Creating a donation receipt letter in Word is a simple yet impactful way to acknowledge contributions. Whether for personal records or for tax purposes, a clear and professional receipt helps donors feel appreciated while ensuring they have the necessary documentation. A donation receipt typically includes the donor’s details, the donation amount, and the date, along with a thank you note that adds a personal touch.

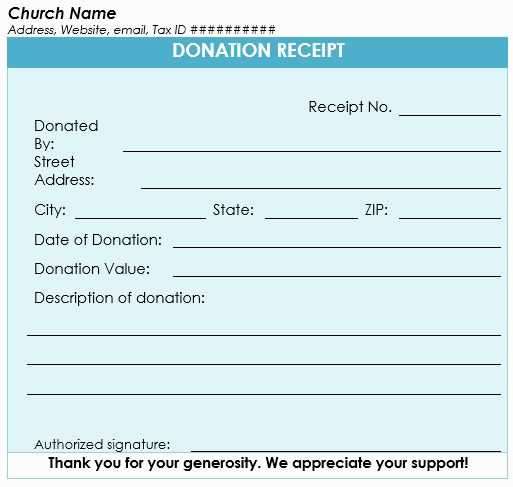

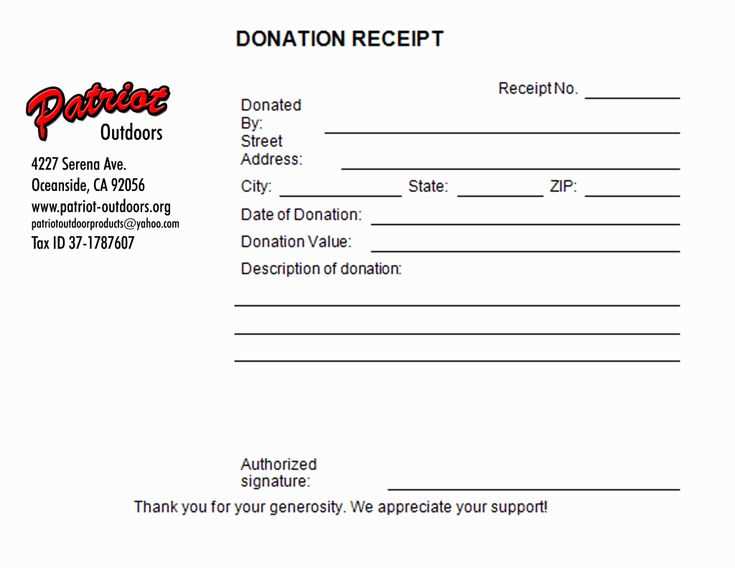

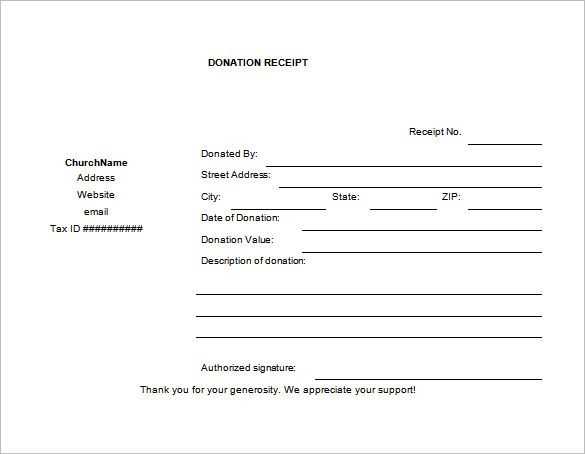

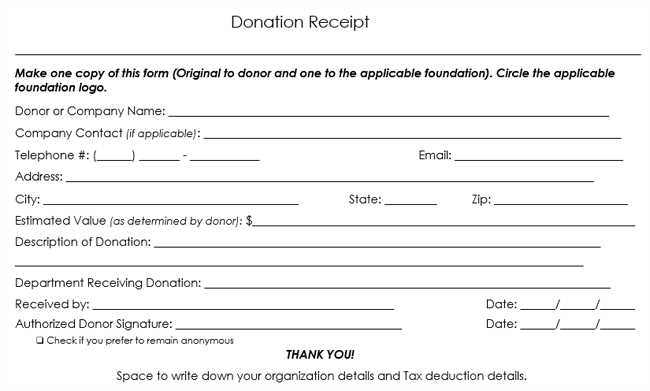

To get started, use a clean, easy-to-read template. This makes the process smoother and ensures consistency in your receipts. The template should include fields for the donor’s name, address, donation amount, and a brief description of what the donation was (e.g., cash, goods, or services). Make sure to also add a statement confirming that no goods or services were provided in exchange for the donation, which is important for tax purposes.

It’s helpful to maintain a record of all donations and send receipts promptly. Using a Word template allows you to easily customize the letter for each donor, saving time while maintaining a personalized feel. Consider adding your organization’s logo or letterhead for a more professional appearance.

- Donation Receipt Letter Template in Word

To create a donation receipt letter in Word, follow these specific guidelines for accuracy and clarity:

1. Include Donor and Donation Information

Begin by entering the donor’s name, address, and contact details. Below this, specify the date of the donation and provide a brief description of the items or monetary amount donated. For monetary donations, list the exact amount. If it is an in-kind donation, describe the items and their estimated value, if necessary. Ensure the donation amount or items are clearly stated for record-keeping and tax purposes.

2. Acknowledge the Donation

Express gratitude to the donor. Acknowledge the significance of their contribution. If applicable, mention any services or benefits provided in exchange for the donation. This acknowledgment helps clarify whether the donation qualifies for a tax deduction.

3. Provide Tax Information

Include your organization’s tax-exempt status and Employer Identification Number (EIN). This is crucial for the donor’s tax records. Ensure the letter explicitly states that no goods or services were provided in exchange for the donation unless applicable. This confirms the donor’s eligibility for a tax deduction.

Open Microsoft Word and create a new document. Begin with your organization’s letterhead or name at the top. Include the name of the organization, address, and contact information. Make sure to align this to the top left or center of the page, depending on your preferred layout.

Include the Donor’s Information

Next, add the donor’s full name, address, and contact details. Place this below your organization’s information, leaving enough space between the two sections. Make sure to format this clearly and concisely.

Write the Donation Details

State the date of the donation and the amount donated. Include a short description of what the donation is for (e.g., “general support” or “specific project”). If applicable, specify if the donation was in cash or another form (e.g., check or goods).

End the letter with a closing sentence expressing gratitude, such as “Thank you for your generous contribution.” Sign the letter manually or insert a scanned signature at the bottom. You may also include a line for a printed name and position title.

Finally, save the document as a Word file (.doc or .docx) or export it as a PDF to share with the donor. Make sure the layout is clean and professional, ensuring it reflects your organization’s values and dedication to donors.

Provide the donor’s name and address, ensuring accuracy for recognition and future correspondence. Include the donation date, specifying when the gift was made to maintain a clear record. Clearly state the amount donated, whether in cash, goods, or services, and describe any applicable restrictions on the donation use.

Offer a brief message of appreciation, acknowledging the donor’s contribution and its impact. Include your organization’s tax-exempt status and ensure the wording complies with IRS requirements, especially for tax deduction purposes. Indicate if the donation was made in memory or honor of someone, if relevant, to personalize the acknowledgment.

Provide your contact information and a phone number or email for any follow-up questions. If applicable, include a statement about the donor’s involvement with the organization, highlighting their ongoing support. Make sure to offer an official signature or an authorized representative’s name for authenticity and transparency.

Adjust your donation acknowledgment template to reflect the specific needs and tone of your organization. Tailoring the letter ensures it feels personal, professional, and aligned with your mission. Follow these steps:

- Include Your Organization’s Branding: Add your logo and contact information at the top. This helps the donor identify your organization immediately and reinforces your brand image.

- Personalize the Greeting: Address the donor by name and mention specific details about their contribution (e.g., amount or type of donation). Personalization shows appreciation and makes the letter feel unique.

- Customize the Acknowledgment Message: Write a brief but heartfelt message thanking the donor for their support. Clearly state how their donation will be used to make a positive impact, reinforcing the cause they are supporting.

- Legal Compliance: Ensure the letter includes the necessary tax information, such as your organization’s EIN and a statement confirming that no goods or services were provided in exchange for the donation. This is important for tax purposes.

- Customize the Closing: Express your gratitude once again and offer any additional contact information, should the donor have any questions. A polite and sincere closing leaves a lasting impression.

- Proofread: Before sending, carefully review the letter for spelling or formatting errors. A polished document enhances the donor’s experience and reflects your attention to detail.

By customizing your letter in these ways, you’ll create a meaningful and professional acknowledgment that strengthens relationships with your donors and aligns with your organization’s values.

Structuring the Donation Receipt Letter

Use a clear and simple format for your donation receipt letter. Start with a brief introduction that confirms the contribution and includes the donor’s name and the date of the donation.

Key Elements to Include

Make sure the letter includes the following details:

| Detail | Description |

|---|---|

| Donor’s Name | Include the full name of the donor as they provided it in the donation. |

| Donation Date | Clearly state the date the donation was received. |

| Amount/Value of Donation | State the monetary value or description of the goods donated. If applicable, specify if it was a non-monetary donation. |

| Tax Status | Clarify if the donation is tax-deductible and include any necessary legal disclaimers. |

Closing the Letter

Finish by thanking the donor and providing your organization’s contact information for any follow-up inquiries. This should be concise yet sincere, ensuring the donor feels appreciated for their contribution.