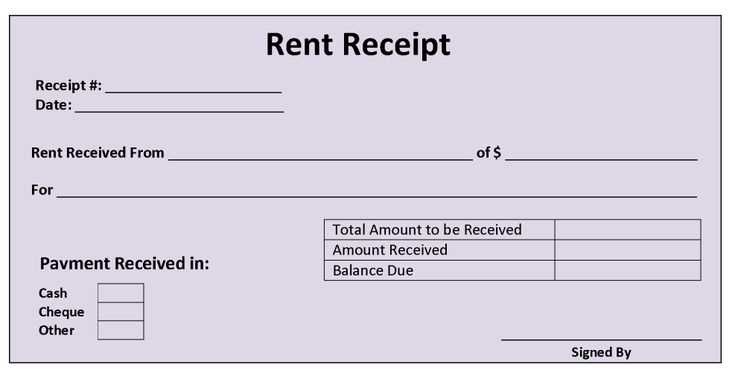

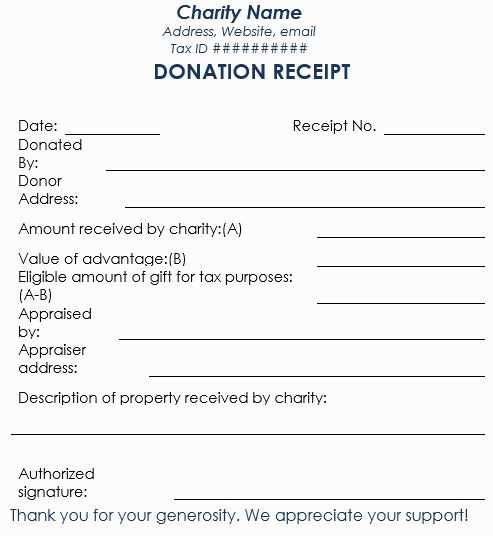

If you need to create a Donation of Goods Receipt Letter, a Word document template can make the process much easier. With the right format, you can ensure all the necessary details are included clearly and professionally.

A well-structured letter should begin with a formal greeting, followed by the date of the donation and the recipient’s name. Clearly state what goods were donated, including quantities and descriptions. Be sure to acknowledge the donation with gratitude, as this is important for both legal and relationship-building purposes. Closing the letter, include a polite note thanking the donor again and offering any further assistance if needed.

Having a template ensures you don’t miss key details and keeps the letter consistent and easy to customize for future donations. The template should also include a space for both the donor’s and recipient’s signatures, providing a formal confirmation of the transaction.

Here’s the revised version:

Start by addressing the donor and clearly state the purpose of the letter. Use a direct and polite tone, acknowledging the contribution and its value. Ensure the donor understands the impact of their donation. Here’s a useful structure:

Donation Receipt Letter Template

Donor’s Name: [Donor’s Full Name]

Address: [Donor’s Address]

Date of Donation: [Date]

Items Donated: [List of donated items]

Dear [Donor’s Name],

Thank you for your generous donation of [items donated]. Your support helps us [briefly describe how the items will be used]. We deeply appreciate your contribution and are grateful for your continued support.

Tax Deductibility: [Include information if applicable, such as the fair market value of the donated items for tax purposes.]

We look forward to your continued partnership and support in the future.

With sincere appreciation,

[Your Organization’s Name]

[Your Contact Information]

- Donation of Goods Receipt Letter Template in Word Document

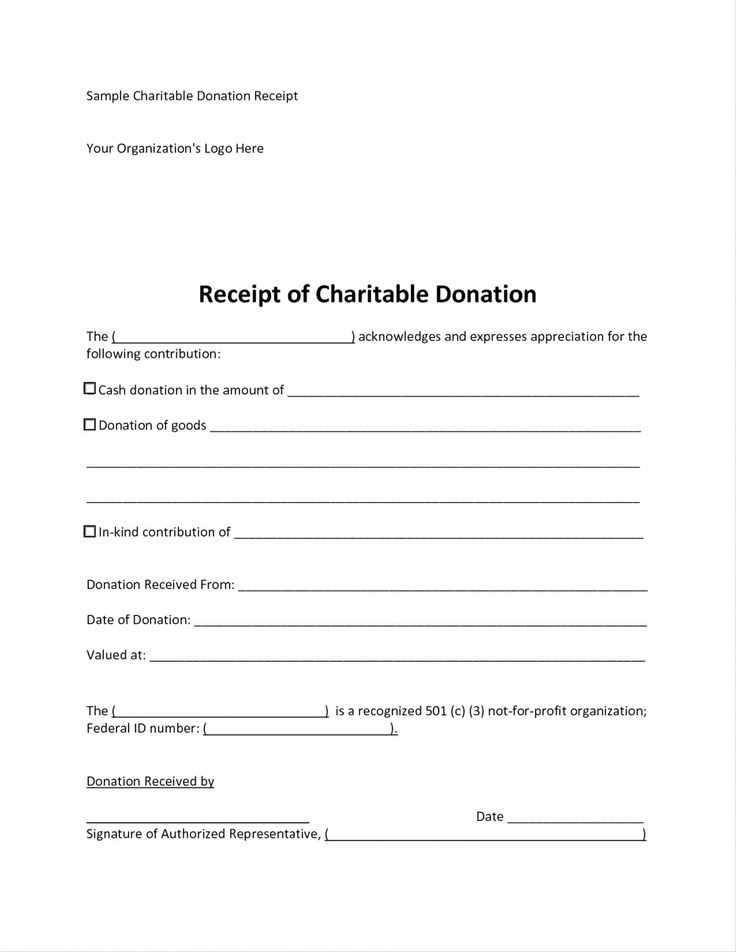

A donation of goods receipt letter serves as an acknowledgment of items given to an organization. A well-structured letter is crucial for record-keeping and tax purposes. Below is a recommended template that can be easily adapted into a Word document.

Ensure that the letter includes the following details:

| Section | Description |

|---|---|

| Donor’s Information | Include the full name, address, and contact details of the donor. |

| Organization’s Information | State the name of your organization, its address, and contact information. |

| Date | Clearly mention the date the donation was received. |

| Item Description | Provide a detailed list of the donated goods, including quantity and condition. |

| Statement of Acknowledgment | Write a brief statement confirming that the donation has been received and appreciated. |

| Signature | Include a signature from an authorized person in the organization for validation. |

This template ensures transparency and a professional approach to managing donations. You can copy and paste the content into a Word document, adjusting the specifics as needed.

To create a donation receipt letter in Word, follow these clear steps:

- Open a New Document: Launch Microsoft Word and open a blank document.

- Set Up the Layout: Choose a professional font like Arial or Times New Roman. Set margins to 1 inch on all sides and ensure the document is formatted for readability.

- Include Donor’s Information: At the top, type the donor’s name, address, and contact information, aligned to the left.

- Insert the Date: Below the donor’s information, write the date of the donation. Ensure it’s clear and placed on the right side of the document.

- Write the Organization’s Information: Below the date, include your organization’s name, address, and contact details. This information should be aligned to the left side of the page.

- State the Donation Details: Clearly mention the type and value of the donation received, whether it’s cash or goods. For goods, provide a brief description and approximate value.

- Include a Statement of No Goods or Services: If applicable, mention that the donation was made without receiving goods or services in return, in accordance with IRS requirements for charitable contributions.

- Express Gratitude: End the letter with a thank-you note for the donor’s generosity. Express how their contribution will help further your cause.

- Sign the Letter: The letter should be signed by an authorized person from your organization, typically a manager or the executive director.

- Review and Save: Double-check the information for accuracy. Save the document as a template for future use.

Once you’ve finished these steps, your donation receipt letter will be ready to print or send electronically to your donor.

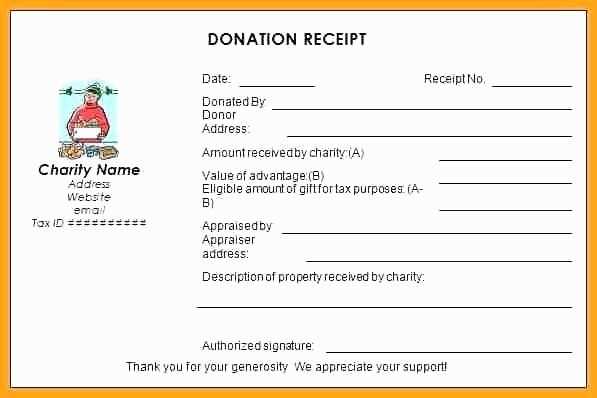

Include the name and address of your organization. This provides legitimacy and transparency for both the donor and your organization. Make sure it’s easy for the donor to identify your nonprofit for tax purposes.

Clearly state the date of the donation. Accurate record-keeping is important for both parties. The date is often required by tax authorities for deductions.

List a description of the donated goods or services. Be specific, including the type, condition, and quantity of the items. Avoid assigning a value to the donation unless you’re a qualified appraiser–just note that the donor is responsible for valuing the items.

Tax Information

Include a statement confirming that no goods or services were provided in exchange for the donation, or specify what was received, if applicable. This is important for donors claiming tax deductions.

Donation Amount

If the donation was monetary, specify the exact amount contributed. If it’s in-kind, refer to the description of the goods or services. Always ensure accuracy to avoid confusion for the donor’s records.

Provide a thank-you message. A personal touch can go a long way in strengthening donor relationships. It’s also an opportunity to encourage further support and involvement.

Choose a clean and readable font such as Arial or Times New Roman. Use font sizes that are easy to read: 12pt for body text and 14-16pt for headings.

Align text to the left for clarity and consistency. Centering headings and certain important sections is acceptable, but keep everything else left-aligned.

Font Styles and Hierarchy

- Use bold for headings and key information like dates or donor names.

- Italicize for emphasis on smaller details like specific instructions or additional notes.

- Make sure the font size for headers is noticeably larger than the body text to create a clear visual hierarchy.

Spacing and Margins

- Maintain consistent margins on all sides (typically 1 inch) for a clean and balanced layout.

- Use spacing between sections to separate different elements clearly. Include space before and after headings and sections.

- Ensure line spacing is set to 1.15 or 1.5 for better readability.

Incorporate bullet points or numbered lists to present information clearly, such as the list of donated items or donor details.

Use a simple, professional color palette for borders, headings, or other accents. Stick to subtle, neutral colors to avoid distraction.

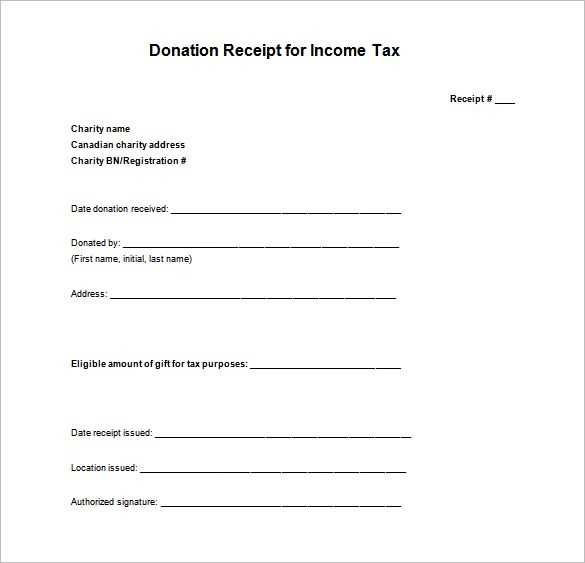

Donation receipt letters must meet specific legal standards to ensure they comply with tax laws. A receipt letter should include the name of the organization, the donor’s name, and the date of the donation. Additionally, the letter must specify whether the donation was monetary or non-monetary, detailing the goods or services donated. If the donation is a non-cash item, it is important to include an estimated value, but avoid overestimating, as the IRS may request substantiation.

Required Information

The letter should clearly state that no goods or services were provided in exchange for the donation, which is required for tax deductions. This statement is crucial for non-profit organizations to avoid any legal complications regarding charitable contributions. If any goods or services were provided, their fair market value must be indicated, and the donor must acknowledge the amount they contributed beyond the value of these services or goods.

Tax-Deduction Implications

When donors claim tax deductions, the IRS mandates the inclusion of specific details such as the organization’s name, tax-exempt status, and the amount of the gift. For non-monetary donations, the IRS often requires donors to provide an independent appraisal of the item’s value if it exceeds a certain threshold. Therefore, it is vital to ensure the receipt letter includes accurate and complete information to avoid any issues with tax deductions.

Adjust your donation letter template to fit the specifics of the contribution. If you receive physical goods, acknowledge the item(s) in detail. List each donation with its estimated value, or note that a value is not applicable if the donor has not provided one. For monetary donations, focus on expressing gratitude and mention the exact amount. If the donation is anonymous, respect the donor’s privacy while still conveying appreciation.

For donations of services, tailor the letter to highlight how the donated services benefit your cause. Avoid detailing specific hours or tasks unless provided. Instead, emphasize the impact of the donation. If the donation is in-kind, such as food or supplies, provide specifics about how the items will be used and why they are valuable to your organization.

Customizing your letter for different types of donations not only ensures accuracy but also strengthens relationships with your donors by showing that you understand and appreciate their contributions in a meaningful way.

To save and share a receipt letter in Word format, first ensure the document is complete. Click on “File” in the top left corner of your screen, then select “Save As” to choose your desired location. Select “Word Document (.docx)” from the available file formats and click “Save.” This ensures your letter is in a standard, shareable format.

Saving and Naming the Document

Give the document a clear name that identifies it, such as “Donation Receipt Letter [Date].” This will make it easier to locate and share later. Make sure the location on your computer is easy to access, such as the Desktop or a specific folder where you store similar files.

Sharing the Document

To share the letter, open your email client or preferred file-sharing platform. Attach the saved Word document and send it to the recipient. If you are using a cloud storage service like Google Drive or OneDrive, upload the file and share the link with the recipient for easy access and download. Make sure the permissions allow the recipient to view or download the document.

To create a clear and professional donation of goods receipt letter, focus on key details. Start by including the date of the donation and the donor’s information. Be specific about the items received, including quantities, conditions, and descriptions. This shows transparency and helps both parties stay organized. Clearly state that the goods were donated without any exchange of money and indicate the purpose, if known.

Don’t forget to add a section expressing gratitude for the donation. Finish with the signature of the recipient, along with their position or title if relevant. Using a formal but friendly tone helps ensure the letter serves as both a record and a token of appreciation.