so all you need to do is fill in the information. If you prefer, you can also create your own template from scratch, ensuring it aligns with your organization’s branding and requirements.

Key points to remember: Always include a clear statement of the donation amount and confirm whether it’s monetary or an in-kind gift. Adding a unique receipt number can help you track donations more easily. If applicable, note whether the donation is tax-deductible, and include your organization’s contact information for any future inquiries.

By organizing your donation receipts with a Word template, you ensure a smooth and efficient process for both your donors and your administrative team.

Sure! Here’s the text with reduced repetition:

When designing a donation form receipt template, aim for clarity and simplicity. Ensure the donor’s name, donation amount, date, and purpose of the donation are clearly presented. Also, include your organization’s name, contact details, and a thank you message to acknowledge their contribution. A simple and organized structure helps the donor quickly recognize the information they need.

Key Components of a Donation Form Receipt Template

| Component | Description |

|---|---|

| Donor Information | Include the donor’s name, address, and contact details. |

| Donation Details | Clearly state the amount donated, the donation date, and if applicable, the specific cause or event. |

| Tax Information | Provide any tax-relevant information, such as the organization’s tax ID number for deductions. |

| Thank You Message | Express gratitude to the donor for their contribution. |

Tips for Clear Communication

Use concise language to ensure the donor can easily understand the information. Avoid jargon and focus on the key details that validate the donation. Keep the layout simple and easy to read. Using bullet points or a clean table format helps with quick comprehension. Lastly, ensure that all information is accurate and up-to-date to maintain donor trust.

- Donation Form Receipt Template for Word

Using a donation form receipt template in Word ensures that your receipts are organized and professional. A well-designed receipt helps maintain transparency and build trust with your donors. Here’s a simple guide on how to create one.

Creating a Template from Scratch

Open a new document in Word and set up your page layout. Include essential information like the donor’s name, donation date, amount, and any special instructions or notes. Use a table for clear alignment of this data. Add your organization’s name, logo, and contact details at the top to personalize the receipt.

Using a Pre-made Template

If you prefer not to create a template from scratch, you can download a pre-made donation receipt template from trusted sources. These templates are usually formatted for quick customization, allowing you to easily adjust the fields to your needs. Simply replace placeholder text with your organization’s details, and you’re ready to go.

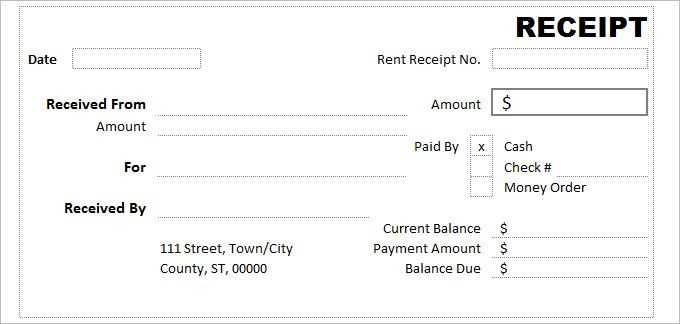

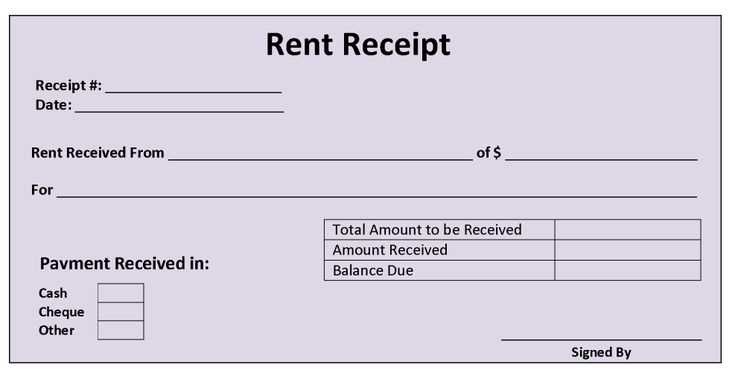

Open Microsoft Word and create a new blank document. First, set the page margins to a standard size (1 inch) for a clean, professional look. Add a header to display your organization’s name, address, phone number, and email address at the top of the page. This ensures the recipient knows who issued the receipt. You can use the “Header” section in Word’s Insert tab to easily add this information.

Next, insert a title such as “Donation Receipt” or “Receipt” in bold and centered at the top. Below the title, include essential fields such as “Date of Donation,” “Donor’s Name,” “Amount Donated,” and “Donation Description.” Align this text neatly for readability, making use of the tab key or table layout if necessary.

For added clarity, use a table to organize the information. Insert a simple table with two columns–one for labels (e.g., “Date,” “Amount”) and another for the corresponding information. The table ensures that the layout remains neat and easy to follow.

Under the table, include a thank-you message and any necessary legal disclaimers or tax information related to the donation. You may also want to include a line for the signature of the person issuing the receipt, either by hand or digitally. Leave enough space for this signature.

Save the document as a template, so it can be reused for future donations without having to recreate the layout each time. You can also adjust font sizes and styles to suit your preferences, but maintain consistency for a polished result.

Keep the layout clean and simple. Use clear fonts and proper spacing to ensure easy readability. Limit the use of fonts to two styles, one for headings and another for body text, to maintain clarity and avoid clutter.

1. Organize Information Hierarchically

- Start with your logo and organization name at the top for brand recognition.

- Follow with key transaction details such as donation amount, date, and donor’s name. Ensure this information stands out.

- End with a thank-you note or message of appreciation. Place it near the bottom to leave a lasting impression.

2. Use Consistent Margins and Alignment

- Maintain consistent margins on all sides to prevent a cramped or uneven look.

- Align text properly, especially numerical values like the donation amount. This creates a neat and professional appearance.

Include a footer with your contact details or website, keeping the font size smaller so it doesn’t distract from the main content.

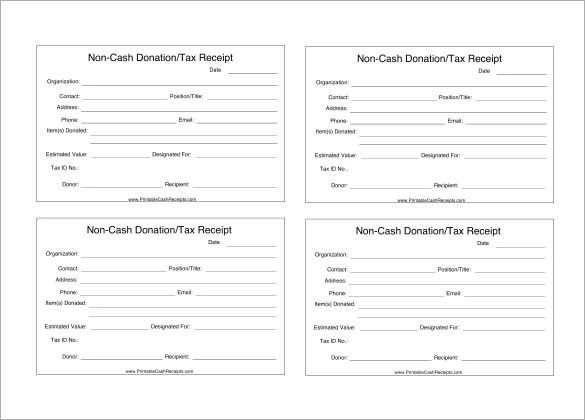

Include the donor’s full name and address to ensure proper identification. The receipt must clearly state that the donation is tax-deductible if applicable. Include the organization’s name, address, and EIN (Employer Identification Number) for validation. Specify the date of the donation and the donation amount, whether it’s cash or non-cash. If the donation is non-cash, describe the items donated and their estimated value. If goods or services were provided in exchange for the donation, include a statement indicating the value of those goods or services, as required by law. Ensure this information is accurate and transparent to comply with tax regulations and maintain donor trust.

Use form fields and macros to automate data entry in your receipt templates. Implement drop-down menus and checkboxes for common data points, reducing the need for manual input. By integrating fields like date, donor name, and amount into your template, you ensure a streamlined process. To create these fields, use Microsoft Word’s built-in content controls or macros that can auto-fill certain parts of the template based on previous entries or data sources. This minimizes human error and saves time.

Link the template to a database or CRM system where the donor information is stored. This integration allows you to populate receipt details automatically without entering them manually. Once the database is updated, the information can be pulled directly into the template, providing a more efficient method for managing receipts.

Another technique is using Excel or Google Sheets to track donations, where each row represents a donor. You can export this data into Word and apply mail merge, automatically inserting the information into the receipt template. This method speeds up the process and ensures consistency across multiple entries.

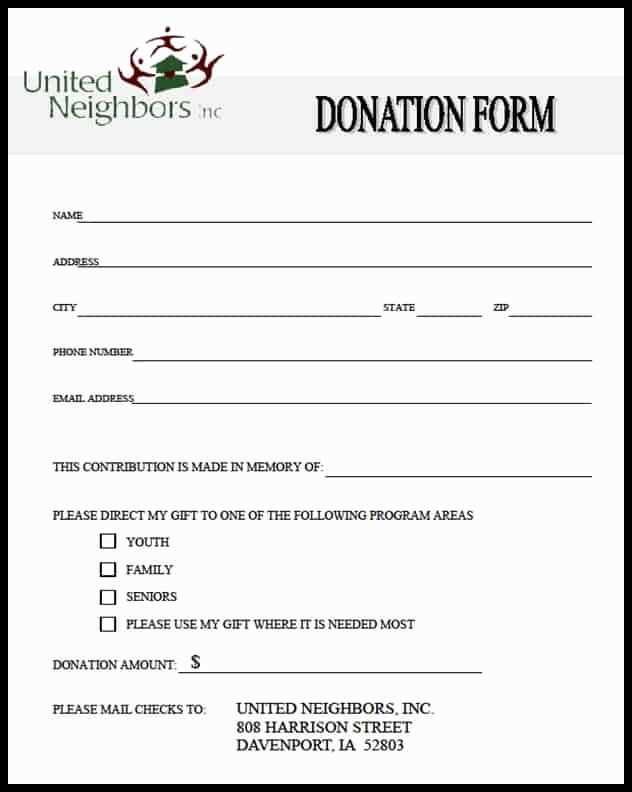

When creating a donation form, adding customizable fields tailored to different types of donations enhances the flexibility and usability of the form. Customize fields such as donation amount, donor type, or specific cause to better capture relevant information. For example, if someone is donating to a specific event or campaign, a dropdown field for selecting the campaign can be added. This ensures that all necessary details are captured efficiently and without confusion.

Specific Donation Categories

For one-time donations, adding a field for the donor to choose between a single contribution or a recurring donation is essential. For pledges, allow donors to specify the frequency (monthly, quarterly, etc.) and amount. Custom fields like this help manage donations effectively and ensure that funds are allocated correctly.

Donation Personalization

To further personalize the donation process, consider including fields for donors to leave messages or dedicate their donations in memory or honor of someone. This small addition allows donors to feel more connected to their contribution and the cause they are supporting.

Organize receipts by saving them in clearly labeled folders, either digital or physical. For digital records, use a cloud service like Google Drive or Dropbox, ensuring you have access from any device. Create subfolders based on donation types, dates, or events to make searching easy.

For physical receipts, store them in file cabinets or folders, using dividers to separate categories. If possible, scan or photograph each receipt to keep a backup. Store scanned files in a digital folder, ensuring they’re clearly named with date and donor information for quick retrieval.

To distribute receipts, automate email confirmations with templates for quick sending after each donation. Use email services or CRM systems to track donations and distribute receipts automatically. Ensure the emails contain a clear subject line and body text with donation details for clarity.

Always double-check for any errors before sending out receipts, especially if personal details are involved. Implementing an automated system saves time while maintaining accuracy and helps avoid delays in sending receipts.

Ensure clarity and accuracy in your donation receipt template by including the following key elements:

- Donor Information: Include the donor’s name, address, and contact details.

- Donation Details: Specify the amount donated, the date of donation, and any relevant campaign or purpose details.

- Organization Details: Clearly state your organization’s name, address, and tax ID number, if applicable.

- Tax Deductibility Notice: If the donation is tax-deductible, mention that along with any necessary instructions for the donor’s tax filing.

- Transaction Method: Indicate whether the donation was made via check, credit card, or other methods.

- Receipt Number: Assign a unique number to each receipt for better tracking and record-keeping.

By following these guidelines, you ensure the donation receipt is both professional and easy to understand for both your organization and the donor.