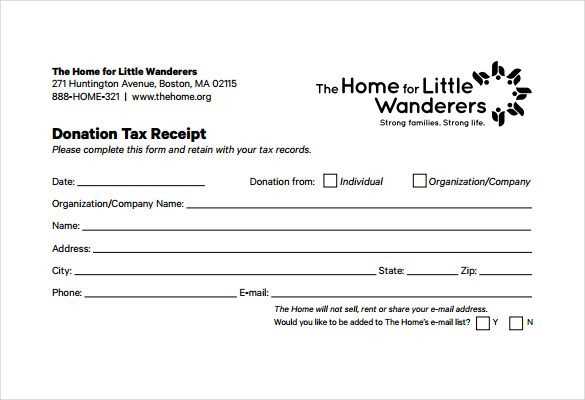

If you’re looking to create a professional and clear donation receipt letter, using a template in Word can save you time and ensure accuracy. A well-structured receipt provides the donor with necessary details, confirms the donation, and helps both parties keep organized records for tax purposes.

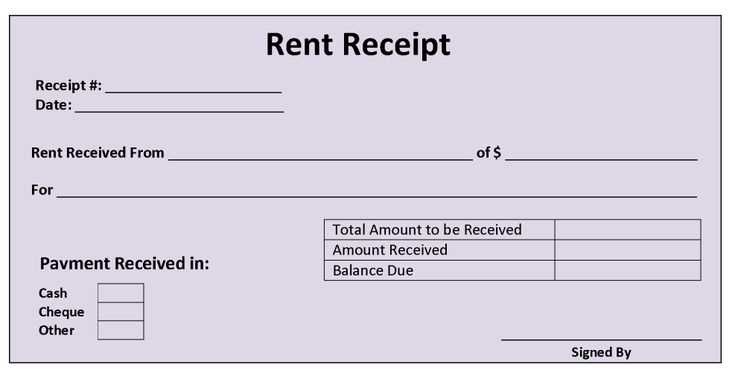

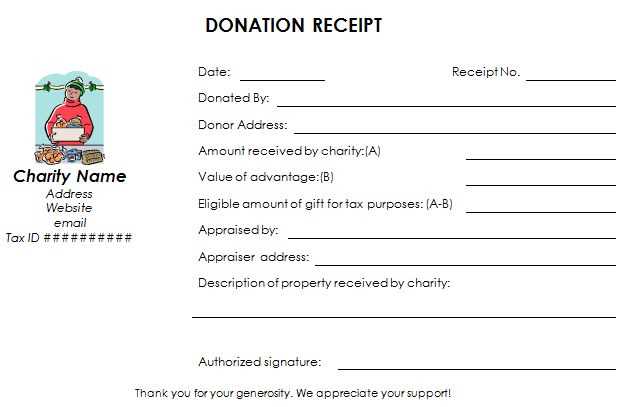

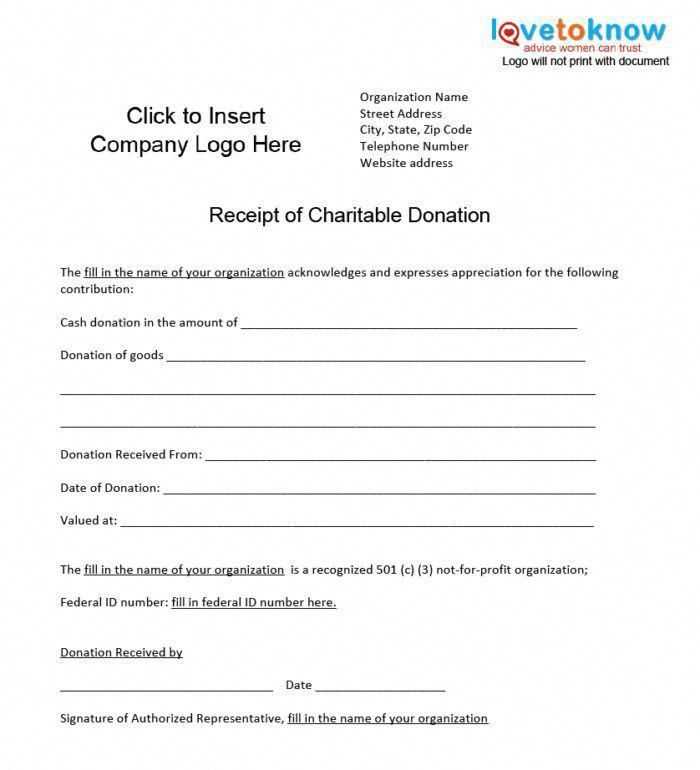

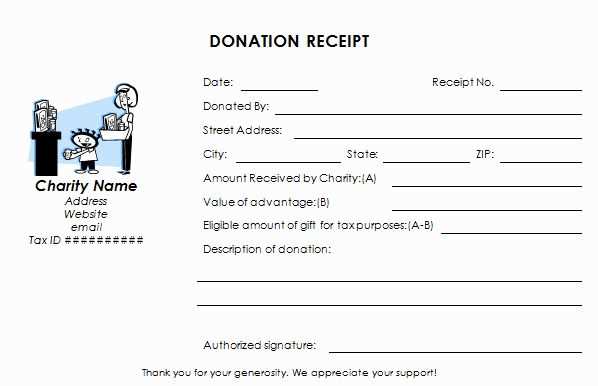

Start by including the donor’s full name, address, and the donation amount. Make sure the date of the donation is clearly stated. Next, outline the type of donation–whether it’s monetary, goods, or services–and specify if any goods or services were exchanged. This helps both the donor and the organization track the transaction properly for tax deduction claims.

For added clarity, consider providing your nonprofit’s legal status and tax-exempt number. This demonstrates that the donation qualifies for a tax deduction. A simple statement confirming that no goods or services were provided in exchange for the donation can further streamline the process.

Finally, remember to sign the letter and provide a contact for any questions. Having a Word template makes it easy to adjust the letter for each donor while maintaining consistency and professionalism across your communications.

Here’s the revised version with minimized repetition:

When creating a donation receipt letter, clarity and simplicity are key. Keep the language direct, avoid redundant phrases, and ensure all important details are present without unnecessary elaboration.

To streamline the content, structure the letter with clear headings and bullet points where necessary. This format helps readers easily find relevant information.

| Element | Description |

|---|---|

| Donor’s Name | Include the full name of the donor as it appears in your records. |

| Donation Date | List the exact date of the donation to maintain an accurate record. |

| Donation Amount | Clearly specify the value of the donation (whether in cash, items, or services). |

| Tax-Exempt Status | If applicable, mention the nonprofit’s tax-exempt status and the legal context for the donation. |

| Thank You Statement | Include a simple expression of gratitude for the donor’s contribution. |

By adhering to this structure, the donation receipt letter remains clear, professional, and easy to process. Avoid any redundant wording, and keep the message focused on the transaction details and appreciation.

- How to Create a Basic Donation Receipt Letter in Word

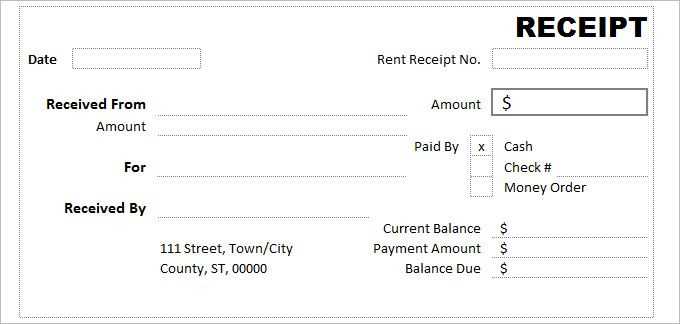

To create a simple donation receipt letter in Word, first open a blank document. Begin by adding your organization’s name, address, and contact information at the top. Include the date on which the donation was received, typically aligned to the right.

Next, insert a formal greeting. A common choice is “Dear [Donor’s Name],” followed by a brief thank-you message. Acknowledge the donor’s generosity and mention the specific item or monetary amount donated.

For monetary donations, list the amount given and note that no goods or services were provided in exchange. For material donations, describe the items donated and their approximate value. Always include a statement indicating that the donation is tax-deductible to the extent allowed by law.

Include a closing statement, such as “Thank you for your support of [organization’s name]. Your contribution makes a difference.” End with a professional sign-off like “Sincerely” or “Best regards,” followed by the signature and name of the person issuing the receipt.

Finally, proofread your letter to ensure all details are accurate. Save the document as a template for future use, so you can quickly create receipts for new donations.

Ensure your donation receipt letter contains these key elements to meet IRS requirements and provide clarity for the donor:

- Organization’s Name and Contact Information: Clearly display the name, address, and phone number or email of your nonprofit. This establishes legitimacy and makes it easy for the donor to reach out if necessary.

- Donation Date: Specify the exact date the donation was received. This helps the donor with tax reporting and record-keeping.

- Donation Amount: For cash donations, list the exact amount given. If the donation is non-cash (goods, services, etc.), describe the items or services and their estimated value.

- Statement of Goods or Services: If the donor received something in exchange for the donation (such as a ticket to an event or a gift), include a statement with the estimated fair market value of the goods or services provided. This helps the donor determine the deductible amount.

- Organization’s Tax-Exempt Status: Include a reminder that your organization is a tax-exempt entity under section 501(c)(3) of the Internal Revenue Code. This confirms that the donation may be tax-deductible.

- Donor’s Information: Include the name of the donor as well as their address, if applicable. This makes the receipt more personal and easier to track.

- Thank You Message: Always include a note of gratitude to acknowledge the donor’s generosity. It reinforces a positive relationship with the donor.

By including these details, you make the process smoother for both your organization and the donor, ensuring proper documentation and a positive experience for all parties involved.

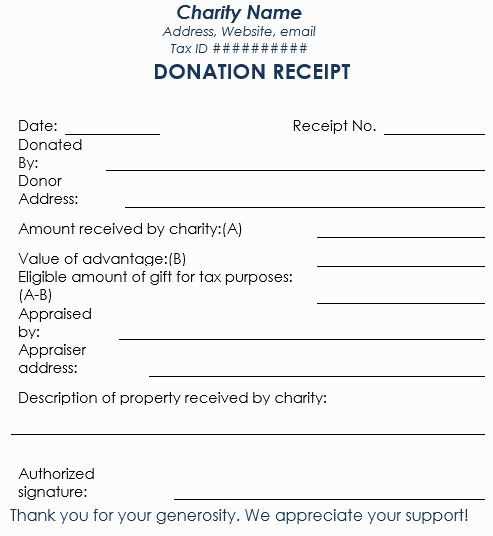

Keep your donation receipt letter clear and concise. Start by using a simple, easy-to-read font such as Arial or Times New Roman. Set the font size between 10 and 12 points for readability. Make sure the text aligns left for a clean appearance. Keep paragraph spacing consistent, ideally with a 1.5 line spacing for clarity.

Include Key Information in a Structured Layout

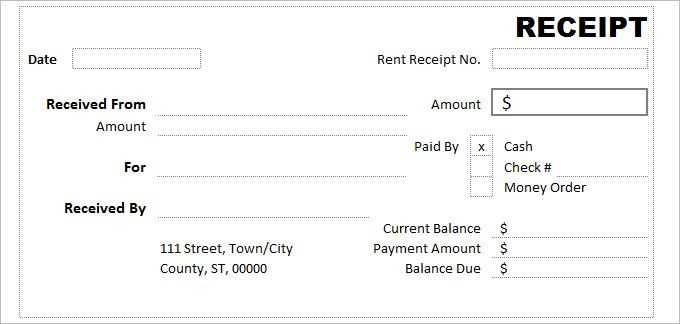

Organize the content into clear sections. The header should include your organization’s name, logo, and contact information. This sets a professional tone from the start. Below the header, include the date and the donor’s details, such as their name, address, and contact information. Use bullet points or numbered lists for any details that need emphasis, such as donation amount, the date of donation, and any special instructions.

Maintain Consistency in Your Design

Consistent formatting throughout the letter builds trust and professionalism. Use headings to separate key sections like the “Donation Details,” “Acknowledgement,” and “Thank You” statements. Align text consistently, with attention to spacing between paragraphs and headings. Avoid clutter by using adequate margins and leaving space between sections.

Common Mistakes to Avoid in Donation Receipt Templates

Ensure the donation receipt includes the correct donor name and contact details. Incorrect or missing information can lead to confusion or cause problems during tax filing. Always double-check the accuracy of this data.

Do not forget to clearly state the date of the donation. Omitting this detail can complicate tax deductions and make the receipt less useful for record-keeping. Always include the exact date when the donation was made.

It is vital to specify the exact amount of the donation. For cash donations, include the total sum given, and for non-cash donations, describe the item and its estimated value. Failing to do so can result in confusion or disputes down the line.

Make sure to include a clear statement that the donation is tax-deductible. If the charity is registered, this will help donors with their tax filings. A lack of this information might prevent donors from claiming their tax benefits.

Do not use vague descriptions of the donation. For example, avoid generic phrases like “a generous donation” or “a valuable contribution.” Be specific about the item or amount received. This ensures transparency and clarity.

Never forget to include the organization’s tax-exempt status and registration number. This is important for the donor’s tax purposes and provides credibility to the receipt.

Finally, ensure your donation receipt template is consistent with the charity’s branding and professional in appearance. A poorly designed or unprofessional receipt can undermine the donor’s trust in your organization.

Begin by updating the organization’s name, address, and contact details in the header section. Make sure these details are consistent with your official branding and legal documents. This ensures clarity and professionalism in your receipts.

Adjust Donation Information

Modify the template to include specific donation fields such as the amount, date, donor’s name, and method of payment. Ensure that the receipt reflects all necessary information for both tax and record-keeping purposes. For example, you can add a field for the donation’s purpose (e.g., general fund or special project). This helps track contributions more accurately.

Personalize the Thank-You Message

Craft a short, personalized message of appreciation for your donors. Include a note of gratitude that aligns with your organization’s tone and mission. Customizing this part not only enhances the donor’s experience but also strengthens the relationship between your organization and its supporters.

Donation receipt requirements vary by jurisdiction. Organizations must adhere to specific rules depending on the country or region they operate in. Here are the key legal considerations for donation receipts in different jurisdictions:

- United States: The IRS requires a donation receipt for charitable contributions of $250 or more. The receipt must include the charity’s name, date of the donation, amount or description of the donation, and a statement confirming whether any goods or services were provided in exchange for the donation.

- Canada: The Canada Revenue Agency (CRA) mandates that receipts must contain the charity’s registration number, the donor’s information, the donation amount, and a declaration of any benefits received by the donor. In-kind donations must also be valued.

- United Kingdom: Charities must issue receipts for donations over £25. Receipts should include the donor’s details, the amount, and a statement confirming no goods or services were provided in exchange, if applicable.

- Australia: The Australian Taxation Office (ATO) requires donation receipts for gifts of $2 or more. The receipt must state the organization’s name, the donor’s details, and confirm that the donation is tax-deductible.

- European Union: EU member countries have varying rules, but receipts must generally include the donor’s information, donation amount, and confirmation that the donation is tax-deductible where applicable. Specific rules may apply in countries like Germany, France, and Spain.

Organizations must ensure that they follow the legal requirements for each jurisdiction in which they operate to maintain compliance and provide accurate records for tax purposes. Not complying with these requirements could lead to penalties or the loss of tax-exempt status.

Got it! How’s the article going? Would you like some help with specific sections of the diagram or any other details?